Together with

Good Morning,

Investors have a strong appetite for 10-year treasuries, Citadel got Morgan Stanley’s block-trading leaks, the BOJ ruled out rapid rate hikes, the biotech IPO window is opening, DoorDash is expanding overseas, Soho House stock tumbled on a shortseller report, and Disney invested in Epic Games.

ICYMI: Litquidity’s identity has finally been revealed in an exclusive interview with the Financial Times. You can check out the article here. More information behind the reason for revealing his identity will be released later this week!

Let’s dive in.

Before The Bell

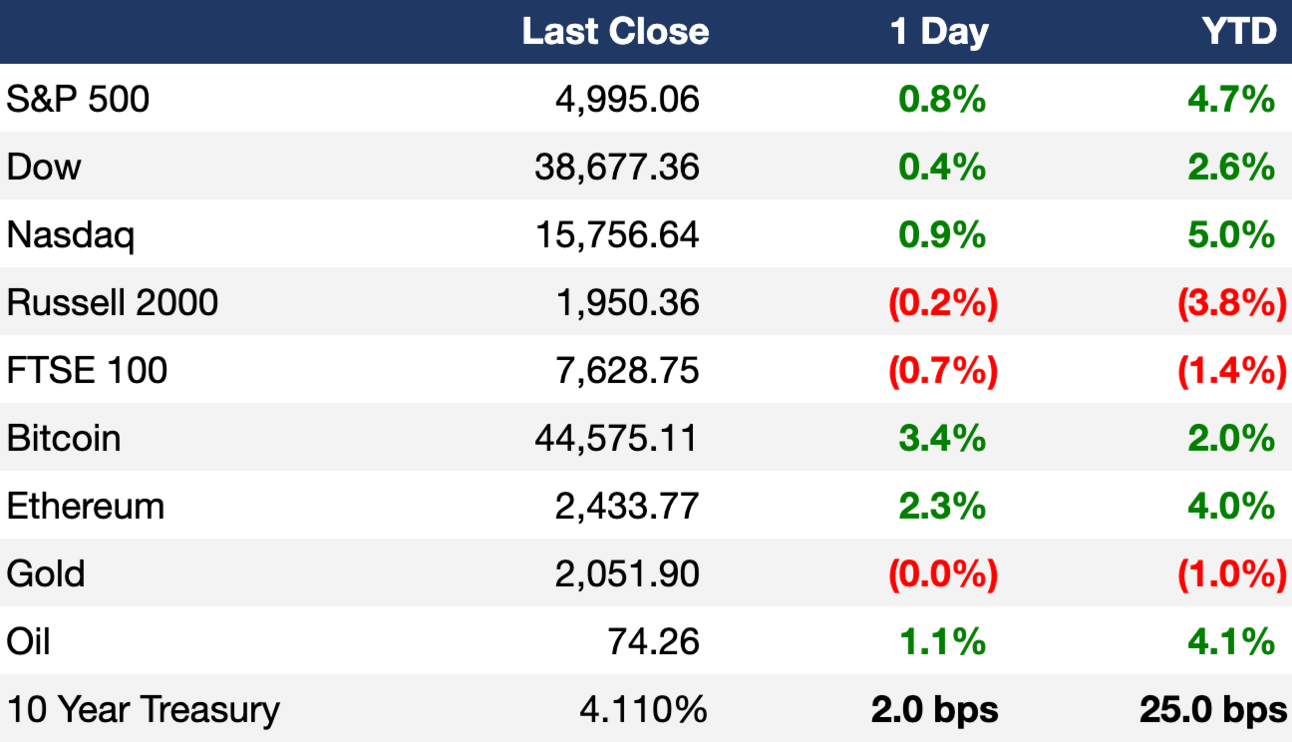

As of 2/7/2024 market close.

Markets

US stocks rose with the S&P closing just short of 5,000 as investors digested positive corporate earnings

The Nasdaq led indices with a 0.95% gain

Chinese stocks rose thanks to optimism regarding government support

Earnings

Disney shares jumped ~7% after beating Q1 earnings expectations and hiking 2024 profit guidance thanks to cost-cutting; the media giant missed on revenue, which was almost flat YoY (CNBC)

Arm shares surged ~20% after beating Q3 earnings and revenue expectations and forecasting a strong Q4 thanks to AI (CNBC)

Alibaba shares fell ~6% after missing revenue expectations for the December quarter, although it boosted its buyback program by $25B (CNBC)

PayPal shares fell ~8% despite better-than-expected Q4 earnings and revenue due to underwhelming full-year and Q1 guidance (CNBC)

What we're watching this week:

Today: Apollo Global, ConocoPhillips, Affirm, Pinterest, Cloudflare

Friday: PepsiCo

Full calendar here

Headline Roundup

US Treasury’s biggest-ever 10-year auction garners solid demand (BBG)

Citadel among hedge funds that got Morgan Stanley’s block-trading leaks (BBG)

Xi’s markets shakeup surprised insiders, showing alarm over route (BBG)

BOJ rules out rapid rate hikes, signals ending risky asset buying (RT)

Biotech IPOs jump more than 20% as momentum builds for listings (BBG)

DoorDash aims to expand overseas while delivery rivals struggle (BBG)

Streaming venture from ESPN, Fox and Warner blindsides sports leagues (WSJ)

Soho House tumbles after short seller draws WeWork comparison (BBG)

Ackman exits Lowe’s after bet earned $1.3B for Pershing Square funds (RT)

China offers support to accelerate EV maker’s global push (WSJ)

Las Vegas is trying to become the sports capital of the world (BBG)

US to tackle secrecy in all-cash home purchases (WSJ)

Spirits sales beat out beer and wine for second straight year, despite little growth (CNBC)

Warner Music to cut 600 jobs, or 10% of staff (CNBC)

America’s most expensive home for sale hits the market for $295M (WSJ)

New Zealand’s unemployment rate nudges higher (WSJ)

Mobile phone services suspended across Pakistan as voting begins (RT)

A Message From Eight Sleep

A Mattress Cover Fine-Tuned to Your Sleep

Our bodies sleep best when the temperature drops 1-3 degrees as we fall asleep, cools down further during REM sleep, and warms as we wake up to leave us feeling refreshed. The problem is that most beds trap heat, resulting in uncomfortable and inefficient sleep.

Eight Sleep fixes this.

I’m sure you’ve heard of Eight Sleep, the company that has been revolutionizing sleep from Wall Street to Silicon Valley. But did you know that their buzz-worthy mattress cover, the Pod, can be added to your existing mattress to immediately improve your sleep quality?

The Pod, which fits on your bed like a fitted sheet, includes sensors that track your health while you sleep, and it cools down and warms up each side of your bed throughout the night to improve your sleep quality. Want to try it yourself? Get started by clicking below:

Deal Flow

M&A / Investments

Bohai Leasing, a Shenzhen-listed arm of failed Chinese conglomerate HNA Group, is kicking off the sale of container leasing business Seaco, which it hopes will fetch a valuation of over $5B, including debt (BBG)

UK housebuilder Barratt will acquire rival Redrow in a ~$3.2B deal, cementing itself as the UK’s largest homebuilder (FT)

Chip-designer Synopsys is preparing to kick off the sale of its SIG software integrity business, which could be valued at $3B or more (BBG)

US energy company California Resources will acquire oil and gas company Aera Energy in an all-stock deal valuing the company at $2.1B, including debt (RT)

China National Pharmaceutical Group is considering another attempt to take China Traditional Chinese Medicine Holdings private; Hong Kong-listed TCM has a market cap of ~$2B (BBG)

Distressed Chinese developer Guangzhou R&F Properties agreed to sell London’s Market Towers at 1 Nine Elms Lane, which is valued at $1.7B, for some of its dollar bonds and just 13¢ cash (BBG)

Walt Disney will take a $1.5B minority equity stake in Fortnite's publisher Epic Games (RT)

Europe’s largest asset manager, Amundi, agreed to acquire private markets specialist Alpha Associates, which manages ~$9.2B of assets, for up to $377M (FT)

VC

Platform Accounting Group, a startup acquiring and supporting the operation of boutique professional services firms, raised an $85M funding round led by Cynosure Group (BW)

DeSo, a decentralized social media app, raised $75M in token reservations in its first week of launch; backers include Coinbase, Sequoia, a16z, and Polychain (FN)

Edge management and orchestration startup ZEDEDA raised a $72M Series C led by Smith Point Capital (BW)

Overflow, a startup building a financial operating system for the faith space, raised a $20M Series B led by Wesleyan Investment Foundation (BW)

3D scanning app Polycam raised an $18M Series A led by Left Lane Capital (TC)

Commercial construction insurance tech platform Shepherd raised a $13.5M Series A led by Costanoa Ventures (FN)

Amperesand, a startup looking to commercialize silicon-carbide solid-state transformer tech, raised a $12.45M seed round led by Xora Innovation and Material Impact (TC)

Neurotech startup Elemind raised a $12M seed round from Village Global, LDV Partners, E14 Fund, and more (FN)

Device Authority, a global leader in identity and access management for enterprise IoT systems, raised a $7M Series A led by Ten Eleven Ventures (PRN)

Green chemistry startup DUDE CHEM raised a $7.1M seed round led by Vorwerk Ventures and b2venture (EU)

Omega, a Web3 infrastructure provider, raised a $6M round from Lightspeed Faction, Borderless Capital, and more (FN)

EV fleet management startup Guided Energy raised a $5.2M seed round from Sequoia and Dynamo Ventures (TC)

Event rental management software startup Goodshuffle raised a $5M Series A from FINTOP Capital (TC)

Subscription-based healthcare startup Subscribili raised a $4.3M seed round led by Darby Group Companies (BW)

AI.Fashion, a startup using AI to enhance the fashion industry, raised a $3.6M seed round led by Neo (FN)

Supply chain finance platform Cashinvoice raised a $3.4M Series A from Pravega Ventures, HDFC Bank, and Accion Venture Lab (FN)

Simplify, a startup using AI to optimize job applications, raised a $3M seed round led by Craft Ventures (TC)

Danish neobroker startup Pluto.markets raised a $2.6M funding round led by Magnetic (EU)

IPO / Direct Listings / Issuances / Block Trades

Shares of Athens International Airport rose 12% in its debut day of trading after its $852M IPO, the largest in over two decades for the Athens Stock Exchange (BBG)

American Healthcare REIT shares rose 7% in its debut day of trading after its $672M IPO (RT)

Shares in Renk jumped as much as 27% in its debut day of trading after the German tank gearbox maker’s $539M IPO (RT)

Saudi Arabia's Modern Mills for Food Products is planning a local IPO of 30% of its shares (RT)

SPAC

Clean energy project developer RBio Energy will merge with Perception Capital Corp. III. in a $350M deal (GNW)

Debt

A group of private-credit firms including Apollo Global and Blackstone is close to finalizing a $2B debt package that will help finance the buyout of software developer Alteryx by Clearlake Capital and Insight Partners (BBG)

Alimentation Couche-Tard, the owner of Circle K, priced ~$1.5B worth of euro-denominated bonds, which garnered over ~$10.8B worth of bids (BBG)

Dow, a maker of plastics for packaging, raised ~$1.3B through the green-bond market to reduce its carbon emissions and plastic waste (BBG)

UBS Group’s $1B sale of Additional Tier 1 bonds attracted ~$12B in orders (BBG)

Bankruptcy / Restructuring

New York Community Bancorp has been reaching out to investors to raise capital to finance a portfolio of residential mortgages as pressure mounts (BBG)

Fundraising

PE firm Coalesce Capital raised ~$900M for its debut fund that will invest in mid-size companies (WSJ)

PE firm Trinity Hunt Partners closed its Fund VII at $700M, which will focus on growing small-cap companies (FN)

Lower middle-market healthcare-focused PE firm 3 Boomerang Capital closed its flagship PE fund at $375M (FN)

Private investment firm Riverside closed its RAC Riverside Acceleration Capital Opportunity Fund II at $235M, which will focus on B2B software companies (FN)

Bill Ackman’s investment firm Pershing Square Capital Management plans to launch a new fund called Pershing Square USA for retail investors; the fund will invest in one- to two-dozen large, undervalued companies (BBG)

Crypto Corner

Exec’s Picks

Semafor published an excellent interview with Medium’s CEO about the blogging platform’s likely profitability in 2024 about broader trends in the media industry.

Employers are trying to figure out how to navigate layoffs without getting shamed on social media, according to Bloomberg.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter