Together with

Good Morning,

Trump denied personal involvement in DOJ's investigation into J Pow, PE LPs offloaded a record amount of fund stakes last year, Apple partnered with Google's Gemini to power Siri, CD&R is looking to raise one of the biggest PE funds ever, and Paramount sued Warner Bros and launched a proxy fight to thwart the Netflix deal.

Week two of 2026: New Year, New You energy is in full swing. Too bad the IRS still wants to talk about 2025. If you've outgrown 'tax prep' and standard filing check out OLarry, a proactive, year-round tax advisory service. All for a flat price.

Let's dive in.

Before The Bell

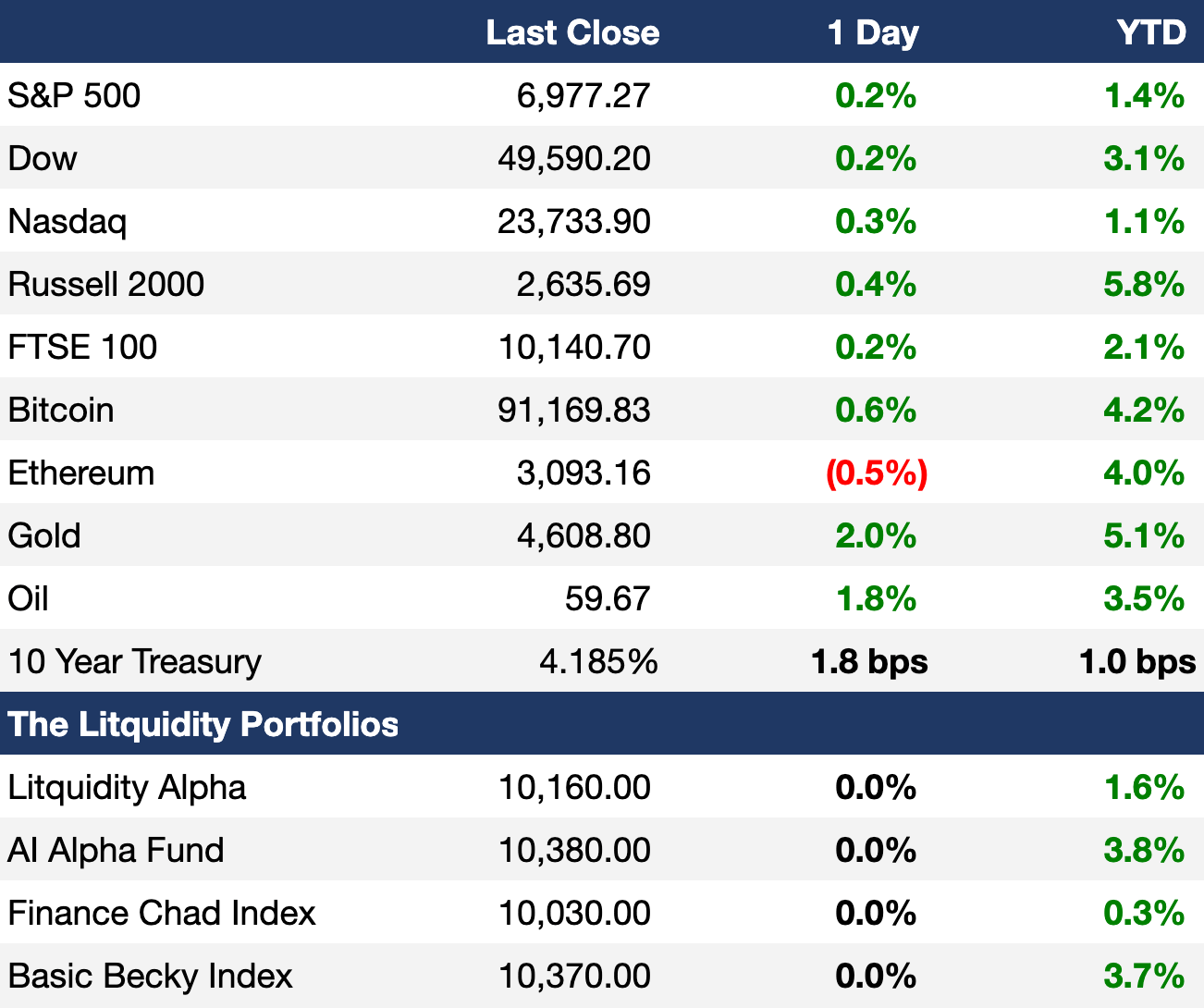

As of 1/12/2026 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks reversed losses to close slightly higher as traders digested the DOJ's investigation into J Pow

S&P and Dow hit fresh ATHs

Small-caps Russell 2000 hit a new ATH

Russell 2000 outperformed S&P for a seventh-straight day for its best relative win streak since 2019

Japan's Nikkei 225 surged 4% to a new ATH on local political optimism

China stock turnover jumped to a record $516B

Lebanese bonds rallied to their highest since Covid

Oil hit a seven-week high after Trump threatened to tariff Iran's partners

Dollar fell 0.3% in its worst day since Christmas

Yuan-dollar hedging costs hit a three-year low as yuan optimism grows

Earnings

What we're watching this week:

Today: JPMorgan, Delta Airlines

Wednesday: Wells Fargo, Citigroup, Bank of America, Infosys

Thursday: TSMC, BlackRock, Goldman Sachs, Morgan Stanley

Friday: State Street, PNC

Full calendar here

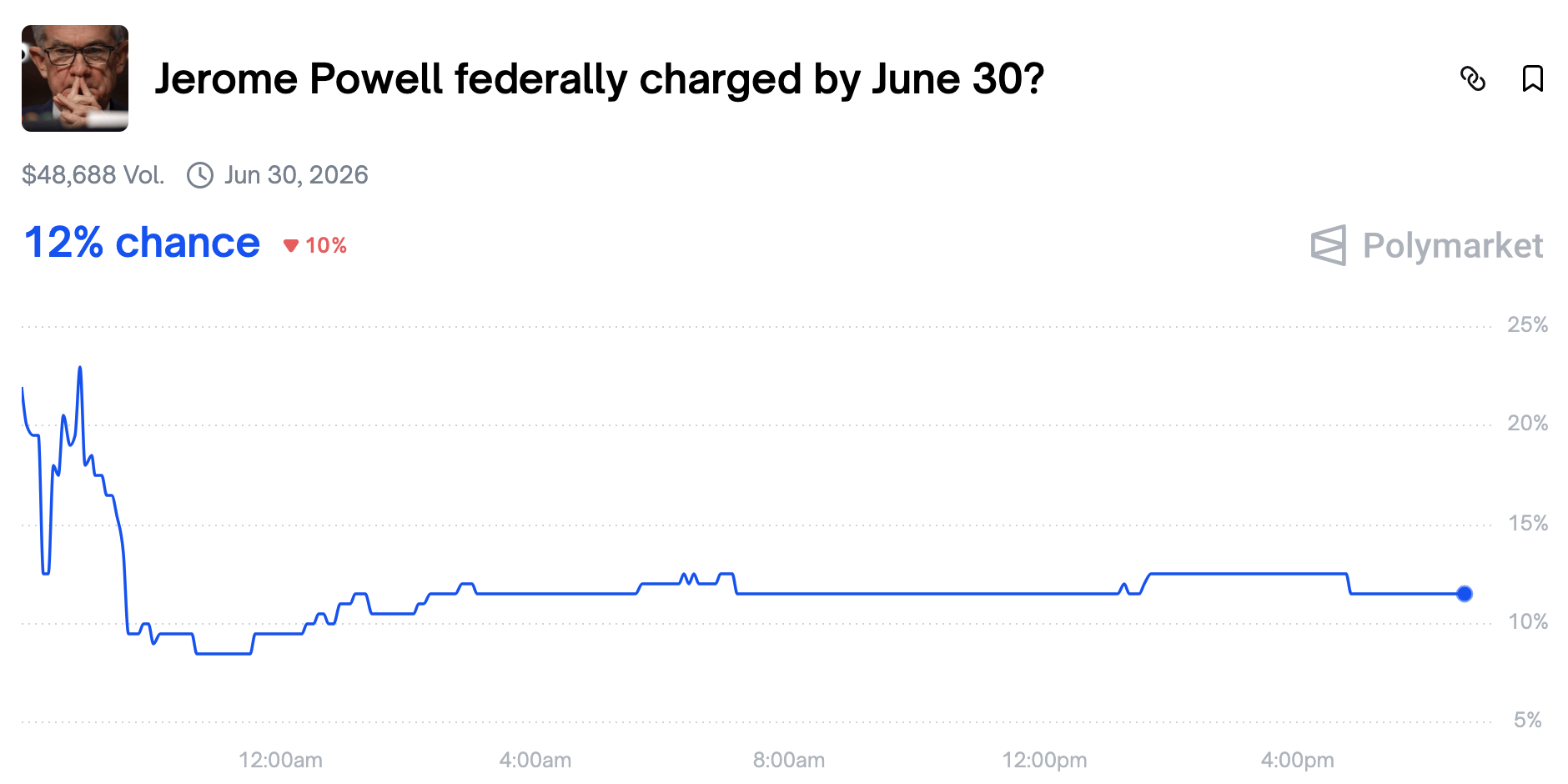

Prediction Markets

Big 'nothing ever happens' sentiment surrounding J Pow's investigation

Trade your prediction on the Fed's independence on Polymarket

Headline Roundup

DeepSeek founder Wenfeng's quant hedge fund gained 57% in 2025 (BBG)

DOJ attack on J Pow revives 'Sell America' trade (BBG)

Trump denied involvement in DOJ's Fed subpoenas (NBC)

Senate threatened to thwart Trump's Fed nominee on J Pow probe (BBG)

Banks gear up for bond sales as Trump turns up pressure (BBG)

PE LPs offloaded a record $110B in fund stakes last year (FT)

Wall Street is set to report its best IB year since Covid (FT)

Hedge fund-lite trades are back from the dead with $153B (BBG)

Global AI race shows Asia leading as stocks start 2026 with a bang (BBG)

Data centers will need over $3T in investments through 2030 (BBG)

US regulators say credit risk for big bank loans is 'moderate' (BBG)

Middle East VC funding hit a record high (BBG)

Surging stock listings turbocharge India IPO fees to a record (BBG)

Alphabet became fourth company to hit a $4T market cap (RT)

Apple partnered with Google's Gemini to power Siri (CNBC)

Meta named ex-Goldman partner and Trump advisor Dina McCormick as president (RT)

A Message from OLarry

You shouldn't be the one chasing down your CPA or doing your own research.

OLarry was created with this in mind. OLarry provides Private Client tax advisory for individuals and businesses with complex needs all for a flat fee.

Go beyond traditional tax filing with:

Unlimited Strategy: Unlimited year round service, whether you want to meet 4 times or 52 times per year.

Zero Cross-Selling: Real strategy without the worry about being sold annuities, insurance or other financial products

Proven Track Record: Trusted by thousands of individuals and businesses

Pass-Through Complexity: K-1's, Multi-State Residence, Trusts/Estates, and Corporate Entities (S-Corp, C-Corp, Partnerships) and more

"Easily the best and most strategic tax convos I've had." -Raj, CEO

Book a free consultation today and get 10% off with code Execsum.

Deal Flow

M&A / Investments

Paramount Skydance launched a proxy fight to nominate directors to Warner Bros. Discovery's board to thwart its $83B merger with Netflix in favor of Paramount's $108B offer; Paramount also sued WBD

Italian lender UniCredit discussed buying a stake in $28B-listed peer BMPS after its recent pursuit of Banco BPM failed

Golden State Group, the parent company of NBA team Golden State Warriors, is selling a 5% stake at an $11B valuation

Activist hedge fund Engaged Capital will launch a proxy fight to install four directors at $3.4B-listed financial software maker BlackLine to push for a sale

Apollo, Temasek, PGIM, and ICONIQ will more than double their investment in home building products company QXO to $3B to support M&A

India's Kotak Mahindra Bank and Blackstone-backed Federal Bank offered to acquire $2.5B of Deutsche Bank's India retail and wealth managements assets

Patrick Drahi, the owner of telecoms group Altice, relaunched a sale of his 50% stake in German broadband network OXG Glasfaser at a $2.3B valuation

Blackstone is seeking to sell UK rental home business Leaf Living for over $1.3B

NBA is pitching investors on a new European league, targeting team valuations of up to $1B

Jacobs Capital is exploring a $585M sale of Swiss outdoor gear maker Mammut

UK medical products maker Smith & Nephew agreed to acquire US-based Integrity Orthopaedics in a $450M deal

B.Grimm Power, the energy unit of Thai conglomerate B.Grimm, acquired a 25% stake in New England Reliable Hydropower for $230M

US and Australia's Pinnacle Asset Management will invest $450M in critical metals producer ATALCO

CVC-owned communications and consulting firm Teneo will acquire Nordic M&A and strategy boutique Clarity Partners and PwC's business restructuring services unit in New Zealand

PGIM, the investment management business of Prudential Financial, is considering selling its loss-making India asset management unit

VC

French defense-tech startup Harmattan AI raised a $200M Series B at a $1.4B valuation led by Dassault Aviation

Liquid-cooling startup Accelsius raised a $65M Series B led by Johnson Controls

Stablecoin infrastructure startup VelaFi raised a $20M Series B led by XVC and Ikuyo

African autonomous defense startup Terra Industries raised an $11.75M round led by 8VC

Polar Light Technologies, a Swedish MicroLED display startup, raised a $6M round led by J2L Holding

Get real-time updates on any startup, VC, or sector on Fundable.

IPOs / Direct Listings / Issuances / Block Trades

Crypto wallet firm BitGo is seeking to raise $200M at a $1.96B valuation in an IPO; the firm was last valued at $1.75B in 2023

China-listed OmniVision Integrated Circuits rose 16% after raising $616M in a Hong Kong listing

China-listed GigaDevice Semiconductor rose 40% after raising $600M in a Hong Kong listing

Chinese brain-computer startup BrainCo filed for a Hong Kong IPO that could raise several hundred million dollars

Korean industrial robotics maker HD Hyundai Robotics hired banks for a Korea IPO

Chinese EV maker Xpeng hired banks for a Hong Kong IPO of its flying car unit

Debt

Italian administrators overseeing Europe's largest steelworks have sued former owner ArcelorMittal for $8B in damages

TD Bank Group is gauging investor demand for a SRT tied to a portfolio of $5B of corporate loans

Argentina secured financing from an unnamed multilateral institution to repay $2.5B to US from an FX swap agreement

Goldman Sachs, JPMorgan, and UBS are leading a $1.05B debt financing deal backing Chinese PE firm HSG's $2.9B acquisition of Italian luxury sneaker maker Golden Goose from UK PE firm Permira

JPMorgan is lending telecoms firm Altice USA an additional $1.1B to refinance a $1B ABF from Goldman Sachs and TPG before an early repayment penalty kicks in

UK lender Standard Chartered raised $1.1B in a debut green bond sale

India's state-owned Power Finance Corp. plans to sell a $555M retail bond

Chilean chemicals giant SQM is seeking to sell $500M in dollar-denominated notes

Spanish lender BBVA is seeking to sell $444M of soured mortgages

Indonesia sold $2.7B of dollar bonds in Asia's first such deal this year

Bankruptcy / Restructuring / Distressed

PJT Partners urged struggling Chinese developer Vanke's $1.3B dollar bondholders to call a default using cross-default provisions

Car rental firm Hertz lost its SCOTUS appeal to block $320M in make-whole premiums and interest owed to bondholders from its Covid bankruptcy

Struggling Brazilian petrochemical giant Braskem paid interest due Monday on its dollar bonds

Trucking firm STG Logistics filed for Chapter 11 bankruptcy and raised $150M in DIP financing with plans to slash interest burdens and reduce debt by 91%, amid contentious debt deal litigation

Fundraising / Secondaries

PE firm CD&R is seeking to raise $26B for its thirteenth flagship PE fund

European MM PE firm Apheon raised $1.5B for its sixth midcap buyout fund

Consumer-focused investment firm Bansk raised $1.45B for its second fund

Rosberg Ventures, the VC firm of 2016 F1 world champion Nico Rosberg, raised $100M for its third fund

Crypto Sum Snapshot

Strategy acquired $1.25B in Bitcoin in its largest purchase since July

Trump-linked World Liberty Financial launched World Liberty Markets, a $3.4B crypto lending platform

Standard Chartered will set up a prime brokerage for crypto trading within its SC Ventures unit

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Bloomberg published a profile on Tre Upshaw, the man seeking to arbitrage out insider trading on Polymarket.

Joachim Klement wrote a short but insightful piece on choosing between concentrated and diversified funds.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.