Together with

Good Morning,

Stocks were down again last week on a hot inflation report, consumer spending was flat in September, Lizz Truss ditched her corporate tax cut plan, Chinese president Xi Jinping is expected to be confirmed for a third term, Instacart cut its valuation again, Nikola founder Trevor Milton was found guilty of fraud, North Korea is testing more missiles than ever before, and Tennessee beat Bama in an instant classic to cap off a wild weekend of college football.

Tired of managing multiple crypto wallets across different chains? Check out today's sponsor, Brave.

Let's dive in.

Before The Bell

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

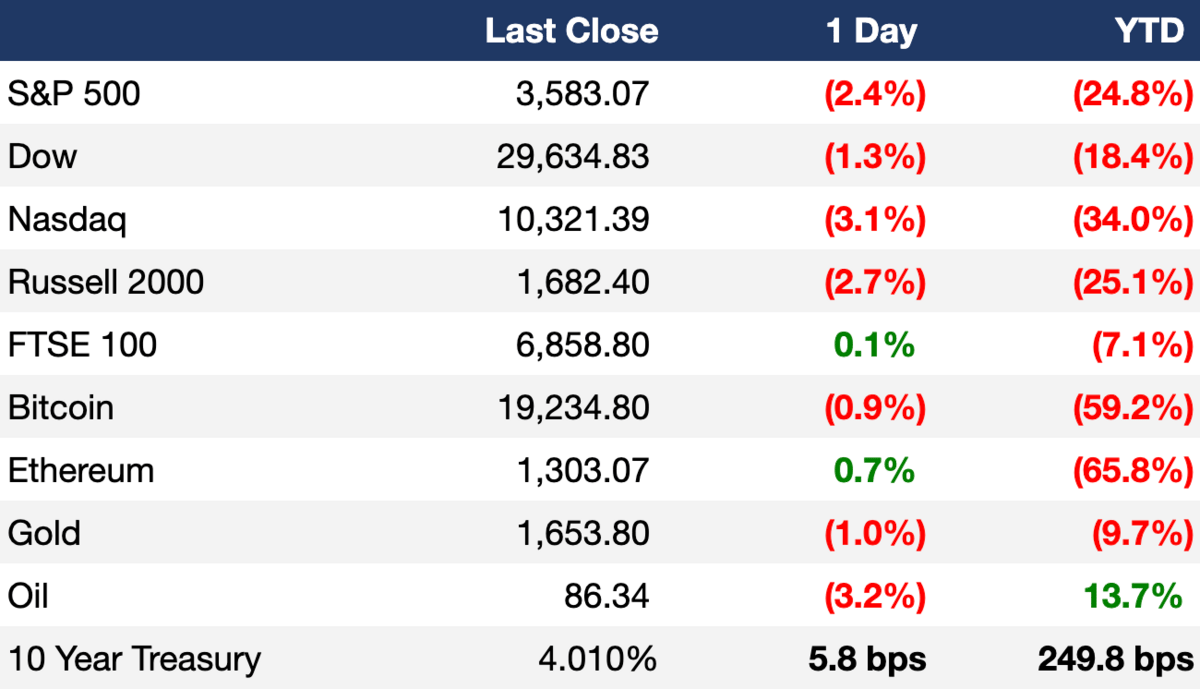

Markets

The S&P 500 was down 1.55% this week to close four of the last five weeks in the negative thanks to a hotter-than-expected inflation report and skepticism about the Fed’s coming rate hikes

Nasdaq also ended the week lower, falling 3.11%

The Dow stood out, gaining 1.15% on the week

The pan-European Stoxx 600 rose 0.7% on Friday after Lizz Truss U-turned on her fiscal plans

Earnings

JPMorgan beat Q3 profit estimates on its highest quarterly net interest income ever while raising FY guidance; their shares rose nearly 4% on the report (RT)

Wells Fargo missed on Q3 profit estimates due to accruals covering regulatory fallout from the 2016 fake accounts scandal, but beat revenue expectations driven by higher interest rates and loan balances; their shares rose 1.9% on Friday (FT)

Morgan Stanley missed Q3 profit and revenue estimates as IBD revenue collapsed by 55%; their shares fell nearly 5% (CNBC)

Citigroup reported a 25% decline in Q3 profits on credit loss provisions and poor deal flow but topped revenue expectations on high net interest income; their stock rose 2% in late morning trading (CNBC)

HDFC Bank met estimates with a 20% rise in Q3 net profit buoyed by higher loan growth and rise in other income (BBG)

What we're watching this week:

Today: Bank of America

Tuesday: Goldman Sachs, Netflix

Wednesday: Tesla, IBM, Procter & Gamble, Nasdaq

Thursday: Blackstone, Snap Inc.

Full calendar here

Headline Roundup

US consumer spending was flat in September and below expectations (CNBC)

US Treasury is asking major banks if it should buy back bonds (RT)

Lizz Truss sacked UK finance minister Kwasi Kwarteng and ditched her corporate tax-cut plan (FT)

CCP is expected to select Xi Jinping as President for a precedent-defying third term (AX)

Goldman plans sweeping reorganization, combining investment banking and trading (WSJ)

China will ease share buyback rules amid a sluggish market (RT)

South Korea will scrap taxes on foreigners' income from bonds (RT)

US will probe Samsung, Qualcomm and TSMC over semiconductors and circuits (RT)

Kroger pledged to reduce prices if they successfully merge with Albertsons (AX)

Instacart cut its internal valuation for a third time to ~$13B (TI)

Beyond Meat will cut 19% of its workforce amid struggling sales and stock (CNBC)

Citigroup will shut down its institutional banking operations in Russia (FT)

Nikola founder Trevor Milton was found guilty of making fraudulent statements (CNBC)

Elon Musk dropped his request for Starlink funding to foot Ukraine bill (AX)

College endowments posted their biggest losses since the financial crisis (BRN)

North Korea is testing more missiles than ever before (AX)

Tennessee beat Alabama in a wild game and weekend for college football (ESPN)

Brussels is set to propose a temporary gas price ceiling across the EU to curb extreme prices (FT)

A Message From Brave

Brave Wallet is your multi-chain onramp to Web3

Gone are the days of juggling multiple crypto wallet extensions that put you at risk of phishing, spoofing, and tracking. With Brave Wallet, you only need one wallet to manage your crypto across more than 100 chains, including Ethereum, Solana, L2s and more. All without downloading risky extensions.

Brave Wallet is easy to set up, and removes the headache of jumping between wallets and extensions. It’s lightweight but packed with great features, like:

built-in token swaps

fiat on-ramps

support for hardware wallets like Ledger

live market data, NFT portfolio management, and much more

Brave’s mission is to make Web3 easier to navigate and use for its over 55 million users, with new features shipping monthly. Download Brave & click the wallet icon to get started.

Deal Flow

M&A / Investments

Grocery giant Kroger agreed to buy rival Albertsons for $24.6B (CNBC)

Credit Suisse is preparing to sell parts of its Swiss domestic bank in an attempt to close a ~$4.5B capital hole. Assets under consideration include a stake in the SIX Group (which runs the Zurich stock exchange), an 8.6% holding in Allfunds (a listed Spanish investment company), Pfandbriefbank and Bank-Now (two specialist Swiss banks), and Swisscard (a JV with American Express) (FT)

Insight Partners agreed to buy a minority stake in enterprise software company Aptean at a $3.55B valuation (PEI)

UK broadcaster ITV is exploring a sale of its studio production division, which could fetch up to $3B (FT)

Subsidiaries of Ivan Tavrin’s investment group agreed to buy Russian classified-ads business Avito for $2.4B (BBG)

News Corp., which owns publishing titles including Wall Street Journal and New York Post, and Fox Corp., which encompassed Fox News and Fox Sports, are exploring a potential merger that would reunite the two media giants after nine years (RT)

One Equity Partners agreed to buy engineering consultancy and infrastructure services provider Amey (PEI)

Digital wealth platform Endowus agreed to buy a 60%+ stake in Hong Kong independent wealth manager Carret Private Investments (BBG)

VC

Skydance Media, the Hollywood producer behind Top Gun: Maverick, received a $400M investment at a $4B valuation in a funding round led by KKR (FT)

VUZ, an immersive social app, raised a $20M Series B led by Caruso Ventures, Vision Ventures, and more (PRN)

CoolR Group, a startup automating ordering for brands using AI, raised a $10M round led by First Analysis (PRN)

Debt

British online fashion retailer ASOS is in talks with lenders to amend the terms of its ~$390M borrowing facility (RT)

Fundraising

LongueVue Capital Partners, a New Orleans-based PE firm, raised a $360M fourth fund focused on lower middle market founder-owned businesses (PRN)

Crypto Corner

Bankrupt crypto lender Celsius received a US grand jury subpoena and inquiries from the SEC, CFTC and FTC (BBG)

India aims to develop standard operating procedures for cryptocurrencies during its G20 presidency (CT)

Over 50% of major UK banks allow customers to interact with crypto exchanges (FB)

JPMorgan and Visa will bridge their private blockchain network to streamline cross-border payments (FRB)

Exec's Picks

The Information dug into a shareholders' agreement prepared by Elon Musk's lawyers for equity investors in the Twitter buyout. Despite relying on outside investors to help finance his $44B purchase of Twitter, Elon will have absolute authority over key decisions, like pursuing a sale, IPO, or refi of the business. Check out the findings here.

Crazy weekend in sports with playoff baseball, college football upsets, and crazy NFL finishes. If you want to get in on the action with some sports bets, be sure to check out BetMGM and claim any offers for free trades they've got for ya.

Noah Smith wrote a great piece breaking down everything you need to know about Biden's sanctions on the Chinese semiconductor sector. Check it out here.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.