Good Morning,

An unlikely billionaire is bidding for TikTok, credit assets are outperforming at PE mega funds, Chevron overtook Tesla as the most shorted big-cap, and HSBC and Deloitte are withdrawing UK job offers over new visa rules.

Let’s dive in.

Before The Bell

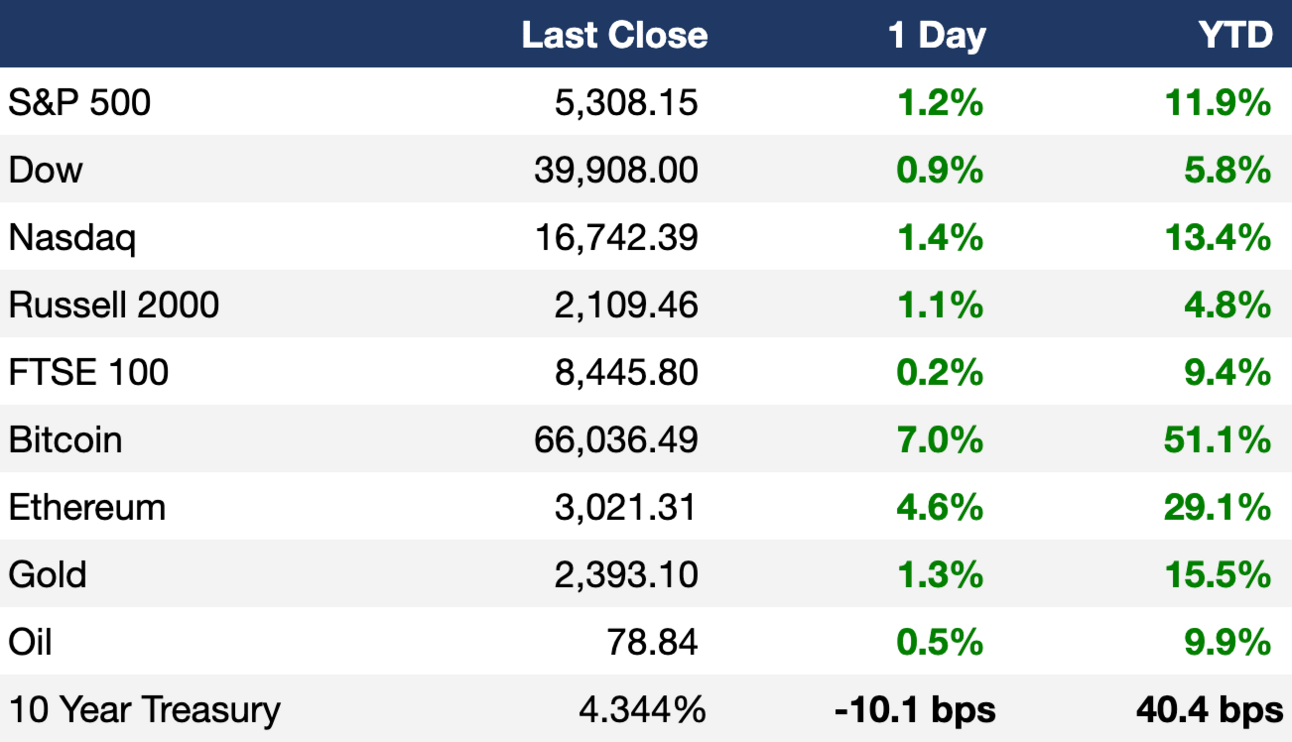

As of 05/15/2024 market close.

Markets

US stocks rallied yesterday as investors digested lighter-than-expected CPI data as a signal for upcoming rate cuts

All three major US indexes closed at record highs

Fed funds futures traders are now pricing in 52 bps of rate cuts this year

Global stocks in Europe and elsewhere also hit record highs

Copper is at a record high, up 28% YTD and 14% from last week

US dollar fell 0.75% in its biggest one-day drop YTD to a one-month low

Earnings

Headline Roundup

Credit assets outperform for large PE firms (WSJ)

New visa rules force HSBC and Deloitte to withdraw UK job offers (FT)

PE deal machine restarts but exits still sputter (WSJ)

Global corporate defaults doubled in April (RT)

Goldman poached two bankers from Evercore and Lazard (RT)

Accountant shortage prompts US plan for quicker path to qualification (FT)

Saudi Arabia's PIF slashed holdings of US equities (BBG)

CalPERS will allocate $25B to green private market investments (FT)

University of California will cut back on private markets exposure (WSJ)

Chevron tops Tesla as most-shorted stock in April (RT)

Berkshire Hathaway reveals secret minority stake in Chubb (FT)

US bank failures could surge by almost 50 (RT)

Trafigura, IXM caught in copper short squeeze as prices hit record (RT)

Bank of America banker who died had sought to leave over long hours (RT)

US CPI eased slightly in April to 3.4% YoY (CNBC)

Japan GDP declined 2.0% YoY in Q1 (RT)

Welsh Carson escapes FTC price-fixing case over PE rollups (WSJ)

Meme stock rally fizzled after two days (CNBC)

Microsoft’s emissions up 30% since 2020 due to data center expansion (CNBC)

A Message From RYSE

Missed out on Ring and Nest? Don’t let RYSE slip away!

Ring 一 Acquired by Amazon for $1.2B

Nest 一 Acquired by Google for $3.2B

If you missed out on these spectacular early investments in the Smart Home space, here’s your chance to grab hold of the next one.

RYSE is a tech firm poised to dominate the Smart Shades market (growing at an astonishing 55% annually), and their public offering of shares priced at just $1.50 has opened.

They have generated over 20X growth in share price for early shareholders, with significant upside remaining as they just launched in over 100 Best Buy stores.

Retail distribution was the main driver behind the acquisitions of both Ring and Nest, and their exclusive deal with Best Buy puts them in pole position to dominate this burgeoning industry.

Deal Flow

M&A / Investments

Real estate mogul Frank McCourt plans to build a consortium to bid for TikTok’s US business, which is potentially worth $35B-$40B (BBG)

KKR will offer a package of remedies as to win an early EU approval for its $23.8B bid for Telecom Italia’s land-line network (BBG)

Royal Mail's parent company International Distributions Services will agree to a $4.4B takeover by Daniel Kretinsky if the Czech billionaire tables a formal offer (RT)

Malaysia’s SWF Khazanah Nasional, Employees Provident Fund, GIP and Abu Dhabi's ADIA are set to privatize Malaysia Airports in a $3.9B deal (BBG)

Malaysian telco giant Axiata and Indonesian conglomerate Sinar Mas are considering merging their Indonesian telecom operations in a potential $3.6B deal (WSJ)

KPS Capital Partners will acquire Siemens' Innomotics large motors and drives division for $3.3B (RT)

$3B enterprise SaaS firm SoftwareOne received multiple approaches to go private (BBG)

UK oilfield services and engineering firm John Wood Group rejected an improved $1.9B takeover offer from Dubai-based company Sidara (RT)

Novo Nordisk acquired a ~60% stake in Austria-based life science tools company Single Use Support in a near $1B deal (RT)

Insurance giant Aflac acquired a 40% stake in middle market private-credit shop Tree Line Capital Partners for ~$100M (WSJ)

VC

Restaurant365, an all-in-one restaurant enterprise management platform, raised a $175M funding round led by ICONIQ Growth (PRN)

AI-native data platform Weka raised a $140M Series E at a $1.6B valuation led by Valor Equity Partners (FN)

Network infrastructure platform Alkira raised a $100M Series C led by Tiger Global (PRN)

Insurtech startup Cover Genius raised an $80M Series E led by Spark Capital (FN)

Battery recycling startup cylib raised a $60.6M Series A led by World Fund and Porsche Ventures (FN)

enspired, an AI-based power trading company, raised a $28.6M Series B led by Zouk Capital (FN)

Spanish HR management startup Sesame raised $24.1M in funding led by PSG and GP Bullhound (FN)

Fintech and financial media startup Annuity.com raised a $15.7M seed round led from undisclosed backers (FN)

Infinite Orbits, a French startup building in-orbit services for satellites, raised a $13M round led by Newfund Capital (FN)

AI startup Malted AI raised a $7.9M seed round led by Hoxton Ventures (FN)

Arch Labs, a Bitcoin-native application platform, raised a $7M seed round led by Multicoin Capital (FN)

Orange Charger, a provider of EV charging solutions, raised a $6.5M seed round led by Munich Re Ventures and Climactic (FN)

Relocalize, a startup building an autonomous microfactory platform, raised a $5.8M seed extension led by Desjardins Capital (PRN)

Arcium, a Swiss on-chain confidential computing project, raised a $5.5M round led by Greenfield Capital (FN)

Aerial, an AI-powered unstructured business data platform, raised a $2M pre-seed round led by Fuse (FN)

IPO / Direct Listings / Issuances / Block Trades

Italy is selling a $1.5B, 2.8% stake in oil giant Eni in a bid to reduce debt (BBG)

Platinum Equity-backed tech firm Ingram Micro is preparing for an IPO that could raise over $1B at an up to $10B valuation (BBG)

Blackstone-backed mortgage lender Aadhar Housing Finance's shares rose ~9% in its India trading debut after its $359M IPO, India's second-largest this year (BBG)

UK PC maker Raspberry Pi is considering a London listing at a potential $630M valuation (BBG)

AMC reached a private deal to swap $164M of its 10% notes due 2026 for 23.3M newly issued shares (BBG)

SPAC

Debt

Goldman Sachs sold $3.5B in investment-grade bonds for the third time since March (BBG)

Peloton hired JPMorgan to raise ~$850M through a new loan sale to refinance existing debt (BBG)

Morgan Stanley agreed to buy ~$700M of property loans made by failed Signature Bank from a group including Blackstone, CPP Investments, and Rialto Capital (BBG)

Blackstone’s credit unit is looking to sell ~$450M of loans, some of which are distressed (BBG)

Bankruptcy / Restructuring

A group of Red Lobster creditors is considering bidding for assets through a potential Chapter 11 sale process and seizing control of the firm (BBG)

Fundraising

PE firm Leonard Green & Partners is targeting $1.5B for its debut GP-led secondaries fund (BBG)

PE firm Cresta Fund Management is raising $650M for a sustainability fund to invest in green energy (AX)

Canada’s Polar Asset Management Partners raised $300M for a fund to invest in credit risk transfers (BBG)

Food VC PeakBridge raised $187M for its second growth fund to invest in the agri-food tech sector (TC)

Crypto Corner

Exec’s Picks

With Jim Simons' recent passing, WSJ published some of his secrets that he attributed to his firm's success.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter