Good Morning,

Global stocks continued to trade near record highs in the penultimate trading day of 2025.

Let's dive in.

Before The Bell

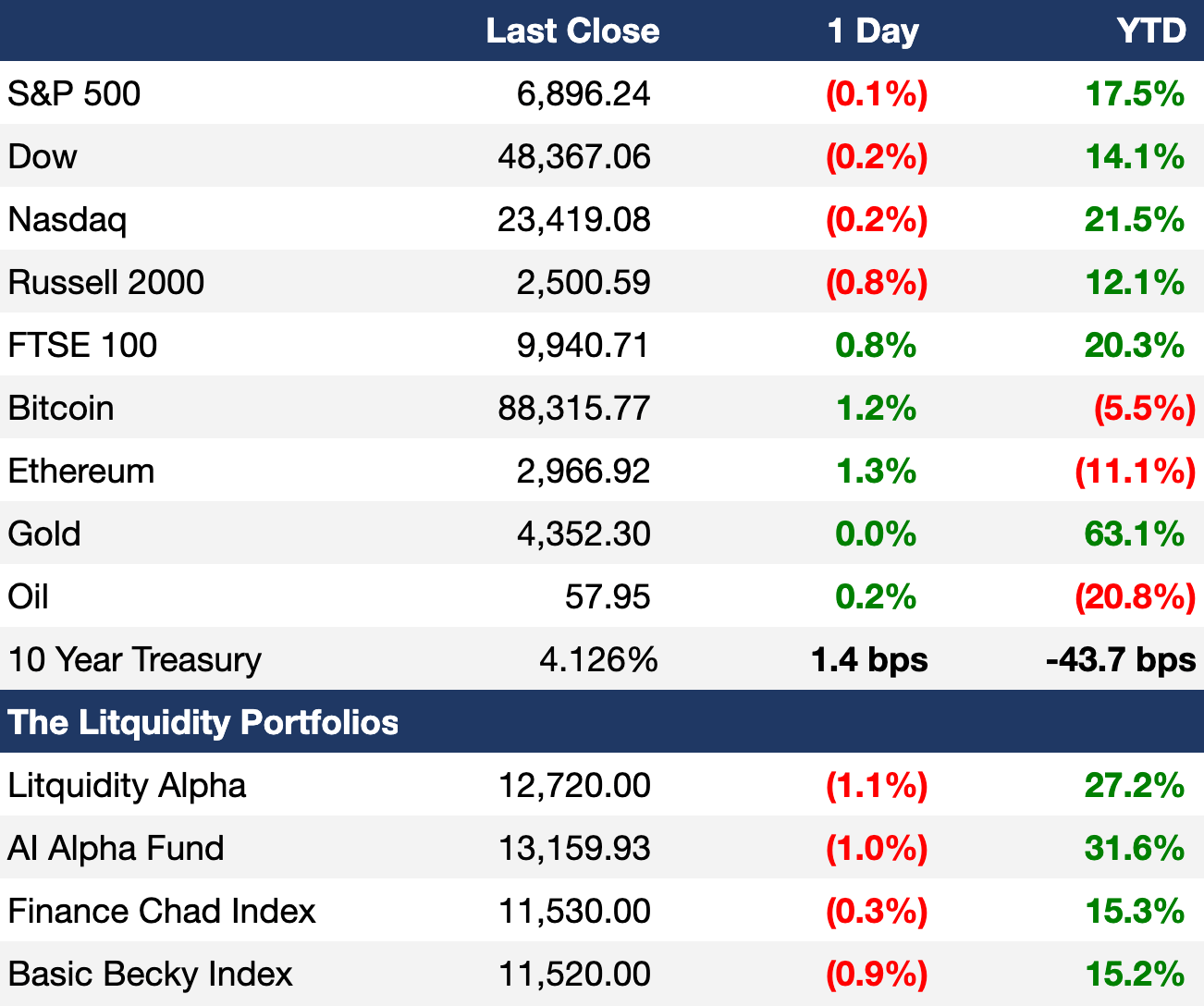

As of 12/30/2025 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks finished near ATHs in a low-volume penultimate trading day of 2025

Europe's Stoxx 600 hit a fresh ATH to gain 16% in its best year since 2021

Banks sub-index gained 65% for its best year since 1997

UK's FTSE 100 hit a fresh ATH to cap its best year since 2009 and top-five year ever

Japan's TOPIX index gained 22% this year as Japan stocks finally recovered all losses from the 1991 bubble burst

MSCI China index gained 28% in its best year since 2017

Platinum hit an ATH high in its best month in forty years after EU reversed its 2035 combustion engine ban

The metal gained 146% this year

Nickel hit a nine-month high as Indonesia cut supply

Copper rose for an eighth-straight day to an ATH for its longest win streak since 2017

Dollar dropped 9.5% in its worst year since 2017

Earnings

Full calendar here

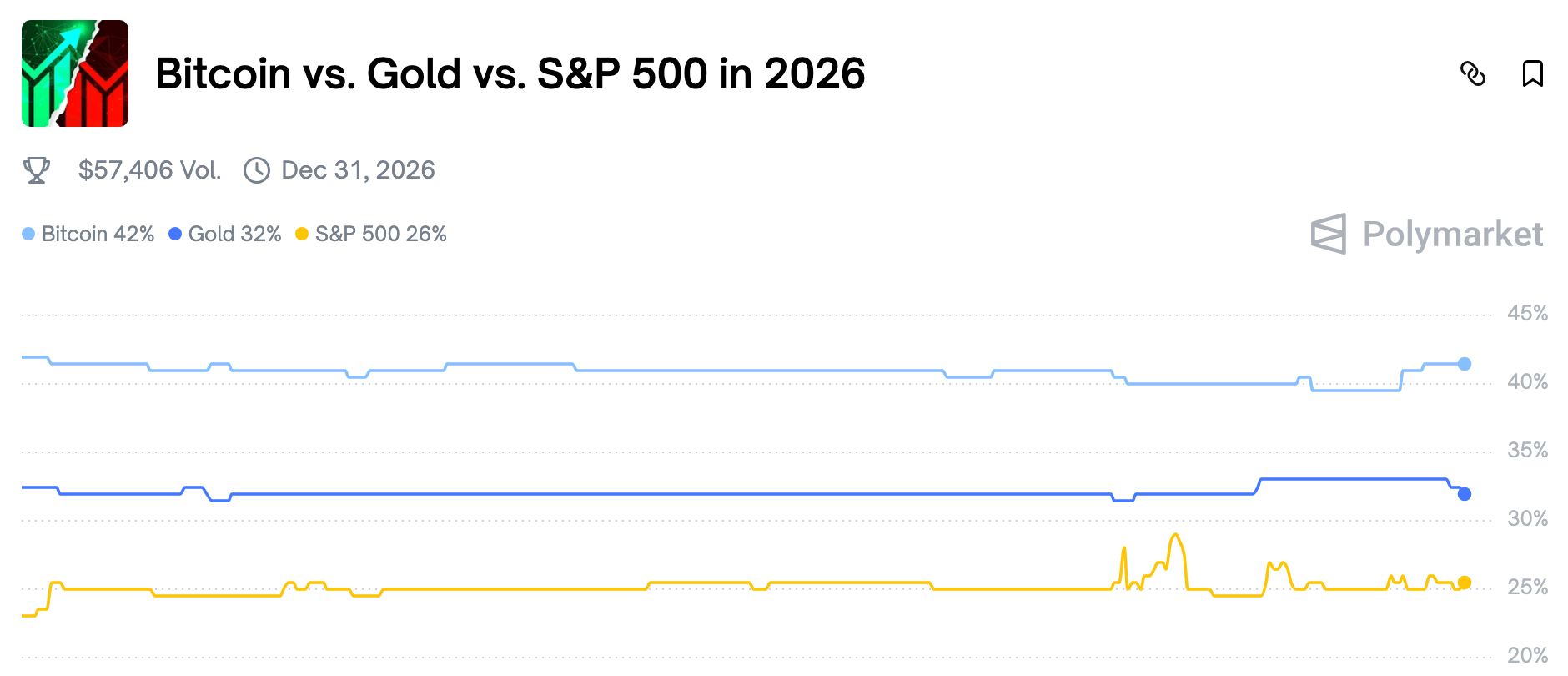

Prediction Markets

FWIW: Gold has been outperforming stocks since the start of this century.

Trade your prediction on markets for 2026 on Polymarket.

Headline Roundup

Fed minutes show officials in tight split over December rate cut (CNBC)

One-fifth of PE deals this year were firms selling assets to themselves (FT)

IPOs that minted billionaires this year are down 23% (BBG)

AI chip makers are expecting an even bigger 2026 (WSJ)

AI has fueled $70B in data center M&A talks this year (BBG)

US stocks defy 'Sell America' warnings to end 2025 at ATHs (WSJ)

Global stocks beat US this year as investors diversify (FT)

Tariffs set US materials sector up for best earnings in five years (BBG)

Activist investors are circling US banks (WSJ)

Hopes dim for Covid-era VC funds (WSJ)

China's reawakening boosts Asia M&A optimism for 2026 (BBG)

Wealth management is one of this year's hottest deal drivers (WSJ)

China's PBOC delivered fewest rate cuts since 2021 (BBG)

Asia's wealthy turn to Switzerland to park assets (FT)

Top US law firms handed associates $300k+ bonuses (FT)

CME raised margins on precious metal futures for a second time (BBG)

Deal Flow

M&A / Investments

Warner Bros. Discovery plans to reject Paramount Skydance's amended $108.4B hostile bid in favor of Netflix's, despite Oracle-founder Larry Ellison personally offering an equity backstop

Nvidia is in advanced talks to buy Israel-based AI startup AI21 Labs for $3B

Meta agreed to acquire Chinese-led agentic AI startup Manus for over $2B

Citigroup's board approved Renaissance Capital's acquisition of its Russian unit AO Citibank to that will see a $1.2B pre-tax loss

Australia's Macquarie will invest $330M of equity into UK utility Southern Water

VC

SoftBank completed its $40B investment in OpenAI, marking one of the largest private funding rounds ever

French rad-hard FPGA developer NanoXplore raised a $23.5M round from MBDA and Bpifrance's Defence Innovation Fund

Get real-time updates on any startup, VC, or sector on Fundable.

IPO / Direct Listings / Issuances / Block Trades

Six Chinese firms including InSilico Medicine, Digital Twin Technology, USAS Building System, Shanghai Forest Cabin Cosmetics, Xunce Technology, and OneRobotics gained an average 40% in their trading debuts after raising a combined $900M in Hong Kong IPOs

Four Chinese tech firms including MiniMax, Knowledge Atlas Technology, Iluvatar CoreX Semiconductor, and Edge Medical are seeking to raise a combined $1.5B-$2B in Hong Kong IPOs next week

UK renewable energy startup Octopus Energy will spinoff its utility management platform Kraken Technologies at an $8.65B valuation

Bankruptcy / Restructuring / Distressed

Hedge fund Arini Capital is contesting the inclusion of Irish packaging firm Ardagh's senior unsecured bonds as deliverable obligations in a CDS auction that will determine default protection payouts

Crypto Sum Snapshot

David Beckham-backed biotech Prenetics paused Bitcoin treasury plans

Koreans cling to Ether hoarder BitMine despite 80% drop

Netflix announced a crypto-themed comedy film

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

WSJ did a profile on Ralf Etienne: the BofA IB associate seeking to represent Haiti in the Winter Paralympics.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.