Together with

Good morning,

Elon Musk continues to do Elon things. His followers voted to have him sell 10% of his stake in Tesla and he epically trolled Senator Ron Wyden, NYU marketing professor Scott Galloway, and others on twitter.

If you missed it on Friday, re-circulating the results of our Buy Side compensation survey. Now get out there and negotiate your all-in comp and tell em Litquidity sent you.

Special shout to today's sponsor, Capital Allocators. Ted Seides has a great podcast worth checking out.

Let's dive in.

Before The Bell

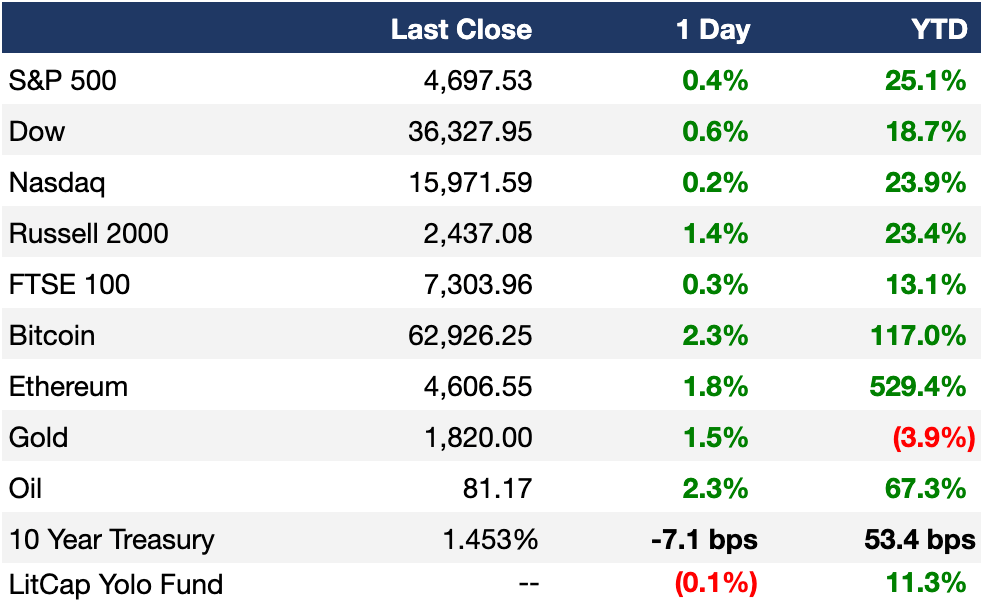

As of 11/5/21

Markets

A promising October jobs report pushed stocks to rally and close last week at ATHs, with the S&P notching its seventh straight positive day

Nonfarm payrolls crushed consensus estimates with the economy adding 531K jobs (compared to the 450K economists had expected)

Both the better-than-expected jobs report and Pfizer’s Covid pill announcement pushed reopening stocks higher

Investors will continue to digest this news and last week’s Fed announcement on tapering

PPI and CPI inflation readings will be released on Tuesday and Wednesday, respectively

Earnings

What we’re watching this week:

Mon: PayPal, AMC

Tues: Palantir, Coinbase

Weds: Affirm, Beyond Meat, Disney

Fri: AstraZeneca

Full calendar here

Headline Roundup

Pfizer says its Covid pill cuts risk of hospitalization or death by 89% (CNBC)

House passes $1T bipartisan infrastructure bill, sends to Biden for signature (CNBC)

Musk pledges to sell 10% of his Tesla stock if Twitter voters agree (and they did) (WSJ)

Federal appeals court temporarily blocks Biden admin vaccine rules for private employers (WSJ)

NYC Mayor-elect Adams says crypto should be taught in schools (BBG)

Stonepeak Partners is in talks to raise debut real estate fund (BBG)

Rise of the robots speeds up in pandemic with US labor scarce (BBG)

Crushed by pandemic workloads, Wall Street’s youngest want more money and better conditions. But mostly more money (NYM)

A Message From Capital Allocators

What do Chamath, the Mooch, A-Rod, and the CIO of CalSTRS all have in common?

All guests on the Capital Allocators podcast – a critically acclaimed podcast for institutional investors. Host Ted Seides interviews a who’s who of asset owners, money managers, and thought leaders in the space. It’s an MBA-lecture series in podcast format (no student loans required).

Subscribe to the podcast on Apple, Spotify, or wherever you listen to podcasts. Also, check out the Capital Allocators monthly newsletter – it’s infrequent enough that it won’t distract from the Exec Sum and gives in-depth commentary on the institutional investing space.

Join the Capital Allocators community

Deal Flow

M&A

Sydney Aviation Alliance (SAA), comprised of Australian infrastructure investors and US-based Global Infrastructure Partners, is set to acquire Sydney Airport after it agreed to accept the ~$17.5B takeover bid (RT)

Advent International and Permira are in talks to take cybersecurity software maker McAfee private in a potential $10B+ deal (BBG)

French conglomerate Bouygues agreed to buy energy giant Engie’s services unit Equans for $8.2B (BBG)

Brookfield Asset Management is in talks to buy a 19.9% stake in utility company FirstEnergy’s transmission businesses for $2.4B (BBG)

Carlyle offered to buy Australian data services company Link for ~$2.1B (BBG)

British asset manager Abrdn is in advanced talks to buy online investment service Interactive Investor for ~$2B (RT)

Stanmore Resources is set to acquire a controlling interest in two coal mines owned by BHP, the world’s biggest miner by market cap, for up to $1.35B (WSJ)

Polish e-commerce platform Allegro agreed to buy Czech peer Mall Group and logistics company WE|DO for $1B (BBG)

Autolus Therapeutics, a biotech company developing a new therapy to treat a serious form of leukemia, is set to raise as much as $250M from Blackstone to fund the final stages of development; the company had a market cap of $404M as of Friday's close (WSJ)

Lions Gate Entertainment is considering a spinoff of its media networks business that includes the Starz channel (BBG)

Chinese state firm Bauhinia Culture is in talks to offer to buy Hong Kong’s South China Morning Post (BBG)

Luxury clothing department store Selfridges & Co. is in talks with potential investors about splitting off its e-commerce business while also considering a potential sale of the department store group (BBG)

Venture Capital

Shared electric micromobility startup Lime raised $523M in convertible debt and term loan (TC)

Chinese beverage maker Genki Forest is nearing a deal to raise $500M at a $15B valuation in a round including Temasek and Warburg Pincus (BBG)

Clean energy startup Helion raised a $500M Series E led by Sam Altman, the CEO of OpenAI and former president of Y Combinator; the round also includes an additional $1.7B of commitments tied to “specific milestones” (TC)

Autonomous driving solution provider Momenta raised a $500M Series C extension from China’s state-owned SAIC Motor, GM, Toyota, Mercedes, Bosch, and more (TC)

H2O.ai, a startup building an open-source framework for businesses to build AI services, raised a $100M Series E at a $1.7B valuation led by Commonwealth Bank of Australia (TC)

BrightChamps, an Indian edtech startup, emerged from stealth and raised $51M at a ~$500M valuation led by Premji Invest (TC)

Meat substitute startup AKUA raised a $3.2M seed round led by Vibrant Ventures (TC)

DTC beauty platform Thirteen Lune raised a $3M seed round led by Fearless Fund (TC)

IPO / Direct Listings / Issuances / Block Trades

SPAC

FiscalNote Holdings, a DC-based provider of services used to track government policy and owner of political publication CQ Roll Call, is in talks to merge with Duddell Street Acquisition Corp. in a ~$1.3B deal (WSJ)

Exec's Picks

Don’t Miss This “Early Amazon”: The Motley Fool has been recommending stocks for a few decades now, and their average stock pick has returned a mind-boggling 637%*... that’s more than 4x the return of the S&P 500. In addition to recommending investors get in early on Amazon, analysts at The Motley Fool have correctly predicted the success of many of the market’s biggest winners – stocks like Netflix, Nvidia, Marvel, and more. Get the Free Report.

*Returns as of 10/15/21. Past performance is not a guarantee of future results.

As we said announced last week, we've partnered up with Ansarada to give away two tickets to the S**er B*wl. Details here.

Yellow Label has incredibly comfy and stylish "runner hoodies" that are ideal for a workout or that "just worked out / on my way to workout" athleisure look. Check it out here.

We've got 15% off site-wide at the Litquidity merch store from now through Sunday. Just use code "thx15" at checkout.

The Hiring Block (Job Board)

If you're looking to break into finance, lateral, or move out, check out our job board, where we curate highly relevant roles for you. We've got 80+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're looking to hire candidates and want to post a job, all you have to do is hit "+ Post a Job" on the top right of the job board.