Together with

Good Morning,

Trump has no plan to fire J Pow, Goldman is exploring prediction market opportunities, the UBS CEO succession race commenced, LPs are doubling down on multi-strat hedge funds, and Wall Street banks eliminated over 10k jobs last year all while the industry is oozing with optimism.

Mizuho execs published their 2026 deal outlook for every sector, offering unique insights into opportunities for M&A, IPOs, and LBOs ahead. Read it here.

Let's dive in.

Before The Bell

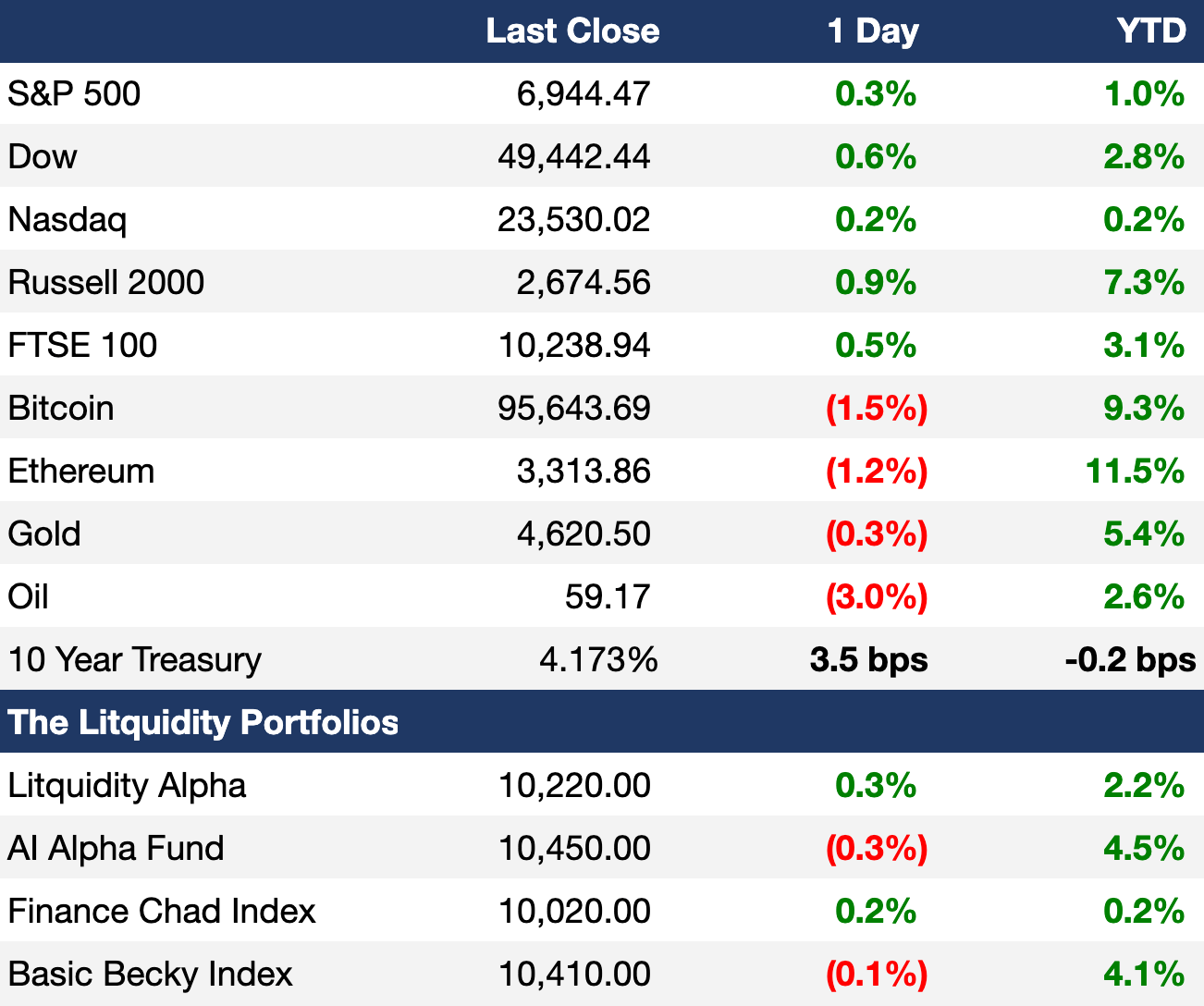

As of 1/15/2026 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rose yesterday as investors digested strong bank and tech earnings

Small-caps Russell 2000 outperformed S&P for a tenth-straight day for its best relative win streak since 1990

Europe's Stoxx 600 hit a fresh ATH

UK's FTSE 100 hit a fresh ATH

Canada's TSX index hit a fresh ATH

Cocoa futures slid to a two-year low

Dollar rose to a six-week high

Earnings

BlackRock beat Q4 earnings estimates as record ETF inflows and $13B in private market inflows pushed AUM above $14T (WSJ)

Goldman Sachs beat Q4 earnings and revenue estimates as record-beating equities trading and strong asset and wealth management offset steady IB fees, ahead of a strong M&A pipeline and momentum going into 2026 (CNBC)

Morgan Stanley beat Q4 earnings and revenue estimates on a 47% surge in IB revenue driven by debt and M&A deals, record equities trading, and new milestones in wealth management (CNBC)

TSMC beat Q4 earnings estimates for another record quarter as profit jumped 35% on the back of robust AI chip demand (CNBC)

What we're watching this week:

Today: State Street, PNC

Full calendar here

Prediction Markets

Marco Rubio finding out he's the president of the United States

Trade the 2028 US elections on Polymarket

Headline Roundup

Trump has no plan to fire J Pow despite investigation (RT)

Taiwan will invest $250B in US under new trade deal (CNBC)

Foreign holdings of US Treasuries hit an ATH but China pulls back (RT)

Wall Street eliminated over 10k jobs last year in the most since 2016 (BBG)

Private credit is dropping safeguards to win deals on Wall Street (BBG)

Bank CEOs say $130B trading record is just the start (BBG)

Bankers shift focus to busy 2026 after cashing in on big deals (RT)

Jamie Dimon will never take Fed chair job but is open to Treasury (BBG)

UBS CEO wants an internal successor as succession race begins (BBG)

UBS moves closer to getting US national bank charter (RT)

LPs are doubling down on multi-strat hedge funds for 2026 (RT)

Hedge funds hire talent scouts in Japan to tap comeback (BBG)

Flipping Japan IPOs loses luster as small share sales fade (BBG)

China new loans shrunk to the least since 2018 as demand weakens (BBG)

European earnings are set to be the worst in two years (RT)

Goldman is exploring prediction market opportunities (BBG)

Polymarket races to crack 'parlays' as stakes rise in sports trading (FT)

75% of Jain Global's 2025 trading profits went to fees (RT)

OpenAI is raiding top talent from Thinking Machine Lab (WRD)

France raided Big Four accounting firms as part of antitrust probe (RT)

White-collar enforcement has sunk under Trump (BBG)

A Message from Mizuho

As we enter 2026, Mizuho sees a strong pipeline for dealmaking for corporates and the potential for enhanced participation by financial sponsors. We expect market activity to broaden beyond Big Tech, with more mid-market transactions alongside the mega deals. Barring any unforeseen geopolitical grey or black swans, 2026 should offer opportunities for dealmaking, whether initial public offerings (IPOs), mergers & acquisitions (M&A) or leveraged buyouts (LBOs), across sectors.

In spite of our optimism, we will be keeping our eye out for choppy waters resulting from uncertainty around interest rate policy, the impact of tariffs, geopolitics and the proliferation of AI. Consumers and executives alike remain cautious, with some companies pumping the brakes on hiring while the Fed wrestles with how to boost employment without fueling inflation.

In light of this backdrop, Mizuho's industry sector heads offer their outlook on the driving forces impacting their respective domains.

Deal Flow

M&A / Investments

Soft drinks giant Keurig Dr Pepper launched an $18B all-cash takeover bid for coffee group JDE Peet's

Life sciences giant Boston Scientific agreed to buy medical device maker Penumbra in a $14B cash-and-stock deal, representing a 19% premium

Jared Kushner's PE firm Affinity Partners is backing a merger between workout booking app ClassPress and fitness tech company EGYM with a $785M investment in a deal that values the entity at $7.5B, including debt

Member's club Soho House secured ~$200M in alternative funding to close a $2.7B take-private led by MCR Hotels after prior financing fell through

Japan's Mitsubishi Electric is seeking bids for a sale of its automotive equipment business that could fetch $1.3B-$1.9B

Tom Lee's corporate crypto holder Bitmine agreed to invest $200M in YouTuber MrBeast's holding company Beast Industries

Tokyo Broadcasting System parent TBS agreed to acquire a $150M stake in film production studio Legendary Entertainment from Apollo at a $4B valuation

Hungarian energy company Mol Nyrt is nearing a takeover of Serbia's sole refinery NIS as US sanctions force Russia's Gazprom Neft to sell its majority stake

Brazilian conglomerate CSN plans to divest key assets to reduce debt by $3.3B

VC

AI coding startup Replit is in talks to raise a $400M round at a $9B valuation led by Georgian

Self-driving car startup Tensor is in talks to raise $300M-$400M in funding ahead of a potential IPO

German AI customer service agents startup Parloa raised a $350M Series D at a $3B valuation led by General Catalyst

Merge Labs, Sam Altman's rival to Musk's Neuralink, raised a $250M seed round at an $850M valuation led by Bain Capital and OpenAI

Frontline operations software firm Tulip Interfaces raised a $120M Series D at a $1.3B valuation from Mitsubishi Electric

Supply-chain automation startup Mytra raised a $120M Series C led by Avenir Growth

AI video generation startup Higgsfield raised an $80M Series A extension at a $1.3B valuation from Accel, GFT Ventures, and Menlo Ventures

Equal1, a silicon-based quantum computing startup, raised a $60M round led by ISIF

Thermal-infrared satellite startup Hydrosat raised a $60M Series B led by Hartree Partners, Subutai Capital Partners, and Space 4 Earth

GovDash, an AI-native government-contracting ERP startup, raised a $30M Series B led by Mucker Capital

Indian reusable-rocket startup EtherealX raised a $20.5M Series A led by TDK Ventures and BIG Capital

Konnex, an on-chain marketplace for autonomous robot labor, raised a $15M round from Cogitent Ventures, Liquid Capital, and more

Access comprehensive VC and startup data on Fundable

IPO / Direct Listings / Issuances / Block Trades

Hong Kong infrastructure conglomerate CK Hutchison is seeking to raise $2B at a $30B valuation in an IPO of its global retail unit A.S. Watson Group

HVAC group Madison Air filed confidentially for a $2B IPO

Debt

Goldman Sachs raised $16B in the biggest investment grade bond sale ever by a Wall Street bank

Morgan Stanley raised $8B in an investment grade bond sale

Wells Fargo raised $8B in an investment grade bond sale

Silver Lake-backed legal software firm Relativity cut borrowing costs on a $720M private credit loan in a JPMorgan-led refinancing

Bankruptcy / Restructuring / Distressed

Lebanon's $30B defaulted dollar bonds surged from 23¢ to 30¢ on bets that Iran protests could reduce Islamic influence in the region

Lenders led by BMO are seeking to block Ssense's founders from buying the Canadian luxury retailer out of bankruptcy, arguing liquidation would yield better recoveries

UK oilfield services firm Petrofac is asking creditors to approve claim concessions to allow the sale of its asset solutions business

Struggling Florida high-speed rail Brightline tapped its debt service reserve to make an interest payment on munis

A group of lenders led by Bank of Montreal are trying to block a deal to allow the founders to buy Canadian luxury fashion retailer Ssense out of bankruptcy

Funds / Secondaries

BlackRock's Global Infrastructure Partners raised $12.5B for a targeted $30B data centers and energy infrastructure fund partnership with Microsoft, Nvidia, xAI, and UAE's MGX

Spain will launch a $12B SWF

PE firm H.I.G. Capital raised $1.9B billion for its fourth European lower MM PE fund

PE firm New Mountain Capital raised $1.2B for its second growth fund

Point72 Ventures raised a $280M CV from fintech investment platform Portage and Goldman Sachs Alternatives in a deal which will see Portage assume management of numerous Point72 Ventures not included in the CV

OCIO Commonfund's PE arm raised $187M for its latest co-investment vehicle

Growth equity investor SEMCAP raised $125M for its debut fund targeting food and nutrition

Impact investor Blue Earth Capital raised over $100M for a debut secondaries fund

Crypto Sum Snapshot

Senate delayed crypto bill after Coinbase CEO lobbied against

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Bob Seawright published an incredible piece on forecasting, and how no one ever always got it right. It's truly a must-read.

NYT explored some anecdotal cases of early meme stock investors, who are now all grown up.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.