Together with

Good morning,

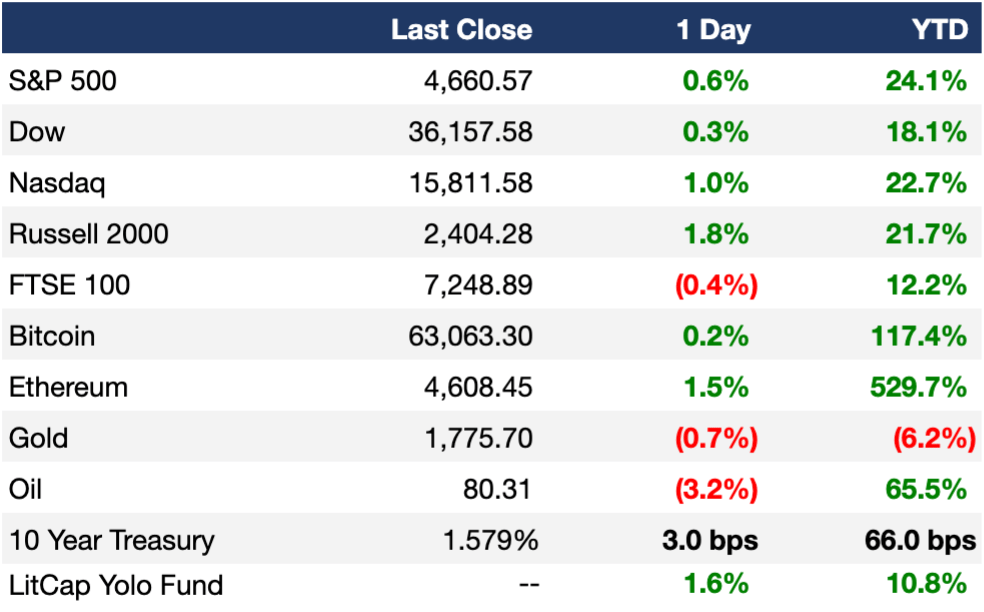

The major US indices all closed at record highs yesterday after J Pow basically said "the show goes on" with the economic rebound. Investors had been waiting for that moment for months but markets still rallied and the "it's priced in" crowd is quiet.

We've got an epic giveaway launching today in partnership with Ansarada. Let's just say the tickets up for grabs are for a big event in LA this upcoming Feb. Details below.

Let's dive in.

Forwarded email? Subscribe here.

Before The Bell

Click here to download the Iris Social Stock app and see the LitCap Yolo Fund's portfolio holdings.

If you want to learn more about crypto trading strategies, check out our Foot Guns newsletter.

Markets

Talk about a bull run… once more, all US major stock indices closed at new ATHs thanks to J Pow and the Fed saying the economy is finally strong enough for them to start tapering their monthly bond purchases implemented at the start of the pandemicThe Fed said it will reduce buying by $15B/month, putting it on track to end its quantitative easing by the middle of 2022

The Fed said it will reduce buying by $15B/month, putting it on track to end its quantitative easing by the middle of 2022

The strong earnings szn continues, with 81% of the S&P 500 companies that have reported so far beating expectations

Yesterday’s ADP report showed that private job creation rose more-than-expected (571K vs. 395K expected) in October, thanks to a burst in the hospitality sector as the economy continues to rebound from the pandemic

Earnings

CVS rose 5.7% to end the day, after it reported better-than expected Q3 earnings and a raised FY outlook before-the-bell thanks to a boost from filling more prescriptions and giving more Covid-19 vaccines (CNBC)

What we’re watching today: Square, Moderna, Uber, Peloton

Full calendar here

Headline Roundup

Cathie Wood’s Ark ETF buys the Zillow dip (BBG)

Biden Administration orders federal agencies to fix hundreds of cyber flaws (WSJ)

Elon Musk says Tesla hasn’t signed contract with Hertz despite earlier announcement (WSJ)

Companies add 571K jobs in October thanks to a boost in hospitality hires (CNBC)

Ford to impose vaccine mandate on 32K workers (CNBC)

Coinbase tests commission-free subscription trading service (BBG)

Just when you think the YOLO trade is done, another meme comes along (BBG)

A Message From Ansarada

🏈 The Bullpen Tales Giveaway 🏈

Do you currently work in (or previously work in) investment banking, private equity, or a unique corporate environment?

Have you seen some crazy good sh*t?

Do you have “Attending the Super… I mean Biggest Game in Football” *** on your bucket list? (*** Legal says we can't say it but y'all know what it is)

Are you overworked and overdue for some time off?

If the answer to all the above is “YES”, then oh boy, do we have a giveaway for you.

Ansarada is the virtual data room and deal technology used by 10 out of the 10 top investment banks (read: they’re legit af). They’ve just launched a brand new online quoting process, it takes 3 clicks and approximately 15 seconds to magically open your data room. Plus, you don’t pay until the deal goes live. Take our word for it, it’s awesome.

Having opened a few VDRs in our time, we know their product is simple, secure, intuitive and was actually built this century.

Ansarada and Litquidity have teamed up to give away two tickets* to "The Big Game" LVI in LA to one lucky Exec Sum subscriber.

TO ENTER: All you need to do is go to this page and fill out the form with your contact info and your absolute best & worst workplace stories. Don't hold back, there's a huge prize at stake!

Ansarada and Litquidity will select the most noteworthy stories and narrow them down to a handful of finalists that will then be voted on by the audience. The giveaway will be live for the next two weeks, closing on 18 November and the finalists will be announced the following week.

We're here to give back to the community and wish you all the best of luck.

So get to submitting your entries now and be sure to make them good!

*Airfares and accommodation are not included

Deal Flow

M&A

Shale driller Continental Resources agreed to buy the Delaware Basin assets of Pioneer Natural Resources for $3.25B (BBG)

Oaktree and American Industrial Partners are exploring a sale of marine transportation logistics company Rand Logistics that could fetch $1B+ (BBG)

Healthcare IT firms PatientPop and Kareo agreed to merge in a $1B deal (BBG)

Romania's state-owned Romgaz agreed to buy Exxon's 50% stake in a Black Sea deepwater natural gas project for ~$1.1B (BBG)

London-based RE firm LandSec agreed to buy a 75% stake in MediaCity, a 37-acre media, digital and tech hub in northern England, for $580M (BBG)

Molecular testing firm Qiagen and French rival BioMerieux are exploring a potential merger (BBG)

Old Mutual’s PE arm is in talks to buy South African investment company Long4Life, which has a current market cap of $267M (BBG)

Argentine fintech startup Ualá agreed to buy Mexican bank ABC Capital, with purchase subject to approval from Mexico’s regulators (BBG)

The founder and controlling shareholder of the media company Daily Mail, the Rothermere Family, agreed to buyout the rest of the shareholders and take the firm private for £850M, with other special dividends to be paid out to other existing shareholders (RT)

Marathon Petroleum is in “advanced discussions with several parties” to sell its Kenai Refinery in Alaska (BBG)

VC

HoneyBook, a client flow and cash flow management software startup, raised a $250M Series E led by Tiger Global (TC)

Cloudbeds, a cloud-based hotel management software startup, raised a $150M Series D led by SoftBank Vision Fund 2 (PRN)

Moonfare, a digital private equity investment platform for individual investors, raised a $125M Series C led by Insight Partners (PRN)

Healthcare admin automation startup Notable raised a $100M Series B at a $600M valuation led by Iconiq Growth (TC)

Brazil-based food tech startup Future Farm raised a $58M Series C at a $400M+ valuation led by BTG (TC)

Gather, a virtual gathering startup, raised a $50M Series B led by Sequoia and Index Ventures (VCJ)

Ocean-monitoring autonomous buoy startup Sofar raised a $39M Series B led by Union Square Ventures (TC)

Femtech startup illumigyn raised a $33M round from Yozma Group Korea, Ubicom Holdings Japan, and more (TC)

Breakfast, an online grocery startup looking to capture the Africa and Middle East market, raised a $26M Series A led by Vostok New Ventures and Endure Capital (TC)

Radar tech startup Spartan Radar raised a $25M round led by Prime Movers Lab (TC)

PadSplit, a maker of a shared household marketplace, raised a $20.5M Series B (TBJ)

B2B integrations platform Merge raised a $15M Series A led by Addition (TC)

QuestDB, a startup building a ‘speedy open source time series database’, raised a $12M Series A from 468 Capital, Uncorrelated Ventures, and more (TC)

Cognitive healthcare software startup BrainCheck raised a $10M Series B led by S3 Ventures and Next Coast Ventures (TC)

Privacy-by-design tech startup Ethyca raised a $7.5M Series A extension from Addition’s Lee Fixel, IA Ventures, and more (TC)

Afterparty, a maker of an NFT and social token platform, raised $3M in seed funding led by Acrew Capital and TenOneTen Ventures (BW)

Privacy-focused customer data platform Blotout raised a $3M seed round led by First Rays Venture Partners (TC)

Nigerian lending startup Payhippo raised a $3M seed round (TC)

Egyptian on-demand grocery delivery startup Appetito raised a $2M pre-Series A led by Jedar Capital (TC)

IPO / Direct Listings / Issuances / Block Trades

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our Litquidity Search Partners job board right here. We've got 80+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, CorpDev and more.

If you're looking to hire candidates and want to post a job, all you have to do is hit submit on the job board.