Together with

Good Morning,

Binance pulled out of its proposed FTX deal, FTX is facing an SEC investigation, 30-year mortgages are nearing a 20-year high, Chinese CPI retreated to 2.1% YoY growth, the NBA launched a PE arm, Meta laid off 11k employees, and TSMC is opening an Arizona factory.

Let's dive in.

Before The Bell

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

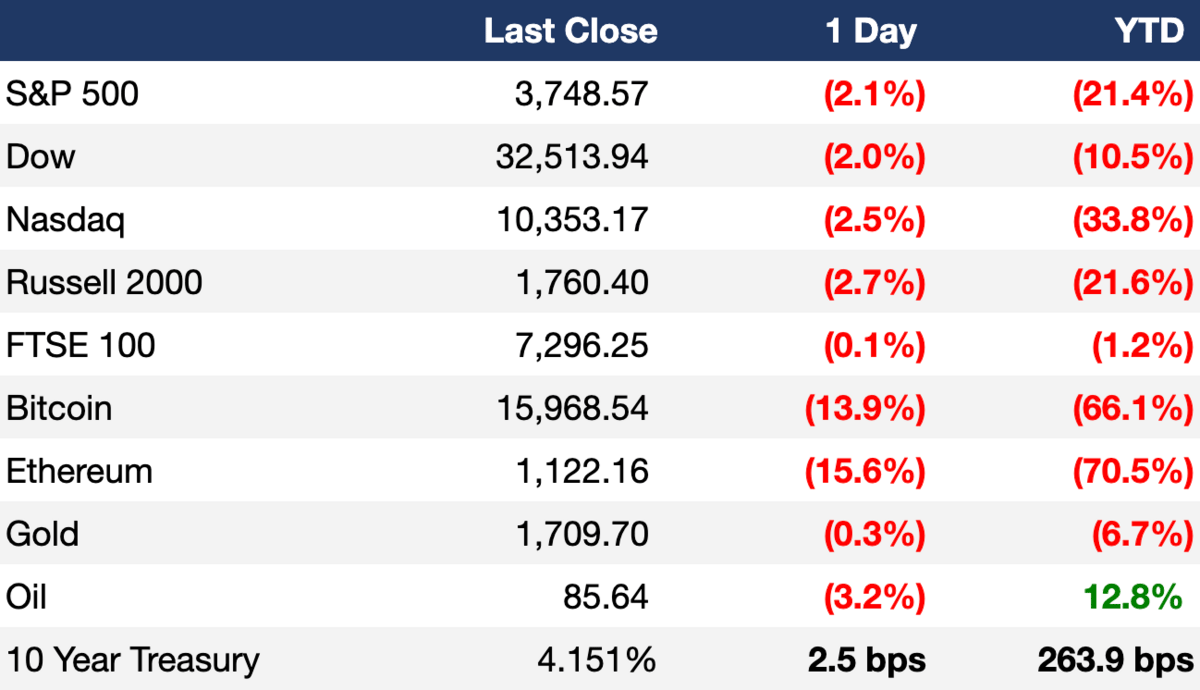

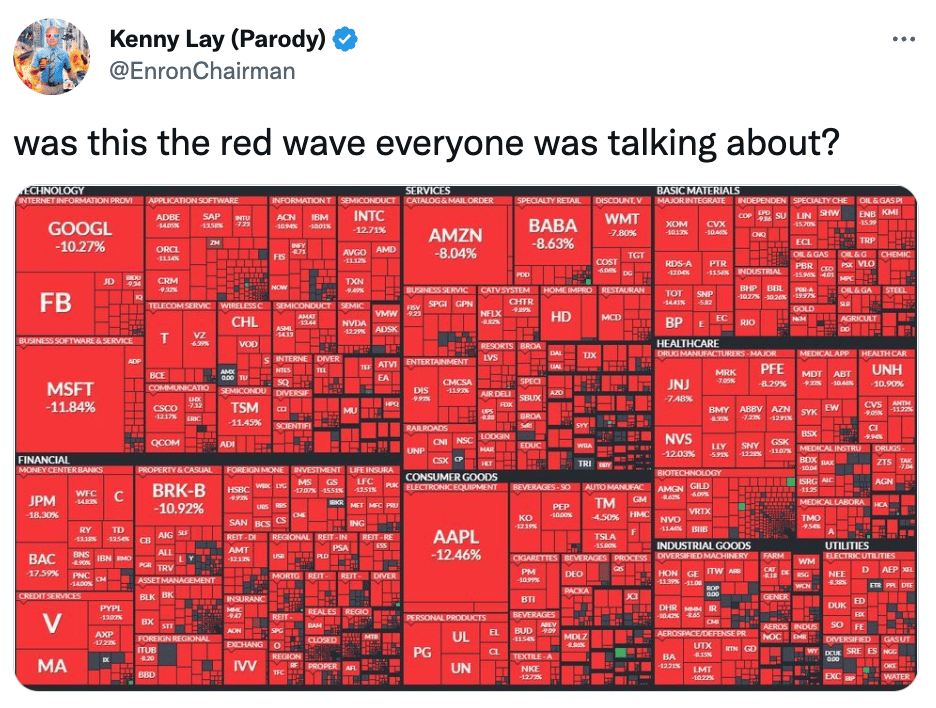

US stocks ended sharply lower yesterday as investors digested tighter-than-expected elections and look ahead to today's CPI update

Oil continued to fall on US inventory build and China Covid worries

Cryptocurrencies saw a second day of sharp declines on continued concern of the sector's stability and the on-going FTX drama

Earnings

Rivian posted another Q3 loss and missed on revenue estimates but reaffirmed its 2022 25k vehicle production target and will cut spending; their stock fell ~12% yesterday before rising 6%+ in AH trading (CNBC)

Beyond Meat reported a worse-than-expected Q3 loss and weak revenue on tumbling demand while also lowering their FY sales outlook; their stock fell 9.2% yesterday (CNBC)

Bumble missed on Q3 revenue estimates and provided disappointing holiday quarter forecasts on foreign currency headwinds; their stock fell ~19% yesterday (MW)

Roblox posted a worse-than-expected Q3 loss but saw a 24% YoY increase in daily active users; their shares fell ~21% yesterday (TC)

What we're watching this week:

Today: WeWork, Six Flags

Full calendar here

Headline Roundup

30-year fixed-rate mortgage rates climbed to 7.14%, a near 20 year high (BBG)

Chinese producer prices fell 1.3% in October in first YoY decline since December 2020 (WSJ)

China's CPI also retreated sharply in October to 2.1% YoY (WSJ)

EU countries and lawmakers are close to a ~$6B satellite internet system deal (RT)

NBA launched a PE arm NBA Equity to invest in startups globally (BBG)

Major PE firms are the SEC's latest targets in communication probe (RT)

EU antitrust regulators may soon bring charges against Meta for misusing customer data (RT)

South Korea unveiled a $7B financing plan to help its struggling real estate market (BBG)

Sequoia Capital circulated an update to its limited partners indicating it has written its FTX investment down to $0 (ES)

Goldman Sachs promoted 80 new partners, with its most diverse class ever (RT)

Meta laid off 13% or ~11k employees (FT)

Redfin laid off 13% of its staff and closed its home-flipping business (WSJ)

Oracle, Sada, Affirm, Hootsuite, and Gem are other high-profile tech names to layoff employees this month (LKN)

TSMC is planning a factory expansion in Arizona (RT)

IBM launched its most powerful quantum computer to date (RT)

Elon Musk says Twitter is ditching its gray 'Official' check mark hours after launching it (WSJ)

A Message From Brave

Tired of getting targeted by creepy ads? It’s time to switch your browser.

Web ads aren’t just annoying—they’re a threat. Many ads contain hidden trackers that help Big Tech follow everything you do online. From the sites you visit, to what you search and stream, Big Tech’s data vacuum exposes and profiles you. Even if you’re profiled as a 73 year old woman due to your affinity for house shoes…it’s not good.

Stop Big Tech with Brave, the browser that blocks ads & trackers, phishing & malware, and more, on everything from recipe sites to YouTube to live streams. Not only that, Brave saves mobile bandwidth and battery life, and loads pages 3x faster. Keep the house shoes, lose the internet stalking.

Ready to join the movement for a user-first Web? It only takes 60 seconds to switch.

Download Brave today on your phone📱or desktop 💻

Deal Flow

M&A / Investments

KKR and GIP agreed to buy a stake in Vantage, the towers unit of British telecom group Vodafone, at a $16.3B valuation (BBG)

A consortium led by Brookfield Asset Management offered to buy Australian gas retailer Origin Energy for $11.82B (RT)

US manufacturer Chart Industries agreed to buy UK-based industrial equipment maker Howden for $4.4B (RT)

Canadian pipeline operator TC Energy plans to sell $3.7B of assets next year to reduce its debt and fund projects (BBG)

One Rock Capital Partners is exploring strategic options, including a sale, for food additive maker Innophos at a potential $3B valuation (BBG)

Fortress Investment Group is nearing a deal to buy retail company Seven & I’s Sogo & Seibu chain of department stores in Japan for $1.4B+ (BBG)

Crypto exchange Binance’s ditched its proposed purchase of rival FTX after further due diligence (RT)

Forbes Media is in exclusive discussions to sell to a family office consortium (BBG)

Port operator Adani Ports agreed to buy a 49.38% stake in liquid storage facility company Indian Oiltanking for $129M (BBG)

Saudi Arabia’s Public Investment Fund agreed to invest $80.6M into English football club Newcastle United FC (BBG)

Lionel Messi took an undisclosed equity stake in NFT fantasy soccer game Sorare (CNBC)

VC

Quantum computing startup Xanadu raised a $100M Series C led by Georgian (PRN)

Blockchain intelligence startup TRM Labs raised a $70M Series B led by Thoma Bravo (BW)

Crypto infrastructure start-up Ramp raised a $70M Series B led by Mubadala and Korelya Capital (CD)

Alida, a customer experience management platform, raised $60M in financing led by the National Bank of Canada (BW)

Beekeeper, a startup helping businesses engage the frontline workforce, raised a $50M Series C from Energize, Kreos Capital, Thayer, SwissCanto, and more (TC)

Fathom, a medical coding automation startup, raised a $46M Series B led by Alkeon Capital and Lightspeed Venture Partners (BW)

Edge computing and cloud-hosting platform Macrometa raised a $38M round led by Akamai (TC)

Equals, a startup aiming to replace Excel, raised a $16M Series A led by a16z (BW)

Ping, a payments platform for freelancers and contractors, raised a $15M seed round from Y Combinator, Race Capital, BlockTower, and more (BW)

Web3 messaging infrastructure startup Notifi raised a $10M seed round led by Hashed and Race Capital (TC)

Meeting productivity software startup Airgram raised $10M in funding led by GL Ventures (PRN)

Agent IQ, a provider of digital customer engagement solutions, raised a $10M Series A led by Mendon Ventures (PRN)

Loyalty platform Antavo raised a $10M Series A led by Euroventures (PRN)

Anything World, a platform creating interactive 3D experiences, raised a $7.5M seed+ round from Acrew Capital, Alumni Ventures, and Warner Music Group (PRN)

YonaLink, a clinical trial software provider, raised $6M in funding led by the Debiopharm Innovation Fund (PRN)

Theia Studios, a startup creating a web3 creator platform for strategy games, raised $2.4M in funding led by Hashed, Snackclub, IVC, Mint Ventures, and more (PRN)

On2Cook, an Indian startup building a fast cooking device, raised $2M in seed funding at a $12.5M valuation led by Dr Mayur Desai (BW)

IPO / Direct Listings / Issuances / Block Trades

Tesla slid to a near two year low after Musk sold ~$4B of shares following his Twitter acquisition (RT)

Emirates Central Cooling Systems Corp raised $724M in its Dubai IPO after pricing shares at the top of a marketed range (BBG)

India's Tata Motors will delist American Depositary Shares from January after ~18 years (RT)

Debt

Bankruptcy / Restructuring

FTX may be forced to file for bankruptcy protection if it doesn't get a cash infusion; the firm needs to cover a shortfall of up to $8B (BBG)

Fundraising

Swedish VC firm EQT Ventures raised a $1.1B third fund to invest in early-stage European startups; this is Europe's largest VC fund committed to early-stage tech startups (TC)

Crypto Corner

TechCrunch is hosting its TC Sessions Crypto conference in Miami next week. Given all the crypto market turbulence, this should be quite an exciting event! Scoop up tix here.

SEC is investigating FTX over handling of client funds (RT)

FTX approached crypto exchange OKX about a deal before Binance agreed to its now-canceled takeover (RT)

Crypto exchange Coinbase assured investors of minimal exposure to rival FTX amid concerns about FTX's financials (RT)

Crypto.com halted Solana USDC and USDT transactions amid “recent industry events” (CD)

Solana falls prey to Binance-FTX deal turmoil, losing over half its value this week (BBG)

Exec's Picks

Binance's CEO Changpeng Zhao shared the note he sent to all Binance employees regarding FTX and the general crypto ecosystem here.

Tiger Global has slashed the value of its private technology investments by billions, according to internal fund documents. The Information breaks it down in their latest article! Read here.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.