Together with

Good Morning,

Goldman has a women exodus problem, PE is betting on everything that’s ever financed, corporate defaults are matching 2008 levels, Morgan Stanley named an AI head, a hedge fund manager is facing arrest, and TikTok M&A is heating up.

We’re super excited to bring the Litquidity community an exclusive opportunity to invest in Y Combinator-backed startups. Read more below!

Let’s dive in.

Before The Bell

As of 03/14/2024 market close.

Markets

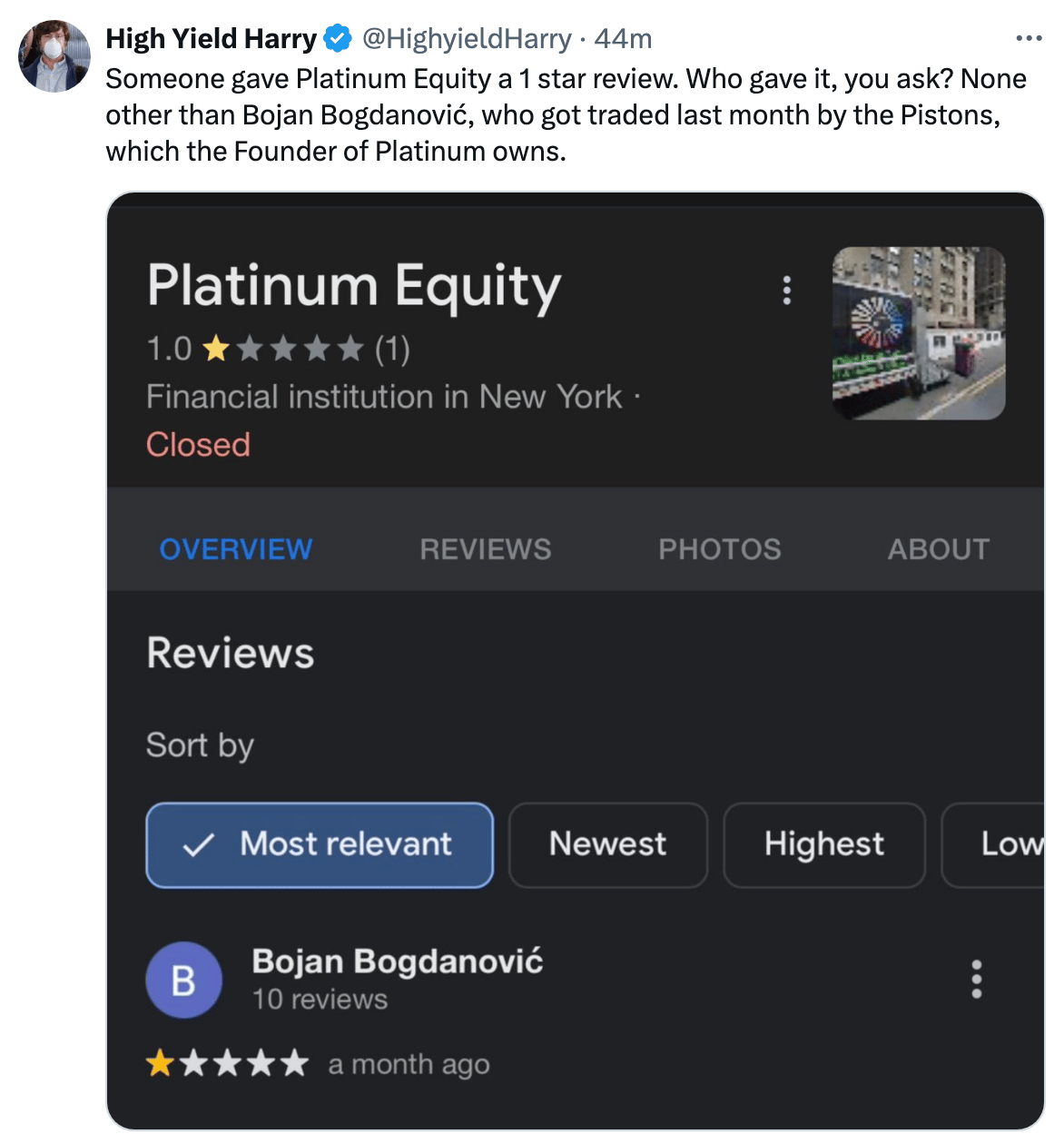

US stocks dropped, while yields jumped, as investors reacted to hotter-than-expected producer inflation data

Nvidia accounts for ~20% of the S&P 500's YTD rise

Italy 10Y bond spread sunk to a two-year low as Italy’s economy outshines Germany

Oil held near a four-month high after sharp supply-side price pressure this week

Earnings

Adobe plunged ~11% despite beating Q1 earnings and revenue estimates as it fell slightly short on Q2 revenue guidance (CNBC)

Dick’s Sporting Goods shares rose ~15% after beating Q4 estimates, posting its largest quarterly sales in history, and raising its dividend by 10% (CNBC)

Dollar General shares fell ~5% despite reporting a surprise increase in same-store sales due to a downbeat profit outlook for the current quarter (MW)

Full calendar here

Headline Roundup

Private funds increasingly replacing banks on everything consumer (WSJ)

Corporate defaults at highest rate since 2008 crisis (FT)

European corporate credit spreads hit two-year low as rate cut hopes shift (FT)

European fund group warns of ‘systemic’ risk from US settlement reform (FT)

Foreigners pile into Japan bonds on bets of end to negative rates (RT)

Blackstone says real estate prices have bottomed (BBG)

Mnuchin plans to acquire TikTok, days after rescuing NYCB (CNBC)

HF manager faces arrest over $533M taken from Byju's startup (RT)

Germany RE giant Vonovia posted a record $7.3B FY loss (RT)

Morgan Stanley named Jeff McMillan as head of AI (CNBC)

UBS's rescue of Credit Suisse creates new risks for Switzerland (RT)

Citigroup is investigating a senior IPO banker over abuse/harassment (RT)

Foreign investment in Germany dropped to a decade low (RT)

JPMorgan hit with $350M fine for compliance failures in trading (WSJ)

Two-thirds of Goldman women partners have exited since 2018 (WSJ)

Bank of America made several leadership changes in capital markets (BBG)

NYCB sold $900M of loans and will integrate Signature Bank into its financial reporting (RT)

A Message From Litquidity Ventures

Announcing: Litquidity Venture Partners I and an opportunity to invest.

Last fall, I launched the Litquidity platform’s first venture fund focused on investing in Y Combinator-backed startups. We launched the fund to provide our investors with access to a curated pool of early-stage companies backed by the premier startup accelerator where we love the team, appreciate the business, and can add value through strategic alignment with the Litquidity platform.

We have already invested in the seed rounds of four exciting companies from YC’s Summer 2023 batch (Pointhound, Casca, Dili, and Coba) and are evaluating investments in the upcoming Winter 2024 batch.

As you likely know, YC has a reputation for spawning tech giants, including Stripe, Airbnb, Coinbase, Instacart, Doordash and Twitch. Since 2005, YC has funded over 4,000 startups with a combined market valuation of $600B (source: YC).

While rounds for companies coming out of YC are often highly competitive, we have won allocation to coveted deals, in part because founders appreciate the strategic advantages we can provide across go-to-market, PR and access to the Litquidity network.

If you’re interested in investing in our fund, please fill out our brief interest survey:

Deal Flow

M&A / Investments

Cisco Systems won unconditional EU approval for its $28B acquisition of cybersecurity firm Splunk (RT)

Cleveland-Cliffs may consider another bid for US Steel at a significantly lower price than Nippon Steels’ $14.9B bid if the Nippon-US Steel merger fails (BBG)

PE firm Genstar Capital is considering strategic options for Prometheus Group, including a stake sale that could value the industrial software company at ~$6B (BBG)

Swiss PE firm Partners Group is considering a sale of infrastructure assets worth a combined value of over $5B (BBG)

KKR launched a $3.1B takeover offer for German utility Encavis (RT)

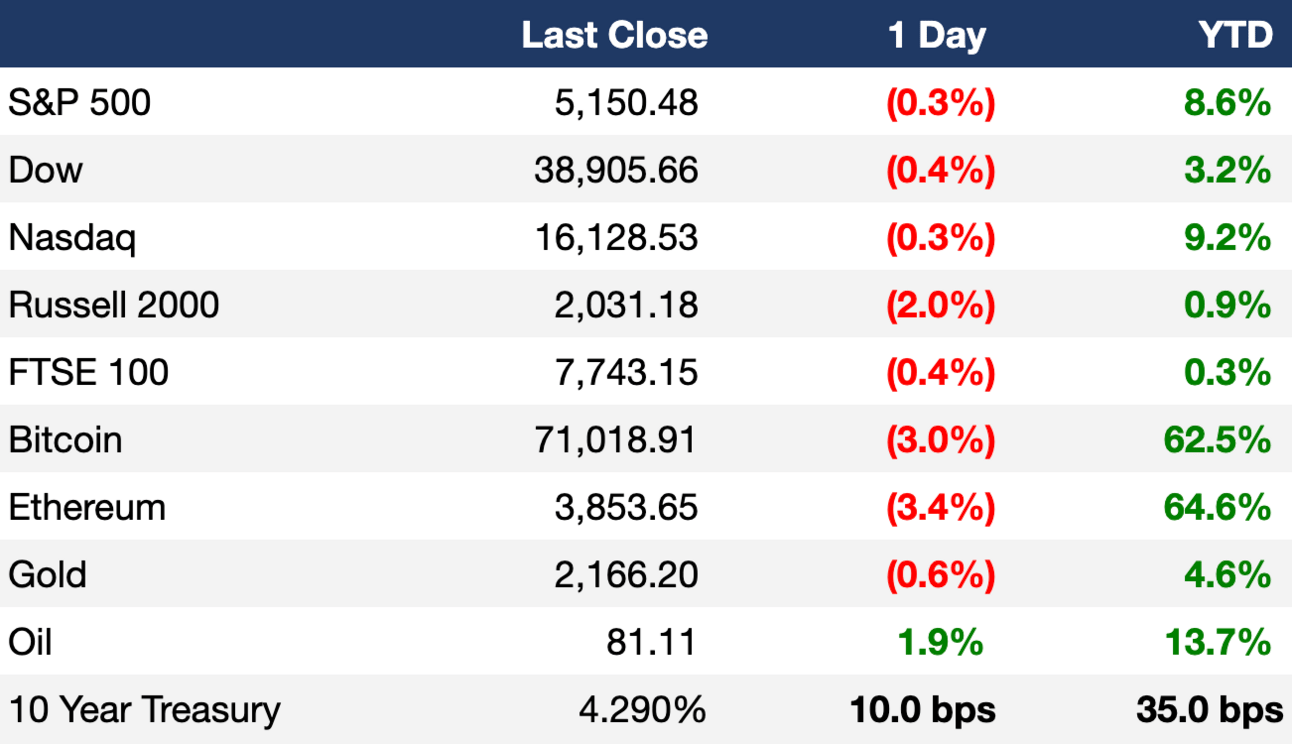

PE firm Platinum Equity is exploring a sale of Club Car that could value the golf cart maker at over $2B, including debt (RT)

BlackRock and Singapore's SWF GIC are exploring the sale of a network of gas pipeline assets in the UK that could fetch ~$2B (BBG)

Permira, the largest shareholder in Exclusive Networks, is considering teaming up with investors to take the $1.8B French cyber security specialist private (RT)

Drugmaker AstraZeneca will acquire endocrine diseases-focused firm Amolyt Pharma in a $1.05B cash deal (RT)

Tata Group is considering buying Walt Disney’s stake in Tata Play to give it full control of the subscription television broadcaster; a deal could value Tata Play at over $1B (BBG)

IT security firm Zscaler acquired Israeli artificial intelligence data startup Avalor in a $310M cash-and-stock deal (BBG)

Hilton will acquire Graduate Hotels from Adventurous Journeys Capital Partners for $210M in its first brand acquisition since 1999 (RT)

Apple acquired Canadian AI startup DarwinAI earlier this year (BBG)

BNP Paribas is considering a potential acquisition of Fosun International’s stake in Belgian insurer Ageas (BBG)

Ex-US Treasury Secretary Steven Mnuchin is targeting a purchase of TikTok from its Chinese parent company ByteDance (BBG)

RedBird IMI, a JV between RedBird Capital Partners and UAE-based International Media Investments, is considering a sale of The Telegraph after UK announced plans to ban foreign state ownership of UK media titles (BBG)

VC

inDrive, a mobility and urban services platform, raised a $150M extension from General Catalyst (FN)

Unstructured, a startup helping ingest and preprocess data for LLMs, raised a $40M Series B led by Menlo Ventures (BW)

AI-powered healthcare data management startup HiLabs raised a $39M Series B led by Denali Growth Partners and Eight Roads Ventures (PRN)

Asgard Therapeutics, a startup using in vivo cell reprogramming to treat cancer, raised a $32.6M Series A led by RV Invest and JJDC (PRN)

Cancer care and clinical research startup Pi Health raised a $30M Series A led by AlleyCorp and Obvious Ventures (BW)

Cloud-native data streaming service WarpStream raised a $20M round led by Greylock and Amplify Partners (TC)

Polyhedra Network, a startup building a zero-knowledge interoperability protocol, raised a $20M round at a $1B valuation led by Polychain Capital (PRN)

SquareDash, a payment advance platform for property insurance restoration, raised a $20M round led by FINTOP Capital (PRN)

BI platform Omni raised $20M in funding from Theory Ventures (BW)

ShopMy, a marketing platform for content creators to connect with brands, raised $18.5M in funding led by Inspired Capital (TC)

Open-source billing platform Lago raised $22M in a Series A led by FirstMark and a seed round led by SignalFire (TC)

Quintessent, a startup building optical connectivity solutions, raised an $11.5M seed round led by OUP (BW)

Blockchain-enabled Web3 fashion startup mmERCH raised a $6.4M seed round at a $25.7M valuation led by Liberty City Ventures (BW)

Carbonova, a startup turning greenhouse emissions into carbon materials, raised a $6M round led by Kolon Industries (FN)

Cybersecurity startup Redcoat AI raised a $4.2M round led by Pear VC (BW)

Data product management company Mindfuel raised a $4M seed round led by Project A Ventures (EU)

Metal 3D printing startup Fluent Metal raised a $3.2M round led by E15 (TC)

Eyris, a digital infrastructure platform providing cybersecurity, secure communications, and data protection, raised a $3M pre-seed round from Red Cell Partners (FN)

Naro, a startup helping companies create their own investment products, raised a $3M pre-seed round led by La Famiglia and Discovery Ventures (EU)

NFT marketplace Pallet Exchange raised a $2.5M round from Spartan Group, Symbolic Capital, Cypher Capital, and more (TC)

Identity verification and anti-money laundering solutions provider Youverify raised a $2.5M pre-Series A from Elm (TC)

IPO / Direct Listings / Issuances / Block Trades

US home builder Lennar is considering a $4B spinoff of its land holdings (BBG)

Cigarette maker Altria raised $2.4B through a sale of Anheuser-Busch shares, with Anheuser-Busch acquiring $200M in the sale (BBG)

Peruvian healthcare and insurance provider Auna is seeking to raise up to $450M at a $1.1B valuation in a US IPO (RT)

Chinese teahouse chain Sexy Tea picked Morgan Stanley and CICC for a potential 2024 Hong Kong IPO that may raise a few hundred million dollars (BBG)

Brazil’s biggest retailer Cia Brasileira de Distribuicao raised $142M through a share offering (BBG)

Debt

US will offer a record $2.3B loan to help Lithium Americas develop a Nevada lithium deposit (BBG)

Indian shadow banks Indiabulls Housing Finance and Manappuram Finance are in talks to raise $600M-$700M via bonds and notes (BBG)

MicroStrategy will sell $500M of convertible, unsecured senior notes to buy more Bitcoin (BBG)

Fundraising

Crypto Corner

Exec’s Picks

Financial Times released its special report on Europe’s leading startup hubs.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Featured Job Opening:

Client Coverage Associate - Financial Advisory Team (San Francisco): We are working with a top-tier, high-touch global investment firm known for its specialized approach to markets, alternative investments, and philanthropy.

The ideal candidate will have 4-7 years of experience working in the UHNW wealth management industry and have a passion for markets, problem solving, and client service.

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter