Together with

Good Morning,

The bond king expects a 2024 recession, banks are ramping up RTO demands, Segantii will return capital to investors, US sued to break up Live Nation, and Archegos accidentally wired $470M to Goldman during their collapse.

Summer season means it's time for a wardrobe overhaul. Check out our personal favorite Mizzen+Main for the most comfortable men's dress shirts in the game!

Let’s dive in.

Before The Bell

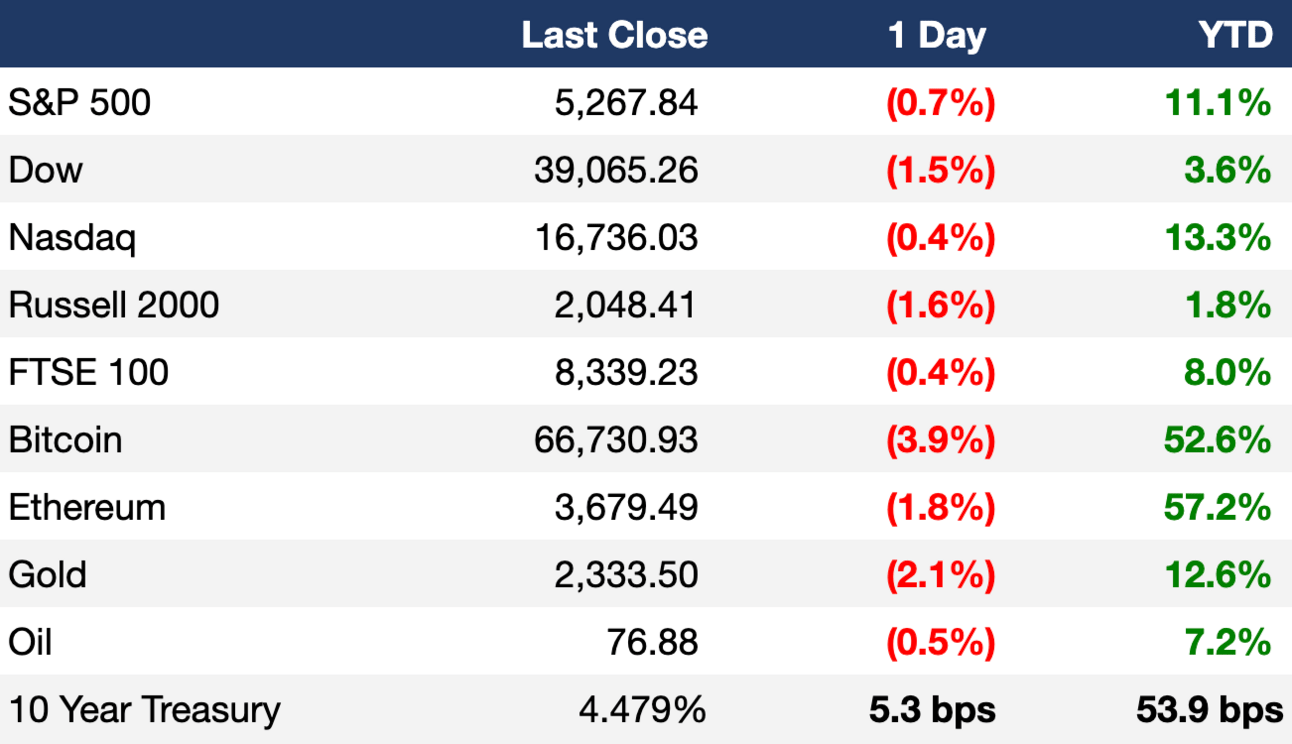

As of 05/23/2024 market close.

Markets

US stocks fell yesterday as robust business activity data offset hype over Nvidia's earnings

The Dow had its worst day since March 2024

Earnings

Workday beat Q1 earnings and revenue estimates but shares nonetheless plunged ~11% due to light Q2 and FY subscription revenue guidance (YF)

Intuit tumbled ~7% despite reporting strong Q3 revenue due to a 1M user decline in free-service filing and mixed Q4 guidance (BBG)

Ralph Lauren beat Q4 estimates but forecast below-estimate FY revenue growth as it grapples with subdued US demand (RT)

Full calendar here

Headline Roundup

Bond king Jeff Gundlach expects a US recession this year (RT)

Citi, HSBC and Barclays ramp up RTO demands (BBG)

Big investors are pouring into emerging markets (RT)

Archegos sent Goldman $470M in error during collapse (BBG)

Ray Dalio joins billionaires snapping up Singapore 'shophouses' (FT)

Goldman picked insiders as co-heads of Germany and Austria IB (RT)

Gildan Activewear board, CEO resign following Browning West's activist campaign (WSJ)

Segantii to return capital amid Hong Kong insider trading probe (FT)

Improved business activity casts doubt over rate cuts (RT)

Boeing says cash slow is worse than expected (WSJ)

Capital Group to partner with KKR in push into private assets (WSJ)

China’s $538B deposit exodus supercharges rally in bonds (BBG)

Starwood limits redemptions in struggling $10B property fund (FT)

Morgan Stanley chairman James Gorman will step down (RT)

Goldman gets license for regional HQ in Saudi Arabia (RT)

JPMorgan to pay $100M over CFTC trade reporting violations (RT)

US sued to break up Live Nation over alleged monopoly (CNBC)

Musk says Tesla can compete with China without tariffs (WSJ)

Jane Street avoids disclosing secrets to Millennium in dispute (BBG)

TD Bank Group fired over a dozen in wake of anti-money-laundering failing (WSJ)

HSBC's New York attendance jumps to 80% at new office (RT)

A Message From Mizzen+Main

"I legit love my Mizzen+Main shirts" - Hank, CEO of Litquidity

Summer szn means it’s time to consider a wardrobe overhaul, but it's hard to find a shirt that meets all our needs. Don’t stress, Mizzen+Main has your back.

With their Leeward No Tuck Dress Shirt, you can have all the comfort of your favorite homey t-shirt with the style of that dress shirt you can wear to the office every day. This shirt is made from machine washable performance fabric that's quick drying and wrinkle resistant—so you'll never have to worry about looking your best.

Stop sacrificing comfort for style, because you can have both in your Mizzen+Main's Leeward dress shirt. Use code EXECSUM and take $35 off any order over $125 today!

Deal Flow

M&A / Investments

CVS Health is seeking a PE partner to fund growth at Oak Street Health, the $10.6B primary care provider it acquired a year ago (BBG)

Peter Hargreaves, who owns 19.8% of Hargreaves Lansdown, is open to taking the company private after the UK investment platform rejected a $5.95B takeover proposal from a consortium led by CVC Advisers and ADIA (RT)

PE firm Centurium Capital Partners is considering bringing in fresh backers for $5.5B Chinese Starbucks rival Luckin Coffee (BBG)

PE firm Astorg is exploring options including a potential sale for French food-ingredients maker Solina that could value the business at ~$4.3B (BBG)

Billionaire Xavier Niel is exploring a bid to buyout other shareholders of Millicom International Cellular that would value the LatAm carrier at ~$4.1B (BBG)

$3.7B wealth-management SaaS firm Envestnet is drawing takeover interest from buyers including Advent International and GTCR (BBG)

PE firm Hg agreed to acquire risk management SaaS firm AuditBoard at an over $3B valuation, including debt (BBG)

Electric components maker TE Connectivity is considering options including a sale for its medical contract manufacturing business at an over $2B valuation (BBG)

Iberdrola is looking for an investor to buy a 50% stake in a portfolio of US renewable-energy assets for up to $1.8B (BBG)

Singapore insurer Great Eastern appointed EY to advise on Oversea-Chinese Banking Corp.'s $1B offer to buy the remaining stake it does not currently own (BBG)

German packaging and medical equipment maker Gerresheimer will acquire peer Blitz LuxCo for an EV of $866M (RT)

Merck’s life science business MilliporeSigma agreed to acquire transfection solutions firm Mirus Bio from Gamma Biosciences in a $600M deal (YH)

JPMorgan is seeking to acquire a private credit shop to augment its $3.6T asset management arm (BBG)

UK energy infrastructure operator National Grid is looking to sell its Grain LNG terminal in Britain, Europe’s largest such facility (RT)

VC

Lumos, a software firm centralizing management of apps and identities for IT and security teams, raised a $35M Series B led by Scale Venture Partners (BW)

Praktika, a language learning app using personalized AI-powered avatars, raised a $32.5M Series A led by Blossom Capital (FN)

Finout, an enterprise-grade FinOps solution, raised a $26.3M Series B led by Red Dot Capital (BW)

Dora Factory, a decentralized governance infrastructure company, raised a $10M round led by Nomad Capital, Sky9 Capital, and more (FN)

Fiberwood, a startup developing fossil-free insulation and packaging materials, raised a $8M round from Metsa Spring, Stephen Industries, and others (BW)

Cloud security startup Averlon raised a $8M seed round led by Voyager Capital (FN)

Userfront, an authentication and identity platform for SaaS firms, raised a $5.3M seed round led by Heavybit (FN)

ZeroPoint Technologies, a hardware-accelerated memory compression technology, raised a $5.5M Series A led by Matterwave Ventures (PRN)

Zest Protocol, a lending protocol built for Bitcoin, raised a $3.5M seed round led by Draper Associates (FN)

IPO / Direct Listings / Issuances / Block Trades

Debt

Bankruptcy / Restructuring / Distressed

Struggling developer China Vanke received a $2.8B syndicated loan facility from lenders including banks led by state-owned ICBC (RT)

Fundraising

Investment group Eurazeo launched an $813M thematic impact buyout fund (ESG)

Crypto Corner

Exec’s Picks

With Nvidia reporting yet another blockbuster earnings, WSJ published an article exploring wherein lies its biggest threats.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter