Together with

Good Morning,

Yesterday was a hot and humid day in NYC and yet Brad & Chads in Patagonia vests were everywhere. Something I'll never understand in the heat! Anyway, back on topic.

Trump's Mar-a-Lago home in FL was raided by the FBI, SoftBank took a big L, investors swarmed back into corporate bond ETFs and out of PE/VC stakes, and the US is sending a $5.5B aid package to Ukraine.

Quick shoutout to today's sponsor, PolicyGenius. If you're like me and have no idea where to start when looking at different types of insurance (especially life insurance) from all the insurers out there, they make it incredibly simple. Check em out here. More info below.

Let's dive in.

Before The Bell

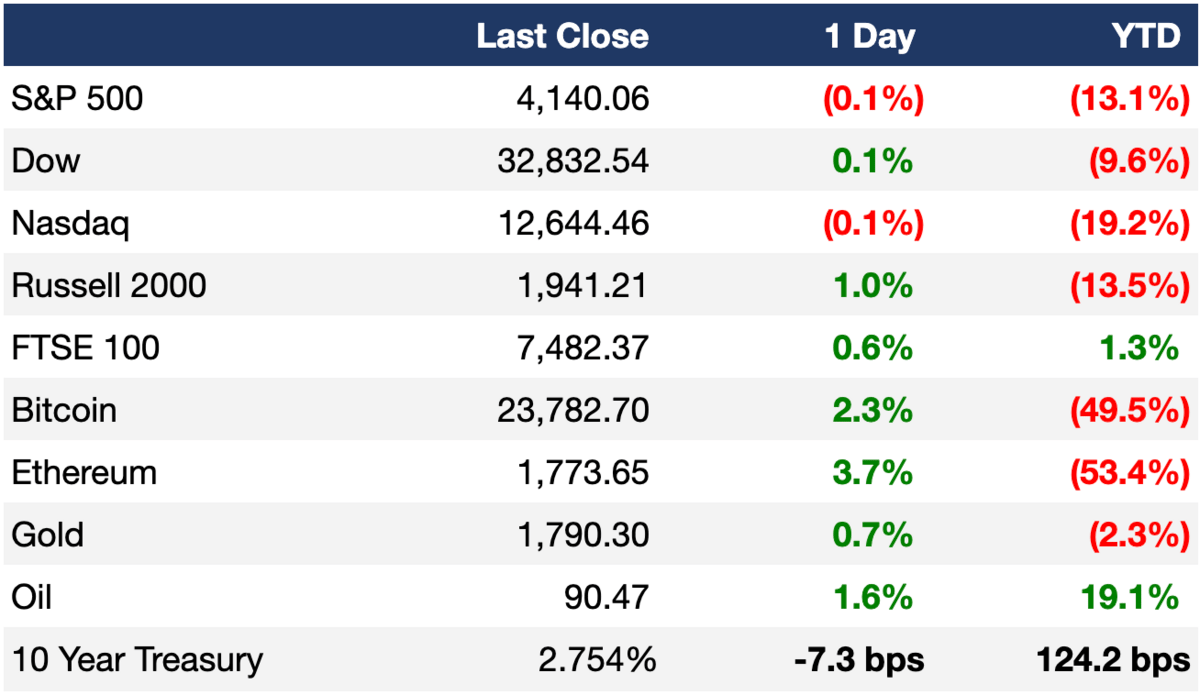

As of 08/08/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

Stocks were a mixed bag on Monday as investors reviewed several earnings reports and awaited US inflation data for July, to be released on Wednesday

The two-year Treasury note remains higher than the 10-year, an inverted yield curve that is widely regarded as a key recessionary signal

Overseas, the pan-continental Stoxx Europe 600 finished 0.7% higher while Hong Kong’s Hang Seng Index slid 0.8%

Earnings

Tyson Foods fell 10% after it reported weaker than expected quarterly earnings and warned of supply constraints and reduced demand for high-priced beef (RT)

SoftBank posted a record $23.4B Q2 loss due to $21B+ in losses from its Vision Fund investment arm, causing its stock to fall 1.4% (WSJ)

Chipmaker Nvidia announced preliminary financial results and issued a warning that Q2 revenue would be about 17% below its prior forecast, causing its stock to fall 6.3% (WSJ)

What we're watching this week:

Today: Ralph Lauren, Spirit Airlines, Coinbase, RCI Hospitality

Wednesday: Jack in the Box, Wendy’s, Walt Disney

Thursday: Cardinal Health

Full calendar here

Headline Roundup

Consumer confidence in housing market dropped to its lowest level since 2011 (CNBC)

Investors swarm back to corporate bond ETFs, attracting $13.8B of capital in July (FT)

Investors sell stakes in PE and VC funds at a record pace (FT)

SoftBank's CEO pledged widespread cost cuts for SoftBank and Vision Fund after a record $23.4B loss (BBG)

Novavax slashed its full-year revenue outlook in half on Monday, citing a lack of demand for its Covid-19 vaccine (WSJ)

60% of EU and UK land is under drought conditions (CNN)

US will send a $5.5B aid package to Ukraine (RT)

The Senate climate bill passed on Sunday provides billions of dollars in subsidies for EV makers but makes it more difficult for companies to qualify (WSJ)

Qualcomm will buy an additional $4.2B in semiconductor chips from GlobalFoundries (RT)

Boeing will resume deliveries of its 787 Dreamliner as soon as Wednesday (WSJ)

BlackRock is opening a satellite office in South Florida to accommodate a top executive and dozens of other employees (WSJ)

Twitter subpoenaed Oracle founder Larry Ellison in its legal battle against Elon Musk (BBG)

Donald Trump’s Mar-a-Lago home was raided by FBI agents as part of an investigation into his handling of official records (WSJ)

A Message From Policygenius

Making Your Life Insurance Search a Little Bit Easier

Navigating life insurance is frustrating. Different policies, different premiums, different coverages, and different companies. It’s easy to ask, “Why should I even worry about life insurance in the first place?”

There is one big reason: life insurance typically grows more expensive as you get older, so the best time to look for a policy is now.

Policygenius will help you find the right policy at your lowest price, as quickly as possible.

Policygenius is an insurance marketplace that makes it easy to compare quotes from top companies like AIG and Prudential in one place. Their licensed agents work for you, not the insurance companies, to ensure that you get the right policy for your needs.

Choosing the right insurance policy is a big decision, and you should use a website that you can trust.

Join the 30M others who have used Policygenius, and click here to find your policy today!

Deal Flow

M&A / Investments

PE firm Vista Equity Partners will acquire tax-management software provider Avalara for $8.4B including debt (BBG)

Pharmaceutical company Pfizer agreed to buy sickle-cell drugmaker Global Blood Therapeutics in a deal worth $5.4B, including debt ($4.6B equity value). The $68.50 / share deal is double the stock’s unaffected share price on August 3rd (BBG)

Home appliance company Whirlpool agreed to buy Emerson Electric’s garbage-disposal business Insinkerator in a $3B all-cash deal (BBG)

Australian financial group Macquarie Group is nearing a deal to buy utility company Suez's UK waste business for $2.4B (BBG)

Shipping giant UPS will buy Italy-based healthcare logistics firm Bomi Group for “between $500M to $1B” (RT)

US conglomerate Huber bought Italian fertilizer maker Biolchim in a ~$610M deal (RT)

Media conglomerate Cox Enterprises agreed to acquire news company Axios for $525M (AX)

German financial group Allianz is considering a sale of its Saudi Arabian unit Allianz Saudi Fransi (BBG)

Chinese PE firm Trustar Capital is considering selling its 23.1% stake in telecommunications software provider AsiaInfo Technologies (BBG)

SoftBank is in talks to sell asset manager Fortress Investment Group (BBG)

Cryptocurrency platform Crypto.com acquired two South Korean startups: payment service provider PnLink and virtual asset provider OK-BIT for an undisclosed amounts (TC)

Haus, a VC-backed aperitif startup, is up for sale after its Series A fell through following the lead investor pulling out (TC)

VC

Geek+, a Beijing-based warehouse robotics firm, raised a $100M Series E1 at a ~$2B valuation with participation from Intel Capital, Vertex Growth and Qingyue Capital Investment (TC)

Betr, a direct-to-consumer sports micro-betting company founded by Jake Paul and Joey Levy, raised a $50M Series A from Florida Funders, 8vc, and others including several prominent athletes (PRN)

Black Buffalo, a provider of smokeless tobacco alternative products, raised a $30M Series A led by The Pritzker Organization and Listen Ventures (PRN)

KatKin, a London-based online cat food ordering and delivery start-up, raised a $22M Series A led by Verlinvest and Perwyn (FRBS)

Kumospace, a VR office platform, raised a $21M Series A led by Lightspeed (TC)

Carbonstop, a China-based carbon emissions management software and consulting solutions provider, raised a ~$14.8M Series B led by Sequoia China (PRN)

Equalum, an end-to-end data ingestion platform, raised a $14M Series C with contributions from Springtide Ventures (TC)

Zap-Map, an EV charging app, raised a ~$10.9M Series A led by Fleetcor (UKTN)

Miferia, a Mexican online wholesale marketplace, raised a $7M seed round co-led by Bain Capital Ventures and Tiger Global (PRN)

Eyestem, an India-based cell therapy startup, raised a ~$6.4M Series A led by Biological E, Alkem Laboratories, and Natco Pharma (ET)

Old Street Digital, a London-based crypto asset manager, raised a $2.8M seed round led by Draper Associates (FSMS)

Produze, an Indian AgriTech startup trying to help native producers export globally, raised a $2.6M seed round led by Accel (TC)

EventPipe, a provider of a cloud-based event housing management software, raised a $2.2M seed round led by Velocior Ventures (PRN)

IPO / Direct Listings / Issuances / Block Trades

SPAC

Global fintech platform Seamless will merge with INFINT Acquisition Corporation in a $400M deal (BW)

Debt

A group of private lenders led by Blue Owl Capital will provide a $2.5B loan to finance Vista Equity Partners’ $8.4B acquisition of Avalara. Apollo and HPS Investment Partners are also part of the financing, which was structured as a recurring-revenue loan (BBG)

Crypto Corner

US Treasury sanctioned web3 mixing service Tornado Cash for aiding North Korean hackers in laundering cyber crime proceeds (YHOO)

Australia to explore case for Central Bank digital currency (BBG)

US lawmakers are pushing the Fed to issue a digital dollar in order to compete with China (WSJ)

Crypto lender Hodlnaut froze withdrawals amid difficult market conditions (CT)

Exec's Picks

A twitter user compiled a list of crypto venture funds with dry powder to deploy. The current tally is estimated at ~$20B+ (based on Crunchbase data between late 2021-current). Check out the full list here.

Our intern Karl was hard at work yesterday pumping out Carried Interest merch, in honor of the favorable taxation status remaining in tact for the time being. Check out the pieces below and grab them on our merch store:

Also available in black here.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started and building your own audience.