Together with

Good Morning,

Hamas attacked multiple Israeli towns this weekend, Iran likely helped plot the attacks, oil prices climbed due to Middle East uncertainty, some investors are willing to bet on Argentina, Wall Street can’t handle all of Washington’s bonds, and distressed debt anxiety is rippling through emerging markets.

Looking to protect your personal data from the risk of internet data leaks? Today’s sponsor, Surfshark, is the solution for you.

Let’s dive in.

Before The Bell

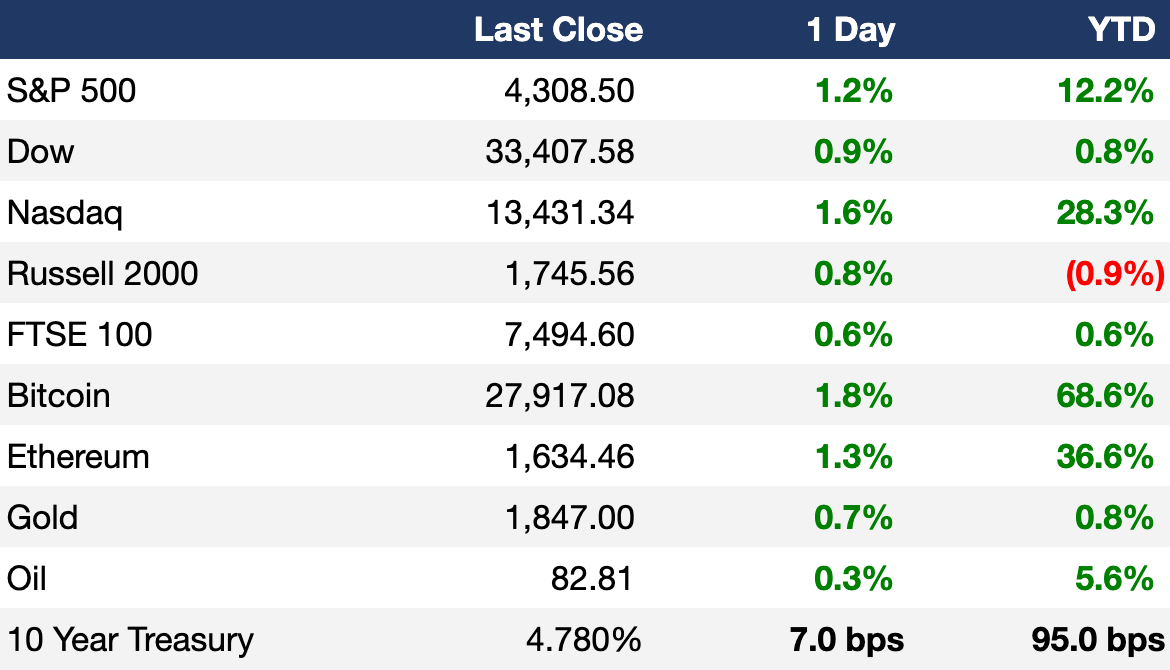

As of 10/6/2023 market close.

Markets

US stocks rallied after the release of stronger-than-expected US jobs data

The Nasdaq led indices with a 1.6% gain

European stocks rose thanks to an increase in German factory orders and positive US jobs data

WTI futures jumped 4.69% the weekend in response to Hamas attacks on Israel

Earnings

What we're watching this week:

Tuesday: PepsiCo

Thursday: Delta Airlines, Domino’s Pizza, Walgreens

Friday: JPMorgan Chase, BlackRock, Wells Fargo, Citigroup, UnitedHealth Group

Full calendar here

Headline Roundup

Iran helped plot attack on Israel over several weeks (WSJ)

Bank of Israel will sell up to $30B to strengthen shekel in wake of Hamas attacks (BBG)

After Hamas attacks Israel, Biden’s top foreign-policy goals hit turbulence (WSJ)

Distressed debt anxiety is spreading across emerging markets (BBG)

Oil prices jump 4% in the wake of Hamas attack on Israel (CNBC)

American Airlines Union tells pilots to refuse to fly to Israel (BBG)

Argentina election lures risk-taking investors to long-odds gamble (RT)

Wall Street isn’t sure it can handle all of Washington’s bonds (WSJ)

UK joins Europe’s growing ‘greenlash’ with new pro-motorist policies (CNBC)

Profit warnings to hit S&P 500 as high rates pinch consumers (BBG)

Weight-loss drugs fuel boom for firms that fill syringes (RT)

Kelvin Kiptum breaks men’s marathon world record in Chicago (WSJ)

Meatpacking plant closures cut deep for small-town economies (WSJ)

A Message From Surfshark

Protect Yourself from Data Leaks

Data privacy is one of the biggest issues facing internet users today, and a single leak could cause spam emails, fraud, and even identity theft for its victims.

With Surfshark One, you can protect your personal data from anywhere on the planet. One Surfshark account shields all your devices with a suite of premium features, like:

24/7 private and secure internet access anywhere

Antivirus protection

Targeted ads and malware blocker

Encrypted browsing to hide your identity and location

NoBorders mode to surf freely in internet-restricted countries

Surfshark One users also get an Alternative ID, complete with a generated email address and personal info, that can provide an additional barrier for avoiding hackers and spammers.

Ditch the targeted ads and protect yourself from data leaks by trying Surfshark here, and Exec Sum readers get 84% off + 2 months free when purchasing a two-year plan.

Deal Flow

M&A / Investments

Amgen completed its $27.8B acquisition of Horizon Therapeutics after it received approval from the FTC last month (RT)

Bristol-Myers Squibb will acquire cancer drugmaker Mirati Therapeutics for $4.8B (RT)

Australian billionaire Gina Rinehart raised her stake in lithium producer Liontown Resources, which is being acquired by US miner Albemarle for $4.3B, to 16.7%, giving her enough leverage to possibly block the deal (RT)

Germany’s billionaire Schaeffler family is considering a buyout of Vitesco Technologies Group to boost their presence in the EV supply chain; the family could announce a deal for the $3.2B company as soon as today (BBG)

RSK Group, a UK environmental, engineering, and technical services firm, is seeking to raise $607M through preferred equity to a new investor to fund growth (BBG)

State investor Abu Dhabi Investment Authority will acquire a 0.6% stake in Indian billionaire Mukesh Ambani’s Reliance Retail for $597M at a $100B valuation (TC)

Italian club Juventus Football Club will seek to raise as much as $212M of new equity from shareholders after another annual loss (BBG)

Kombucha beverage brewer JuneShine is exploring a sale that could value the company at over $100M (RT)

Disney is in talks with Adani, Sun TV Networks, and PE firms to sell its India streaming and television assets; Disney is weighing an outright sale, joint venture, and other options (BBG)

AirTrunk, an Australian data center operator backed by Macquarie, is considering strategic options including a minority stake sale (BBG)

France blocked the takeover of the French units of Canada’s nuclear supplier Velan by US-based Flowserve (BBG)

VC

Regent, an electric seaglider startup, raised a $60M Series A co-led by 8090 Industries and Founders Fund (TC)

On-demand personal rapid transit startup Glydways raised a $56M Series B led by New Science Ventures (PRN)

Immediate-access behavioral health crisis care startup Connections Health Solutions received a $28M growth round led by Town Hall Ventures (FN)

Vibrant Planet, a wildfire protection and ecosystem restoration startup, raised a $15M Series A led by Ecosystem Integrity Fund (FN)

Beat The Bomb, an interactive social video game company, raised a $15M Series B from Otium Capital, Conversion Venture Capital, and more (FN)

Castelion, an El Segundo-based modern defense production company, raised a $14.2M round led by a16z and Lavrock Ventures (FN)

Concentric Educational Solutions, a provider of an education support system, raised a $5M Series A led by New Markets Venture Partners (FN)

Azumuta, a startup providing software for manufacturing process management, raised a $3M seed round led by PMV (EU)

Atalan Tech, a startup providing a platform to accelerate early prediction and prevention of healthcare worker burnout and turnover, raised a $2.5M seed round led by Excelerate Health Ventures and OCA Ventures (FN)

Velostics, a SaaS startup focussed on unified scheduling for shippers, raised a $2M seed round led by Starboard Star (FN)

IPO / Direct Listings / Issuances / Block Trades

Birkenstock Holding secured enough commitments from investors to price its IPO at the top of its indicated range and attain a $10B valuation (RT)

GameChange Solar, a solar parts manufacturer backed by an affiliate of Koch Industries, confidentially filed for an IPO as soon as next year and will seek a valuation of up to $3B (BBG)

Dubai investment management firm Shuaa Capital plans to raise ~$150M through a rights issue (BBG)

Debt

The Philippines raised $1.3B through a sale of dollar bonds (BBG)

Bankruptcy / Restructuring

Troubled British bank Metro announced a $397M capital raise and $733M debt refinancing and will hand majority shareholder control to Colombian billionaire Jaime Gilinski (RT)

PE firm Platinum Equity is nearing a deal to inject an extra $100M into troubled portfolio company Petmate to allow the pet product manufacturer to avoid a default (WSJ)

Online used car seller Shift Technologies, an ex-SPAC, will shut down its business and file for Chapter 11 bankruptcy (BBG)

Fundraising

Energy PE firm Quantum Capital Group raised $1.4B for its Quantum Capital Solutions II to help finance new oil and gas wells and $650M for its first credit opportunities fund (WSJ)

Insurance-focused VC Viewpoint Ventures closed its inaugural Viewpoint Fund I at ~$150M to invest in companies that solve problems in the insurance industry (FN)

Crypto Corner

US CFTC concluded that the ex-CEO of bankrupt crypto lender Voyager Digital Holdings, Stephen Ehrlich, broke derivatives regulations and are weighing enforcement action (BBG)

Yuga Labs, the company behind Bored Ape Yacht Club and CryptoPunks NFTs, is laying off staff across its business as part of an internal restructuring (BBG)

SBF lied about FTX being fine a few days before the exchange filed for bankruptcy (BBG)

Exec’s Picks

In the wake of the recent attacks in Israel, Noah Smith wrote about what a post-Pax Americana world might look like.

Trung Phan explained how Spirit Halloween makes $650M in a month each October.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter