Together with

Good Morning,

A judge ruled Google's App store to be an illegal monopoly, EY is holding back pay for US partners, Starboard Value took a $1B stake in Pfizer, FTX's bankruptcy is looking like a success, and the US presidential race is dead even according to betting markets.

Why only spend at your favorite franchise when you can own a slice of it too? Check out FranShares, a platform democratizing access to profitable franchise ownership.

Let's dive in.

Before The Bell

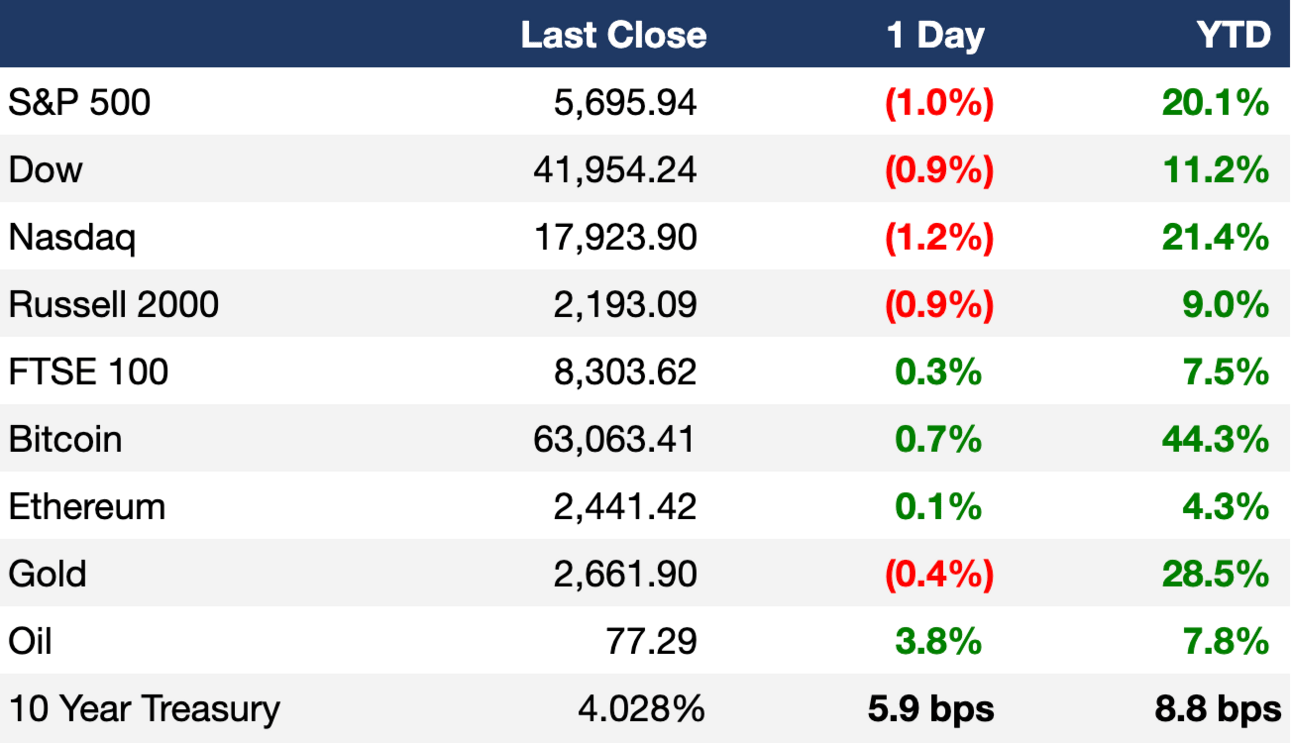

As of 10/07/2024 market close.

Markets

US stocks tumbled as higher yields weighed on markets

S&P closed at a two-week low

Traders slashed all bets of a second 50 bps rate cut

US 10Y yield rose past 4% for the first time since August

Oil prices jumped as the Mideast kept markets nervous

Brent crossed $80/bbl for the first time in a month

Earnings

What we're watching this week:

Today: PepsiCo

Thursday: Delta, Domino's

Friday: JPMorgan, Wells Fargo, BlackRock

Full calendar here

🇺🇸 Election Forecast

Trump gained 1% on Kalshi yesterday to even the election odds

This follows Kamala’s recent appearances on 60 Minutes and the Call Her Daddy podcast

Kalshi has launched over 20 new election markets

Headline Roundup

Cboe will list hedged ADRs (RT)

EY will hold back some pay from US partners after tough year (FT)

Three startups aim to raise $400M as US biotech IPOs gain traction (RT)

Goldman has derivatives positions worth 6.7% stake in UniCredit (RT)

Activist Starboard Value took a $1B stake in Pfizer (WSJ)

A US judge found Google's App store to be an illegal monopoly (TV)

Chinese chip stocks are rallying like Nvidia (WSJ)

US antitrust case against Amazon will move forward (RT)

Hurricane Milton is barreling towards Florida with 180 mph winds, triggering evacuations along the state’s west coast (BBG)

Ever thought about owning a piece of a franchise without the usual day-to-day management?

FranShares offers a unique opportunity to invest in active franchises, so you can earn passive income.

When you buy shares in different franchises, you're getting a slice of a real, varied asset class that spans various industries, places, and types of services.

FranShares selects investments in recession-resistant industries, so even when the stock market dips, your investments in everyday essentials like gyms, hair salons, and restaurants continue to perform.

Ready to see how FranShares can make franchise ownership simple, accessible, and profitable for you?

Deal Flow

M&A / Investments

Canadian Natural Resources will acquire assets in Canada's Athabasca Oil Sands and Duvernay Shale from Chevron for $6.5B

Apollo agreed to buy aerospace components manufacturer Barnes at a ~$3.6B valuation

Norway's Equinor bought a 9.8% stake in Danish offshore wind farm developer Orsted valued for ~$2.5B

Food-focused PE firm Butterfly Equity will acquire winemaker Duckhorn Portfolio for $2B

India's Adani Group is in talks to buy the Indian cement operations of Germany's Heidelberg Materials in a ~$1.2B deal

Investment firm Blue Owl agreed to acquire digital infrastructure investor IPI Partners for ~$1B

Saudi Arabia's PIF is exploring a 10% stake purchase in sports-streaming group DAZN for ~$1B

Luxury goods group Richemont will acquire a 33% stake in the luxury online platform Mytheresa in exchange for its e-commerce business Yoox Net-A-Porter

An American consortium led by PE exec Steven H. Rosen is in takeover talks with UK football club Sheffield United

Thai investor Central Group and PIF will jointly acquire European retail chain Selfridges

VC

Kobold Metals, an AI-powered mineral discovery startup, raised $491M of a targeted $527M round from Bill Gates, Jeff Bezos, a16z, and more

Eleanor, an outpatient addiction treatment provider, raised a $30M Series D led by General Catalyst

Layer, a developer tools for full-stack DApps, raised a $6M seed round led by 1kx

IPO / Direct Listings / Issuances / Block Trades

Chinese automobile maker Chery is considering a Hong Kong IPO for its automotive unit Chery Automobile at a $7.1B valuation

Tokyo Metro is seeking to raise $2.4B in Japan's largest IPO since 2018

Swedish landlord SBB plans to IPO $390M worth of shares in its residential unit Sveafastigheter

Rivus Pharmaceuticals, a drug developer focused on obesity treatments, is considering a $250M US IPO

Saudi perfume maker Al Majed for Oud rose 30% in its trading debut after its $188M IPO

Dutch transmission system operator Tennet is preparing a potential IPO of its German operations

Bankruptcy / Restructuring

A court approved FTX's bankruptcy plan, which will reap profits for creditors

Fundraising

Healthcare PE firm Shore Capital Partners raised $1.9B across three funds

Credit investor Deer Park Road Management is seeking to raise $500M to acquire distressed CRE debt

Fidelity Investments closed its debut VC fund at $250M

Crypto Corner

Crypto adoption is on track to hit 8% by 2025

Robinhood legal chief could be tapped to lead SEC if Trump wins

Exec’s Picks

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Noah Smith wrote a great piece on the one problem with the US economy at present.

Ben Carlson shared an insightful perspective on how quickly we forget how lucky many of us are to be born in a wealthy country like US.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, an executive search partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking and are currently hiring for some incredible roles.

Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity’s brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.