Together with

Good Morning,

The Dow hit 38,000, China is weighing a massive stock market rescue package, the EU is upgrading its economic security, US debt hit a record high, Facebook has made a major change after years of PR disasters, humans are still cheaper than AI for most jobs, and Canada is capping international student permits.

Looking to streamline your spend and expense processing in 2024? Try out a demo with today’s sponsor, BILL, and you can get a $100 Amazon gift card.

Let’s dive in.

Before The Bell

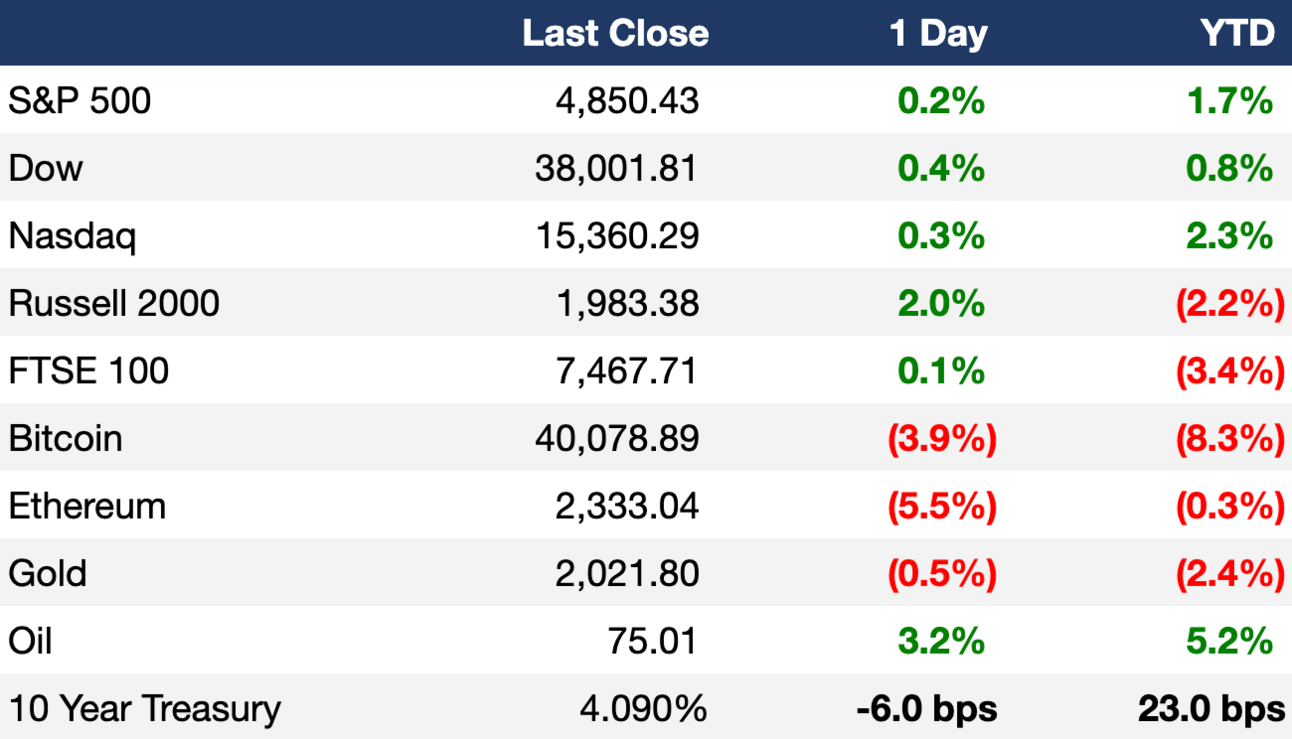

As of 01/22/2024 market close.

Markets

US stocks rose as the Dow and S&P hit all-time highs

The Dow led indices with a 0.36% gain to close above 38,000 for the first time

Asian stocks mostly rose, with Japan’s Nikkei notching a fresh 34-year high

Chinese stocks plunged as Hong Kong’s HSI approaches its lowest close since 2009

Bitcoin prices fell below $40,000, continuing a downtrend that began when bitcoin ETFs were approved

Earnings

United Airlines beat Q4 earnings and revenue expectations but forecasted a Q1 loss due to the FAA’s grounding of Boeing 737 Max 9 planes this month (CNBC)

What we're watching this week:

Today: Netflix, Verizon, 3M, Johnson & Johnson, RTX, P&G, Lockheed Martin

Wednesday: Tesla, AT&T, IBM, ASML, Progressive

Thursday: Intel, Visa, Blackstone, American Airlines, Comcast, Next Era Energy

Friday: American Express

Full calendar here

Headline Roundup

Dow touches 38,000 for first time (WSJ)

China weighs stock market rescue package backed by $278B (BBG)

US debt hits record high as rich economies pile on IOUs (AX)

EU to upgrade economic security to shield key tech from China (BBG)

Home sales were the lowest in almost 30 years in 2023 (WSJ)

Alphabet’s Moonshot X lab cuts staff, turns to outside investors (BBG)

Facebook made a major change after years of PR disasters, and news sites are paying the price (CNBC)

Humans still cheaper than AI in vast majority of jobs, MIT finds (BBG)

Charles Schwab faces more uncertainty after tough 2023 (WSJ)

Canada to cap international student permits amid housing crunch (RT)

New details emerge about SEC’s X account hack, including SIM swap (CNBC)

More workers want to change jobs, but the market is getting tougher (WSJ)

Exxon sues two ESG investors (WSJ)

Top House democrat seeks DOJ probe of AI-generated Biden robocalls (AX)

Samsung races Apple to develop blood sugar monitor that doesn’t break skin (BBG)

Macy’s urged by Arkhouse to open books after rejecting takeover bid (BBG)

Fed review clears central bank officials of violating rules (WSJ)

Southwest Airlines pilots approve new five-year contract (CNBC)

A Message From BILL

Is your desk piled high with invoices, receipts, and paper checks headed for the mailbox?

Time to get your desk back. In honor of National Clean Your Desk Month, take a demo with BILL to learn how to handle your entire financial process digitally. No more chasing down approvals, stuffing envelopes, or asking “Did we send that payment?” to a very tired AP team.

BILL helps you handle everything online, creating a permanent record of invoices, comments, approvals, and payments to keep your team organized and your desk clear.

Best of all, we’ll give you a $100 Amazon gift card1 for a new desk organizer, trash can, or anything else you need to celebrate National Clean Your Desk Month.

Deal Flow

M&A / Investments

Sony Group and Zee Entertainment Enterprises officially called off their $10B media merger in India (BBG)

US gas station owner Sunoco agreed to acquire pipeline and fuel storage company NuStar Energy for $7.3B in an all-stock deal (BBG)

Argus Media’s CEO Adrian Binks and existing investor General Atlantic will acquire PE firm Hg’s stake in Argus in a deal valuing the energy and commodity data provider at a ~$4.6B EV (FT)

Spanish telecom Cellnex is considering selling a minority stake in its Polish operations in a deal that would likely value the Polish unit at over $3.3B, including debt (RT)

State-backed French lottery operator Française des Jeux will acquire Stockholm-listed gambling group Kindred in a $2.8B deal (FT)

Olympus Partners, the PE owners of Rise Baking Company, are preparing a sale of the US bakery provider that could value the company at ~$2.5B, including debt (RT)

Fashion firm Kering, the owner of Gucci and Balenciaga, acquired Manhattan building 715-717 Fifth Ave for ~$963M (BBG)

Affiliates of Cerberus Capital Management will acquire a large portion of debt collection company Intrum’s investment portfolio for $785M (RT)

British catering company Compass Group agreed to acquire rival CH&CO in a deal valuing the Royal Opera House caterer at $604M, including debt (RT)

London-listed investment firm Bridgepoint acquired anti-aging skincare brand RoC Skincare from Gryphon Investors in a ~$500M deal (RT)

Sandoz, a pharmaceutical company specializing in generics, will acquire Cimerli, a biosimilar drug to treat vision impairment and loss, from Coherus BioSciences for $170M (RT)

VC

Device-as-a-Service platform Everphone raised a $295.4M Series D led by Citigroup, Phoenix Insurance, and KfW (FN)

Voice cloning startup ElevenLabs raised an $80M Series B at a $1B+ valuation led by a16z, Nat Friedman, and Daniel Gross (TC)

Captain Fresh, an Indian B2B harvest-to-retail marketplace for animal protein, is in talks to raise $50M in funding from Nekkanti Sea Foods, SBI Investment, Evolvence, Tiger Global, and Prosus Ventures (TC)

Vertical Aerospace, an electric aviation company, raised $50M in funding from founder and CEO Stephen Fitzpatrick (BW)

Comtech Telecommunications, a global technology company providing terrestrial and wireless network solutions, raised $45M in funding from White Hat Capital Partners and Magnetar (BW)

Sano Genetics, a UK-based provider of a software platform for precision medicine clinical trials, raised an $11.4M round led by Plural (FN)

ForthStar, a UK-based mobile free-to-play game studio, raised $10M in funding from Griffin Gaming Partners (BW)

Artisse AI, a Hong Kong-based startup specializing in human-centric AI image tech, raised a $6.7M seed round led by The London Fund (FN)

Talofa Games, a startup building social fitness games, raised a $6.3M seed round led by Chamaeleon (FN)

Brenus Pharma, a startup working on an anticancer vaccine, raised a $4.7M round from Bpifrance (BW)

Kenyan agtech Shamba Pride raised a $3.7M debt / equity pre-Series A led by EDFI AgriFI and Seedstars Africa Ventures (TC)

MitoSense, a startup developing neurodegenerative disease treatments, raised a $3.5M seed round led by Caydan Capital Partners (PRN)

Clinical development company 3Daughters raised a $2M+ seed round led by Thairm Bio (FN)

Huler, a UK-based worktech company providing an employee experience platform, raised a $1.8M round from MEIF Proof of Concept & Early Stage Fund (FN)

Bolden Therapeutics, a neurogenesis-focused biotech startup, raised a $1.5M pre-seed round led by Resolute Venture Partners (FN)

IPO / Direct Listings / Issuances / Block Trades

Debt

Direct lenders are competing with banks to finance a potential LBO of DocuSign with a debt package worth as much as $8B (BBG)

Saudi Arabia’s PIF raised $5B through the sale of dollar-denominated bonds (BBG)

Swedish startup H2 Green Steel secured a $4.6B debt package for the world’s first large-scale green steel plant in northern Sweden (BBG)

Truist Financial and Fifth Third Bank raised $4.5B through the US bond market (BBG)

The University of California will raise ~$1.7B through the municipal bond market by issuing general revenue bonds (BBG)

German real estate company Branicks will try to push back over $436M of debt coming due this year as it faces liquidity pressures due to a property market downturn (BBG)

Bankruptcy / Restructuring

Fundraising

Crypto Corner

Exec’s Picks

Apoorv Agrawal discussed how and why Microsoft, Amazon, Nvidia, and Google are investing so much venture capital into AI startups.

76ers’ GM Daryl Morey chatted with Patrick O’Shaughnessy about decision-making, superstar athletes, and more.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter