Together with

Good Morning,

Trump met with J Pow amid high tensions, Trump had some encouraging words for Musk, American Eagle's stock rallied on a Sydney Sweeney campaign, Blackstone is readying companies for IPOs, and Epstein's birthday book included letters from Apollo founder Leon Black.

J Pow had the most priceless reaction to Trump's statements and this one-minute clip sums it up perfectly.

Automate your complicated business spend and expense allocation process with StavPay, the leading software for alternative asset managers.

Let's dive in.

Before The Bell

As of 7/24/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks closed mixed yesterday as traders digested a slew of corporate earnings

S&P and Nasdaq hit fresh ATHs

VIX index fell to its lowest since February

UK's FTSE 100 hit a fresh ATH

Earnings

Blackstone beat Q2 distributable earnings estimates driven by strong profits from retail and evergreen funds; AUM topped $1.2T and the firm sees its strongest deal pipeline strongest since 2021 as it prepares portfolio companies for IPOs (RT)

Lazard beat Q2 profit estimates on record dealmaking advisory revenue (RT)

Intel beat on Q2 revenue estimates but posted a widening loss as it undergoes a massive turnaround effort under a new CEO; the firm announced drastic cost cuts while completing most of its planned 22% layoffs (CNBC)

American Airlines beat Q2 earnings and revenue estimates but lowered its FY profit outlook and issued a weaker-than-expected Q3 forecast, citing consumer weakness, flat corporate travel demand and operational problems from a series of storms (CNBC)

Nasdaq beat Q2 estimates on success in large-cap listings while also signaling improved IPO market momentum (RT)

Honeywell issued a Q2 beat-and-raise amid strong order backlog and resilience against tariffs (BBG)

What we're watching this week:

Today: Booz Allen Hamilton

Full calendar here

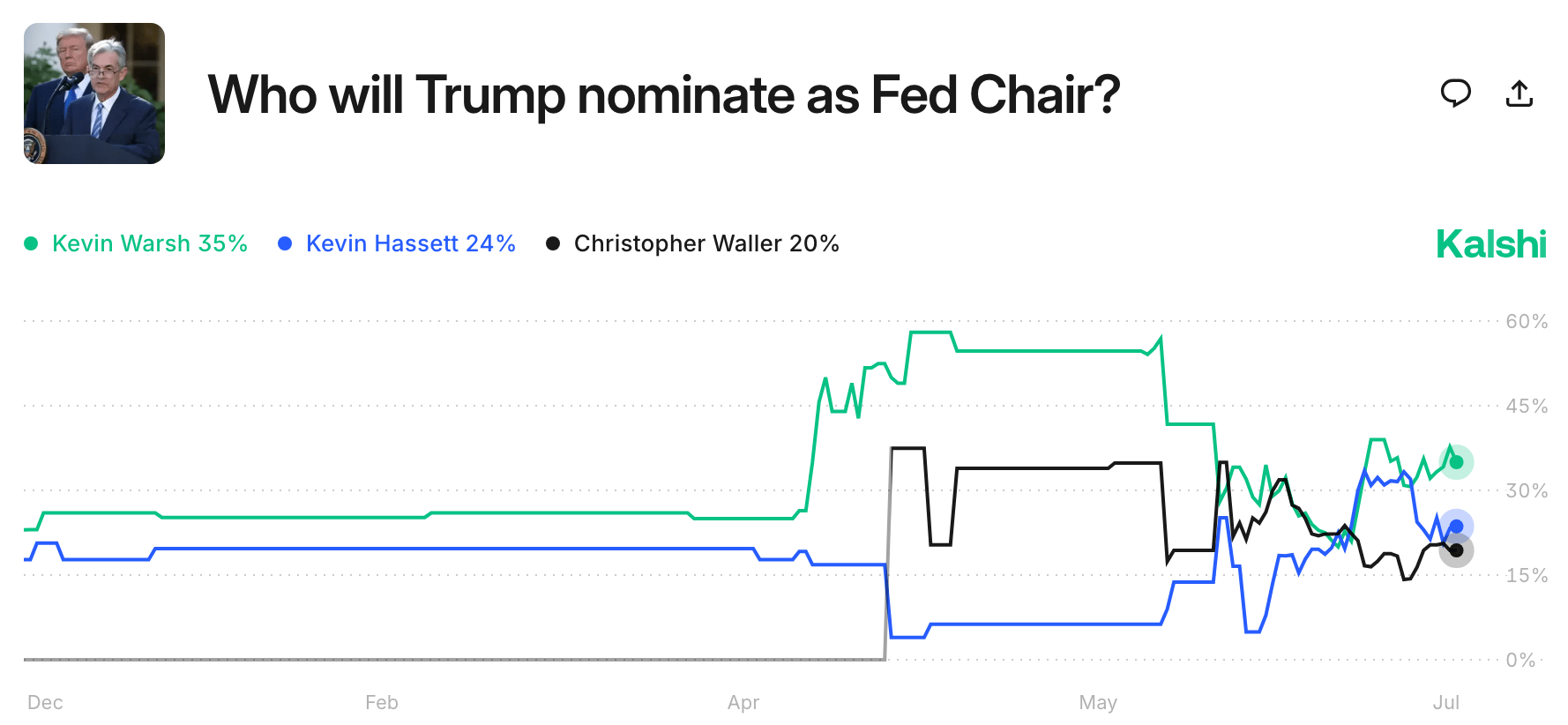

Prediction Markets

Here me out: Joe Biden

Headline Roundup

Trump and J Pow sparred in rare Fed visit (CNBC)

ECB held rates steady at 2% (CNBC)

Citigroup expanded research to private companies (BBG)

US jobless claims fell to the lowest since April (BBG)

US business activity growth hit a YTD high (BBG)

Eurozone business activity growth hit an eleven-month high (RT)

Singapore SWF GIC signals caution on private credit (FT)

Meme stock surge underlines market froth (RT)

A penny/meme stock just made up 15% of US trading volume (BBG)

US green project cancellations hit $22B YTD (BBG)

Over 40% of Americans saw declines in real pay (BBG)

~30% of German companies postponed US investments (RT)

Sydney Sweeney campaign fuels American Eagle stock rally (CNBC)

Proxy firm Glass Lewis sued Texas over DEI and ESG limits (FT)

Nvidia AI chips worth $1B entered China despite US curbs (FT)

'Head of Macro' James Fishback sued the Fed (BBG)

Trump wants Musk and his companies to thrive in US (RT)

Musk's Starlink suffered a rare global outage (RT)

Musk said Vine will return in AI form (RT)

College grads are being paid up to $150 / hour to train AI models (BBG)

Epstein birthday book included letters from Apollo founder Leon Black, Bill Clinton, and Vera Wang (WSJ)

A Message from StavPay

StavPay was built for Alternative Asset Managers to automate the business spend and expense allocation process.

More than 100 managers with over $2.3T of AUM collectively use StavPay to manage their vendors, contracts, invoices, expense allocations, accruals, budgets, services, legal matters, 1099 filings, inter-entity reimbursements, time tracking and payments.

Get more details at stavpay.com and schedule a demo today.

We promise you, it's an hour well spent.

Deal Flow

M&A / Investments

Union Pacific confirmed advanced talks with Norfolk Southern for a merger that could form a ~$200B transcontinental rail giant, the industry's largest ever

Pinnacle Financial Partners and Synovus Financial agreed to merge in an $8.6B all-stock deal to form one of the largest regional banks in the south

Chinese e-commerce giant JD.com is in advanced talks to acquire German electronics retailer Ceconomy for ~$2.6B, at a 23% premium

Healthcare software company Waystar agreed to acquire Advent-backed Iodine Software for ~$1.3B, including debt

European PE firm Cinven emerged as the leading bidder for Ardian-backed French data services firm Artefact, which could fetch a ~$1.2B valuation

India's Torrent Power is in talks to acquire Indian conglomerate Larsen & Toubro's thermal power unit for ~$1B, including debt

Canada's CPPIB will exit its JV with India mall operator Phoenix Mills in a $631M all-cash deal

Food giant Nestlé is considering selling its underperforming vitamin brands amid declining sales

Seven undisclosed parties are interested in acquiring German defense giant Rheinmetall's civilian business, which is no longer considered core amid a strategic shift towards defense

Italian food-and-drinks group NewPrinces agreed to acquire French supermarket giant Carrefour's Italian operations

Global sports investment firm Harburg Group acquired Saudi soccer club Al-Kholood, marking the first foreign ownership deal in Saudi's sports sector

LVMH-backed magazine Paris Match agreed to acquire an 80% stake in French photo and video agency Abaca

Germany is considering acquiring a minority stake in Franco-German tank maker KNDS

Mining giant Rio Tinto is considering a sale of its titanium unit ahead of a restructuring by its incoming CEO

VC

Armada, a startup building modular data centers, raised a $131M round from Pinegrove, Veriten, and Glade Brook

HeroDevs, a provider of security and compliance solutions for deprecated open source software, raised a $125M growth round led by PSG

Yieldstreet, a private markets investment platform, raised a $77M round led by Tarsadia Investments

AI contract review startup LegalOn raised a $50M Series C led by Goldman Sachs Alternatives

Compensation management platform BetterComp raised a $33M Series A led by Ten Coves Capital

Stellaria, a French startup developing a molten salt nuclear reactor, raised a $27M round led by At One Ventures and Supernova Invest

Bitzero, a company redefining sustainable blockchain and data centers, raised $25M in funding

Lightyear, an AI-powered investment platform, raised a $23M Series B led by Nordic Ninja

Memories.ai, an AI platform to process video and extract information, raised an $8M seed round led by Susa Ventures

IdentifAI, an AI startup that detects synthetic images, videos, or audio, raised a $5.8M round led by United Ventures

Brand technology platform Queen One raised $5.5M in a friends and family funding round led by Charge VC, Inspired Capital, and others

Volca, an AI-powered marketing platform for home services businesses, raised a $5.5M seed round led by Pathlight Ventures

IPOs / Direct Listings / Issuances / Block Trades

Michael Saylor's Strategy launched a $2.8B preferred stock sale promising a 9% annual payout with no end date

SoftBank-backed mobile advertising platform InMobi aims to raise up to $1B in an India IPO

Insurance data analytics platform Accelerant surged 26% in its trading debut after raising $724M in an upsized IPO

Medtech firm Shoulder Innovations is seeking to raise up to $105M at a $418M valuation in an IPO

REIT GO Residential is set to raise $410M in Canada's largest IPO since November

SPAC

TON Foundation and Kingsway Capital Partners are seeking to raise $400M for a crypto treasury company to hold Toncoin

Debt

Apollo is leading an $812M private credit deal alongside KKR to support Bridgepoint Group's $1B LBO of UK dental chain Mydentist from Palamon Capital Partner

Carlyle is acquiring $250M of farm loans from FarmOp Capital in a private credit deal amid rising bankruptcies in the agriculture sector

Bankruptcy / Restructuring / Distressed

Chinese developer Country Garden agreed to key restructuring terms with a group of bank creditors, easing the path for an overall debt deal

Fundraising / Secondaries

Blackstone plans to raise $22B for its tenth flagship PE secondaries fund

Prominent VC investor Elad Gil is raising a $1.5B fund, the largest ever for a solo GP

Specialty insurance firm Arch Capital Group is in talks to sell over $350M worth of stakes in BlackRock funds to secondary funds including Ares, including $200M investment in BlackRock's APAC private credit fund

Australian life sciences VC firm Brandon Capital raised $295M for its sixth fund

O&G-focused PE firm High River Resources Management raised $205M for its second fund

Crypto Sum Snapshot

Luxury real estate brokerage Christie's International will allow buyers to acquire real estate using crypto

Subscribe to Crypto Sum for the full stories on everything crypto!

Exec’s Picks

All meme stocks seem to have one thing in common: horrible financials.

Ted Seides conducted a short but insightful analysis on how longer fund lives may affect PE firms and investors.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out our recruiting firm, Litney Partners. Established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners has placed strong candidates across leading firms spanning private equity, hedge funds, venture capital, growth equity, private credit, investment banking, and fintech. Head over to our website to drop your resume / create your profile and we'd love to get in touch!

We are able to move faster than most firms due to our paralleled reach, decades of industry expertise, and ability to attract top caliber candidates.

Next Play

If you're down bad, realizing finance isn't for you, and/or are curious to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play reviews every submission and will reach out to schedule a 1:1 video call if they think they can be helpful as your own, personal startup matchmaker. They’ve grown their community to over 50k talented individuals and have strong relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.