Together with

Good Morning,

All megafunds delayed on-cycle recruiting after Jamie Dimon's pushback, Florida's crazy non-competes bill became law, VC IPO exits are headed for a decade-low, Russia banned Yale University, and ex-UK PM Rishi Sunak re-joined Goldman as a senior advisor.

Columbia Business School Exec Ed and Wall Street Prep launched a comprehensive online program on AI for Business & Finance, covering everything from GenAI foundations to advanced ML and predictive analytics. Get more info below.

Let's dive in.

Before The Bell

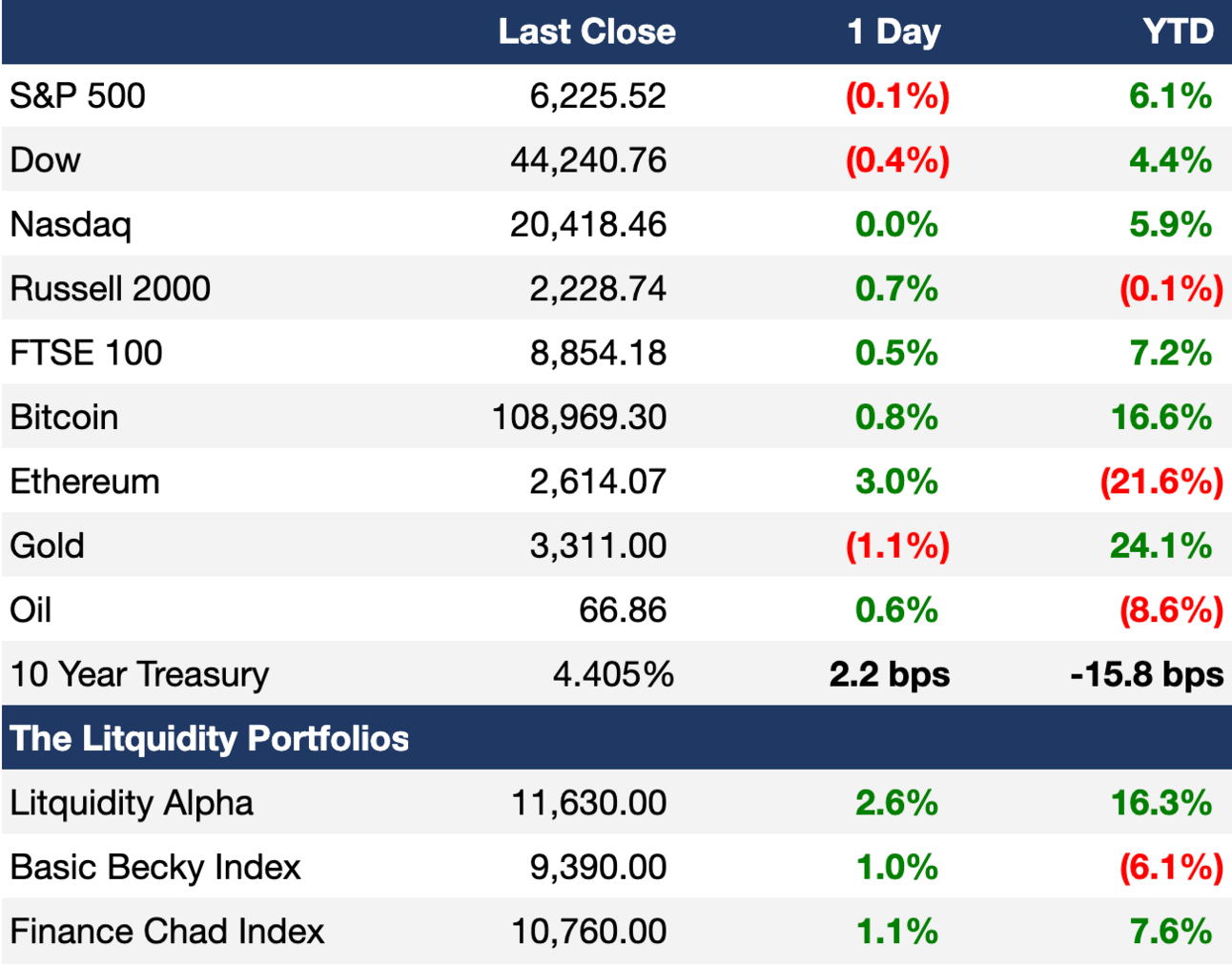

As of 7/8/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks closed flat yesterday as traders sought clarity from Trump's renewed tariff threats

Global stock indexes also ended flat as traders call Trump's bluff

Hong Kong shares of Chinese banks are up 30% YTD amid hunt for yield

US copper prices soared 12% past $12k/ton to a record high on copper tariff threats

Indian rupee was the worst-performing EM currency yesterday on tariff worries

Earnings

What we're watching this week:

Thursday: Delta, Levi's

Full calendar here

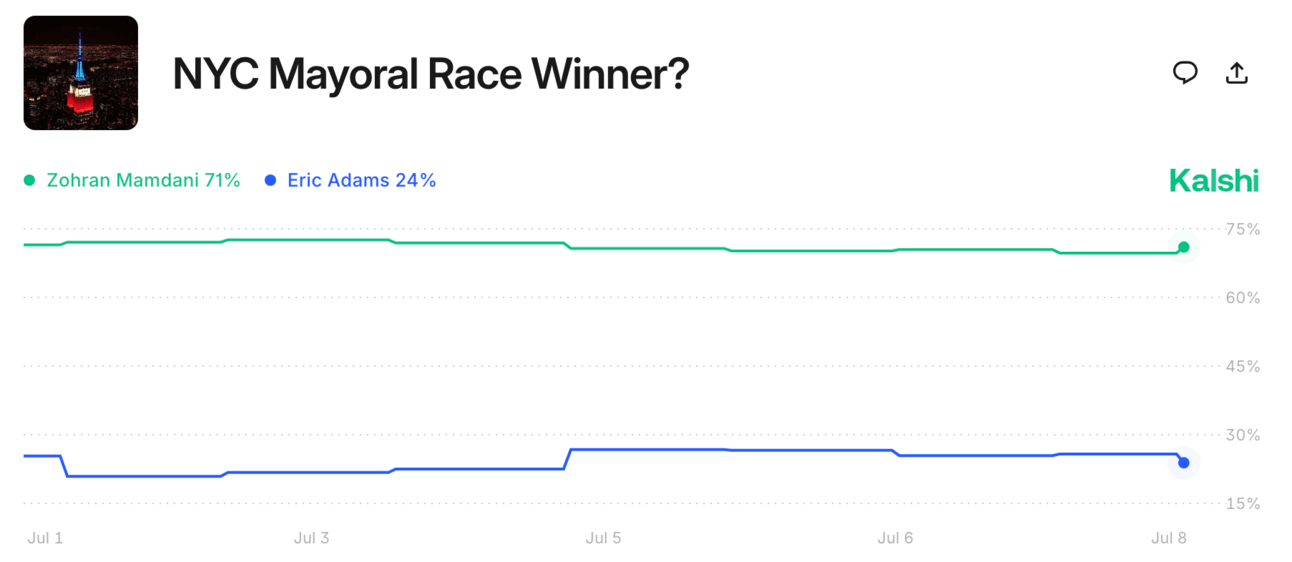

Prediction Markets

Is this seriously what it comes down to??

Headline Roundup

PE abandons early recruiting after Jamie Dimon pushback (FT)

Ken Griffin-backed Florida bill for non-competes became law (BBG)

Trump said J Pow should resign immediately (BBG)

US vowed no extensions for August 1 tariff deadline (BBG)

US plans to impose a 50% copper tariff and 200% pharma tariff (BBG)

Australia unexpectedly held rates steady at 3.85% (RT)

Hedge funds braved market gyrations to deliver positive H1 returns (RT)

VC-backed firms head for fewest US IPOs in a decade (BBG)

China stock exchange is urging firms to speed up IPO applications (BBG)

Activist investors set to push for changes as dealmaking picks up (RT)

Treasury bulls unwind big bets as strong data pushes yields up (BBG)

Gold ETFs saw the largest inflows in five years in H1 (RT)

Goldman hired former UK PM Rishi Sunak as a senior advisor (CNBC)

UBS grants 'goodwill payments' to clients hit by Trump trading losses (FT)

US consumer borrowing increased at the slowest pace in three months (BBG)

SoFi gives retails clients access to OpenAI, SpaceX, and Epic Games (BBG)

OpenAI, Microsoft, and Anthropic partnered with biggest teachers union to bring AI to classrooms (BBG)

OpenAI poached four execs from Tesla, xAI, and Meta (WR)

PwC sued EY for $1B over Bridging Finance accounting fraud (BBG)

Boeing delivered the most jets in 18 months (BBG)

Apple's long-time COO will retire (BBG)

OpenAI's o1 model tried to clone itself onto external servers when faced with shutdown, then denied it when caught (FUT)

SCOTUS gives go-ahead for DOGE mass federal layoffs (RT)

US seeks to ban Chinese from buying US farms (WSJ)

Russia banned Yale University as 'undesirable' (BBG)

A Message from Wall Street Prep

Tired of just prompting ChatGPT?

The AI for Business & Finance Certificate Program helps you go further—guiding you from beginner to building no-code workflows that boost productivity and drive real business impact.

Learn directly from Columbia Business School faculty, and hear from AI leaders at BlackRock, OpenAI, and more.

Automate the busywork and focus on what really needs your expertise.

Enroll today and save $300 with code LITQUIDITY. Time's running out — program starts July 14.

Deal Flow

M&A / Investments

$40B-valued renewable power company AES is exploring a sale amid takeover interest from Brookfield, BlackRock's Global Infrastructure Partners, and others

Meta acquired a ~3% minority stake in Ray-Ban-maker EssilorLuxottica for ~$3.5B

Stonepeak Partners is in talks to invest over $1B in Warburg Pincus-backed data center operator Princeton Digital Group

Construction firm TopBuild agreed to buy commercial-roofing services provider Progressive Roofing from Bow River Capital for $810M cash

Vodacom Group will not face opposition from South Africa's antitrust watchdog to acquire a fiber business from Remgro for $743M

Water utility H2O America is nearing a $540M deal to acquire wastewater utility Quadvest

Disney and Hearst are considering selling their A+E Global Media JV, which includes cable-TV channels like History and Lifetime

Samsung agreed to acquire US health services company Xealth

Starbucks drew investor interest for a controlling stake in its China unit

The Philippines' Villar family agreed to acquire mining giant Glencore's struggling copper refinery

VC

Musk's SpaceX is planning a raise and secondary share sale at a $400B valuation

SiPearl, a startup building European processors, raised a $152M Series A extension led by Cathay Venture, EIC Fund, and France 2030

UK fintech giant Revolut is in talks to raise $100M at a ~$45B valuation from Mubadala

Slate Auto, a customizable EV truck startup, raised a $100M Series A in 2023 led by Jeff Bezos

Data privacy solutions provider Didomi raised a $71.5M round led by Marlin Equity Partners

UAE proptech Huspy raised a $59M Series B led by Balderton Capital

Arbor Energy, a startup building a plant to burn waste biomass for electricity in a data center, received $41M from Frontier

Honor Education, a learning platform for individuals and organizations, raised a $38M Series A led by Alpha Edison, Audeo Ventures, and others

Finnish e-mobility tech company Donut Lab raised a $29M seed round

Tulum Energy, a startup using hydrogen tech to produce methane, raised a $27M seed round led by TDK Ventures and CDP Venture Capital

AI chip startup Arago raised a $26M seed round led by Earlybird, Protagonist, and Visionaries Tomorrow

Parspec, an AI native software platform enabling wholesale distributors and sales agents to efficiently bid and supply construction products, raised a $20M Series A led by Threshold Ventures

AI agentic startup Gradient Labs raised a $13M Series A led by Redpoint Ventures

Bumo, an on-demand childcare marketplace, raised a $10M seed round led by True Ventures and Offline Ventures

IoT connectivity solutions startup Blues raised an $8M follow-on round led by XYZ Venture Capital

Brainfish, an AI platform for reinventing how users interact with digital products, raised a $6.4M pre-Series A led by Prosus Ventures

IPO / Direct Listings / Issuances / Block Trades

Kuwait SWF KIA sold its $3.1B stake in Bank of America, marking an exit of another major crisis-era backer following Warren Buffett

Italian lender UniCredit raised its equity stake in German peer Commerzbank to ~20% to become its largest shareholder

Richard Attias & Associates, the organizer of Saudi Arabia's Future Investment Initiative summit, is preparing for a potential IPO

Chinese e-commerce and fast-fashion giant SHEIN confidentially filed for a Hong Kong IPO to pressure UK to approve their London listing

SPAC

Crypto treasury firm ReserveOne will merge with M3-Brigade Acquisition V Corp in a $1B deal led by Blockchain.com and Kraken

Debt

Indonesia SWF Danantara hired DBS, HSBC, Natixis, and Standard Chartered to lead a $10B multi-currency loan sale, potentially Southeast Asia's largest

Propel Finance, a UK asset finance provider, raised $2B in funding from Barclays, Bank of America, Citigroup, and British Business Bank

Henderson Land Development is seeking to raise $1B through convertible bonds issued via its Happy Ever Holdings unit

Bankruptcy / Restructuring / Distressed

Private investment platform Linqto filed for Chapter 11 bankruptcy amid SEC fraud allegations

Fundraising / Secondaries

Secondaries specialist Coller Capital raised $6.8B for its second credit opportunities fund

PE firm One Rock Capital Partners raised $4B across its latest flagship fund and its debut lower mid-market fund

PE firm New Mountain Capital plans to raise $2B for its debut secondaries strategy focused on backing single-asset continuation funds

Brookfield-backed VC investor Pinegrove Capital Partners is raising an $800M credit fund

Israeli VC Red Dot Capital Partners raised $320M for its third tech startup fund

Bitcoin-focused VC Ego Death Capital raised $100M for its second fund

Crypto Sum Snapshot

Crypto VC funding surged to $10B in Q2, highest since early-2022

Robinhood is discussing tokenized equities with European regulators

Trump Media is tripling down on crypto with third ETF filing

NFT market fell for fifth-straight quarter on drop in trading volume

Tether holds an $8B pile of gold in a secret Swiss vault

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

Carousel is an AI assistant for Excel that builds, edits, and formats models for you. And unlike your intern, Carousel is competent, doesn't complain when asked to fix spreadsheet formatting, and doesn't need a return offer.

@signulll shared a screenshot of one the most profound personal emails Steve Jobs ever wrote. Read it here.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.