Together with

Happy Friday,

Tech stocks had rough earnings yesterday, investors were lovin' McDonald's results, USD GDP contracted, Twitter canceled its earnings call, the FDA advanced its ban on menthol cigarettes, and Robinhood's stock price keeps on dropping.

Our exclusive podcast sponsor, CoinFLEX.US, launched in the US yesterday and will be HQ'd in Miami, FL (shoutout Mayor Suarez with the get). They've got the first interest-bearing stablecoin in the US and zero-fee spot trading. Check em out here.

Let's dive in.

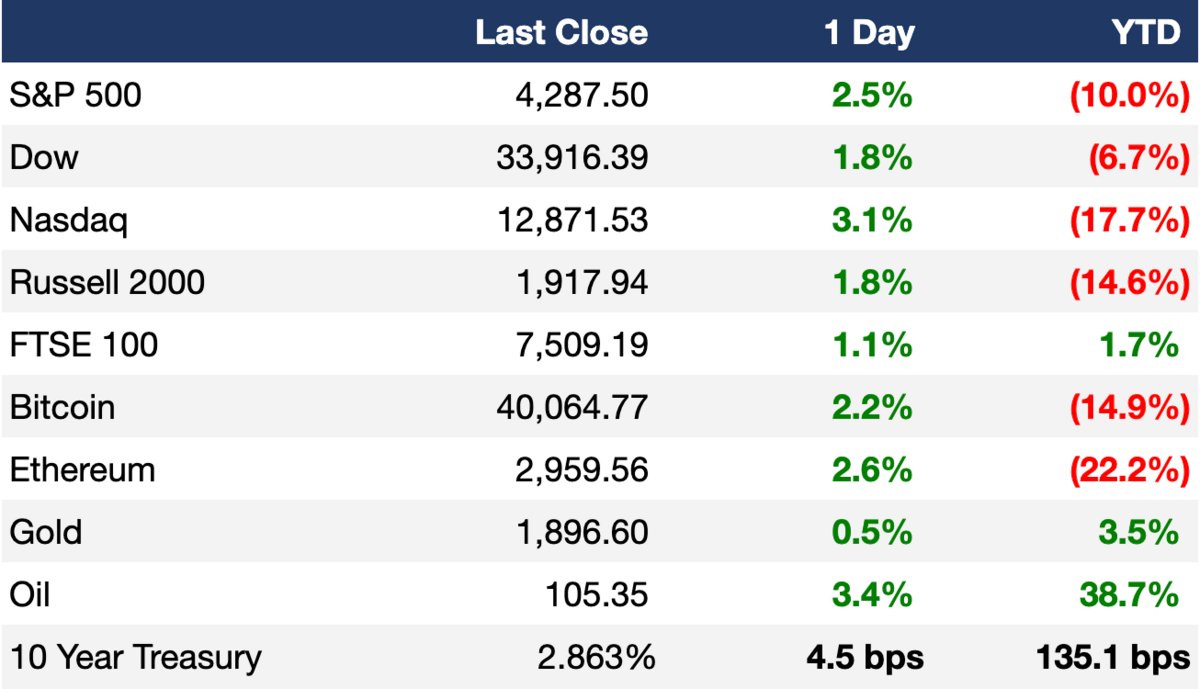

Before The Bell

As of 4/28/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

Markets rebounded yesterday with all three major averages closing in the green following a strong earnings report from Meta

US initial jobless claims fell by 5K to 180K, in line with estimates, which for now shows no indications of a slowing economy

Earnings

Twitter, in what could be one of its last reports as a public company, beat EPS and mDAU (monetizable daily active users) estimates but missed on revenue while also removing its FY guidance and outlook (CNBC)

Southwest posted better-than-expected EPS and revenue results as less Covid-restrictions and a rebound in travel demand continue to help revive airlines (YHOO)

Mastercard beat on top- and bottom-line estimates with a resurgence in travel driving increased spending volumes (MW)

McDonald’s reported better-than-expected Q1 results driven by price hikes in the US and strong international growth helping offset rising commodity and labor costs (CNBC)

Apple shares initially jumped AH before turning negative yesterday after posting better-than-expected Q1 results and 9% YoY growth; their board of directors authorized $90B in share buybacks (CNBC)

Amazon shares fell up to 10% AH after the company reported weaker-than-expected EPS results, a disappointing revenue forecast, and its slowest growth rate since 2001 (CNBC)

Robinhood shares were down 8% AH following a wider-than-expected loss and shrinking revenue in Q1 along with fewer monthly active users YoY (CNBC)

What we’re watching today: ExxonMobil, Chevron

Full calendar here

Headline Roundup

US economy unexpectedly shrinks for the first time since 2020 (BBG)

Biden seeks $33B more for Ukraine, girding for a longer war (BBG)

Moderna asks FDA to clear its Covid-19 vaccine for young children (WSJ)

Twitter cancels earnings call, citing pending $44B Musk deal (DC)

Exxon gets subpoena from California over plastics pollution rise (BBG)

FDA advances ban on menthol cigarettes (WSJ)

SEC sues Vale over dam disclosures before 2019 disaster (WSJ)

CoinFLEX launches in the US, with America's first zero-fee crypto exchange and an interest-bearing stablecoin (PRN)

A Message From Here

A New Way to Invest in Travel

Airbnbs are expensive. You want to go to the beach, but it’s $300 a night for a 1BR apartment. The slope-side ski cabin in Colorado is $800 a night.

Now imagine how much money you could make if you invested in these properties instead.

Thanks to Here, you can! And you can get started for as little as $100.

Here is the first platform to offer fractionalized ownership of premiere vacation properties around the country. You no longer need hundreds of thousands of dollars to enter the real estate market either, Here has lowered the barriers to entry for the everyday investor.

The best part? Here handles everything from property inspections to upkeep, and you get a pro-rata claim on cash flow.

Deal Flow

M&A / Investments

Sembcorp Marine, a Singaporean oil rig builder, agreed to merge with Keppel’s larger offshore and marine unit in a $6.3B deal (RT)

KKR agreed to launch a tender offer for Japanese conglomerate Hitachi’s logistics arm in a $5.2B deal (RT)

Brazil oil company Petro Rio agreed to buy the Albacora Leste oilfield from Petrobras for $2.2B (RT)

EQT is exploring a sale of laundry machine operator Wash Multifamily Laundry Systems which could be worth ~$2B (BBG)

KKR agreed to buy French solar and biomass power producer Albioma in a $1.7B deal (BBG)

G/O Media, the owner of Gizmodo and Deadspin, agreed to buy business site Quartz (NYT)

Vietnamese consumer conglomerate Masan Group agreed to buy a 25% stake in Vietnamese fintech startup Trusting Social at a $65M valuation (BBG)

VC

Securonix, a startup building a next-gen SIEM and XDR, raised a $1B+ round led by Vista Equity Partners (BW)

Berlin-based mobile tax filing app Taxfix raised a $220M Series D at a $1B valuation led by Teachers Venture Growth (TC)

Tractor Beverage Company raised $60M in funding led by Keurig Dr. Pepper (PRN)

Marketing software startup Movable Ink raised a $55M Series D at a $1.3B valuation led by Silver Lake and Waterman (TC)

Kelonia Therapeutics, a biotech company focused on vivo gene delivery, raised a $50M Series A led by Alta Partners and Horizons Ventures (BW)

Beauty brand Madison Reed raised $33M in a round led by Sandbridge Capital with participation from rapper Jay-Z’s Marcy Venture Partners (WSJ)

Lemon Perfect, a hydrating lemon water brand, raised a $31M Series A led by artist Beyonce (BW)

Home energy efficiency startup Sealed raised a $29.5M Series B led by Fifth Wall Climate Tech (BW)

Smallstep Labs, a startup working on automated certificate management, raised $26M in funding led by Boldstart Ventures (BW)

Exafunction, a deep learning infrastructure company, raised a $25M Series A led by Greenoaks (BW)

Kard, a rewards platform for card issuers and brands, raised a $23M Series A led by Tiger Global (BW)

Enterprise device management startup Fleet raised a $20M Series A at a $100M+ valuation led by CRV (TC)

CommandBar, a startup improving the user experience for SaaS apps, raised a $19M Series A led by Insight Partners and Itai Tsiddon (PRN)

Symmetrical.ai, a payroll tech startup, raised an $18.5M round led by Target Global (TC)

Digital knowledge-sharing platform Arbolus raised a $15M Series A led by Element Ventures (PRN)

Deepset, a startup building an open-source NLP framework, raised a $14M Series A led by GV (TC)

Proptech startup Sumutasu raised $10M in funding: an $8.2M Series B co-led by World Innovation Lab and Mobile Internet Capital and $1.6M in debt led by Japan Finance Corporation (TC)

Drone & robot startup Aerones raised a $9M seed round led by Future Positive Capital and Change Ventures (TC)

IPO / Direct Listings / Issuances / Block Trades

SCG Chemicals is seeking to raise up to $3B in what could be Thailand’s largest-ever IPO (BBG)

Contact lens maker Bausch + Lomb has filed to raise up to $840M in a US IPO (BBG)

Dubai-based waste-disposal services provider Averda is exploring an IPO in Saudi Arabia or the UAE after failed SPAC discussions (BBG)

Norway’s Norges Bank Investment Management, Singapore’s GIC, and Abu Dhabi Investment Authority agreed to be anchor investors in India’s Life Insurance Corporation IPO (BBG)

Fundraising

PE firm Leonard Green is nearing an $18.3B close across two funds (BBG)

Crypto Corner

Exec's Picks

Yesterday, Morgan Housel wrote a great piece on the difference between being "rich" and "wealthy". Check out his latest here.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you.

If you're a company looking to post a job here or on our board, you can do so by clicking this link.

Meme Cleanser

Catch the latest episode of our Big Swinging Decks podcast, presented by CoinFLEX.US, on Spotify, Apple Music, and YouTube 🤝