Together with

Good Morning,

All eyes are on big tech earnings this week, plummeting inflation has the Fed watching out for rising real interest rates, Meta is welcoming a headset war with Apple, Argentina’s president says he’s delivering on his free-market revolution, and United’s CEO kickstarted talks with Airbus amid Boeing delays.

Looking to diversify your portfolio outside of just stocks and bonds? Today’s sponsor, Percent, helps accredited investors access exclusive private credit deals.

Let’s dive in.

Before The Bell

As of 01/26/2024 market close.

Markets

US stocks closed mixed but clinched weekly gains thanks to the latest positive economic data

The Nasdaq fell 0.36%, while the Dow rose 0.16%

European stocks rose to close at a two-year high as investors digested the ECB’s latest rate decision, Q4 earnings, and fresh economic data

Earnings

American Express shares jumped 7% after a better-than-expected 2024 earnings forecast; however, Q4 results fell short of expectations (BBG)

What we're watching this week:

Today: Cleveland-Cliffs

Tuesday: Microsoft, Alphabet, AMD, Starbucks, GM, UPS, JetBlue

Wednesday: Qualcomm, Boeing, Novo Nordisk

Thursday: Apple, Amazon, Meta, Royal Caribbean, Altria

Friday: Exxon, Chevron, Bristol Myers Squibb, AbbVie, Cigna

Full calendar here

Headline Roundup

Stock market’s fate rests on $10T in big tech earnings (BBG)

Plummeting inflation raises new risk for Fed: rising real interest rates (WSJ)

Goldman, JPMorgan see euro challenging yen as carry-trade funder (BBG)

Meta welcomes headset war with Apple (WSJ)

Traders line up for a ‘once-in-a-generation’ emerging markets bet (BBG)

Argentina’s President promised a free-market revolution, and says he’s delivering (WSJ)

China tightens securities lending rule to support stock market (BBG)

Aviation’s wheelers and dealers meet under shadow of MAX crisis (RT)

United CEO kickstarts Airbus talks amid Boeing delays (CNBC)

Bank of America employees to share $800M stock reward (BBG)

Big pharma is at a crossroads, as J&J, Merck and others prepare to lose heaps of revenue from blockbuster drugs (CNBC)

Unhappy workers cost US firms $1.9T (BBG)

Taylor Swift’s name not searchable on X days after sexually explicit deepfakes go viral (CNBC)

Musk’s X pledges 100-person office in Texas to police content (BBG)

Three US troops killed in drone attack in Jordan (WSJ)

A Message From Percent

Increase resiliency for 2024 investments with a 40/30/30 portfolio

As investors make their investment plans for the new year, there’s a lot more to consider than stocks and bonds.

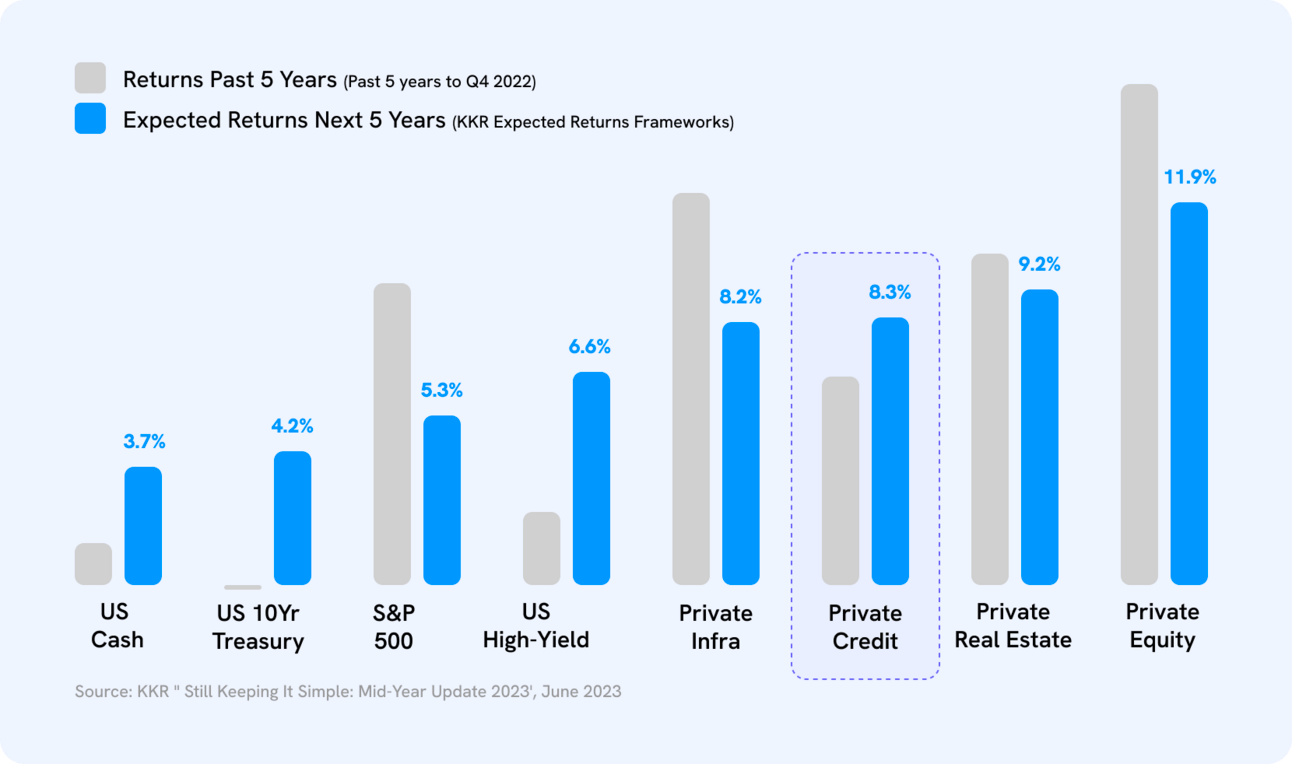

Research shows that alternative investment strategies such as private credit may outperform the S&P 500, as well as other traditional investments like bonds and treasuries, in the next five years. Additionally, 40/30/30 portfolios—in which 30% are alternative investments—are predicted to not only deliver better returns, but involve less risk in macroeconomic environments.

A popular alternative investment is private credit: Non-bank lending to businesses in search of capital. Often associated with higher yields, shorter-term durations, and earned income from contractual return, private credit is a top choice for diversifying institutional portfolios. Now, with Percent, accredited investors can access exclusive private credit deals too.

By investing as little as $500, the everyday accredited investors can access:

Yields up to 20% APY

The ability to regularly re-evaluate and re-calibrate shorter-term investments to meet portfolio needs

A wide range of deals, from small business lending in Latin America to real estate in Europe

Learn more and get a $500 bonus on your first investment with Percent.

Deal Flow

M&A / Investments

UK’s CMA launched a formal probe into the planned $19B merger of Vodafone’s UK operations with CK Hutchison’s Three UK, which would create Britain’s largest mobile operator (RT)

Building products company Johnson Controls International is exploring a sale of a portfolio of heating and ventilation assets worth as much as $5B (BBG)

JetBlue Airways may terminate its proposed $3.8B acquisition of low-cost carrier Spirit Airlines after a federal judge blocked the deal (BBG)

Muscle disease drug developer Dyne Therapeutics, which has a $1.7B market cap, is considering options amid takeover interest from larger pharmaceutical companies (BBG)

Carlyle Group is considering the sale of HSO in a deal that could value the Dutch technology services firm at ~$1B (BBG)

Bain Capital is in talks with SK Hynix to restart negotiations to merge memory chip makers Western Digital and Japan's Kioxia Holdings (RT)

Luxury conglomerate LVMH is in talks to purchase a building at 745 Fifth Avenue in Manhattan (BBG)

VC

Krutrim, an Indian AI startup founded by Ola founder Bhavish Aggarwal, raised a $50M round at a $1B valuation led by Matrix Partners India (TC)

Thentia, a regulatory technology company, raised a $38M Series B extension led by First Ascent Ventures, Spring Mountain Capital, BDC Capital, and Espresso Capital (PRN)

Proof Technology, a service of process and e-filing technology platform, raised a $30.4M Series B led by Long Ridge Equity Partners (FN)

Axiom, a startup using cryptographic proofs to give smart contract developers access to more data on-chain, raised a $20M Series A led by Standard Crypto and Paradigm (FN)

Chef Robotics, a startup building robots to help with food assembly, raised a $14.8M combo equity / debt round led by MaC Venture Capital, MFV Partners, Interwoven Ventures, and Alumni Ventures (TC)

PRISM BioLab, a Tokyo-based biotech company focused on designing small molecule inhibitors of protein-protein interactions, raised a $10.3M Series C led by Eli Lilly and Santec Holdings Corporation (FN)

GreenSpark, a startup building a modern software platform for the metal recycling industry, raised $9.4M in new funding led by Zero Infinity Partners and Third Prime (BW)

Digital investment solutions startup WealthKernel raised a $7.2M Series A extension led by ETFS Capital (FN)

AI testing startup RagaAI raised a $4.7M round led by pi Ventures (FN)

Online psychotherapy platform Hedepy raised a $4.2M round led by Hungarian Impact Ventures (EU)

Cnergreen, a startup manufacturing stable foams for CO2 injection, raised a $2M seed round led by Rhapsody Venture Partners (FN)

IPO / Direct Listings / Issuances / Block Trades

Swiss cement giant Holcim plans to spin off its $30B North American business and list it in the US (FT)

Chipmaking startup Cerebras Systems is weighing an IPO as soon as this year that could value the AI supercomputer maker at well above its $4B valuation from 2021 (BBG)

BrightSpring Health Services shares fell 15% in its debut day of trading, giving the KKR-backed community-based health-care services provider a ~$1.9B market value (BBG)

Debt

Bankruptcy / Restructuring

Steward Health Care System, the largest tenant of hospital REIT Medical Properties Trust, is examining restructuring options amid worsening financials (WSJ)

Fundraising

Credit investor Oak Hill Advisors is seeking $3B for its Oak Hill Advisors Senior Private Lending Fund, which will lend to large PE-owned businesses (WSJ)

Billionaire Michael Hintze is preparing to re-launch his hedge fund under Deltroit Asset Management in March with $2B (BBG)

VC and podcaster Chamath Palihapitiya cancelled plans to raise $1B for an early-stage investment fund (AX)

InnoVen Capital, a provider of venture debt for technology firms, is seeking to raise $250M for its second China-focused fund (BBG)

Crypto Corner

Exec’s Picks

Looking for an AI tool that can help with your investing research? Check out Danelfin, an AI-powered stock-picking tool with an up to a 94% win rate that was named “Best Financial Research Company” at the Benzinga Fintech Awards.

NYU professor Jay Rosen wrote a good thread covering factors that have contributed to the downturn in the news industry.

David Lynch explained why the rest of the developed world is envious of the US’s economy.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter