Together with

Good Morning,

The IMF sees increased risks to financial stability, no companies with investment-grade ratings sold new bonds in the week of March 13th, small US banks see record drop in deposits, the US is mulling more support for its banks, and the Pentagon wants Silicon Valley to join the ranks of arms makers.

Are you a non-accredited investor looking to invest some money in venture capital? Check out today's sponsor, Sweater. They're a platform allowing ordinary investors to gain exposure to the VC asset class.

Let's dive in.

Before The Bell

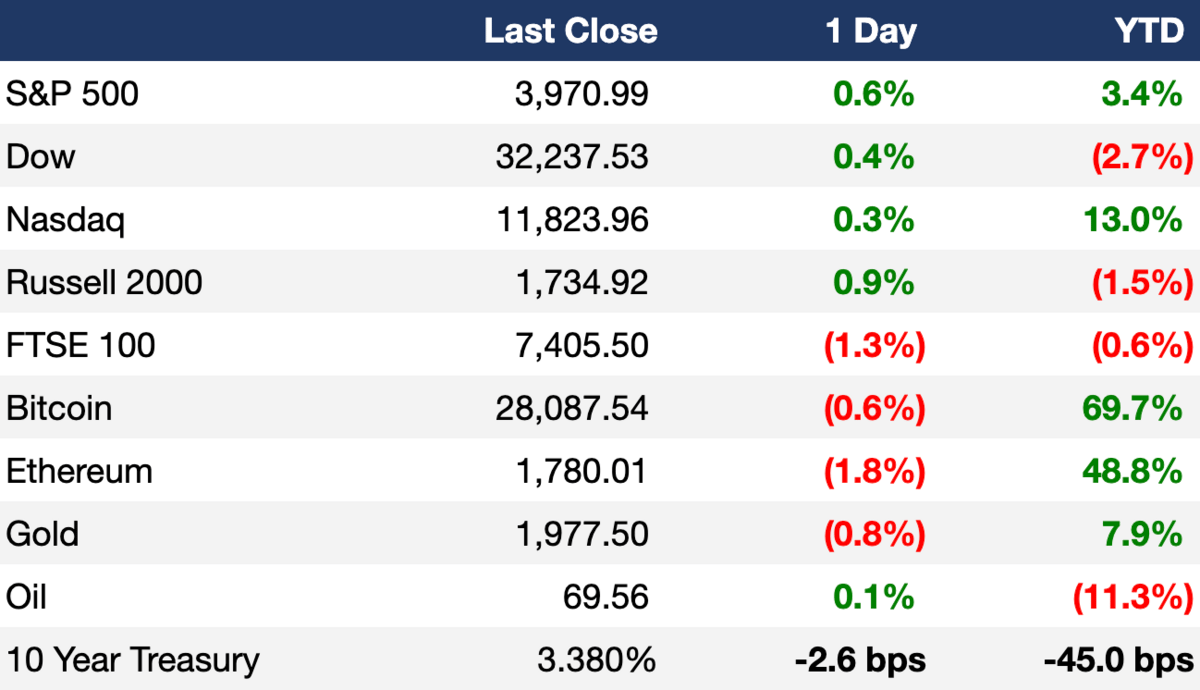

Markets

US stocks ended higher after a volatile trading session on Friday as investors shook off fears of banking crisis spilling over to Deutsche Bank

Deutsche Bank’s stock slid 9% following a CDS spike amid concerns about European banks' stability

All three major indexes ended the week in green

The pan-European Stoxx 600 fell 1.4% on Friday but posted a weekly gain

US 10Y yield declined for a third straight week

On Thursday we'll receive updated Q4 GDP numbers, and on Friday February's PCE reading and the eurozone's March CPI reading

Earnings

What we're watching this week:

Tuesday: Jefferies, Micron, lululemon

Full calendar here

Headline Roundup

US business investment appears weak in Q1 as orders rise moderately (RT)

IMF sees increased risks to financial stability and called for vigilance (RT)

Banking stress puts US and Europe on watch for credit crunch (RT)

No companies with investment-grade ratings sold new bonds in week of March 13 for first time since 2013 (WSJ)

Credit Suisse accessed over $55B in liquidity last weekend (RT)

JPMorgan, Citi and BofA tell staff not to poach clients from stressed banks (RT)

Small US banks see record drop in deposits after SVB collapse (RT)

Deutsche Bank CDS shot up above 220 bps (RT)

Credit Suisse could face disciplinary action (RT)

US mulls more support for banks while giving First Republic time (RT)

Dealmakers expect pick-up in activity despite 'brick wall' facing M&A (RT)

Pentagon woos Silicon Valley to join ranks of arms makers (WSJ)

European PE funds scout for defense deals (FT)

SoftBank’s LatAm fund commits to further investments despite losses (FT)

Bank of America is redeploying wealth management and banking employees (RT)

VCs race to land next AI deal on Big Tech's turf (RT)

Twitter employee stock grants reveal a $20B company valuation (TI)

Hundreds of funds will be stripped of ESG rating (FT)

Cost of rebuilding Ukraine jumped to $411B (NYT)

UBS's CTO and Credit Suisse's COO will lead merger efforts (RT)

Bed Bath & Beyond will cut 1.3k more jobs (RT)

OpenAI launched plugins for ChatGPT (OAI)

A Message From Sweater

With Venture Capital no longer reserved for only the elite, the power of the future is literally in the palm of your hand.

For the first time, accredited and non-accredited investors alike have the opportunity to support innovative startups through our groundbreaking app.

Sweater Ventures has set out to democratize the venture capital landscape, enabling investors of all backgrounds to invest in the fully managed Cashmere Fund.

Download the Sweater app today and join the community that is shaping their future.

Deal Flow

M&A / Investments

Brookfield Asset Management is in exclusive talks to buy a majority stake in data center operator Data4 for potentially $3.8B dollars, including debt (RT)

Bain Capital made a non-binding bid for Australian aged-care provider Estia Health for $518M (RT)

South Korean internet company Kakao agreed to buy a 15.8% stake in K-pop pioneer SM Entertainment from music label HYBE for $437M (RT)

Mysten Labs will buy $96M In shares and token warrants back from FTX (DC)

Financial services firm Bajaj Finance and Cathay Financial are among firms considering bids for retail bank Commonwealth Bank of Australia’s business in Indonesia (BBG)

Pennsylvania lender Customers Bancorp is considering a deal for all or part of the failed Silicon Valley Bank (BBG)

Valley Bank and First Citizens are bidding for SVB (BBG)

Arab Jordan Investment Bank agreed to buy emerging markets-focused bank Standard Chartered’s business in Jordan (BBG)

Sheikh Jassim Bin Hamad Al Thani, the son of Qatar’s ex-PM, submitted an improved bid to buy Premier League club Manchester United (RT)

Tom Brady acquired part ownership of the WNBA's Las Vegas Aces (AX)

VC

Electric commercial vehicle manufacturer Farizon Auto is considering raising up to $300M in funding ahead of a potential US IPO (BBG)

Apprentice.io, a startup allowing life science manufacturers to turn molecules into medicine, raised a $65M round led by ICONIQ Growth (FN)

Computing software startup Strangeworks raised a $24M Series A led by Hitachi Ventures, IBM, and Raytheon Technologies (FN)

Cloud identity security platform Britive raised a $20.5M Series B led by Pelion Venture Partners (FN)

Axios HQ, a communications software company that spun off of Axios last year, raised a $20M Series A at a $100M valuation led by Glade Brook Capital Partners (AX)

Lun Energy, a startup aiming to decarbonize homes, raised an $11.2M seed round from Norrsken VC, Partech, Lowercarbon Capital, and more (FN)

Huupe, a startup building a ‘smart basketball hoop’, raised an $11M Series A led by Protagonist VC, Marvan Ventures, and others (TC)

MystiFly, a vertical SaaS & marketplace provider for the airline industry, raised an $8M pre-Series B led by Cornerstone Venture Partners (PRN)

Dylibso, a startup helping developers take WebAssembly to production, raised a $6.6M seed round led by Felicis (TC)

Digital real estate marketplace ALT DRX raised a $3.6M seed round (FN)

Wilderness Labs, an IoT platform opening the embedded hardware space to .NET developers, raised a $3.3M seed round led by Apertu Capital (FN)

HeavyFinance, a climate tech investment marketplace for the agricultural industry, raised a $3.2M seed round led by Practica Capital (FN)

Social fitness app GoJoe raised a $1.5M round led by Superbet Ventures (FN)

IPO / Direct Listings / Issuances / Block Trades

German lender Oldenburgische Landesbank paused plans for a domestic IPO amid the recent banking crisis (BBG)

Debt

Swedish battery developer Northvolt is in talks to secure $5B+ in debt financing to help expand (BBG)

Fundraising

Portfolio Advisors raised over $1B for its eleventh global PE fund (DSA)

Crypto Corner

Exec's Picks

Have a big idea but struggling to find the right engineers to make it a reality? Meet Lemon.io, your one-stop marketplace for accessing over 1,000 on-demand developers. Lemon.io only offers handpicked developers with 3 or more years of experience and strong proven portfolios, ensuring that you get only the highest-quality talent, and your engineer can start working on your project within a week! Visit Lemon.io to learn more and find your perfect developer.

Virginia Heffernan wrote a cool piece in Wired detailing her experience visiting a TSMC factory in Taiwan.

The Wall Street Journal published an interesting article on why young Americans love Chinese apps.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.