Together with

Good Morning,

The EU proposed new copyright laws for generative AI, PCE index growth slowed to 4.2% YoY in March, First Republic is working on a plan to prevent a government seizure, JPMorgan employees aren’t happy about Dimon’s RTO mandate, Clubhouse is cutting 50% of its employees, and J Pow got duped by a Zelenskiy prank.

Looking to overhaul your math, data, and computer science skills to be more competitive in the job market? Check out today's sponsor, Brilliant.

Let’s dive in.

Before The Bell

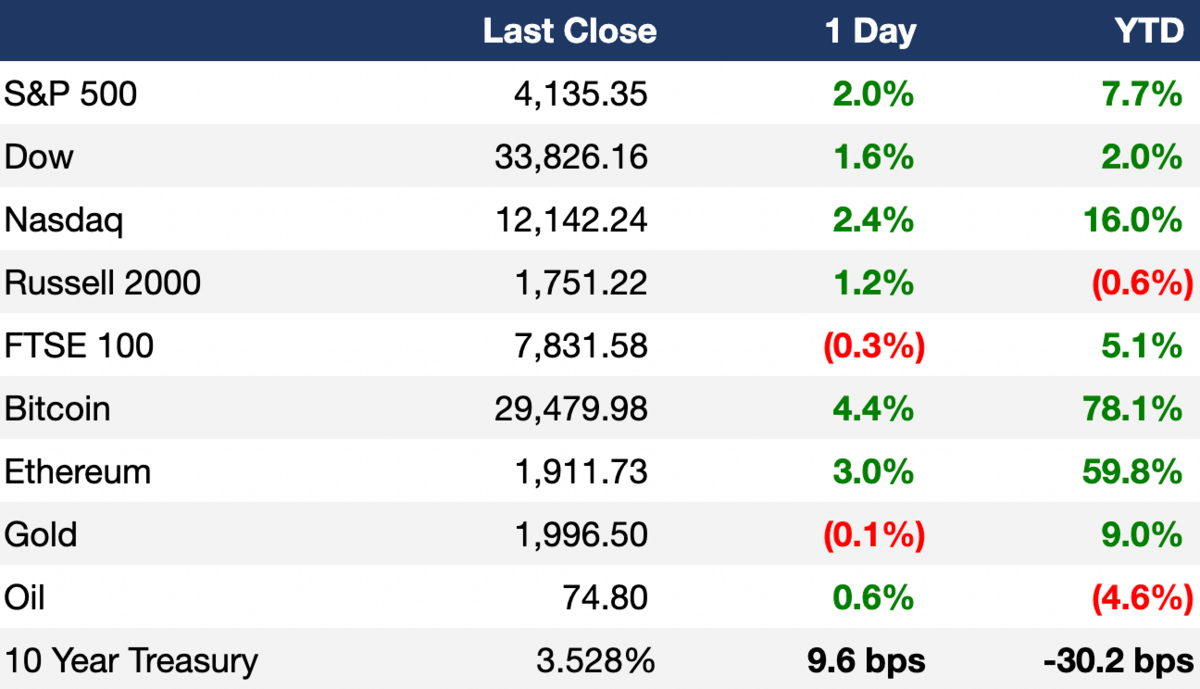

As of 4/27/2023 market close.

Markets

US stocks rocketed yesterday as strong tech earnings overshadowed concerns of slowing US economic growth

The S&P and the Dow posted their biggest daily percentage gains since Jan 6

The Nasdaq recorded its biggest single-day advance since March 16

Markets priced in a 90% chance of a 25 bps rate hike in May, followed by a pause

Earnings

Amazon beat on Q1 top and bottom lines bolstered by strength in its cloud and ads businesses, but suggested weakness in cloud growth could continue in the near term (CNBC)

Intel beat Q1 estimates despite reporting its largest loss ever amid a struggling PC market and forecast another loss for Q2 as it undergoes cost cuts while pursuing a pricey turnaround effort (WSJ)

Deutsche Bank posted an eleventh straight profit in Q1 on strength in its lending business and signs of successful completion of a sweeping cost cut/restructuring plan that began in 2019 (WSJ)

Barclays beat Q1 EPS estimates as strong performance in its US credit card business offset pressure on other profit engines, including IB (RT)

Nomura posted a three-quarters drop in Q1 profit on a second-straight loss in IB and trading (RT)

Capital One missed Q1 estimates as increased provisions for credit losses offset gains from higher interest income (RT)

Snap beat Q1 EPS estimates but missed on revenue as changes to its advertising platform hurt demand for ads; they also forecasted lower than expected Q2 revenue (CNBC)

Eli Lilly missed Q1 EPS estimates but beat on revenue and raised FY guidance on strength of its obesity/diabetes drug and expectations of a weak dollar ahead (CNBC)

What we're watching this week:

Today: Exxon, Chevron

Full calendar here

Headline Roundup

US GDP grew 1.1% annualized in Q1 (CNBC)

Fed favorite PCE index growth slowed to 4.2% YoY in March (CNBC)

EU wants its debt to be included in government bond indexes (RT)

EU proposed new copyright rules for generative AI (RT)

First Republic is working on a plan to prevent government seizure (FT)

Distressed US firms are turning to debt restructurings to avoid bankruptcy (FT)

Local German banks are financing LBOs to plug in gaps left by retreat of larger peers (BBG)

US banks are on alert over falling commercial real estate valuations (FT)

Investors defy Goldman, Wells Fargo and BofA in vote for climate plans (FT)

Sliding diesel prices signal warning for US economy (WSJ)

China ratchets up pressure on foreign firms (WSJ)

White House ready to help First Republic if needed (RT)

Moelis is doubling the number of MDs in tech IB team as it poaches from SVB (BBG)

JPMorgan employees gripe about Dimon's RTO mandate (RT)

Job switchers are seeing smaller pay bumps than last year (WSJ)

Meta merged its ad and business messaging product groups (TI)

Clubhouse cut over 50% of employees (AX)

Dropbox will cut 16% of staff (TC)

Walmart sued Capital One to end its credit-card partnership (BBG)

TIME will make all its content free (TM)

J Pow's call with Ukrainian President Zelenskiy was actually with pranksters (BBG)

Average Hamptons home price hit a record $3M (CNBC)

A Message From Brilliant

Master Math and Computer Science with Brilliant

Are you looking to build in-demand skills that can give you an edge in your career? Look no further than Brilliant.

Their visual, interactive lessons make complex concepts feel intuitive and easy to understand. You can get hands-on with everything from AI and neural networks to data analysis. Plus, their bite-size lessons are perfect for busy people who want to skill up on their own time.

Whether you're a professional looking to hone dormant skills or a lifelong learner interested in building new ones, Brilliant has something for everyone. Join over 10 million learners worldwide and get a 30-day free trial today.

Deal Flow

M&A / Investments

Swiss miner Glencore's $23B takeover bid for Canadian miner Teck Resources still stands, after Teck scrapped a restructuring plan that would have ended it (RT)

German exchange operator Deutsche Boerse will buy Danish financial software maker SimCorp for ~$4.3B in cash at a 39% premium to Wednesday’s closing price (BBG)

Canada's Suncor Energy will acquire France's TotalEnergies Canadian assets in a ~$4B all-cash deal (BBG)

Curium Pharma, a French maker of medical imaging supplies, and PE firm HIG Capital were shortlisted in the bidding of Cardinal Health’s nuclear medicine unit, which could fetch ~$2B (BBG)

Japanese brewer Kirin Holdings agreed to buy Australian vitamins maker Blackmores for $1.2B in cash (BBG)

Swiss miner Glencore will buy a 30% stake in Brazilian alumina refinery Alunorte and a 5% stake in bauxite producer Mineracao Rio do Norte from Norwegian aluminum producer Norsk Hydro for $700M (RT)

PE firm General Atlantic agreed to buy a majority stake in software vendor Tripleseat from Vista Equity valuing the firm at ~$500M (RT)

Indian conglomerate Godrej will buy the consumer goods business of Indian textile firm Raymond for $345M (RT)

Beauty and wellness platform Oddity acquired biotech startup Revela for $76M (CNBC)

Japanese bank SMFG will triple its stake in US investment bank Jefferies from 4.5% to ~15% (BBG)

PE firm Advent International is exploring a stake sale in industrial products firm Rubix Group to another PE firm to help fund a takeover of smaller Dutch rival Eriks (BBG)

A group of investors including French telecoms billionaire Xavier Niel and wealth manager Bruellan bought a 7.5% stake in Swiss asset manager GAM (FT)

Australian infrastructure asset manager Macquarie is close to acquiring a 50% stake in Italian utility Enel's Greek renewables unit (RT)

German engineering giant Bosch will acquire US chipmaker TSI Semiconductors (BBG)

Saudi Arabia’s PIF is in talks to buy a stake in low-cost carrier Flynas (BBG)

German aerospace firm Hensoldt is considering an acquisition of the defense electronics segment of Italian aerospace firm Leonardo (RT)

Elliott Investment Management built a stake in Germany’s Software AG, betting on the planned takeover by PE firm Silver Lake or a counter bid (BBG)

Carbon-fiber road bike maker BMC Switzerland is considering a potential sale (BBG)

Mercedes-Benz sold its shares in its Russian subsidiaries to exit the country (RT)

VC

Vector database startup Pinecone raised a $100M Series B at a $750M valuation led by a16z (TC)

Foresight Diagnostics, a developer of ultrasensitive cancer detection tests, raised a $58.75M Series B led by Foresite Capital (PRN)

Antiva Biosciences, a biopharmaceutical startup developing topical therapeutics for papillomavirus infection, raised a $53M Series E led by MPM-BioImpact Capital (FN)

Energy Dome, a CO2 battery startup, raised a $44M Series B led by Eni Next and Neva SGR (TC)

Therini Bio, a biotech company aiming to develop fibrin-targeted therapies, raised a $36M Series A led by the Dementia Discovery Fund, MRL Ventures Fund, and others (BW)

Pattern Bioscience, a startup developing an infectious disease diagnostic platform, raised a $28.7M Series C led by Illumina Ventures and Omnimed Capital (BW)

Practice Better, a practice management platform for health and wellness professionals, raised $27M in growth funding led by Five Elms Capital (PRN)

TympaHealth, a provider of digitized assessments of ear and hearing health, raised a $23M Series A led by Octopus Ventures (FN)

Legal AI startup Harvey raised a $21M Series A led by Sequoia Capital (RT)

Biomica, a biotech company focused on developing microbiome-based therapeutics, raised a $20M round from Shanghai Healthcare Capital and Evogene (PRN)

DeepHow, an AI company that turns technical knowhow into how-to training videos, raised a $14M Series A led by Owl Ventures (FN)

m3ter, a pricing operations platform, raised a $14M Series A led by Notion Capital (FN)

Reverion, a biogas power plant startup, raised a $9.4M seed round led by UVC Partners, Green Generation Fund, Extantia Capital, and others (FN)

Ctrl, a platform allowing revenue teams to augment their CRM and customer workflows with automation / AI, raised $9M in funding led by LocalGlobe and Earlybird (FN)

Tembo, a London-based digital-mortgage platform, raised $6.3M in funding led by Love Ventures, the McPike Family Office, Aviva Ventures, and Ascension Ventures (FN)

Kluster, a revenue strategy platform, raised a $5M Series A led by Foresight (FN)

Imagia, a startup developing silicon-based optical metalenses, raised a $4.5M seed round led by Gates Frontier (BW)

Secro, a digital bill-of-lading platform, raised a $3.6M seed round led by Augment Ventures (PRN)

Cyber defense platform Bastion Technologies raised a $2.8M seed round from Frst, Global Founders Capital, Kima Ventures, and more (FN)

AIxMed, a smart cytology company, raised a $2.8M SAFE round from existing investors (PRN)

AI commerce management platform Verteego raised a $2.8M seed round from Archipel Ventures, Supercapital, Holnest, and more (FN)

Luca, a startup aiming to optimize retail prices at scale, raised a $2.5M seed round led by Menlo Ventures (TC)

Sinecure, a talent discovery platform that leverages AI to deliver qualified and diverse candidates, raised a $2.5M round led by Golden Section (FN)

Lasso MD, an all-in-one marketing solution for dental and medspa practices, received a $2M investment from Trestle Partners (BW)

Car Space, a luxury coworking space and private social club, raised a $1.5M seed round led by HyperNFT (PRN)

IPO / Direct Listings / Issuances / Block Trades

Chinese state-owned chemicals giant Sinochem is exploring ways to salvage a planned Shanghai IPO of its agrochemical unit Syngenta, which originally intended to raise $9.4B (BBG)

Indian pharma/healthcare products company Mankind raised $529M at a ~$5.3B valuation in India's largest IPO this year (FT)

Fitness startup Forme priced its US IPO at the top of a range to raise $12M at a $115M valuation (BBG)

German chemicals group BASF is looking to list or sell its energy business Wintershall Dea (RT)

SPAC

Training software company iLearningEngines will merge with Arrowroot Acquisition Corp. in a $1.4B deal (RT)

Debt

India's Housing Development Finance Corp. (HDFC) is planning an up to ~$1.8B bond issue as part of a ~$7B financing plan (ET)

Italy’s UniCredit will redeem a $1.38B AT1 perpetual bond and won’t sell similar debt in the near future (RT)

Adani Group is in talks with banks including Mitsubishi UFJ and Standard Chartered to raise $800M for new green energy projects (BBG)

Embattled property developer China Evergrande Group extended the deadline for receiving an incentive for its debt restructuring proposal (RT)

Bankruptcy / Restructuring

Ex-industrial chemical maker Whittaker, Clark & Daniels filed for Chapter 11 bankruptcy protection after asbestos/cancer lawsuits (BBG)

Fundraising

PE firm Alignment Growth Management raised $360M for its first fund (BBG)

PE firm Corsair Capital raised $340M for a targeted $1.25B sixth flagship fund (WSJ)

VC Atento Capital raised $100M for a new fund to invest $20M in pre-seed rounds and $80M in early-stage firms and FOFs (FRT)

UK-based VC Sturgeon Capital raised $35M for its Sturgeon Emerging Opportunities II fund to invest in early-stage startups in emerging Central/South Asian markets (except India) (TC)

Crypto Corner

Coinbase offered a fiery response to SEC’s legal threats (CNBC)

SEC chair Gensler released another video dig at crypto industry (CD)

FBI searched the home of top FTX exec Ryan Salame (NYT)

A fugitive CEO was ordered to pay a record $3.4B fine in fraud case involving Bitcoin (BBG)

One SEC commissioner says SEC must ease off crypto (WIR)

Exec’s Picks

Jack Raines wrote an interesting piece on the risks that declining birth rates pose to developed countries.

Dan Runcie (founder of Trapital) sat down with Logan Bartlett to discuss the business of music.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

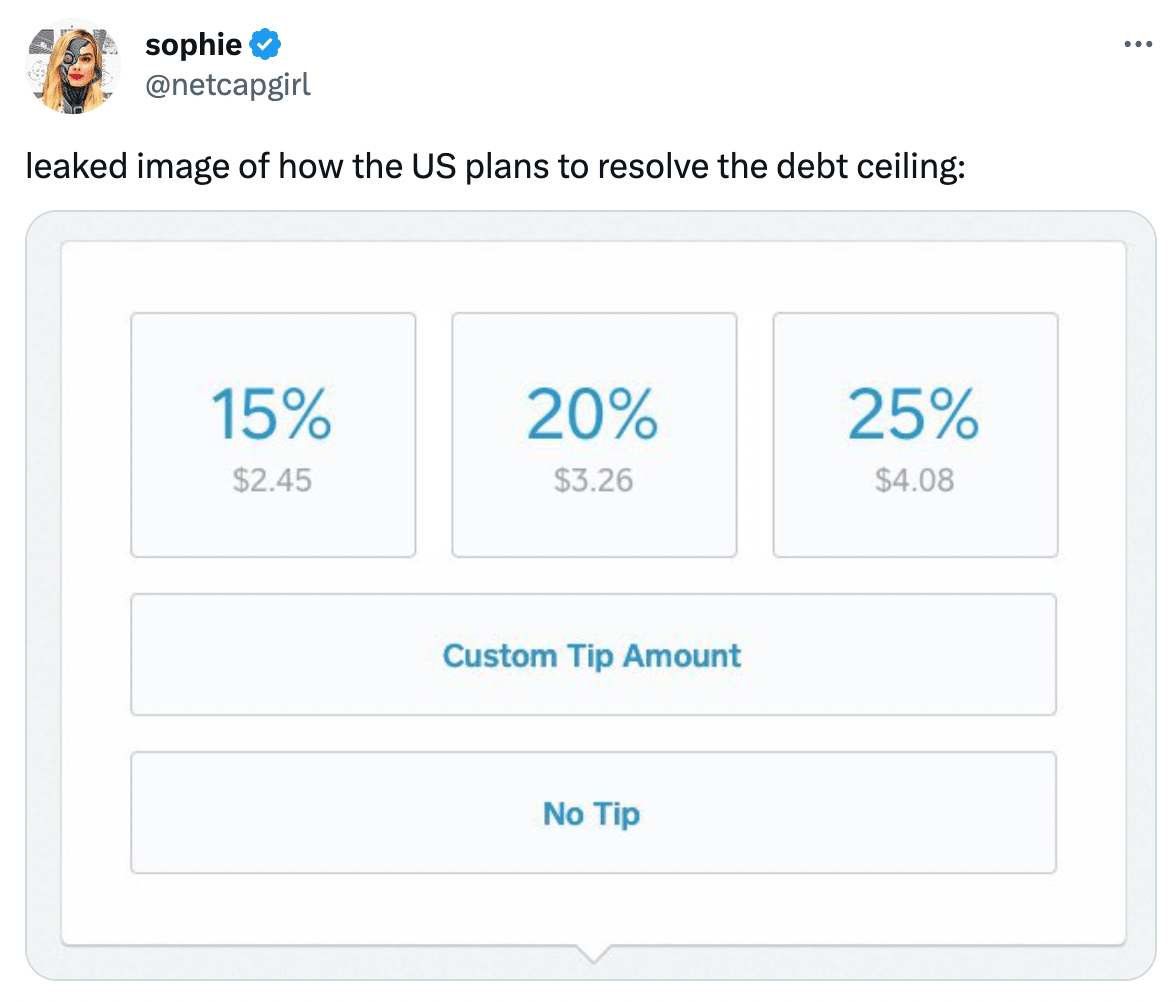

Meme Cleanser

Want to chat social media growth, newsletter strategy, angel investing, Wall Street careers, or something else? Book a call with Litquidity here.

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.