Together with

Good Morning,

BofA is now forecasting rate hikes after a stellar jobs report, IMF will study risks of PIK debt, biotech VC is booming since the turn of the new year, Point72 is raising fees, the dollar is proving difficult for global peers, and Zuck went full anti-woke on Joe Rogan's podcast after eliminating DEI at Meta.

Meta wasn't even the only Big Tech name to stir up DEI news this weekend…

Whether you work with early-stage startups or growing enterprises, Brex offers the complete financial stack for your firm. Optimize your and your PortCos' banking needs with Brex, startup banking that takes every dollar further.

Let's dive in.

Before The Bell

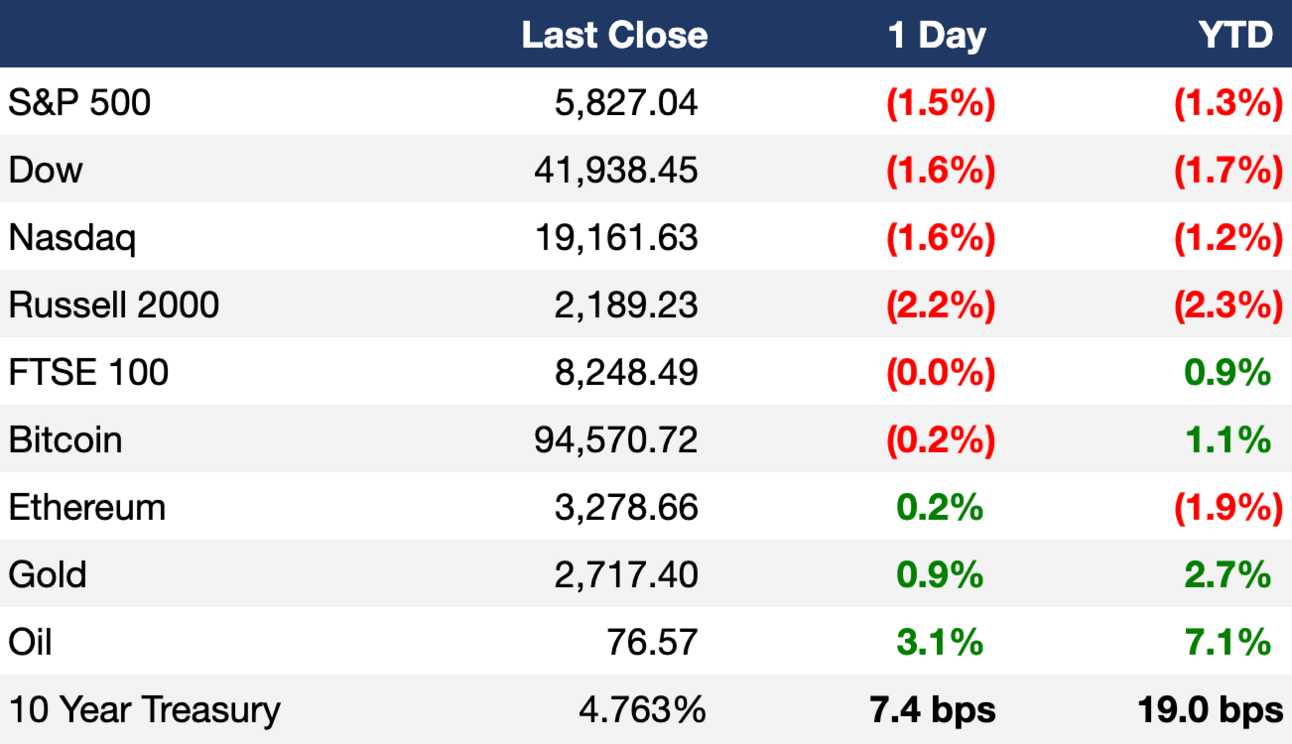

As of 1/10/2025 market close.

Markets

US markets tumbled on Friday as a hot jobs report dashed hopes for further Fed rate cuts

S&P had its worst day since mid-December

Rates traders priced in just one rate cut for 2025

VIX index hit a three-week high

China's CSI 300 fell over 5% last week in its worst start to the year since 2016

MSCI China index entered a bear market

US 2Y yield surged over 10 bps to 4.37%

US 10Y yield spiked to its highest since November 2023

US 30Y yield hit 4.95% to hit its highest since November 2023

China 10Y yield fell below 1.6% to a new record low

US dollar posted a sixth-straight weekly gain to hit a fresh two-year high

Euro fell to its lowest since November

Pound hit a 14-month low on UK fiscal woes

Aussie dollar hit its lowest since Covid

Oil hit a four-month high amid sweeping US sanctions on Russia

Uranium surged to a record high amid an AI energy demand frenzy

Bond markets got absolutely battered last week on dampened rate cut hopes, which also pressured equity valuations. Check out Peter Tuchman's weekly recap on the sentiment from the floor.

Earnings

What we're watching this week:

Wednesday: JPMorgan, Goldman Sachs, Citigroup, Wells Fargo, BlackRock

Thursday: Bank of America, Morgan Stanley, UnitedHealth, TSMC

Full calendar here

Prediction Markets

Not a complete hostile takeover but maybe a minority stake purchase?

Headline Roundup

US unemployment rate fell to 4.1% in blowout jobs report (CNBC)

BofA is now projecting a rate hike (RT)

US stock market faces reality check in high-bar earnings season (BBG)

PE targets Europe for big LBO deals (FT)

IMF will study growing risks from PIK debt (BBG)

UK gilt selloff triggers pension cash calls in first big test since 2022 crisis (RT)

PIMCO, others stick with UK bond bets despite turmoil (BBG)

Point72 will return up to $5B in profits and raise fees (WSJ)

Singapore SWF GIC is increasing private markets exposure (BBG)

Activist investor Weinstein wants to be 'white knight' of UK stock market (FT)

Chinese traders' demand for global stocks prompt rare ETF halts (BBG)

FDIC extended BlackRock deadline over US bank stakes (BBG)

Meta abolished DEI (AX)

Amazon ended some DEI programs (CNBC)

Apple opposes shareholder measure to eliminate DEI (BBG)

Pfizer must face lawsuit over diversity program (RT)

JPMorgan disabled employee comments after RTO backlash (WSJ)

US supports Musk argument in OpenAI lawsuit (RT)

SCOTUS appears inclined to uphold TikTok ban (RT)

Disney, Fox and Warner canceled their Venu Sports streaming JV (WSJ)

Kohl's will close 27 stores (AX)

A Message from Brex

Banking That Takes Every Dollar Further

Brex knows runway is everything, so they built a banking solution that helps companies take every dollar further.

Unlike traditional banking solutions, Brex has no minimums and give companies access to 20x the standard FDIC protection via program banks.

Plus, companies can earn industry-leading yield from their first dollar - while being able to access their funds anything.

If you want to make sure your company and/or your portfolio companies have a place to save, spend, and grow capital, check out Brex.

Deal Flow

M&A / Investments

Electric energy firm Constellation Energy agreed to buy rival Calpine in a ~$27B cash and stock deal, including debt

Johnson & Johnson is exploring a bid for $10B-listed CNS-focused Intra-Cellular Therapies

Apollo is considering taking a $9.5B stake in 7-Eleven-owner Seven & i as part of a bid by the founding Ito family to take the company private

KKR is exploring a sale of UK waste management firm Viridor at an $8.5B valuation, including debt

German media group Ströer is exploring a sale of its $4B core advertising unit after receiving takeover interest from PE firms KKR, H&F, CVC, and EQT

Blackstone is weighing a sale or IPO of mobile app marketing provider Liftoff at an over $4B valuation, including debt

Chow Tai Fook Enterprises is considering a stake sale in Australian electricity supplier Alinta Energy, which it acquired for $2.5B in 2017

Bain Capital sweetened its takeover offer for Australian wealth manager Insignia Financial to match CC Capital's $1.8B bid

Quanterix agreed to acquire life sciences peer Akoya Biosciences in an all-stock deal to create a $670M combined entity

US sued to block American Express GBT's $570M proposed acquisition of rival corporate travel management firm CWT

Biogen offered to acquire the remaining 90% stake in brain-focused biopharma firm Sage Therapeutics at a $442M valuation

Investment firm DBAY Advisors agreed to acquire UK healthcare group Alliance Pharma for $430M cash

Italian fashion brand Prada is reportedly evaluating a potential purchase of Versace from Capri Holdings

VC

Cardiovascular drug development startup Kardigan raised a $300M Series A led by Perceptive Advisors, ARCH Venture Partners, and Sequoia Heritage

Windward Bio, a clinical-stage drug development startup focused on immunological diseases, raised a $200M Series A led by OrbiMed, Novo Holdings, and Blue Owl Healthcare Opportunities

Timberlyne Therapeutics, a clinical-stage biopharma startup developing novel therapies for autoimmune disorders, raised a $180M Series A led by Abingworth, Bain Capital Life Sciences, and Venrock Healthcare Capital Partners

Ouro Medicines, a biotech developing immune reset therapeutics, raised a $120M Series A led by TPG Life Sciences Innovations, NEA, and Norwest Venture Partners

Saluda Medical, a medical device company developing treatments for chronic neurological conditions, raised $100M led by Redmile Group

RhyGaze, a biotech focused on vision loss, raised an $86M Series A led by GV

Light Horse Therapeutics, a developer of small molecule therapeutics, raised a $62M Series A led by Versant Ventures

Numab Therapeutics, a startup developing antibody-based immunotherapies for inflammation and cancer, raised a $55M Series C led by Cormorant Asset Management, Forbion, HBM Healthcare Investment, and Novo

Supply chain security startup Overhaul raised a $55M round led by Springcoast Partners

Immunis, a clinical-stage biotech developing multi-active biologics for age and disease-related immune dysregulation, raised a $25M Series A-1 from LifeSpan Vision Ventures, JLS Fund, and more

AnaCardio, a clinical-stage biopharma focused on heart failure treatments, raised a $19M Series A extension led by Novo Holdings, Pureos Bioventures, and Sound Bioventures

Nsave, a provider of trusted and compliant accounts for people in high inflation economies, raised an $18M Series A led by TQ Ventures

Gumloop, a startup letting users automate tasks with drag-and-drop modules, raised a $17M Series A led by Nexus Venture Partners

Beams, a pricing engine to predict the cost of home renovation projects, raised a $9M Series A led by ETF Partners

Biomaterials startup UNCAGED Innovations raised a $5.6M seed round led by Green Circle Capital and Fall Line Capital

Nevermined, an AI payment infrastructure for AI-to-AI transactions, raised a $4M round led by Generative Ventures

IPO / Direct Listings / Issuances / Block Trades

Venture Global LNG, the second largest US producer of LNG, will begin pitching investors this week for its US IPO, targeting a $110B valuation

PE firm H&F is considering a listing of UK security group Verisure at a ~$20.5B valuation

TDR Capital-backed UK gas station operator EG Group plans to IPO this year at a potential $13B valuation

China's Zijin Mining Group is in talks to take a stake in $6B-listed Chinese lithium miner Zangge Mining, which could potentially lead to a takeover

UK luxury logistics firm Ferrari Group is considering an Amsterdam IPO

Weight-loss drug developer Metsera filed for a US IPO just nine months after emerging

Debt

Mars raised $1B via a privately-placed dollar and pound-denominated bond sale

Nigeria's neighbor Benin is seeking to raise $750M in a dollar bond sale

India's Vedanta Resources is in talks with banks to raise over $450M to repay debt

Tata Capital, the financial services unit of Indian conglomerate Tata Group, is planning a debut dollar bond sale

Bankruptcy / Restructuring / Distressed

Private hospital owner Prospect Medical filed for Chapter 11 bankruptcy

Fabrics and crafts retailer Joann is considering a second bankruptcy filing in less than one year

Italy's Acciaierie d'Italia steelworks, which is currently in state-led administration, received 10 purchase offers

A Hong Kong court ordered the liquidation of a key offshore unit of failed Chinese developer Evergrande

Chinese developer Shimao Group received a liquidation petition

Fundraising

Private credit firm Medalist Partners is seeking to raise $750M for its fourth fund

Eli Lilly partnered with VC a16z on a $500M Biotech Ecosystem Venture Fund

King Street Capital will launch a new private credit fund anchored by Generali

Crypto Sum Snapshot

Jamie Dimon slammed crypto in his latest interview (CBS)

Pastor who saw crypto project in 'dream' was indicted for fraud (BC)

CFPB plans to strengthen consumer safeguards for digital payments (BBG)

Check out Crypto Sum for the full stories on everything crypto!

Exec’s Picks

Two seasoned investment bankers. 30 years of joint industry experience. 45 minutes of exclusive insights.

Join UpSlide's webinar on January 30th and learn how to transform your teams' pitching process and beat the competition this year. Register today.

Joe Rogan sat down at length with Mark Zuckerberg, who slammed DEI and exposed the Biden administration in a candid conversation addressing topics surrounding Meta and their role in the evolving political landscape. It's a worthwhile listen.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.