Together with

Good Morning,

FedEx raised its rates by 6.9%, FTX is looking to raise another $1B in funding, Japan is buying yen for the first time in 20+ years, the luxury home market is tanking, Credit Suisse may split its investment bank into three, Samsung and SoftBank are discussing a chip alliance, and two winners are splitting the Mega Millions Jackpot.

Congrats to the Mega Millions winners, probably the only people making any money in this market.

Let's dive in.

Before The Bell

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

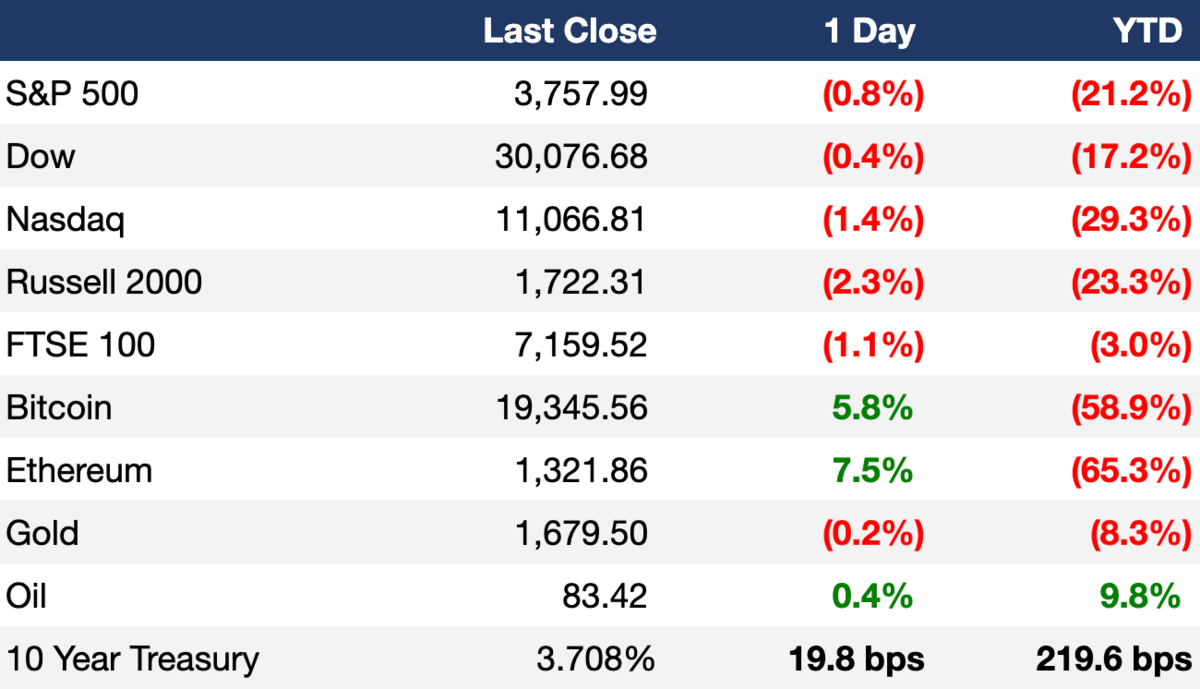

Markets

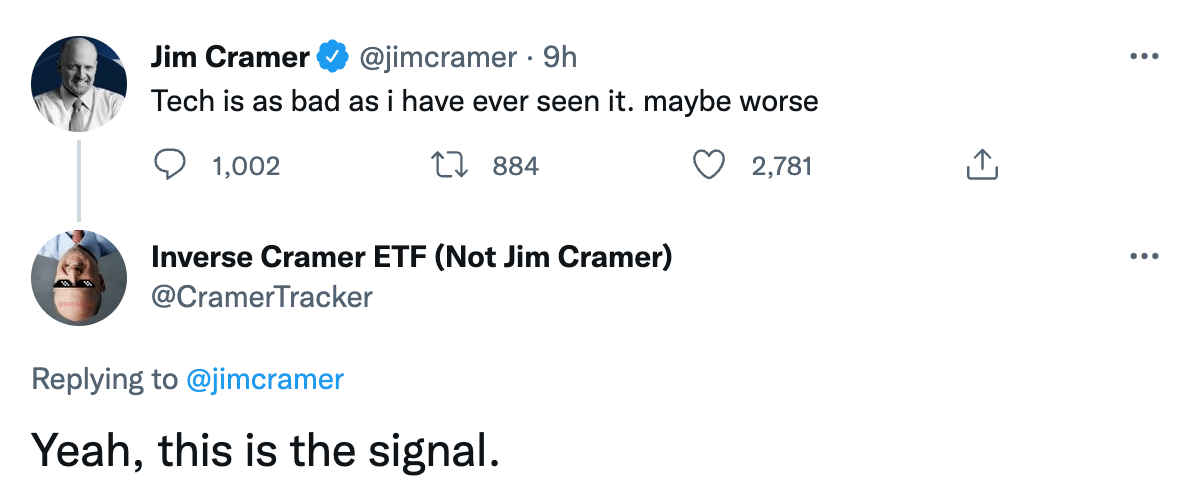

After yesterday, the three major averages are on pace to close the week with losses as the Fed’s aggressive rate hikes continue to mount fears of a recession

Industrials and consumer discretionary were the worst performing S&P 500 sectors thanks to their exposure to the broader economy

Earnings

Accenture met Q4 earnings and revenue estimates but issued lower-than-expected FY 2023 guidance citing high interest rates; their stock slid ~3.2% yesterday (BW)

Costco beat Q4 earnings estimates while revenue came in in-line with expectations as the retailer continues to battle cost pressures with its robust membership model (IBD)

FedEx released their official earnings report yesterday and fell short of revenue and earnings expectations; they also announced price hikes and cost-cutting efforts (CNBC)

Manchester United missed earnings and revenue estimates on a Q4 loss but strengthened operations and achieved record e-commerce revenues, memberships, and digital engagements in FY 2022; their stock was down ~2.5% yesterday (BW)

Full calendar here

Headline Roundup

China sent regulators to Hong Kong to assist in US audit inspection (RT)

Bank of England raised rates by 0.5% and said the UK may already be in recession (CNBC)

Japan intervened to buy yen for the first time since 1998 to shore up the battered currency amid ultra-low interest rates (RT)

Europe's vegetable farmers are warning of shortages as energy crisis bites (RT)

Luxury home market posted its biggest decline in a decade (WSJ)

Credit Suisse is considering splitting its investment bank in three (FT)

Samsung and SoftBank are set to discuss a potential chip designing alliance (WSJ)

Hedge fund Ancora is seeking to oust Kohl’s CEO and chairman (RT)

Target plans to hire 100k workers for holiday shopping season (WSJ)

Fintech Klarna will lay off employees for a second time despite CEO's word that layoffs were over (TC)

Ford will restructure supply chain following $1B in unexpected quarterly costs (CNBC)

Tesla recalled nearly 1.1M US vehicles to update window reversing software (RT)

Mercedes-Benz recalled over 100k C-class models (RT)

Two winners will split the $1.3B Mega Millions jackpot (CNBC)

FedEx to raise shipping rates by 6.9% as it combats slowdown (WSJ)

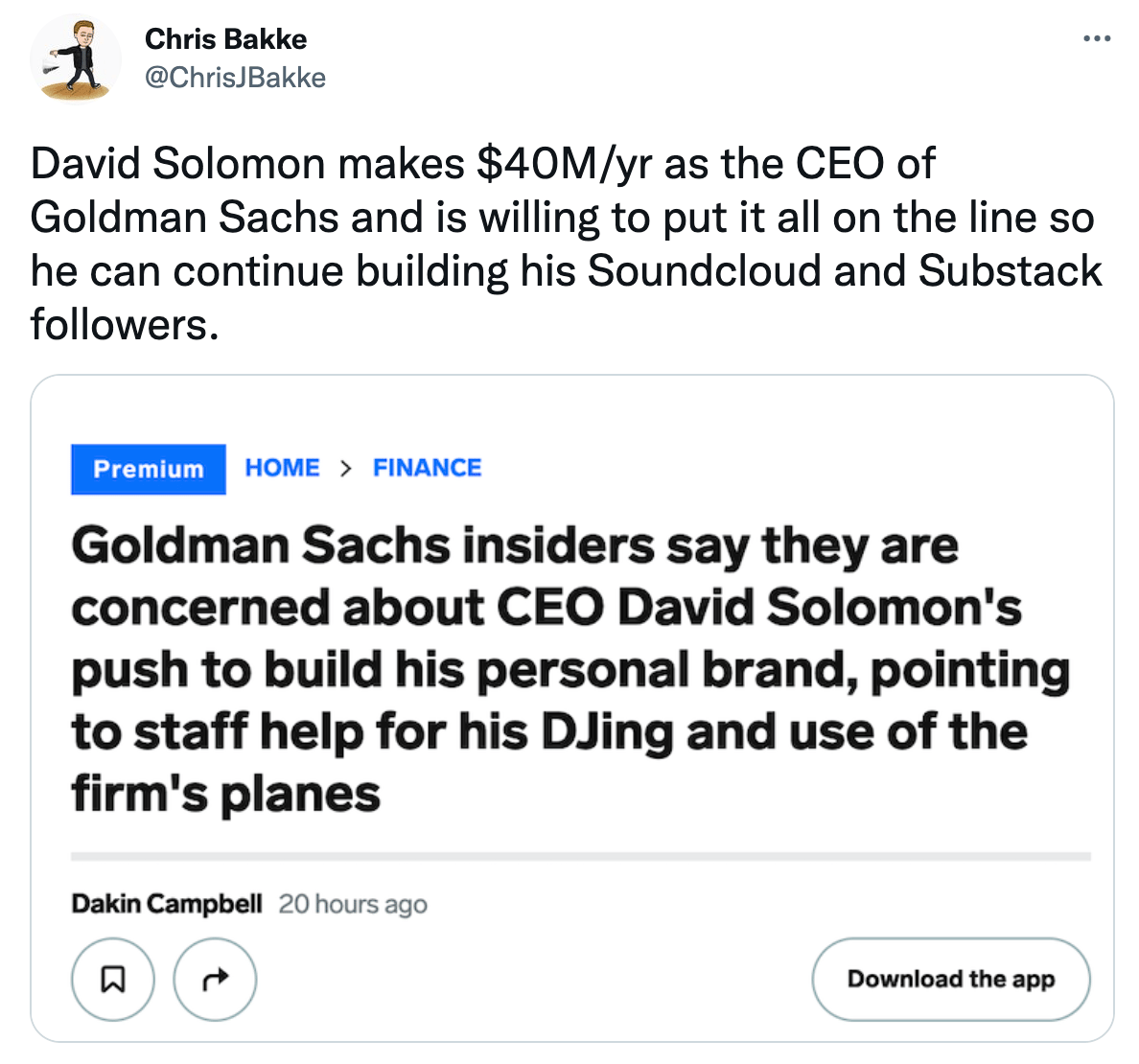

Goldman Sachs insiders say they are concerned about CEO David Solomon’s push to build his personal brand, pointing to staff help for his DJing and use of the firm’s planes (BI)

A Message to Sports Bettors

Winning with Analytics

You probably bet with a DraftKings, a bookie, FanDuel, or some other website. There's now an app, Juice Reel, that lets you link in any betting account(s) and your bet history automatically loads in. This free app not only gives you analytics on yourself, but also uses the pool of data that the whole Juice Reel Community synced in to give you insights on what the best and worst historical bettors are doing.

Juice Reel is exploding in the betting community and I highly recommend this app if you bet on sports -- the fact that it's totally free makes it even better.

Get on Juice Reel right now and start winning with analytics 🤝

Deal Flow

M&A / Investments

Prudential Financial is considering buying a majority stake in ABC Life Insurance Co. at a potential $3-$4B valuation (BBG)

Talos Energy agreed to buy Gulf of Mexico oil producer EnVen Energy in a $1.1B deal (RT)

France’s Worldline, Italy’s Nexi, and US firm Fiserv have made indicative bids for the payments arm of Spanish bank Sabadell at an up to $394M valuation (RT)

French EV charging operator Bump received a $180M investment from DIF Capital Partners (TC)

Humana and CVS Health are among several companies looking to buy senior-care facility operator Cano Health (RT)

Germany is considering nationalizing gas importer Sefe to protect it from bankruptcy (RT)

Credit Suisse is weighing the sale of its Latin American wealth management operations excluding Brazil (BBG)

VC

Crypto exchange FTX in talks to raise up to $1B at a ~$32B valuation (CNBC)

Rivus Pharmaceuticals, a clinical stage biopharmaceutical company focused on improving cardiovascular and metabolic health, raised a $132M Series B led by RA Capital Management (PRN)

DataGuard, a startup providing corporate privacy and data protection services, raised a $61M Series B led by Morgan Stanley Expansion Capital (TC)

AccessFintech, a fintech startup providing data sharing and workflow collaboration tools for the capital markets, raised a $60M Series C led by WestCap (BW)

Theorycraft Games, a game studio focused on making deep and collaborative games, raised a $50M Series B extension led by Makers Fund (BW)

Automated crypto trading bot investment platform 3Commas raised a $37M Series B led by Target Global, Alameda Research, Jump Capital, and CEO/founder of Copper, Dmitry Tokarev (BW)

E-commerce roll-up startup OpenStore raised a $32M round at a $970M valuation led by Lux Capital (TC)

Seoul Robotics, an autonomous vehicle infrastructure startup, raised a $25M Series B led by KB Investment (TC)

Web3 bug bounty platform Immunefi raised a $24M Series A led by Framework Ventures (TC)

Codacy, a startup automating code reviews, raised a $15M Series B led by Bright Pixel Capital (TC)

Remofirst, a startup helping businesses hire remote workers without setting up entities in each country, raised a $14.1M seed round led by Mouro Capital and QED Investors (TC)

Somewear Labs, a startup enabling critical communications in wildland fires, raised a $13.7M Series A led by David Dorman, former CEO of AT&T (PRN)

Champ Titles, a startup bringing advanced title and registration capabilities to DMVs, auto retailers, and insurance carriers, raised a $12.9M Series B (PRN)

Steadybit, a startup improving reliability for complex software systems, raised a $7.8M seed round led by boldstart ventures (BW)

Carbon Ridge, a developer of modular onboard carbon capture and storage solutions for the maritime industry, raised a $6M round led by the Grantham Foundation (BW)

Digital health startup Pattern Health raised a $3.3M Series A led by the Dr. William H. Joyce Family Office (PRN)

Kalogon, a smart cushion wheel-chair startup, raised $3.3M in seed funding led by SeedFundersOrlando (TC)

Right Pedal LendOS, a fintech startup building an end-to-end lending solution, raised a $3M seed round led by Liberty City Ventures (PRN)

IPO / Direct Listings / Issuances / Block Trades

SoftBank slashed the valuation of hotel-booking firm Oyo Hotels’ IPO by 20%+ to $2.7B, down from $3.4B, ahead of its 2023 IPO (BBG)

Chinese EV battery supplier CALB is seeking to raise up to $1.7B in its Hong Kong IPO (BBG)

Health-care provider Burjeel is scaling down its IPO plans to a local affair after International Holding Co., a firm controlled by the Abu Dhabi royal family, agreed to buy a 15% stake (BBG)

SPAC

Online betting operator PlayUp agreed to merge with IG Acquisition Corp. in a $350M deal (BBG)

Fundraising

Visionaries Club, a Belin-based VC focused on B2B startups, raised a $150M seed fund and $200M growth fund (TC)

Crypto Corner

Exec's Picks

On Bloomberg's Odd Lots podcast, Joe Weisenthal and Tracy Alloway recently had a super interesting discussion on what exactly is happening in the China real estate market. Check it out here.

With the SPAC market left for dead, Jack Raines wrote a piece reflecting on the wild ride in SPACs over the last two years. Check it out here.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.