Together with

Good Morning,

Spirit is in a tough spot after the failed JetBlue buyout, Sheryl Sandberg left Meta’s board, Apple is banned from selling watches in the US with a blood oxygen sensor, election-year messaging will drive consumer trends, CNN’s newest boss is shaking up their news operations, and Harvard is trying to smooth over relations with Silicon Valley.

Today’s sponsor, Plaid, just published their 2023 report on the state of Fintech, and you can download it here.

Let’s dive in.

Before The Bell

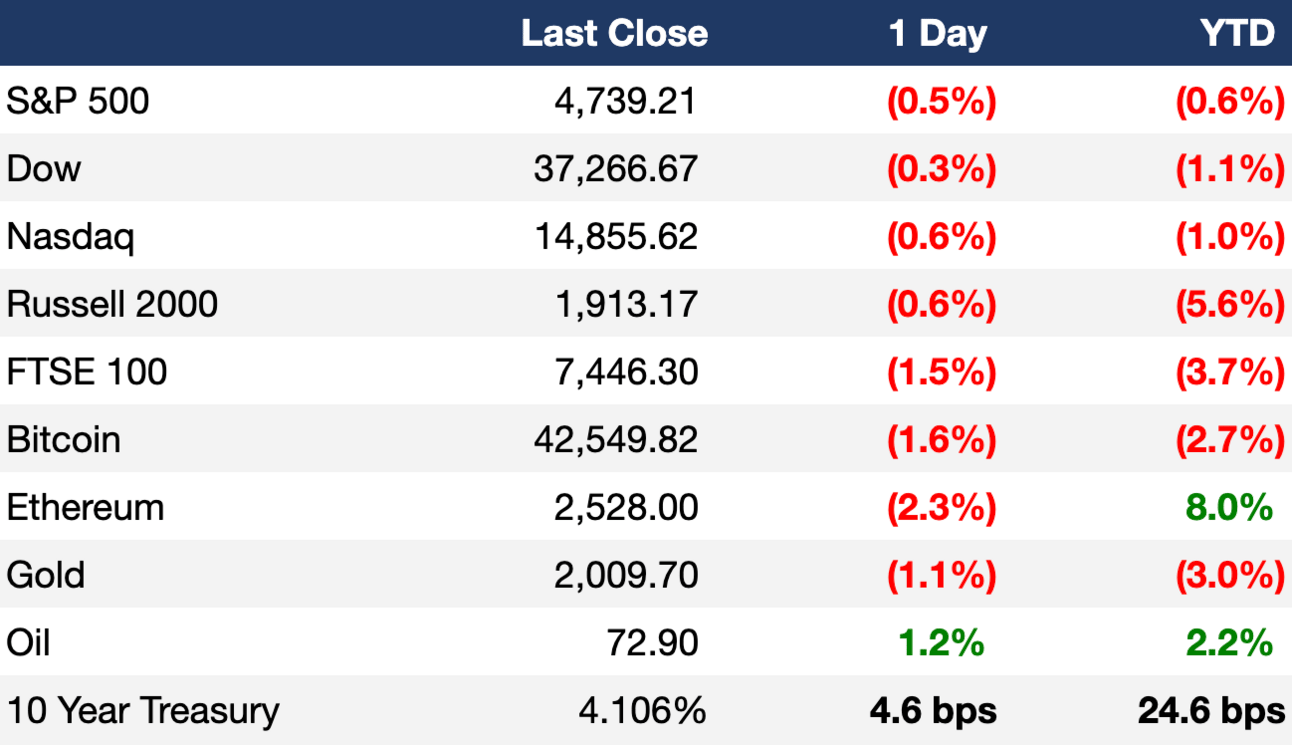

As of 1/17/2024 market close.

Markets

US stocks fell due to stronger-than-expected US retail sales data hurting expectations of a Fed rate cut in March

The Nasdaq led indices with a 0.59% decline

Asian stocks fell, led by a plunge in Chinese stocks, as China’s Q4 GDP growth missed estimates

European stocks fell as UK’s inflation unexpectedly accelerated to 4% YoY in December

Earnings

Charles Schwab Q4 profit fell 47% due to bigger interest payments on its client deposits and debt hurting gains from a jump in asset management fees (YF)

Discover Financial shares fell ~10% after reporting a 62% fall in Q4 profit as the lender set aside funds to cover loans that could sour (RT)

What we're watching this week:

Today: TSMC, Truist

Friday: Ally Financial, State Street

Full calendar here

Headline Roundup

Markets expect rate cuts soon, but central banks say not so fast (WSJ)

Failed JetBlue buyout leaves Spirit Airlines with a tough path forward (CNBC)

Sheryl Sandberg to exit Meta’s board (AX)

Apple again banned from selling watches in the US with blood oxygen sensor (CNBC)

Election-year messaging to drive consumer shifts (AX)

Chinese lab mapped deadly Coronavirus two weeks before Beijing told the world (WSJ)

Chile taps global debt markets with resurgence of emerging bond sales (BBG)

China goes all in on green industry to jolt ailing economy (WSJ)

US likely to levy higher penalties for export-control violations (WSJ)

A $300B pension fund leads big-money charge back to bonds (BBG)

Samsung shows Smart Ring to rival Oura in renewed health tech push (BBG)

Jamie Dimon praises Trump, warns MAGA criticism could hurt Biden (CNBC)

New CNN boss shakes up news operations, explores digital subscription model (WSJ)

Half of Japan firms look at restructuring to boost performance (CNBC)

Harvard is trying to smooth things over with Silicon Valley (WSJ)

Apple to face US antitrust lawsuit as soon as March (BBG)

Knicks owner James Dolan accused of sexual assault (WSJ)

A Message From Plaid

WTFintech?

Then you need to check out the 2023 Fintech Effect by Plaid.

Plaid partnered with The Harris Poll by surveying 2,000+ fintech consumers to get a pulse on what’s currently working in fintech and which gaps need to be filled for the future.

From exploring the next wave of customers, the latest usage trends, and the future of AI in finance; it covers everything you need to truly understand the fintech space.

But what makes this year’s edition worth the download? Good question. Plaid has…

Dug into why 86% of customers see the benefits of pay by bank relative to debit/credit cards

Broken down how fintech is successfully aiding lower-income populations with access to digital finance where traditional institutions have failed.

Dialed into consumers’ (7 out of 10) desire to use fintech to intellectually navigate high inflation

For anyone looking to grow their business by leveraging fintech, this report is a must-read.

Deal Flow

M&A / Investments

Italy approved KKR’s $23.9B acquisition of Telecom Italia’s landline grid after deeming the asset sale of strategic value to the state (BBG)

French telecoms group Orange and Spanish rival MasMovil are set to gain conditional EU antitrust approval for their $20.2B Spanish tie-up (RT)

Warren Buffett's Berkshire Hathaway bought the remaining 20% stake of truck-stop business Pilot Travel Centers from the Haslam family for an undisclosed sum; Berkshire paid $8.2B for a 41.4% stake last January (RT)

AirTrunk’s owners, including Macquarie Asset Management and PSP Investments, are planning to sell the Australian data center operator and could seek a valuation of ~$7.9B (BBG)

GI Partners and TA Associates, the PE owners of Netsmart Technologies, are exploring a sale of the US healthcare software firm, hoping to value the company at over $5B, including debt (RT)

US door maker PGT Innovations agreed to a $3.1B take-private offer from window and door manufacturer Miter Brands, ditching its previous $3B deal with Masonite International (RT)

British drugmaker GSK raised $1.2B through a discounted stake sale in consumer healthcare company Haleon (RT)

India's Sun Pharmaceutical Industries, which owns ~78.5% of Taro Pharmaceutical Industries, will acquire all remaining shares of the Israeli pharmaceutical manufacturer for $348M (RT)

Data platform LiveRamp Holdings agreed to acquire marketing data startup Habu for $200M in cash and stock (RT)

PE firm Convergence Partners acquired South Africa’s Datacentrix, an IT network manager and data center operator (BBG)

German auto supplier ZF Friedrichshafen is preparing to sell its airbag operation to a buyer or spin off the business in an IPO (RT)

VC

Game studio Build a Rocket Boy raised a $110M Series D led by RedBird Capital Partners (TC)

Cleveland Diagnostics, a clinical-stage biotech company focused on early cancer detection, raised $75M in growth capital financing led by Novo Holdings (BW)

Timeline, a Swiss consumer health biotech company developing solutions for healthy aging/longevity, raised a $66M Series D led by BOLD (BW)

LatAm payments infrastructure startup Pomelo raised a $40M Series B led by Kaszek (TC)

Lightship, an all-electric RV startup, raised a $34M Series B led by Obvious Ventures and Prelude Ventures (PRN)

Vulnerability remediation platform Vicarius raised a $30M Series B led by Bright Pixel Capital (TC)

CloudTalk, an AI-powered calling solution, raised a $28M Series B led by KPN Ventures and Lead Ventures (PRN)

Expense management startup Vertice raised a $25M Series B led by 83North and Bessemer Venture Partners (TC)

Prismatic, an iPaaS startup for B2B SaaS, raised a $22M Series B led by Five Elms Capital (TC)

Prota Therapeutics, a Melbourne-based biotech startup focused on the development of novel oral immunotherapy treatments, raised $21M in equity/debt led by SPRIM Global Investments (FN)

SocialFi app Focus raised $20M in funding in under 24 hours from Coinbase, Sequoia, a16z, Social Capital, and other top funds (FN)

Unbox, a provider of infrastructure for the programmable exchange of value, raised a $12M Series A led by HSBC Asset Management (FN)

Certis Oncology, a precision oncology and translational science company, raised a $10M Series C led by John Tozzi (BW)

Green materials startup Element Zero raised a $10M seed round led by Playground Global (BW)

PredictAP, a machine learning-enabled invoice ingestion and coding solution for real estate accounts payable, raised an $8M Series A led by RET Ventures (BW)

End-to-end payment technology company Payzli received a $6M investment from Esquire Financial Holdings (FN)

RocketStar, an NYC-based space exploration and satellite services startup, raised a $2M seed round (FN)

IPO / Direct Listings / Issuances / Block Trades

KKR-backed community-based health-care services provider BrightSpring Health Services is seeking to raise as much as $1.4B in an IPO and sale of convertible securities (BBG)

Wilson tennis racket maker Amer Sport is planning to price its $1B US IPO by the end of January (RT)

Mobile app provider Kaspi.kz’s shareholders are seeking to raise $873M in a US IPO (BBG)

Israeli real estate firm Azrieli Group is considering options for its data center arm, including a potential IPO (BBG)

SPAC

Korean Alzheimer’s treatment developer Mediforum is merging with Vision Sensing Acquisition Corp. in a $250M deal (GNW)

Debt

JPMorgan Chase, Wells Fargo, and Morgan Stanley raised $23B total through bond sales, with JPMorgan leading issuers with an $8.5B jumbo deal (BBG)

Bankruptcy / Restructuring

Diamond Sports Group, the largest regional sports broadcaster, reached a restructuring agreement with creditors in bankruptcy to avoid liquidation; Amazon agreed to invest in its streaming business (WSJ)

The insolvent Signa Group’s development unit, Signa Development Selection, plans to gradually sell assets to repay creditors and cease all business (BBG)

Mexico’s once-biggest shadow bank, Unifin Financiera, submitted a restructuring deal before a Mexican bankruptcy court that will turn control over to creditors (BBG)

Fundraising

Saudi Arabian oil giant Aramco will more than double its VC fund Aramco Ventures from $3B to $7B (AX)

Travel and leisure investor KSL Capital Partners raised $1.3B for its latest private credit fund, KSL Capital Partners Credit Opportunities Fund IV (FN)

VC and PE firm Top Tier Capital raised $1.1B to invest with global venture funds and tech companies (TC)

Crypto Corner

Exec’s Picks

Matt Levine provided excellent commentary on Musk’s latest request for a bigger stake in Tesla.

Semafor interviewed Microsoft’s consumer chief marketing officer about Microsoft’s latest AI products.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter