Together with

Good Morning,

Yesterday was a fairly eventful day in capital markets, with the NFL nearing its first PE deal and geopolitics continuing to dominate investor sentiment. Most notable, however, was OpenAI's historic fundraise. Besides being valued higher than the likes of Goldman and BlackRock, the firm asked investors to not invest in five rival startups. Ironically, four of these were founded by OpenAI alumni 🧐

In other news, Chinese stocks continued to rally, European rate cuts are almost a certainty in October, and election betting was legalized in the US.

Transform your sleep for the better with Eight Sleep, technology trusted by the likes of Mark Zuckerberg, Elon Musk, and Lewis Hamilton.

Let's dive in.

Before The Bell

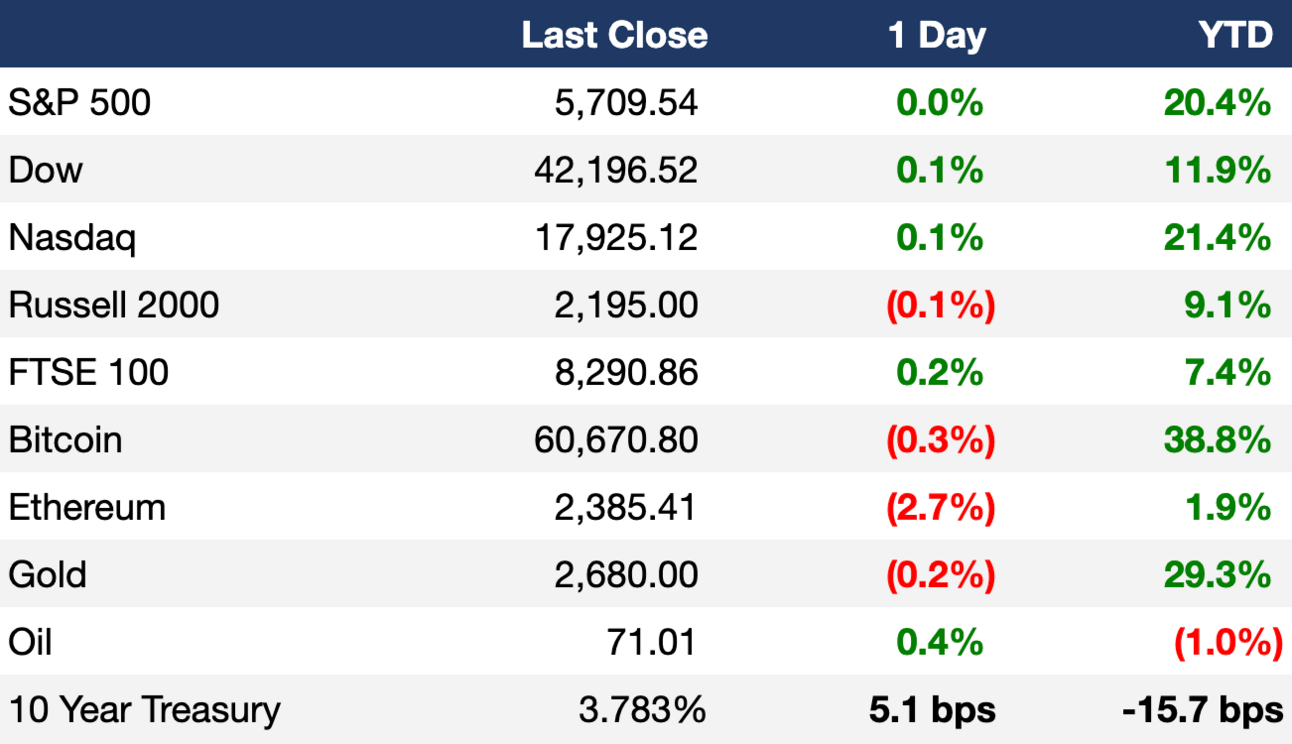

As of 10/02/2024 market close.

Markets

US stocks closed flat as investors digested further economic data

Hong Kong's HSI rose 6% for a sixth-straight day amid a China frenzy

The index is at a 22-month high after rising 31% in three weeks

Yen fell over 2% in its worst day in two years on dimmed BOJ rate hike hopes

Earnings

Headline Roundup

US hiring rose for the first time in six months (BBG)

JPMorgan says IPO market for PE exits is 'very' open (BBG)

JPMorgan says anti-ESG backlash in US is overstated (RT)

Federal appeals court cleared Kalshi to offer US election betting (AX)

Venture firm CRV will return to investors $275M of its $500M Select fund citing overvaluation of mature startups (TC)

BoE warns of future stress from hedge fund shorts on US debt (FT)

Finance firms worries about global economy rose to a five-year high (RT)

OpenAI told investors to not invest in five rivals, including xAI (WSJ)

Musk's xAI moved into OpenAI's old HQ (TC)

SoFi debuts platform to expand access to IPOs (RT)

Character.ai abandons AI models after $2.7B Google poach (FT)

F1 and LVMH announced a historic ten-year partnership (FT)

Tesla deliveries rose in Q3 for first time this year (CNBC)

A Message From Eight Sleep

Upgrade Your Sleep with the Pod by Eight Sleep

You've heard about the importance of recovery for optimal performance, but how are you prioritizing your sleep?

That's where the Pod by Eight Sleep steps in – a cutting-edge sleep technology trusted by the likes of Elon Musk and Mark Zuckerberg.

The Pod is a cover that can be easily added to any bed to optimize your body temperature throughout the night, helping you gain up to one extra hour of quality sleep every night.

The Pod cools to as low as 55°F, detects and reduces snoring, elevates to adjust breathing, and tracks vital health metrics for you and your partner individually and automatically…to have you waking up sharper, energetic, and fully rested from day one.

Ready to elevate your sleep? Head to eightsleep.com/lit and use code LIT to get $350 off your Pod 4 Ultra. Try it risk-free for 30 days. Your body (and mind) will thank you!

Deal Flow

M&A / Investments

EQT-backed fiber network firm Zayo and TPG are competing to acquire fiber and wireless assets of Crown Castle for potentially ~$10B

Ares is in talks to buy a 10% stake Miami Dolphins, which includes Hard Rock Stadium and Miami GP, from billionaire Stephen Ross at an $8.1B valuation

Singapore SWF GIC agreed to acquire a 25% stake in waste management firm Reworld from EQT at a ~$8B valuation, including debt

KKR is weighing a bid for $5.2B Hong Kong-listed chip firm ASMPT

A group including BDT & MSD agreed to acquire a majority stake in Badia Spices at a ~$1.2B valuation

PE firm Hg is weighing a sale of French software firm smartTrade at a ~$1.1B valuation

$11B-listed Korea Zinc is working with Bain Capital to buy back 18% of shares to thwart a hostile takeover from PE firm MBK Partners

Italy and Spanish infrastructure fund Asterion submitted a $774M bid for Telecom Italia's submarine cable unit Sparkle

Real assets investor Tailwater Capital will acquire Summit Midstream for $450M in cash and stock

PE firm Altor agreed to buy a majority stake in Canadian sports equipment manufacturer CCM Hockey

Levi's is considering a sale of its Dockers brand

VC

OpenAI raised $6.6B at a $157B valuation in a round led by Thrive Capital

AI coding startup Poolside raised a $500M Series B at a $3B valuation led by BCV

Vizit, a visual AI startup for e-commerce, raised a $25M Series B led by Industry Ventures

Logistics software startup Pallet raised an $18M Series A led by BCV

Harmonic Security, a zero-touch data protection platform, raised a $17.5M Series A led by Next47

AI-powered contract management platform Formality raised an $8.8M round led by Partech and Serena

Retail supply chain AI startup Ameba raised a $7.1M seed round led by Hedosophia

IPO / Direct Listings / Issuances / Block Trades

Carlyle-backed StandardAero raised $1.44B in an upsized IPO

Brazilian energy firm Eneva launched a $774M share offering

Commercial retail landlord FrontView REIT raised $251M in its IPO

Brazilian digital bank PicPay is planning a 2025 US IPO

SPAC

Chinese food biotech Zhong Guo Liang Tou will merge with Iron Horse Acquisitions Corp. in a $523M deal

Debt

Hunter Point Capital raised $425M in debt to pay a dividend to its LPs

Canary Wharf is seeking to refinance $930M in high-yield debt

Bankruptcy / Restructuring / Distressed

Short-term rentals firm Sonder is renegotiating leases to avert a WeWork-like bankruptcy

Fundraising

Healthcare investment firm Frazier Life Sciences closed its evergreen Public Fund at $630M

Crypto Corner

Half of US voters consider crypto 'important' ahead of elections

Wall Street behemoths BlackRock and Franklin Templeton are taking big steps towards allowing the use of tokenized shares of money-market funds as trading collateral

Exec’s Picks

Gain insights into the latest trends in private and public markets, and network with leaders in data, tech, finance and operations at S&P Global's flagship Interact conference in New York on October 15-16. Hear the latest on private credit, the role for AI, and more. Register here.

Nir Kaissar wrote an insightful opinion piece on the declining quality of small cap stocks.

Amid a historically consequential dockworkers strike, WSJ did a profile on the man responsible for bringing US ports to a halt.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, an executive search partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We are currently seeking talent for some incredible roles. Check 'em out and we'd love to get in touch!

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter