Together with

Good Morning,

Stock market pain is extending to PE and VC firms, CEOs are breaking silence on the trade war, US short sellers are up $127B in one week, global hedge funds are negative YTD, a16z plans to raise its biggest fund ever, and US bond yields are surging after a sharp drop in an apparent basis trade unwind.

Megafunds like CVC and Warburg Pincus already leverage Mosaic to build LBO models in mere minutes. It's time that you do too.

Let's dive in.

Before The Bell

As of 4/8/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks continued their slide after a turbulent trading session, triggered by the announcement of a 104% tariff on Chinese goods

US stocks had the sharpest four-day selloff in five years

S&P fell to a one-year low, nearing bear market territory

S&P is the most oversold since 2020

Nasdaq blew its biggest intraday gain since 1982

Europe's Stocks 600 rallied 2.7% in its first gain in five days following its worst week in five year

UK's FTSE 100 recovered 2.7% in its best day since March 2022 after falling to a one-year low

US 30Y and 10Y yields are up over 60 bps in two days

30Y yield surged to 5% overnight to the highest since October 2023 in an apparent Treasuries basis-trade unwind

10Y yield surged back to 4.5% overnight

Munis index fell 2.85% in its worst day since 1994

Munis yields surge 58 bps in two days

US corporate investment grade yields soared to 5.32% to the highest since June 2022

UK 30Y gilt yields rose to 5.4% to its highest since January

Japan 30Y and 20Y yields surged 19 bps and 15 bps to 2.7% and 2.25% respectively

South Africa's sovereign spread jumped to its highest in two years

PBOC fixed yuan at the weakest level since September 2023

New Zealand kiwi fell to the lowest since Covid amid a rate cut

Asia FX index dropped to a record low

Earnings

What we're watching this week:

Today: Delta, Constellation Brands

Thursday: CarMax

Friday: JPMorgan, Morgan Stanley, Wells Fargo, BlackRock

Full calendar here

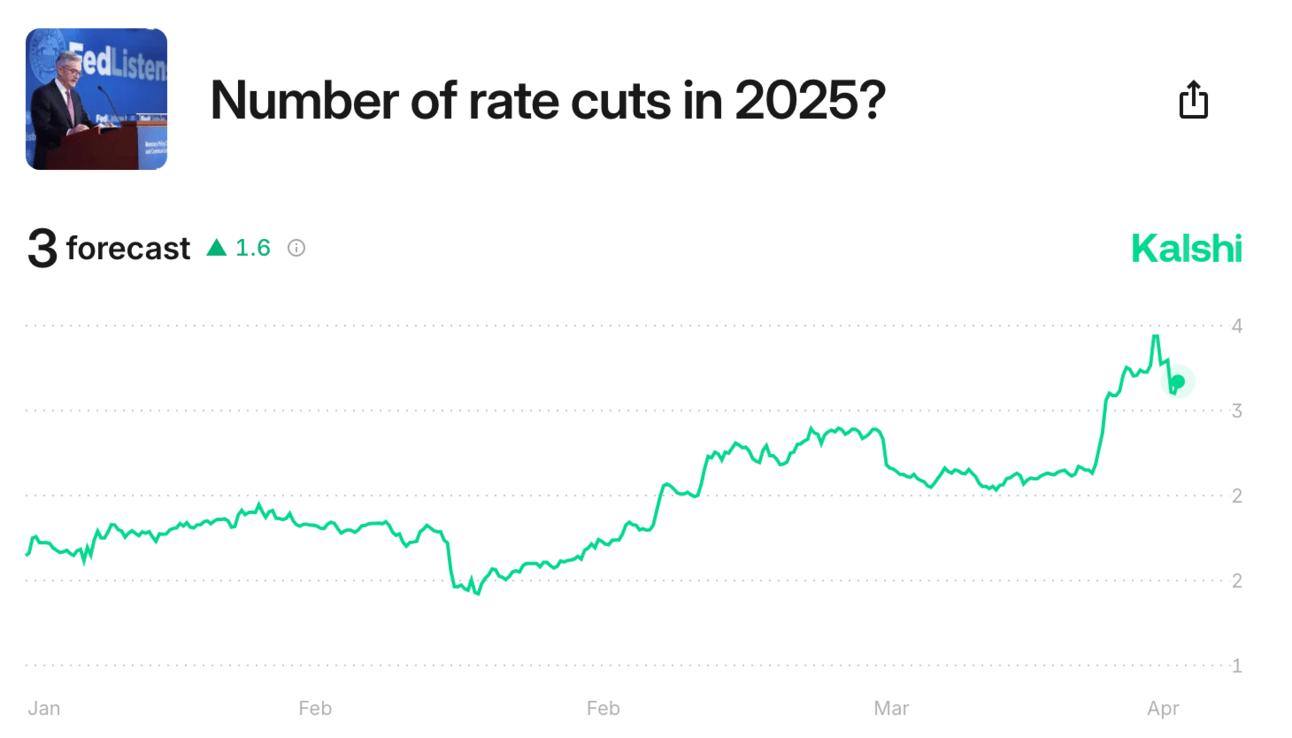

Prediction Markets

Traders are severely questioning the path of Fed rate cuts amid the global trade war, with prediction markets forecasting some major easing.

Headline Roundup

US raised China tariffs to 104% (CNBC)

Japan rules out using US debt to counter Trump tariffs (RT)

New Zealand cut rates by 25 bps to 3.5% (WSJ)

Global hedge funds are down 3% YTD (RT)

PE firms are demanding fund commitments for LPs to sell stakes (BBG)

PE-backed firms are facing cash struggles (BBG)

VCs fear crisis amid IPO delays (BBG)

US short sellers are up $127B in one week (RT)

Investors lost a record $25B in leveraged ETFs last week (FT)

Financing standstill triggers alarm for debt-dependent firms (BBG)

Wall Street braces for souring earnings amid trade war (BBG)

CEOs break silence on US trade war (WSJ)

Many US firm plan to keep China ties (WSJ)

China will support firms with share buybacks (RT)

Taiwan activated a $15B stock stabilization fund (RT)

JPMorgan sees more for junk bonds and private credit (BBG)

Japan firms pull debt deals as tariffs hit outlook across Asia (RT)

BlackRock wants to unite public and private markets (BBG)

FDIC will ease banks' living-will mandates (BBG)

Microsoft is now the world's most valuable company (CNBC)

Singapore steps up efforts to become Asia's restructuring hub (BBG)

Google is paying AI staff to do nothing than join rivals (TC)

Barclays ended DEI in US (RT)

Constellation Brands ended DEI (RT)

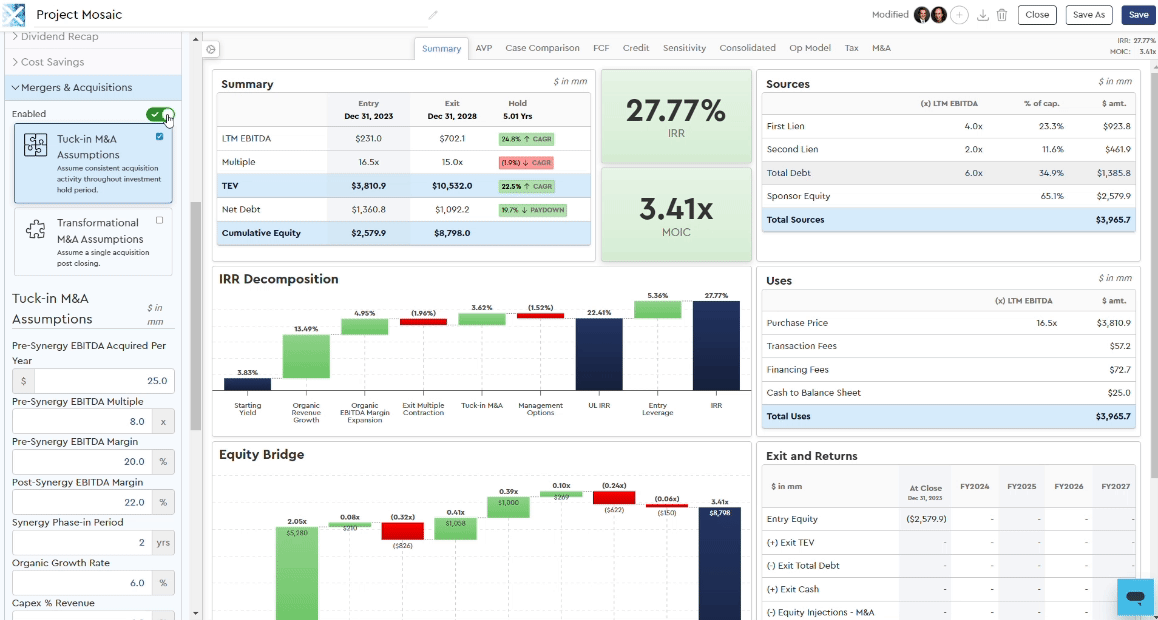

A Message from Mosaic

Model with Mosaic

By now, I'm sure you've heard of the buzz-worthy deal modeling platform, Mosaic.

Mosaic was recently featured in Bloomberg and FT for their next-gen technology that allows investment professionals to build LBO models in minutes.

The platform was built by PE veterans themselves, and its accuracy, complexity and practicality virtually eliminates the tediousness of modeling tasks that many of us face daily.

I wish I had this tool during my PE days and I'm not surprised that Mosaic is emerging as the new industry standard in deal modeling.

Some of the biggest investors already use Mosaic to save hours on modeling workflows and it's something that you must try.

Deal Flow

M&A / Investments

Arla Foods and DMK plan to merge into a single cooperative under the Arla name, forming a $21B European dairy giant

Spanish bank Santander is weighing a sale of its 62% stake in Santander Bank Polska worth $8B

Peabody Energy is reviewing its ~$3.8B deal to acquire Anglo American's Australian steelmaking coal assets amid a mine ignition incident

KKR is nearing a deal to acquire Swedish consumer health firm Karo Healthcare from EQT for over $2.7B

Bain Capital agreed to buy healthcare software firm HealthEdge from Blackstone for $2.6B, including debt

Tire manufacturer Continental is weighing a sale of its ContiTech industrial unit and spinoff of its auto unit

Crypto firm Ripple will acquire prime brokerage Hidden Road for ~$1.3B

Japanese financial conglomerate SBI Holdings is considering selling a minority stake in its crypto unit B2C2 at a $100M valuation

Sohar Bank made a merger bid for smaller rival Ahli Bank to create one of Oman's largest lenders

VC

German solar energy startup Enpal raised a $121M equity round led by TPG

Turkish fintech Sipay raised a $78M Series B at a $875M valuation led by Elephant VC

Commerce platform SILQ is raising a $110M round led by Valar Ventures and Sanabil Investments

Brinc, a startup building emergency response drones, raised a $75M round led by Index Ventures

Rain, a startup offering employer-integrated earned wage access, raised a $75M Series B at a $340M valuation led by Prosus

Hawk, a German AI-powered anti-money laundering and fraud prevention solutions, raised a $57M Series C led by One Peak

Haball, a Pakistani supply chain financing and payments fintech company, raised a $52M pre-Series A led by Zayn VC

Aurascape, an AI-native security company, raised a $50M round led by Mayfield Fund and Menlo Ventures

Blockchain based restaurant payments and loyalty app Blackbird raised a $50M round led by Spark Capital

NexGen Cloud, a UK startup specializing in AI infrastructure, raised a $45M Series A from HNIs and family trusts

Supply chain design software provider Optilogic raised a $40M Series B led by NewRoad Capital Partners

Zero trust security provider Portnox raised a $37.5M Series B led by Updata Partners

Corinex, a startup building broadband over power line grid visibility and flexibility solutions, raised a $30M round led by Energy Growth Momentum, Suma Capital, and Adara Ventures

Corsha, a machine-to-machine traffic protection startup, raised an $18M Series A-1 led by SineWave Ventures

Enter, a one-stop platform for energy efficiency in the real estate sector, raised a ~$17.5M Series B led by Coatue, Target Global, and others

Defense technology company Gallatin raised a $15M seed round led by 8VC

Blumind, a developer of low-power analog AI chips for edge computing, raised a $14M Series A led by Cycle Capital and BDC Capital

Pet food startup Untamed raised a $13M Series B led by Coefficient Capital

AI-driven food innovation startup Starday raised an $11M Series A led by Slow Ventures and Equal Ventures

Autonomous security startup Qevlar AI raised a $10M round led by EQT Ventures and Forgepoint Capital International

Ingenix, a startup simulating clinical trials using AI, raised a $10M seed round led by Inovo.vc

SigIQ.ai, an AI-driven edtech startup, raised a $9.5M seed round led by The House Fund and GSV Ventures

EV exclusive wholesale auction platform Plug raised a $6.7M seed round led by Floodgate, Autotech Ventures, and A*

Private capital management platform Dealstack raised a $5.5M seed round from execs at Paul Weiss, Kirkland & Ellis, Latham & Watkins, KKR, CVC, TA Associates, Goldman Sachs, and more

Spektion, a software vulnerability management company, raised a $5M seed round led by LiveOak Ventures

Swedish IT asset management startup Starhive raised a $5M pre-Series A led by Ventech

Sperm Racing, a startup launching the world's first live sperm race, raised a $1M round led by Karatage

IPO / Direct Listings / Issuances / Block Trades

Tiger Global-backed Indian construction-tech startup Infra.Market plans to raise $1B at a $5B valuation in an India IPO this year

Indian EV-scooter maker Ather Energy will reduce its planned $400M India IPO offering to ~$350M

Debt

EU received $95B in bids for a $7.7B bond sale

Payroll processing company Paychex sold $4.2B in notes to finance its acquisition of rival Paycor in its first investment grade bond sale

PIF-owned EV maker Lucid raised $1.1B in a private convertible senior notes offering

African Export-Import Bank raised $300M in its first Chinese panda bond

Kashiv BioSciences raised $150M in private credit from GoldenTree Asset Management

Indian cement maker Nuvoco Vistas is seeking $140M in private credit to finance its acquisition of Vadraj Cement

Bankruptcy / Restructuring / Distressed

Royal Paper, a paper goods-maker supplying major grocery chains, filed for Chapter 11 bankruptcy and agreed to sell its business to peer Sofidel America Corp. for $126M

Fundraising

VC a16z plans to raise $20B for its largest fund ever to invest in US AI growth-stage startups

Private markets investor Pantheon raised $5.2B for a third fund to invest in private credit secondaries

Campbell Global, the timberland-focused investment platform of of JPMorgan Asset Management, raised $2.3B across its second climate solutions fund and SMAs

Carlyle's private markets FOF AlpInvest Partners raised $3.2B for its second portfolio finance fund

Renewables investor Excelsior Energy Capital raised $1B for its second fund

Utah Jazz-owner Ryan Smith and Accel partner Ryan Sweeney are forming a $1B VC fund

PE firm RCPDirectV raised $994M for its fifth co-investment fund

Crypto Sum Snapshot

US will scale back enforcement on crypto lawsuits

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

Periods of market stress often give rumors the power to move markets. Check out J. Edward Moreno's breakdown of one Twitter tariff rumor that caused a $4T stock market move.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.