Together with

Good Morning,

US execs are dumping stocks in record numbers, Bridgewater is expanding its strategy to retail investors, Ken Griffin thinks the multi-strat hedge fund boom is over, Morgan Stanley is courting wealth clients who are not yet wealthy, and markets have once again shifted all attention to Nvidia's earnings.

Exec Sum folks, in 2025 we're turning the page from old-fashioned inefficient CPAs to bespoke tax platforms to save us the time and money we deserve. No matter your profession, Gelt has the right solutions for you. Transform your tax experience with Gelt.

Let's dive in.

Before The Bell

As of 11/19/2024 market close.

Markets

US stocks rose as investors digested Ukraine-Russia developments and braced for Nvidia's earnings

Options markets are implying an 8.5% swing in Nvidia shares following earnings

Treasury shorts were met with dip-buyers as yields failed to break May highs

Gold and safe-haven currencies rose on Russia-Ukraine tensions

Bitcoin crossed $93k to hit a new high

Earnings

Walmart issued a Q3 beat-and-raise thanks to growth in e-commerce and a rise in discretionary spending by high-income consumers (CNBC)

Lowe's beat Q3 earnings estimates and hiked FY guidance which nonetheless conveyed a YoY sales decline as high rates continue to pressure the home improvement market (CNBC)

What we're watching this week:

Today: Nvidia, Palo Alto Networks, Target, TJX

Thursday: John Deere, Baidu, Gap

Full calendar here

Headline Roundup

JPMorgan chair of tech IB expects more IPOs after election (BBG)

David Solomon expects deal flow to pick up in 2025 (RT)

David Solomon sees global investors still on the sidelines in China (FT)

China pledged capital markets reform and support for Hong Kong (RT)

Execs are cashing in in record number amid post-election rally (FT)

Japan and China dumped US Treasuries before Trump's victory (BBG)

Ken Griffin says multi-strat hedge fund boom is over (BBG)

Barings sees public and private ABF converging (BBG)

Morgan Stanley is courting near-IPO startup employees for wealth management (RT)

Bridgewater opens strategy to retail investors via State Street ETF (FT)

Vanguard will allow shareholders to vote for profits over ESG (FT)

Car loan-backed ABS sales soar despite record delinquencies (WSJ)

EU will demand tech IP transfers from Chinese firms (FT)

Trump named Cantor CEO Lutnick as Commerce Secretary (CNBC)

FDIC chair Gruenberg will retire in January, clearing way for Trump picks (RT)

Activist Elliott took a 5% stake in Tokyo Gas (BBG)

New Abrdn CEO overhauled leadership amid poor performance (FT)

Head of Volkswagen North America stepped down amid poor results (FT)

Mulberry will cut 25% corporate jobs and slash China exposure (FT)

Congress is pushing for a Manhattan Project-style AI initiative (RT)

JPMorgan Chase UK debuted lending via credit card launch (FT)

Xi's push for stable world of low tariffs undone by Trump and Putin (BBG)

Tech jobs are mired in a recession (BI)

Gender equality declined at fund managers (FT)

Milan beat London and NYC as home to most expensive shopping street (FT)

Paul-Tyson fight was the most-streamed sporting event in history (RT)

A Message from Gelt

Get ahead of the tax curve with Gelt

Between investments, income, and business progress, even traditional CPAs don't save you from the annual tediousness of tax filing. In fact, they often don't even optimize your tax returns and leave you paying more than what you should.

Gelt is built for professionals, investors, and business owners, who want to maximize their returns without the headache. Gelt understands the complexities of managing significant assets, from real estate portfolios to investment gains, and delivers solutions that minimize liabilities and maximize returns.

Aided by proprietary AI, Gelt's experts tailor bespoke solutions to make your entire tax process seamless, strategic, and simple.

Say goodbye to your tedious traditional tax habits and welcome premier planning and filing with Gelt.

Get 10% off when you upgrade to Gelt this year.

Deal Flow

M&A / Investments

Packaging firm Amcor agreed to buy US peer Berry Global in an $8.4B stock deal

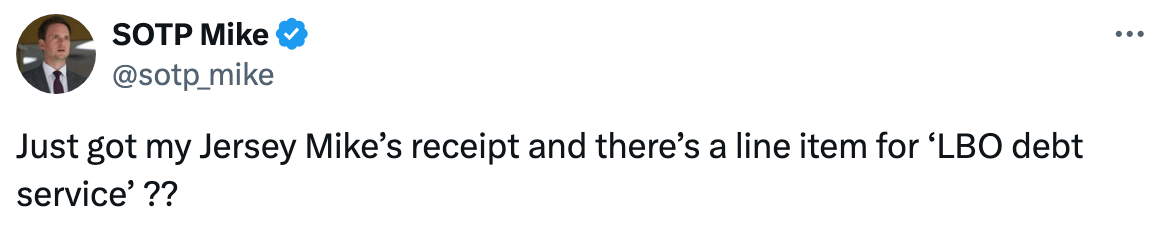

Blackstone will acquire Jersey Mike's Subs at an $8B valuation, including debt

Brookfield is considering a $6.9B bid for Spanish pharma giant Grifols

SWFs ADIA and GIC are in advanced talks to acquire a minority stake in Pye-Barker Fire & Safety from Leonard Green & Partners and Altas Partners at an over $6B valuation, including debt

Drone maker AeroVironment will buy space and defense engineering firm BlueHalo from Arlington Capital Partners in a $4.1B all-stock deal

$2.6B-listed French fuel distributor Rubis is exploring a sale

Japanese trading house Mitsui emerged as the highest bidder for a ~$2B, 20% stake in First Quantum Minerals' Zambian copper mines

DT Midstream will buy three natural gas transmission pipelines from Oneok for $1.2B

Prosperity Asset Management and insurance firm Kuvare acquired minority stakes in real estate investor Evergreen Residential for $1B

Keppel DC REIT agreed to acquire two data center buildings in Singapore in a $747M deal

Sony is exploring a takeover of Japanese publisher Kadokawa

India is considering minority stake sales in Central Bank of India, Indian Overseas Bank, UCO Bank, and Punjab and Sind Bank

VC

Kong, a developer of cloud API technologies, raised a $175M Series E at a $2B valuation led by Tiger Global

High-performance networking chip maker Enfabrica raised a $115M Series C led by Spark Capital

AI-based data processing company ChapsVision raised $90M led by Tikehau Capital, Qualium Investissement, Bpifrance, and more

Smart ring maker Oura raised a $75M Series D at a $5B valuation from Dexcom

Kubernetes management platform Spectro Cloud raised a $75M Series C at a $750M valuation led by Goldman Sachs

Rox, a startup developing AI agents for salespeople, raised a $50M seed and Series A round led by Sequoia and General Catalyst respectively

Database startup Neo4j raised a $50M round at a $2.2B valuation from Noteus Partners

Selector, an AI-based IT incident response platform, raised a $33M Series B led by Ansa

OneChronos, an Alternative Trading System optimizing electronic trading, raised $32M in expansion capital led by Addition

Lightyear, an enterprise telecom management startup, raised a $31M Series B led by Altos Ventures

Minu, a Mexican startup helping employers provide benefits, raised a $30M Series B led by QED

Goodstack, a SaaS and fintech platform for charitable donations, raised a $28M Series A led by General Catalyst

Ample, a battery swapping technology for EVs, raised $25M from Mitsubishi

Synapticure, a virtual care platform for dementia patients, raised a $25M Series A led by B Capital

Distyl, an AI engineering and research team, raised a $20M Series A led by Lightspeed Venture Partners

Levanta, an affiliate marketing platform for Amazon sellers, raised a $20M Series A led by Volition Capital

Revv, a startup simplifying auto repair, raised a $20M round from Left Lane Capital

Quantum interconnect startup Lightsynq raised an $18M Series A led by Cerberus Ventures

AI publishing platform Spines raised a $16M Series A led by Zeev Ventures

Physical AI startup BrightAI raised a $15M seed round led by Upfront Ventures

CommBox, an enterprise-grade omnichannel AI customer experience platform, raised $15M from PSG Equity

Citizen Health, an AI-powered consumer health platform, raised a $14.5M seed round led by Transformation Capital

DEScycle, a startup improving e-waste recycling, raised a $13.4M Series A led by BGF and Vorwerk Ventures

Creator marketplace startup Agentio raised a $12M Series A led by Benchmark

IPO / Direct Listings / Issuances / Block Trades

Blackstone-owned casino operator Cirsa Enterprises is preparing a $1.1B Spain IPO

Cinven and CPP Investments-backed travel tech firm HBX Group is preparing a $1.1B Spain IPO

Dutch industrial infrastructure provider Vopak's India JV Aegis Vopak filed for a $415M India IPO

Comcast plans to spin off its NBCUniversal cable TV networks which include MSNBC, CNBC, and others

Thoma Bravo-backed enterprise security software firm SailPoint Technologies is planning a H1 2025 IPO

Debt

The family behind 7-Eleven-owner Seven & i plans to raise $52B from Japan's three largest banks and major US financial institutions to go private

Citigroup and Santander are preparing a $4.2B debt package to back a potential LBO of Platinum Equity-owned Spanish waste management firm Urbaser

Alibaba launched a $2.7B dollar bond sale to repay offshore debt and fund buybacks

Mattress firm Sleep Country Canada is in talks for a potential loonie bond sale to finance its $1.2B LBO by Fairfax Financial

United Airlines launched a $1B junk munis sale to fund a Houston terminal renovation

Fundraising

Defense-focused Enlightenment Capital closed its fifth fund at $825M

Saudi Arabian PE firm Jadwa Investment raised $266M for Mideast deals

Crypto Corner

Exec’s Picks

Joe Wiggins wrote a great piece on the groups of investors involved in every asset bubble.

With Meta and EY recently in the news for questionable firings, FT explored the real reason why employers have been terminating staff for minor offenses.

Where Diversification Meets 11.4% Cash Returns 📈

Our friends at Webstreet are launching their eighth fund. WebStreet buys and operates cash-flowing websites and SaaS businesses for accredited investors to invest in. So far WebsStreet has delivered 11.4% cash returns and is on track for 20%+ IRR.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.