Together with

Good Morning,

Fauci plans to step down by the end of Biden's term, US home buying has slowed, Delta is buying 100 new Boeing 737 MAX jets, Apple is slowing hiring, H&M is exiting Russia, and Hulu has been outpacing Disney+ in new subscribers.

Shoutout to today's sponsor, Stream. They've got a great library of transcripts and one-on-one calls w/ former execs, customers, and competitors that were all conducted by hedge fund analysts. Ideal for research analysts looking for unique insights as they conduct DD on potential new investments.

Let's dive in.

Before The Bell

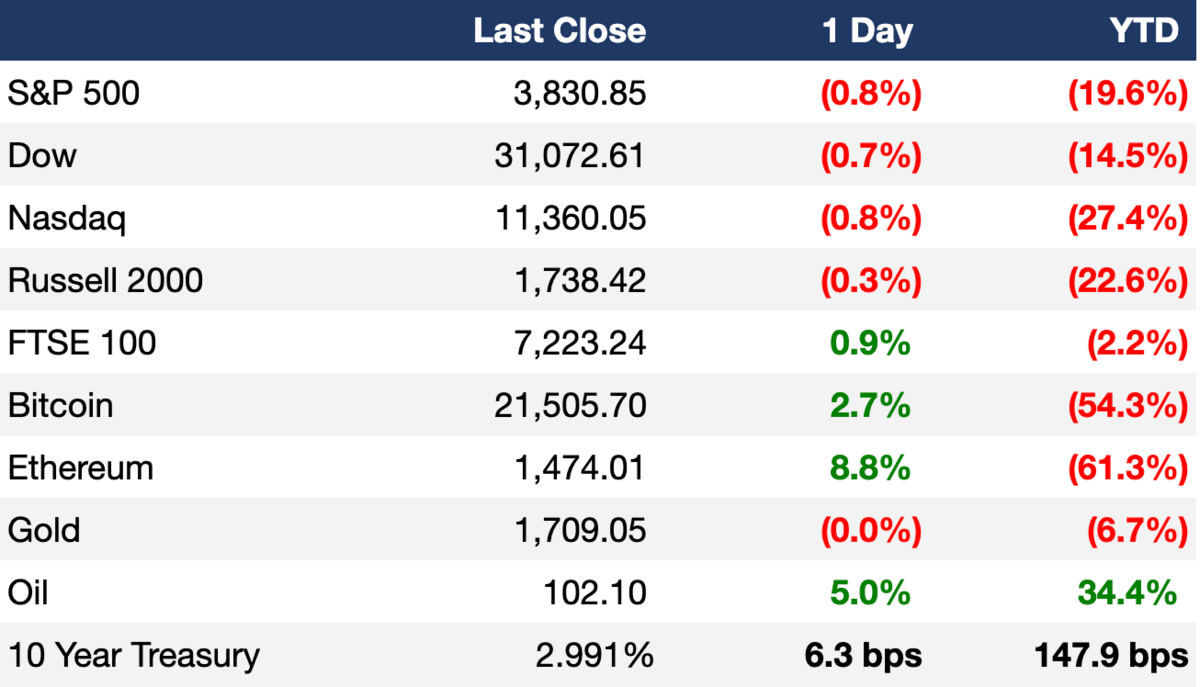

As of 7/18/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

The broader market closed red despite spending most of Monday’s session in the green

9 of the S&P 500’s 11 sectors declined

Tech giants fell after Bloomberg News reported that Apple plans to slow their hiring next year; Apple, Alphabet, and Microsoft fell 2%, 2.5%, and 1%, respectively

Commodity prices rebounded after a stretch of weakness with oil, gold, and copper all posting gains

Big financial firms kicked off a major week of earnings reports that will provide insight to the country’s current and future economic prospects

Earnings

Bank of America’s Q2 profit fell 32% but revenue increased on strong consumer spending and borrowing, resulting in no significant changes to their share price (WSJ)

Goldman Sachs shares rose 2.5% after exceeding both profit and revenue expectations, driven by ‘significantly higher’ trading activity (CNBC)

IBM reported after the market close and beat expectations with 9% sales growth, but the dollar’s surge negatively impacted reported revenue by $900M; the company warned the total hit for 2022 from forex markets could be as high as $3.5B (CNBC)

What we’re watching this week:

Today: Johnson & Johnson, Netflix

Wednesday: Tesla, United Airlines

Thursday: AT&T, American Airlines, Snap Inc., Capital One

Friday: Verizon, American Express, Twitter

Full calendar here

Headline Roundup

The National Association of Home Builders’ index of confidence among US home builders fell in July, the second largest decline in the index's history (MW)

Foreign purchases of US homes fell for the fifth straight year ending in March, down 7.9% from the prior year (WSJ)

California home sales plunged 21% in June, the biggest drop since California’s three-month pandemic lockdown in 2020 (BBG)

Delta Air Lines agreed to purchase 100 of Boeing’s 737 MAX Jets, valued at roughly $13.5B before customary discounts (WSJ)

Fashion giant H&M will exit Russia completely (WSJ)

Twitter said Elon Musk’s motion opposing an expedited trial request 'fails on every level', a decision on the motion will likely occur today (WSJ)

Advertisers agreed to buy $9B in commercials across media giant Walt Disney's channels and streaming services for the 2022-23 TV season (BBG)

Uber agreed to a multi-million dollar settlement over a lawsuit that the company wrongfully charged wait-time fees to customers with disabilities (WSJ)

New subscriptions to Hulu exceeded those to Disney+ in each of the last six quarters (WSJ)

Apple plans to slow hiring and spending growth next year (BBG)

Anthony Fauci will retire by the end of President Biden’s term (AX)

A Message From Stream RG

In this market roller coaster, you need financial insights straight from the source.

Stream by AlphaSense is an expert transcript library used by hedge fund analysts, portfolio managers, and strategic decision-makers to get unique investment ideas and make informed decisions with speed.

The Stream platform provides transcripts of one-on-one calls with former executives, customers, competitors, and supply chain members that have gone through three layers of rigorous compliance testing to ensure quality. Stream offers the market’s broadest library, dozens of new transcripts every day, and curated daily / weekly digests.

Why the world’s leading financial firms trust Stream for primary research:

Over 17,000 on-demand expert call interviews, with 100+ new transcripts added each day

AI smart search technology

Mobile app for on-the-go research

Over 70% of the experts are unique to their network, giving you exclusive investment insights and ideas

We also wanted to share with you an exclusive webinar they have coming up Next Friday, July 22. They will be discussing the shift in the state of the market with Morgan Housel and what the last two years have taught us about behavioral finance.

Deal Flow

M&A / Investments

European PE firms Astorg Asset Management and Epiris will buy financial media firm Euromoney Institutional Investor for ~$1.9B (BBG)

Hong Kong conglomerate Swire Pacific will buy Coca-Cola's Vietnam and Cambodia bottling plants for $1B (BBG)

7-Eleven Malaysia is weighing a sale of drugstore chain Caring, which could be valued at ~$400M (BBG)

Bestselling author Malcolm Gladwell’s company, Pushkin Industries, will acquire podcast studio Transmitter Media (BBG)

South Korea-based micro mobility scooter operator Gbike will acquire Hyundai Motor’s shared micromobility platform ZET (TC)

VC

Delfi Diagnostics, an early cancer detection and monitoring startup, raised a $225M Series B led by DFJ Growth (PRN)

ForSight Robotics, a startup developing a surgical platform for fully robotic cataract surgery, raised a $55M Series A led by The Adani Group (CT)

Pan-African technology company Cassava Technologies received a $50M strategic investment from C5 Capital (BBG)

All-in-one HR platform HireArt raised a $26.25M Series B led by Three Fish Capital (TC)

Smart credit card company X1 Card raised a $25M Series B led by FPV Ventures (PY)

SupplyPike, a supply chain SaaS company, raised a $25M Series B led by Noro-Moseley Partners (TC)

Meow, a startup that provides corporate treasurers a regulated way to access crypto yield, raised a $22M Series A led by Tiger Global (BW)

Indonesian social commerce startup KitaBeli raised $20M in funding led by Glade Brook Capital Partners (TC)

Retia Medical, a healthcare startup with cardiovascular monitoring technology, raised a $15M Series B led by Fresenius Medical Care Ventures (PRN)

Refundid, a fintech startup that provides instant refunds for online returns, raised a $12M seed round led by Salesforce Ventures (AFR)

Humanity Health, a talent sourcing platform for healthcare and life sciences, raised a $6M Series A led by Jumpstart Nova (PRN)

Rex, a veterinary practice with digital infrastructure, raised a ~$5M seed round led by Vorwerk Ventures (EUS)

IPO / Direct Listings / Issuances / Block Trades

Primary care platform Everside Health Group scrapped plans for potential ~$100M IPO (BJ)

Shares of Haleon, pharmaceutical company GSK's consumer health unit spinoff, dropped 6.6% in London's biggest IPO debut in over a decade (FT)

SoftBank Group paused plans for a London IPO of chip designer Arm, citing political turmoil in the UK government (FT)

Dubai supermarket chain Union Coop traded 18% below the indicated price in its Dubai IPO debut (BBG)

Fundraising

Oxford Science Enterprises, the independent VC firm partnered with Oxford University, raised $300M in new funding to finance businesses stemming from Oxford research (PRN)

FORTY51 Ventures raised $43M for its first fund, FORTY51 Ventures I, which is committed to early stage investments in biotech with geographic emphasis on Switzerland, France and Germany (PRN)

Fundrise, a retail real estate investment platform, plans to raise a $1B evergreen growth equity fund to invest in late-stage tech startups (TC)

Crypto Corner

Crypto assets regained a $1T market cap despite on-going crypto firm failures (YHOO)

Crypto broker Genesis Global Trading filed a $1.2B claim against insolvent crypto hedge fund Three Arrows Capital (CD)

Crypto exchange Gemini laid off 7% of its staff after letting go of 10% of its workforce just two months earlier (TC)

Monthly NFT trading volumes fell 74% from May to June (TB)

Exec's Picks

Picture this: the crew hits you up to go out, but you have a big presentation at work tomorrow. You don’t want to disappoint the fam, but also need to crush the presentation. More Labs has you covered. Drink their Morning Recovery before you go out to avoid the ‘rough morning’, then take a Dream Well so you fall asleep fast at the end of the night. The next day, take their Liquid Focus for energy to power you through the meeting. You'll crush it. Use code LITQUID for 25% off

Andrew Lahde's final letter to investors in 2008, delivered after he successfully profited from the housing bubble crash, has been circulating the web this week, and it just might be the finest letter ever written. Check it out here

Jack Niewold dove into the legal document on the Three Arrows Capital case today, and he shared his findings, from the timeline of Three Arrows' implosion to the hedge fund's creditors, here

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

Featured jobs:

Techstars is hiring for an Investment Associate role based in Los Angeles, CA

Basecamp Fund is hiring for a VC principal role based in Menlo Park, CA

If you're a company looking to hire candidates and want to list a job opening on our board and feature it on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.