Together with

Good Morning,

Apollo will delay associate recruiting after JPMorgan banned analysts from recruiting too early, Moelis' incoming CEO pledged to push hazing out of banking culture, Musk regrets attacking Trump on Twitter, and private market funds underperformed the S&P 500 over all time horizons for the first time in 25 years.

With summer in full effect, we're bringing back the annual Litquidity Classic on June 28th in NYC. It's going to be an epic weekend of padel, music, food, and fun as Wall Street folks compete for a shot at glory. Join us if you're around!

Procrastinating on taxes after filing your extension? Check out OLarry, a personalized tax service for professionals with emerging wealth.

Let's dive in.

Before The Bell

As of 6/11/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks closed lower as traders digested fresh inflation data US-China trade talks progress

S&P snapped a three-day win streak

Canada's TSX index hit a new ATH

US 2Y yield fell below 4%

Oil climbed to a two-month high

Egg prices fell to lowest since December

Dollar hit its lowest since 2023

Earnings

Oracle beat Q4 earnings and revenue estimates on strong demand in cloud infrastructure and cloud services (CNBC)

Chewy beat Q1 earnings and revenue estimates and reaffirmed FY guidance on rising active customers and net sales per user, and minimal tariff impacts (MW)

Victoria's Secret beat Q1 earnings and revenue estimates despite a 1% comparable sales decline, but issued a weak Q2 profit outlook dealing a setback to its ongoing turnaround under a freshman CEO (BBG)

What we're watching this week:

Today: Adobe

Full calendar here

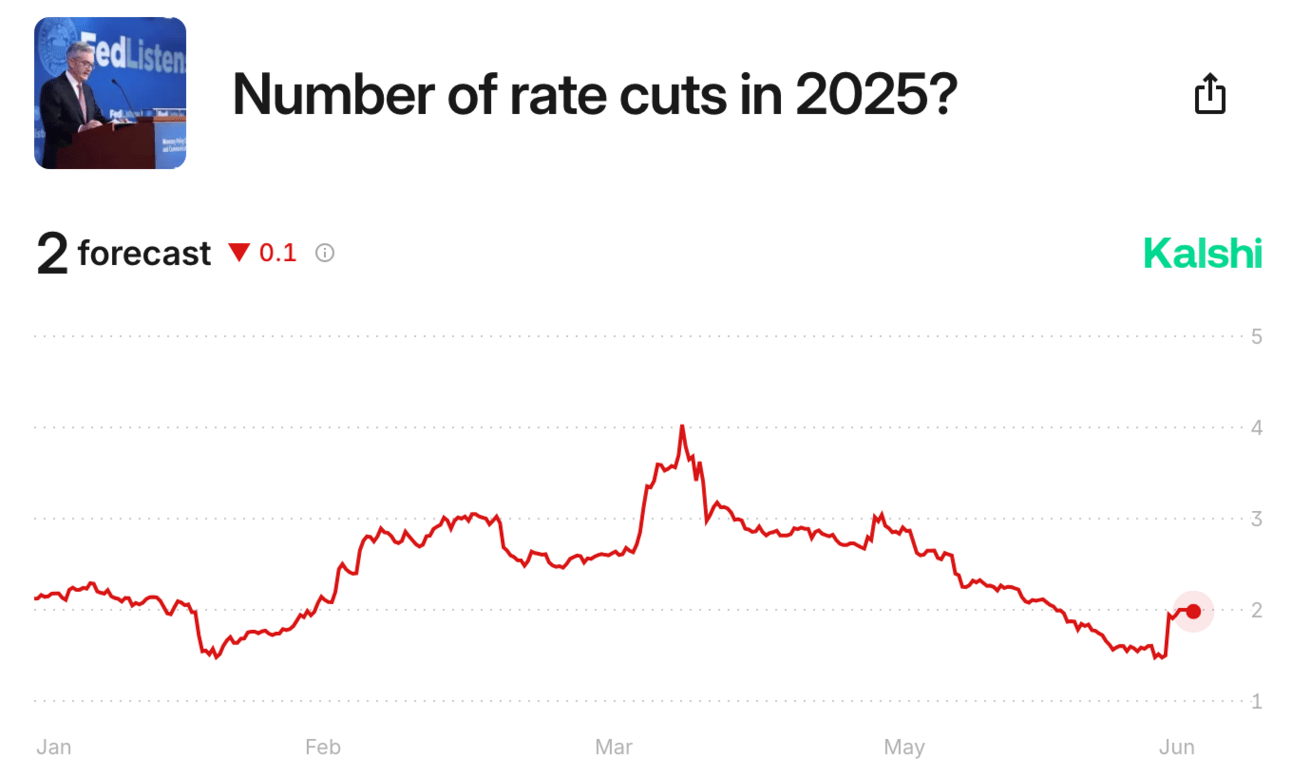

Prediction Markets

Inflation came in lower-than-expected despite all the tariff turmoil, causing traders to raise odds of a September Fed rate cut from 57% to 68%.

Headline Roundup

Apollo will delay associate recruiting after Jamie Dimon's comments (BBG)

Moelis' new CEO pledged to push 'hazing' out of banking culture (BBG)

US inflation rose to 2.4% YoY (CNBC)

China will temporarily supply rare earths to US as trade talks progress (WSJ)

EU will likely be at 'very end' of US trade deals (BBG)

Private market funds lag US stocks over short and long term (FT)

Gold overtook euro as global reserve asset (FT)

'Bond King' Jeff Gundlach says 'reckoning is coming' for US debt (BBG)

AI and lender battles are seen as the biggest risks in private credit (BBG)

Investors are moving money from US stocks to EM and Europe assets (RT)

Hong Kong funds plan to cut Treasuries if US loses AAA rating (BBG)

Japan bonds are a tactical buy for PIMCO after yields hit record (BBG)

BofA expects thirteenth-straight quarter of S&T growth but dip in IB (BBG)

Kirkland & Ellis' top RX lawyer says creditor pacts are 'anticompetitive' (BBG)

Europe banks have spent over $1B on axing senior staff (FT)

Fitch sees worsening outlook for North American firms (BBG)

Warner Bros. Discovery was downgraded to junk on split-up plans (RT)

Nvidia CEO says quantum computing is reaching an 'inflection point' (CNBC)

Pop Mart's Labubu doll fetched $150k at China auction (BBG)

Musk 'regrets' Trump attacks after call with Trump (WSJ)

A Message from OLarry

If your current tax support only shows up in April, you're already behind.

OLarry delivers proactive, year-round strategy for founders, fund managers, and sophisticated investors. There is no generic advice, no paper-pushing, just a real plan custom—made to your carry, equity, and liquidity.

Built for complexity: QSBS, K-1s, multi-entity, and international

Unlimited access to US-based pros—no hourly fees

AI-backed insights designed to reduce friction and maximize returns

You operate at a high level—your tax team should too.

ExecSum readers get 10% off their first year with code Execsum.

Deal Flow

M&A / Investments

Italian lender UniCredit ruled out a bid for $37B-listed German peer Commerzbank at current valuations

UniCredit will withdraw its takeover bid for $15B-listed smaller peer Banco BPM if Italy doesn’t clarify deal conditions

Owners of French towers company TDF Infrastructure, including Brookfield, chose are planning a sale at an ~$11B valuation, including debt

Bain Capital, KKR, and Lone Star Funds advanced to the second bidding round for Japan's Sapporo Holdings' real estate unit, which could fetch a $2.8B valuation

KKR and Stonepeak raised their bid for UK healthcare landlord Assura to $2.3B, a 39.2% premium, in an ongoing takeover battle

Apollo and Irth Capital offer to take-private Papa John's for $2B

Golf course operator Arcis Golf is now valued at $2B, including debt, after acquiring three Atlanta-area golf clubs from rival Invited to become the second-largest US golf facility operator

PE owners Durational Capital and TJC are exploring a sale of fried chicken chain Bojangles at an over $1.5B valuation

Canadian shipbuilder Chantier Davie agreed to acquire assets of Texas-based Gulf Copper & Manufacturing for over $1B

UK real estate manager Long Harbour proposed an $852M bid for UK's PRS REIT at a 3.3% discount

Japan's Mizuho Financial is close to acquiring a majority stake in Indian investment bank Avendus Capital at an ~$800M valuation, including debt

Japan's Mitsubishi Estate will acquire a majority stake in European real estate PE firm Patron Capital and will commit $686M equity to support new strategies

European PE firm Oakley Capital acquired a majority stake in UK strategic advisory firm G3 at a $340M valuation

DoorDash agreed to acquire ad tech firm Symbiosys for $175M

Payments fintech Stripe agreed to acquire crypto wallet provider Privy, following its recent acquisition of stablecoin firm Bridge

Food processing giant General Mills is considering selling its 250 Häagen-Dazs ice cream stores in China

French banking group BPCE emerged as the leading bidder to acquire Portuguese lender Novo Banco from Lone Star Funds, pulling ahead of rival CaixaBank

Starbucks received significant interest in a potential stake sale of its China business, which includes 8k stores

NFL team Chicago Bears are exploring a sale of late Andrew McKenna Sr.'s minority stake to PE

VC

Data-security startup Cyera raised a $540M Series E at a $6B valuation led by Georgian, Greenoaks and Lightspeed Venture Partners

Wealthbox, a CRM platform for financial advisors, received a $200M strategic investment from Sixth Street Growth

AI-powered productivity platform Glean raised a $150M Series F at a $7.2B valuation led by Wellington Management

German nuclear fusion startup Proxima Fusion raised a $148M Series A led by Balderton Capital and Cherry Ventures

Protein splicing company SpliceBio raised a $135M Series B led by EQT Life Sciences and Sanofi Ventures

Project management Enterprise software startup Linear raised an $82M Series C at a $1.25B valuation led by Accel

Coco Robotics, a robotics startup building last-mile delivery robots, raised an $80M round from Sam Altman, Max Altman, Pelion Venture Partners, and more

Product analytics platform PostHog raised a $70M Series D at a $920M valuation led by Stripe

Spanish business fintech Abacum raised a $57M Series B led by Scale Venture Partners

Fermat, an AI-native commerce platform, raised a $45M Series B led by VMG Partners

Nuclear fuel startup Standard Nuclear raised a $42M round led by Decisive Point

Tebi, a startup building an all-in-one financial OS for hospitality businesses, raised a $34M round led by CapitalG

Farsight, an AI startup automating workflows at financial institutions, raised a $16M Series A led by SignalFire

Remarcable, a procurement platform for the construction industry, raised a $15M Series A led by Insight Partners

Space computer and autonomous spacecraft startup Aethero raised an $8.4M seed round led by Kindred Ventures

OpenTrade, an institutional-grade infrastructure platform, raised $7M in strategic funding led by Notion Capital and Mercury Fund

Arlequin AI, a French startup building a sovereign European data operations platform, raised a $5M seed round led by Vsquared Ventures

AI-powered building permit platform Shovels raised a $5M seed round led by Base10 Partners

IPO / Direct Listings / Issuances / Block Trades

Defense tech firm Voyager Technologies surged 139% in its trading debut after raising $383M in an upsized IPO, giving the firm a $3.9B market cap

Prudential's Indian asset management JV is nearing an IPO filing that could raise up to $1.2B

No-fee banking fintech Chime raised $864M at an $11.6B valuation in an IPO priced above a marketed range

SoftBank-backed Indian e-commerce platform Meesho plans to confidentially file for an India IPO aiming to raise $700M-$800M

India's oldest depository National Securities Depository plans to launch a $400M IPO in July

Biotech MediLink Therapeutics hired CICC, JPMorgan, and Morgan Stanley for a planned Hong Kong IPO that could raise over $100M

Insomnia Cookies investors Verlinvest and Mistral Equity Partners acquired Krispy Kreme's remaining 34% stake in the cookie chain for $75M

Peter Thiel-backed crypto exchange Bullish Global filed for a US IPO

Indian conglomerate Adani Group plans to list its Adani Airport Holdings unit within two years

Debt

Bitcoin miner IREN will raise $450M in a convertible debt offering

Bankruptcy / Restructuring / Distressed

KKR-owned Japanese auto parts supplier Marelli has filed for Chapter 11 bankruptcy, with lenders, who are set to take over, committing $1.1B in DIP financing

Fundraising / Secondaries

Ares plans to raise over $2B for a new Asia special situations fund to boost Asia credit investments

VC Geodesic Capital launched a $250M fund targeting tech startups that strengthen the US-Japan alliance

Investment firm Nuveen raised $196M from Canada's CPPIB for its flagship commercial property credit fund in Australia,

European family office Yaday is launching a $115M fund targeting high-potential tech startups driving transformative change

High-frequency trading firm Tower Research Capital plans to launch a fund for external investors

Crypto Sum Snapshot

New generation of crypto ETFs edge closer to reality after SEC scrutiny

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

Get AI Certified from Columbia Business School Exec Ed

Learn how leaders from BlackRock, Morgan Stanley, and more are using AI in their work—and get step-by-step guidance from Columbia Business School faculty on how to apply it to your role. Get the program brochure to learn more.

Save $300 with code LITQUIDITY + $200 for early enrollment by June 16!

Joachim Klement shared an insightful piece on how companies react to tariffs.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.