Together with

Good Morning,

St. Louis Fed President Jim Bullard is stepping down, the US deficit jumped to $228B in June, a UPS strike would be perilous to US supply chains, Meta is releasing a commercial AI model, the FTC is investigating ChatGPT, a Stability AI co-founder got hosed on his equity, and Twitter is now sharing ad revenue with creators.

Work shouldn’t be the only hard thing in your life. If something else hasn’t been, today’s sponsor, Hims, might be able to help.

Let’s dive in.

Before The Bell

As of 7/13/2023 market close.

Markets

US stocks continued this week’s rally yesterday after investors digested further optimistic inflation data and a stronger-than-expected start to earnings season

Nasdaq 100 notched its best ever H1 performance

Asian stocks rose early today on course for their best week this year

Money market traders see a 20% chance of another Fed rate hike to follow one this month

Crude oil rose to the highest in nearly three months

Gold is on track for its best week in three months

Dollar index sank to a fresh 15-month low and is on track for its worst week since November

Yen is headed for its longest rally since 2018

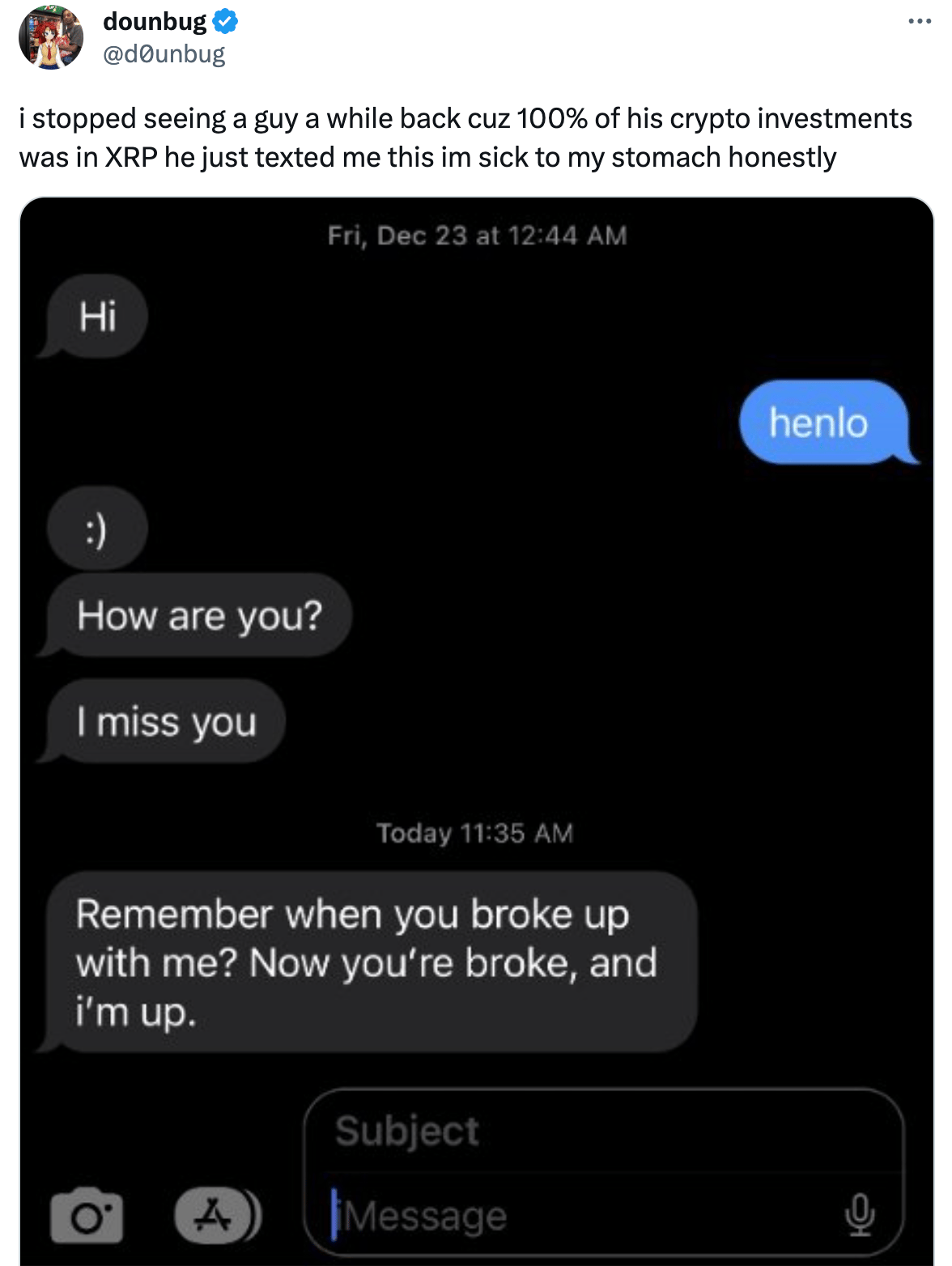

Crypto/related stocks rallied after a landmark court judgement for Ripple Labs

Earnings

Pepsi posted a Q2 beat and raise thanks to price increases on various lines of products and new innovations in the Frito-Lay division (YF)

Delta posted record-high Q2 earnings and revenue thanks to scorching international travel demand that has defied fears of an economic slowdown for months (CNBC)

What we're watching this week:

Today: JPMorgan, Wells Fargo, Citigroup, BlackRock, State Street, UnitedHealth

Full calendar here

Headline Roundup

St. Louis Fed president Jim Bullard is stepping down (CNBC)

Australia picked Michele Bullock to lead central bank after sacking incumbent Philip Low (CNBC)

Cost of servicing US debt jumped 25% from Q1-Q3 (BBG)

US posts sharply higher $228B June deficit (RT)

UK retail investors are dumping equity funds for debt funds (FT)

SEC adopted new rules for money-market funds (WSJ)

China exports fell at fastest YoY pace since Covid in June (RT)

UPS strike could be costliest in US in a century (RT)

Meta to release commercial AI model in effort to catch rivals (FT)

FTC is investigating ChatGPT over unfair/deceptive practices (WSJ)

Google announced numerous updates to Bard in race versus ChatGPT (WSJ)

Stability AI co-founder was allegedly duped into selling stake for $100 (FT)

Q2 biotech/pharma VC funding was lowest since the pandemic (BJ)

Sapphire Ventures plans to invest over $1B in enterprise AI startups (RT)

FDA approves first over-the-counter birth-control pill (WSJ)

Tesla looking to make about 500k EVs annually in India (RT)

Microsoft under fire after hacks of US State and Commerce departments (RT)

160k Hollywood actors strike (NYT)

Twitter to offer ad revenue share to select content creators (RT)

A Message From Hims

Life is Hard, You Should Be Too

We get it. You’re dealing with strict deadlines, an unreasonable boss, and long hours. Work has been hard lately… but something else hasn’t been.

It’s time to fix that (your love life, not your career) with Hims.

Hims offers 100% online, FDA-approved treatment options with free, discreet shipping (if prescribed) so you can get back on your A-game as soon as possible, and they offer treatments that are up to 95% cheaper than brand names.

It’s time to stop being soft in the one area that matters. Get started with Hims today.

*Prescription products require an online consultation with a healthcare provider who will determine if a prescription is appropriate. Restrictions apply. See website for full details and important safety information. Actual price to customer will depend on product and subscription plan purchased.

Deal Flow

M&A / Investments

A judge rejected the FTC’s request to temporarily block Microsoft’s $69B acquisition of Activision Blizzard; FTC appealed the ruling (BBG)

French Billionaire Pinault is in talks to buy CAA Talent Agency in a $7B deal (BBG)

Roivant Sciences is nearing a sale of its experimental stomach disease drug RVT-3101 to Swiss multinational healthcare company Roche Holding in a deal that could be worth over $7B (WSJ)

Exxon Mobil agreed to buy Denbury for $4.9B to expand its carbon capture business (RT)

Carlyle Group and Trustar Capital are in talks to raise $4B through a partial sale of their stakes in Hong Kong and Chinese McDonald’s operations to sovereign wealth funds GIC and Mubadala Investment in a deal that will value the entire business at $10B (BBG)

Asian data center operator and designer Chindata Group Holdings says its largest shareholder Bain Capital does not plan on selling any shares; Chindata has $2.9B and $3.4B take private offers from Bain and state-run China Merchants Capital (RT)

Indonesian logistics and marine shipping business Meratus is exploring a sale for ~$2B after interest from investors (BBG)

3D printer manufacturer 3D Systems greatly increased its offer to buy rival Stratasys for $1.6B in a cash-and-stock deal after two previous offers were rejected (BBG)

PE firm CapVest Partners has agreed to acquire UK software provider Kerridge Commercial Systems in a $1B deal (BBG)

Alternative investment firm Varde Partners bought $1B of consumer loans from Goldman Sachs’ consumer unit Marcus (RT)

Indian conglomerate Nirma and Sekhmet Pharmaventures are among bidders competing for a $731M, 83% stake in Glenmark Pharmaceuticals (BBG)

Carmaker Nissan will invest $725M in French multinational carmaker Renault’s EV unit, Ampere (RT)

Barclays is preparing a sale of its German consumer-finance business and may seek ~$557M for the unit (BBG)

AG Mortgage Investment Trust, a REIT backed by Angelo Gordon & Co, made a ~$300M stock-and-cash offer for peer Western Asset Mortgage Capital, which is managed by Franklin Resources (RT)

India’s third-largest IT services company HCL Technologies is acquiring German automotive engineering company ASAP Group for $231M (BBG)

Saudi Arabia's sovereign wealth fund PIF, who owns of Premier League team Newcastle United FC, is interested in buying another top European football club (BBG)

UK’s TalkTalk Telecom is looking for investors in its wholesale unit and looking to sell its B2B Direct unit to help pay down debt (BBG)

Mexico is no longer interested in buying Citigroup's local retail unit Banamex (RT)

VC

AI startup Hugging Face is raising a ~$200M Series D at a $4B valuation led by Sound Ventures (FRB)

Avnos, a startup developing hybrid direct air capture tech for CO2 removal, raised $80M in funding from ConocoPhillips, JetBlue Ventures, and Shell Ventures (BW)

Causaly, an AI platform for drug discovery and biomedical research, raised a $60M Series B led by ICONIQ Growth (TC)

HawkEye 360, a company that provides geospatial intelligence from space, raised a $58M round led by BlackRock (TC)

Cybersecurity startup Secure Code Warrior raised a $50M Series C led by Paladin Capital Group (TC)

In-store inventory tracking platform RADAR raised a $30M Series A led by Align Ventures (BW)

Inventory robotics startup Simbe Robotics raised a $28M Series B led by Eclipse (TC)

Parker Health, an innovative biotech company for electronic health records, hospital developers, and management raised a $25M Series A led by Bias Capital (BW)

MerQube, a provider of index-linked investing technology, raised a $22M Series B led by Intel Capital (FN)

Zluri, a SaaS operations platform, raised $20M in funding led by Lightspeed (FN)

Mattilda, a Mexican startup providing collections management and payment processing for private schools, raised a $19M Series A led by GSV Ventures (TC)

Spline, a no-code design tool for creating 3D assets, raised a $15M seed round led by Gradient Ventures (TC)

Trunk Tools, a construction-focused fintech startup, raised a $9.9M seed round led by Innovation Endeavors (BW)

Passes, a Miami-based provider of an invite-only brand-friendly paywall platform, raised a $9M seed round led by Multicoin Capital (FN)

Efficient Capital Labs, a fintech startup providing non-dilutive capital to B2B SaaS companies in the South Asia-US corridor, raised a $7M pre-Series A led by QED Investors (BW)

Blockchain employment platform Opolis raised a $6.6M bridge round led by Greenfield (BW)

Tangibly, a SaaS trade secret management platform, raised a $6.5M seed round led by Madrona (BW)

Capstack, a provider of an integrated OS for banks, raised a $6M pre-seed round led by Fin Capital (FN)

LunarCrush, a social media analytics startup for cryptocurrency and financial industries, raised a $5M Series A at a $30M valuation led by Draper Round Table / INCE Capital (FN)

Aktivate, a provider of scholastic sports management software, raised a $3.7M Series A led by Will Ventures, Tal Ventures, and Benson Oak Ventures (FN)

Data security startup Teleskope raised a $2.2M pre-seed round led by Lerer Hippeau (BW)

WaitWell, a startup providing service optimization products, raised a $1.5M seed round led by Graphite Ventures and Accelerate Fund III (FN)

IPO / Direct Listings / Issuances / Block Trades

Canned water company Liquid Death hired Goldman Sachs to lead on a potential 2024 IPO (TI)

Debt

Bankruptcy / Restructuring

Distressed Indonesian airline Sriwijaya Air won regulator approval to restructure up to $488M of debt (BBG)

Carlyle Group is considering handing portfolio company Praesidiad Group to debtors as part of a debt restructuring (BBG)

China's Guangzhou R&F Properties creditors have sued the property developer to seek bankruptcy restructuring (RT)

Dutch e-bike maker VanMoof filed for protection from creditors (RT)

Fundraising

Wing Venture Capital closed a $600M fund to invest in startups that build AI tools for businesses (BBG)

Climate-tech VC Azolla Ventures closed its $239M blended fund to invest in pre-seed, seed and Series A startups (TC)

OpenAI is looking to raise a second VC fund, larger than its $175M debut fund (TI)

Crypto Corner

Celsius' ex-CEO Alex Mashinsky arrested on fraud charges as FTC lines up $4.7B fine (TV)

A US judge ruled that Ripple Labs did not violate securities laws by selling its XRP tokens on public exchanges (RT)

Coinbase soared 25%, the most since its debut, after Ripple ruling (BBG)

India's largest private lender HDFC Bank signed up 100k and 170k merchants in pilot programs in using the central bank digital currency (RT)

Exec’s Picks

Jack Raines wrote about whether or not Threads poses an existential threat to Twitter.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter