Together with

Good Morning,

Russia is leaving the ISS, home prices continued climbing in May, the EU will cut gas consumption this winter, China tried to infiltrate the US Federal Reserve, Credit Suisse's CEO is stepping down, and Alibaba is looking for a Hong Kong listing.

New investment opportunity for our accredited investor community circulating this AM. If you've filled out our survey, keep an eye out for the email 👀. If you haven't yet, the link is at the bottom of this email.

Let's dive in.

Before The Bell

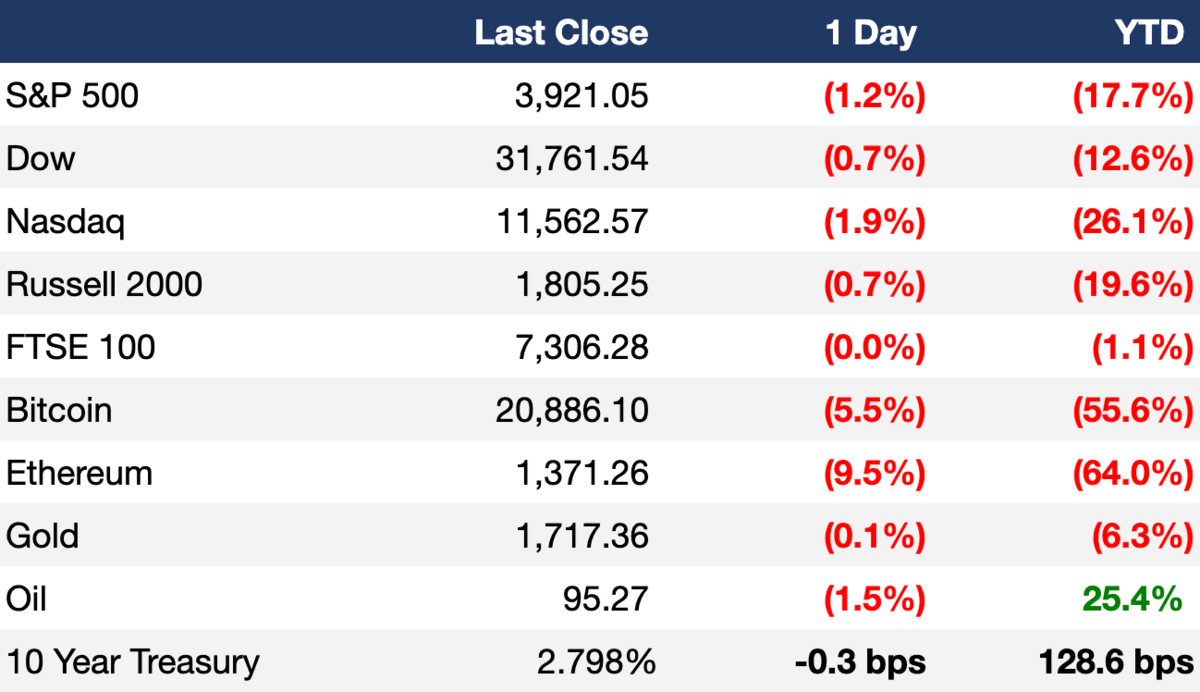

As of 7/26/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

The broader market fell on Wednesday following a mixed set of earnings reports highlighted by misses from the technology sector

Walmart fell 7% after announcing on Monday it plans to lower prices amidst lower consumer demand

Natural gas prices hit their highest point in seven weeks on concerns that Russia’s reduced usage of the Nord Stream pipeline could mean a gas shortage in Europe this winter

The Fed is expected to announce another interest rate increase of 75 bps at the end of its 2-day meeting today at 2pm ET

Earnings

UPS fell 3.4% on the day after beating profit expectations but reporting that package deliveries declined more than expected during Q2 (YHOO)

Coca-Cola topped expectations as their sales recovered from the pandemic and the company also increased their organic revenue growth forecast for the year; their stock rose 1.6% (CNBC)

General Motors reported net profits that tumbled 40% in Q2 as a result of producing tens of thousands of unfinished vehicles that couldn’t be sold due to supply chain issues; their stock fell 3.5% (WSJ)

McDonalds rose 2.7% after beating profit expectations due to higher prices and value menu offerings, despite a decline in total revenue (WSJ)

Alphabet shares rose 4.8% after-hours despite falling short of both earnings and revenue expectations, their stock is down 27% this year (CNBC)

Microsoft also missed expectations on the top and bottom line, citing pressures such as the war in Ukraine, the rising dollar, Covid shutdowns in China, and lowered advertiser spend (YHOO)

Visa reported a 33% quarterly rise in profit on Tuesday that it attributed to robust consumer spending; its earnings exceeded expectations and closely mirrored those of American Express, which reported on Friday (YHOO)

Chipotle shot up 8% in after-hours trading after reporting Q2 revenue that increased by 17% and exceeding profit expectations; the growth was reportedly driven by comparable restaurant sales growth and new store openings (MW)

What we’re watching this week:

Today: Shopify, Boeing, Spotify, Meta, Ford, Qualcomm

Thursday: Pfizer, Southwest, Apple, Amazon, Intel

Friday: ExxonMobil, Chevron

Full calendar here

Headline Roundup

The Senate voted to advance a $280B package of subsidies and research funding to boost US competitiveness in semiconductors and advanced technology (WSJ)

The International Monetary Fund lowered its outlook for global economic growth again to 3.2% and 2.9% for 2022 and 2023, respectively (AX)

Home price growth stayed strong at a 19.7% annual increase in May (WSJ)

The US will sell an additional 20M barrels of oil from the Strategic Petroleum Reserve to calm oil prices (RT)

EU countries agreed to curb natural gas consumption this winter amid expected supply cuts by Russia (AX)

Chinese officials attempted to infiltrate the US Federal Reserve for over a decade (AX)

Middle Eastern wealth funds are pouring record investments into global deals as liquidity dries up (BBG)

The US Treasury Department is correcting a set of December regulations in order to soften its limits on foreign tax credits (WSJ)

The federal government’s student loan servicing contractors have been instructed to hold off on sending billing statements ahead of an Aug. 31 deadline for ending the pandemic freeze on loan payments (WSJ)

Twitter shareholders will vote on Elon Musk’s proposed acquisition of the company in September (BBG)

Greece and Saudi Arabia sealed a deal to lay an undersea data cable that will connect Europe with Asia (RT)

Alibaba became the latest Chinese firm to apply for a Hong Kong primary listing amid fears of being kicked off US exchanges (BBG)

Shopify will cut 10% of its global workforce, causing its stock to fall 14.5% ahead of its earnings release today (WSJ)

Credit Suisse CEO Thomas Gottstein will depart from the company (WSJ)

A former Goldman Sachs banker, a former FBI agent trainee, and a technology executive were charged in three separate insider trading schemes (RT)

Russia will depart from the International Space Station after 2024 (WSJ)

A Message From Policygenius

Life Insurance on Your Terms

Navigating life insurance can be frustrating. Different policies, different premiums, and different companies. And the worst part? The group options offered by your employer may not even provide enough coverage in the first place, especially if you change jobs or get laid off.

It’s time to find your own life insurance policy on your terms.

Policygenius will help you find the right policy at your lowest price, as quickly as possible.

Policygenius is an insurance marketplace that makes it easy to compare quotes from top companies like AIG and Prudential in one place. Their licensed agents work for you, not the insurance companies, to ensure that you get the right policy for your needs.

Choosing the right insurance policy is a big decision, and you should use a website that you can trust.

Join the 30M+ others who have used Policygenius, and click here to find your policy today!

Deal Flow

M&A / Investments

Iberian software business Grupo Primavera will combine with French cloud firm Cegid in a $6.9B all-stock deal (RT)

French satellite operators Eutelsat Communications and UK satellite operator OneWeb will merge in a $3.4B all-stock deal (BBG)

PE firm Astatine Investment Partners is looking to sell its 38% stake in Texas pipeline operator Howard Energy Partners, which could attract a ~$2B valuation (BBG)

Geostationary satellite company Viasat is considering a sale of its government encryption services unit, which could fetch ~$1.8B (BBG)

Satellite developer York Space Systems is weighing a potential ~$1.5B sale (BBG)

Taiwan logistics firm Morrison Express is weighing a majority stake sale at a potential ~$1B valuation (BBG)

UAE’s primary energy company Abu Dhabi National Oil Co. acquired local offshore energy services company ZMI (BBG)

VC

Carmot Therapeutics, a clinical-stage biotech company focused on metabolic disease and cancer, raised a $160M Series D led by The Column Group (PRN)

Spotnana Technology, a travel-as-a-service platform for companies, raised a $75M Series B led by Durable Capital Partners (PRN)

B2B marketplace and ecommerce payments platform Balance raised a $56M Series B led by Forerunner Ventures (BW)

Elation Health, a clinical-first platform aimed at improving primary care, raised a $50M Series D co-led by Generation Investment Management and Ascension Ventures (PRN)

Cordial, a cross-channel marketing and data management platform, raised a $50M Series C led by NewSpring (PRN)

Boston Micro Fabrication, a creator of microscale 3D printing systems, raised a $43M Series C led by Shenzhen Capital Group Co. (PRN)

Sovrn, a publisher technology platform that empowers content creators to remain independent on the open web, raised a $36M funding round from Foundry, Archer Venture Capital, and others (PRN)

Underdog, a paid fantasy sports platform, raised a $35M Series B from BlackRock, Acies Investment, and others (PRN)

Neon, the first open-source, fully-managed, multi-cloud Postgres as a service, raised a $30M Series A-1 led by GGV Capital (PRN)

Butlr, a startup developing heat sensors to estimate office occupancy, raised a $20M Series A with participation from Carrier Global Corporation, Tiger Global, Primetime Partners and others (TC)

Nash, an optimization platform for food delivering merchants, raised a $20M Series A led by a16z (TC)

86 Repairs, a restaurant equipment repair and maintenance company, raised a $15.2M Series A led by Storm Ventures (PRN)

Pogo, a data scaling platform for online shoppers, raised $14.8M in financing: a $12.3M seed round led by Josh Buckley and a $2.5M pre-seed round (TC)

Datch, a company that develops AI-powered voice assistants for industrial customers, raised a $10M Series A led by Blackhorn Ventures (TC)

Taro donut producer Holey Grail Donuts raised $9M in financing across a seed round led by True Ventures and a Series A led by Collaborative Fund and Lee Fixel for an LA retail expansion (TC)

Geomiq, a UK startup that matches manufacturers with suppliers through its digital platform, raised an ~$8.5M Series A led by AXA Venture Partners (UKTN)

Bento, a technology-powered platform that connects customers with dentists and is seeking to disrupt the dental insurance industry, raised an $8.1M Series A led by Schooner Capital (PRN)

Resourcely, a security automation platform for coders, raised an $8M seed round led by a16z and Felicis Ventures (TC)

PixieBrix, a low-code platform for customizing and automating any web interface, raised a $5.4M Series A led by New Enterprise Associates (PRN)

Clarke Valve, a global provider of industrial control valves, raised a $5M preferred stock Series D led by Flowserve Corporation (PRN)

Kona, an employee experience platform for remote teams, raised a $4M seed round led by Unusual Ventures (PRN)

DepositLink, a digital payment platform in the real estate industry, raised a $3M Series Seed 2 from a variety of angel investors (PRN)

Egyptian fashion e-commerce startup The Fashion Kingdom raised $2.6M in seed funding led by CVentures (TC)

Guava, a banking and networking platform for Black entrepreneurs, creators and small business owners, raised a $2.4M pre-seed round led by Heron Rock (PRN)

Hgen, a sustainable electrolyzer manufacturer for heavy industries, raised a $2M seed round led by Founders Fund (TC)

Insightly Analytics, a San Francisco-based startup that helps companies efficiently build high-quality software, raised a $1M seed round led by Together Fund (TC)

IPO / Direct Listings / Issuances / Block Trades

SPAC

'Pro-America' fintech company GloriFi will go public through a SPAC merger with DHC Acquisition Corp in a $1.7B deal (RT)

Australian anti-counterfeit technology company Security Matters will delist from the ASX and merge with SPAC Lionheart III on the Nasdaq at a $200M valuation, nearly 15x its ASX market cap (YHOO)

Digital media provider Getty Images will go public again on Monday via merger with CC Neuberger Principal Holdings at a $4.8B valuation (GW)

Debt

Wall Street lenders led by Bank of America, Credit Suisse, and Goldman Sachs backing the buyout of cloud computing company Citrix Systems are discussing new ways to sell chunks of the $15B financing to soften potential losses (BBG)

Fundraising

Saudi Arabia will set aside $80B for an investment fund tied to the crown prince’s flagship smart city project Neom, with tentative plans to IPO Neom by 2024 (BBG)

VC firm Cambrian is launching an inaugural $20M fund 'to back the next generation of fintech founders' at the angel, pre-seed and seed levels (TC)

Crypto Corner

Stablecoin issuer Tether is facing scrutiny over an $840M loan it recovered from Celsius in a test concerning how insolvency rules apply to digital assets (FT)

The US Treasury is investigating global crypto exchange platform Kraken for allegedly violating US sanctions and allowing Iranian users to trade digital tokens (CD)

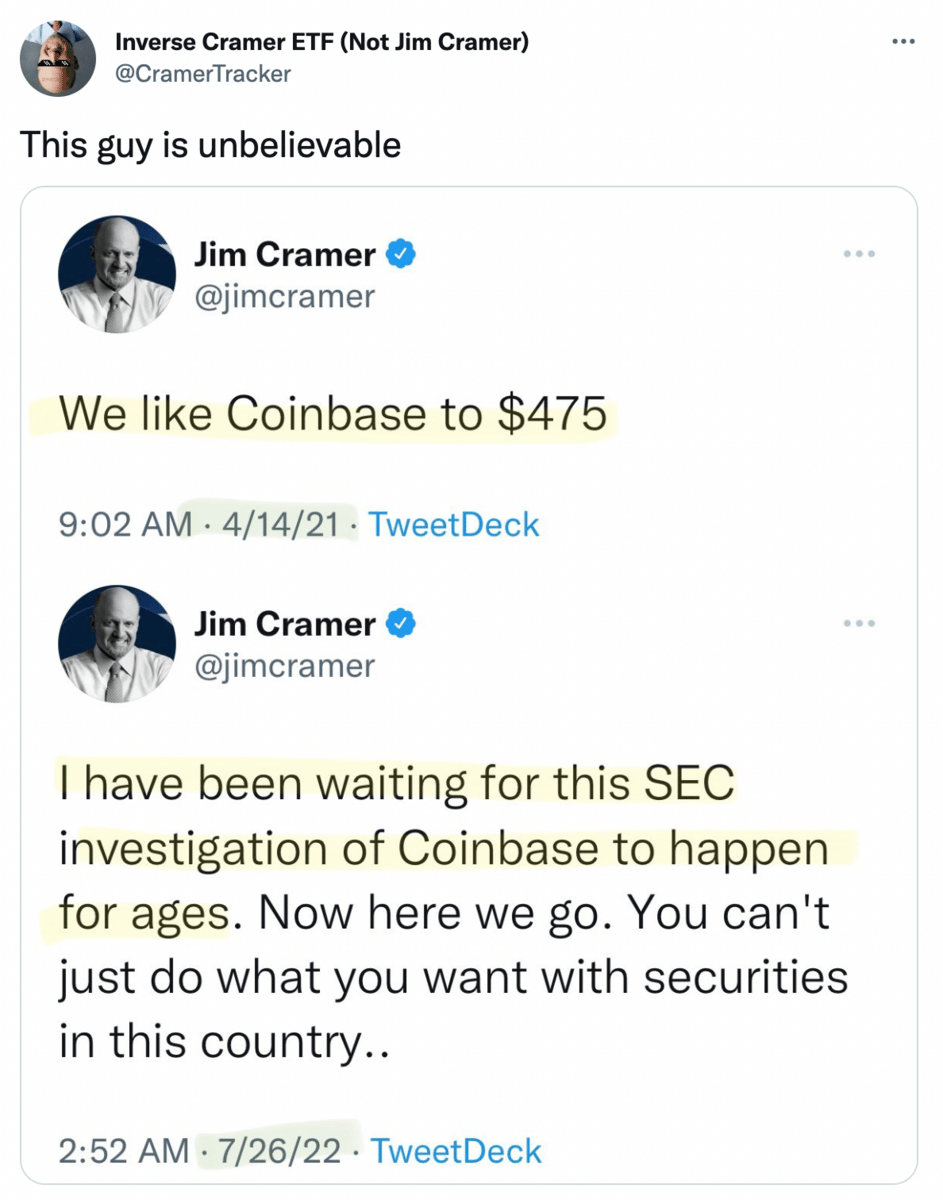

The SEC is investigating whether crypto exchange Coinbase improperly let Americans trade digital assets that should have been registered as securities (RT)

Exec's Picks

Heading to the Hamptons, Nantucket, Amalfi Coast, or Nice this Summer? Need to freshen up your swim shorts game? Check out Meriggi, the premium men's swimwear brand inspired by the Mediterranean lifestyle and aesthetic. Their swim shorts are some of the absolute cleanest in the game. You'll also get free shipping if you use this link.

Just copped a Towel Terry polo from Rhone. Total game changer during this heatwave.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

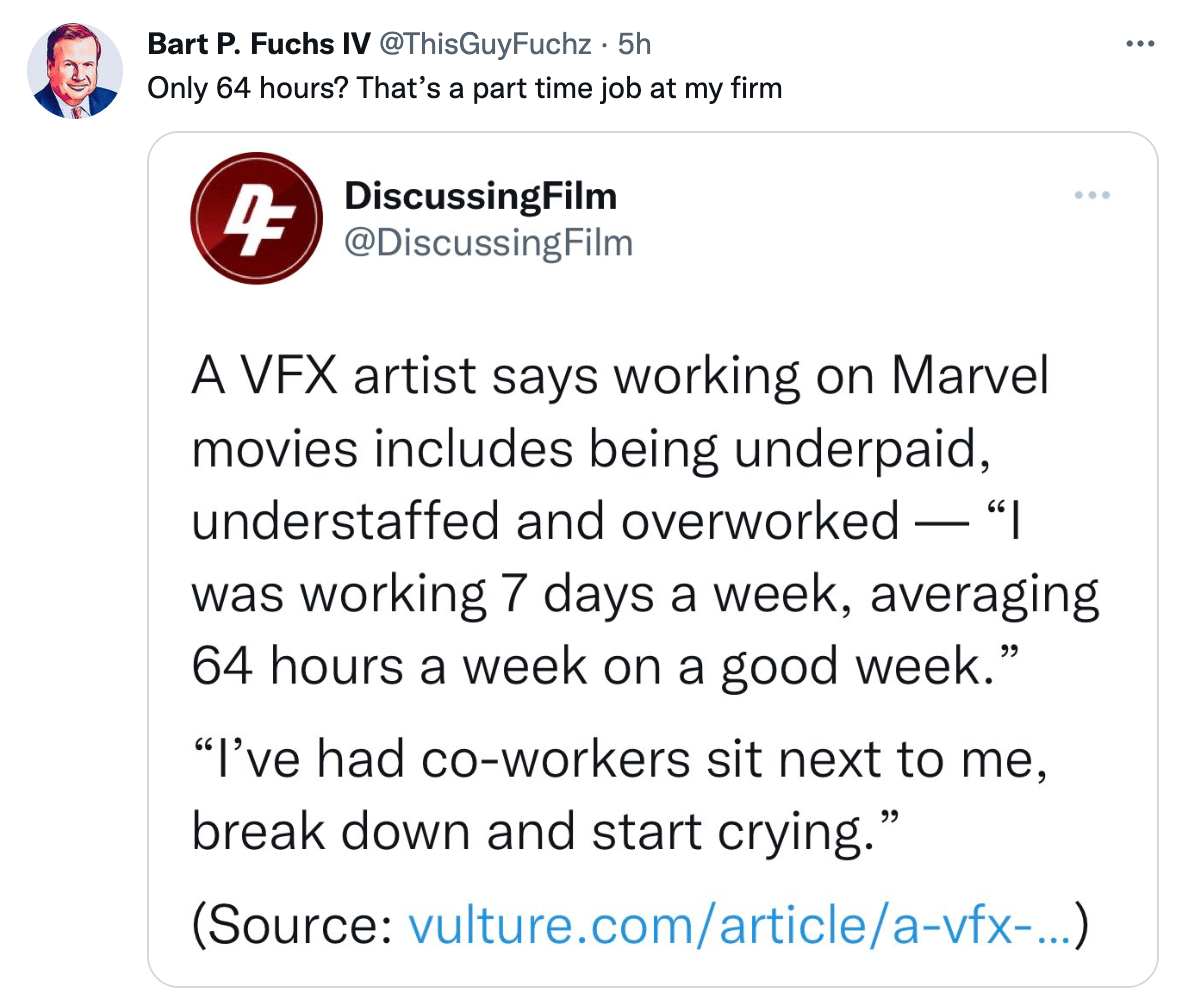

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.