Together with

Good Morning,

PE firms are resorting to new fundraising tactics, investors are swapping gold ETFs for Bitcoin ETFs, Jamie Dimon sold $150M of his shares, Nvidia identified Huawei as a top competitor, retail investors likely drove the recent crypto rally, and Gemini restricted AI image generation amid comical racial inaccuracies.

Looking to invest in private markets alongside veteran Wall Street investors? Check out today’s sponsor, 10 East.

Let’s dive in.

Before The Bell

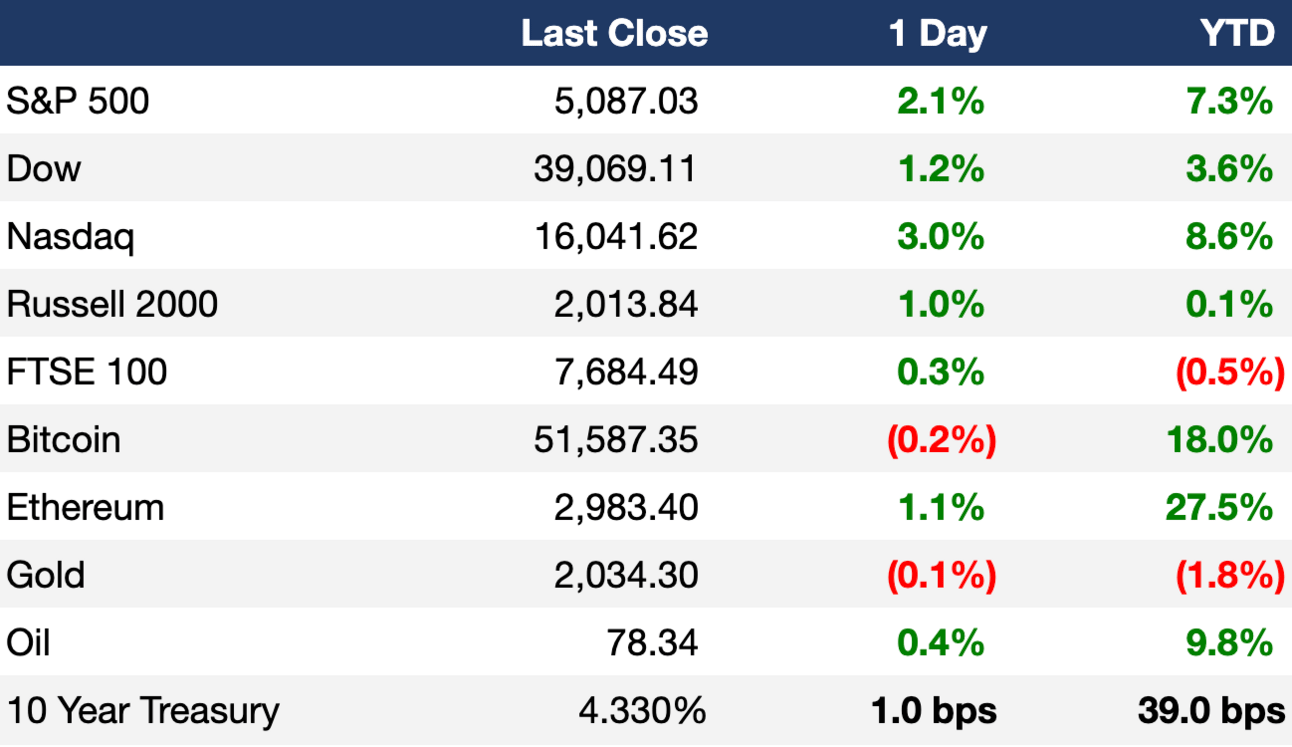

As of 2/22/2024 market close.

Markets

US stocks rallied to new highs yesterday as Nvidia's strong earnings helped lift the tech sector and broader market

The Nasdaq had its best day in a year, almost fully recovering from its November 2021 fall

Europe's Stoxx 600 hit an all-time high

The global MSCI ACWI index also posted a record high

Earnings

Headline Roundup

Wall Street may follow Canadian trend of using synthetic securities to transfer credit risk (BBG)

PE turns to new fundraising tactics in tough market (FT)

Private credit moves into banks’ infrastructure lending turf (BBG)

JPMorgan CEO Dimon sold ~$150M of his shares (RT)

Nvidia identifies Huawei as a top competitor (RT)

Investors swap gold ETFs for Bitcoin ETFs (RT)

Nvidia adds record $277B in market value (RT)

ECB reported a record loss for 2023 as rate hikes bite (RT)

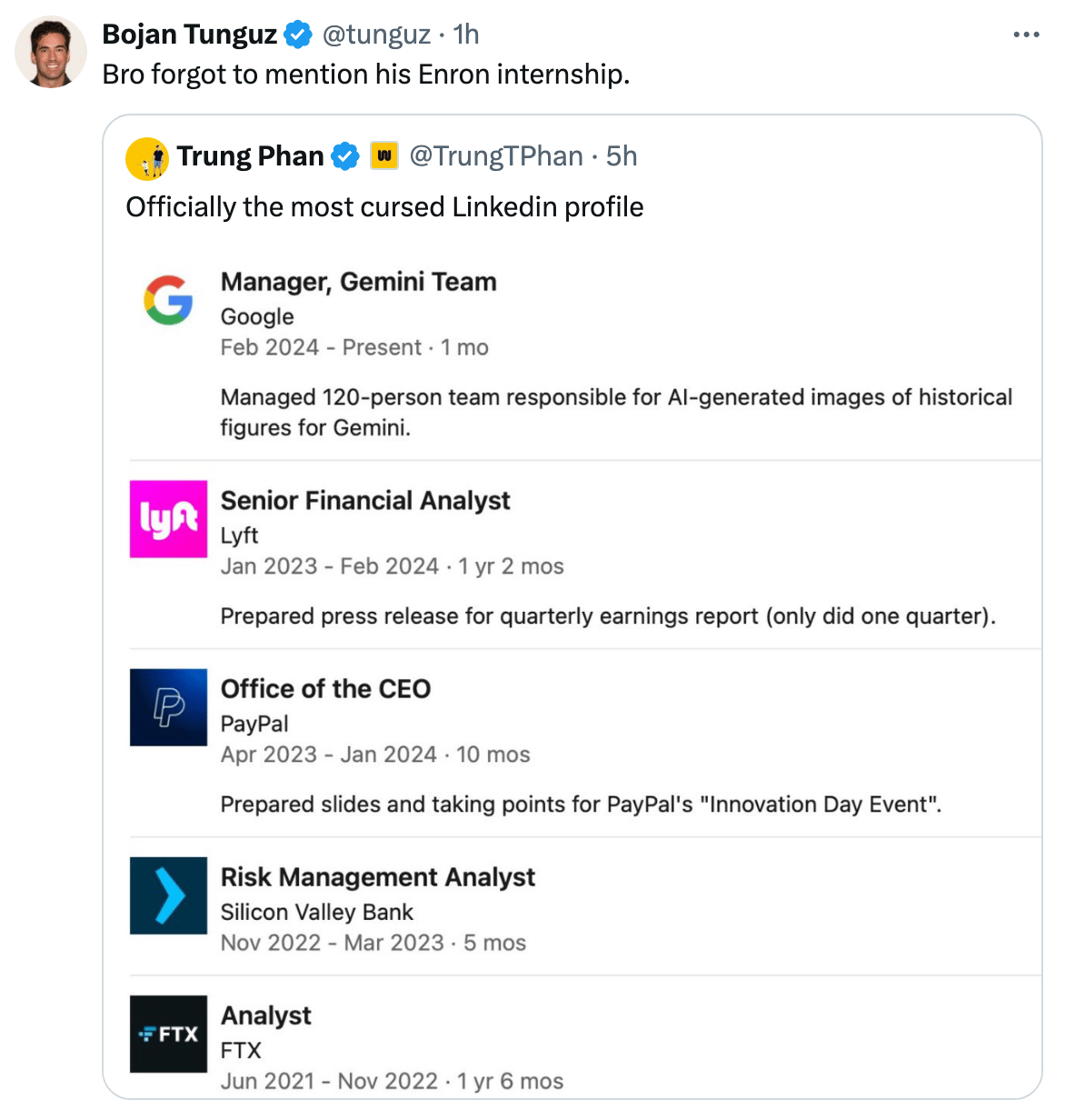

Google restricts AI image generation amid racial inaccuracies (WSJ)

Capital One-Discover merger deal termination fee set at $1.38B (RT)

Europe to cut red tape for farmers following protests (BBG)

Reddit struck and AI content licensing deal with Google (RT)

Red Sea ship attacks not driving inflation (RT)

Tax evasion by the wealthy tops $150B / year (CNBC)

FBI and Homeland Security is investigating AT&T's outage (RT)

Half of college grads are in jobs that don't require degrees (WSJ)

First commercial spacecraft lands on the moon (FT)

A Message From 10 East

10 East is a co-investment platform where sophisticated investors access private market investments alongside a veteran team with a 12+ year track record of strong performance across over 350 transactions. The firm is led by Michael Leffell, former Deputy Executive Managing Member of Davidson Kempner.

Members have the flexibility to participate on a deal-by-deal basis across private equity, credit, real estate, and venture capital.

Benefits of 10 East membership include:

Flexibility – members have full discretion over whether to invest on an offering-by-offering basis.

Alignment – principals commit material personal capital to every offering.

Institutional resources – a dedicated investment team that sources and diligences each offering.

There are no upfront costs or commitments associated with joining 10 East.

Exec Sum readers can join 10 East with complimentary access here.

Deal Flow

M&A / Investments

US is examining Nippon Steel’s connections to China, a potential barrier for the Japanese giant’s $14.9B acquisition of American rival United States Steel (BBG)

UAE’s state-owned ADNOC is inching toward an improved bid for Covestro after finding a way to resolve the impasse over its $12.1B pursuit of the German chemical maker (BBG)

Infrastructure-focused PE firm Stonepeak will acquire a 50% non-controlling stake in one of Dominion Energy’s offshore wind farms for $3B (BBG)

Newmont, the world’s top gold producer, will seek to sell six mines and two projects to raise $2B (BBG)

Italian-Thai Development is considering selling its 90% stake in Asia Pacific Potash, which owns mining rights in Thailand, for ~$500M (BBG)

British Airways owner IAG may receive a warning from EU antitrust regulators regarding its $432M bid to buy out Air Europa if it does not offer remedies (RT)

German food delivery group Delivery Hero failed to sell its Southeast Asian Foodpanda business (BBG)

UBS Group is considering selling Credit Suisse’s Turkey investment bank unit (BBG)

VC

Renewable energy developer rPlus Energies raised $460M in funding from Sandbrook Capital (BW)

AlTi Global, a global wealth management platform, received a ~$450M investment from Allianz X and Constellation Wealth Capital (BW)

Industrial heat and power startup Antora Energy raised a $150M Series B led by Decarbonization Partners (BW)

Crypto restaking project Eigen Labs raised $100M from a16z crypto (CD)

Fabric, a startup developing a care enablement system, raised a $60M Series A led by General Catalyst (FN)

Crisp, a platform providing brands and distributors with store and shelf-level data, raised $50M in funding: a $20M Series B extension and $30M in debt financing from TriplePoint Capital (BW)

Uhnder, a provider of commercial digital radar chips and software, raised a $50M Series D led by ACME Capital (FN)

PermitFlow, a startup helping builders speed up the process of obtaining construction permits, raised a $31M Series A led by Kleiner Perkins (FN)

Highway 9 Networks, a startup providing a mobile cloud for the AI-driven enterprise, raised a $25M round from Mayfield, General Catalyst, and others (FN)

Synadia Communications, creators of a cloud and edge-native messaging system, raised a $25M Series B led by Forgepoint Capital (VC)

Carewell, an online retailer providing tools and resources to family caregivers, raised a $24.7M Series B led by the principals of MBF Healthcare (BW)

Pozitivf, a fertility clinic network, raised $20M in growth funding led by MonCap (PRN)

Elve, a startup building millimeter wave amplifiers, raised a $15M Series A from TomEnterprise Private, Green Sands Equity, Yu Galaxy, and more (BW)

Autonomous driving startup Haomo.AI raised a $14M Series B led by Chengdu Wufa Private Equity Fund Management (TC)

Payments platform Zūm Rails raised a $10.5M Series A led by Arthur Ventures (TC)

Helius, a developer platform for Solana, raised a $9.5M Series A led by Foundation Capital (BW)

Hohm Energy, a South African solar installer marketplace, raised an $8M seed round led by E3 Capital and 4DX Ventures (TC)

Inco, a developer of a confidentiality layer for Ethereum and other networks, raised $4.5M in funding led by 1kx (FN)

IPO / Direct Listings / Issuances / Block Trades

Debt

Pharmaceutical giant AbbVie sold $15B of bonds to help fund its acquisitions of ImmunoGen and Cerevel Therapeutics (BBG)

PE firms Clayton Dubilier & Rice and Stone Point Capital lined up over $9B of debt from banks led by JPMorgan and Morgan Stanley to help finance their buyout of Truist Financial’s insurance brokerage business (BBG)

Blackstone refinanced $8.8B of fresh debt for its Mileway warehouse business in European real estate's largest-ever refinancing (BBG)

Bankruptcy / Restructuring

Fundraising

Crypto Corner

Exec’s Picks

With gurus comparing Nvidia’s rally to Cisco in 1999, we’re bringing back FT’s three-year-old piece on the collapse of Cisco’s bubble.

WSJ wrote an insightful piece on why Manhattan is perpetually filled with scaffolding.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter