Together with

Good Morning,

A cheaper and better Chinese AI model has Silicon Valley on edge, corporate America is racing to keep up with executive orders, BOJ raised rates for a third time, London lawyers are flocking to PE, and Starbucks' new CEO made some serious bank in just four months on the job.

Master your modeling and valuation skillset and accelerate your Wall Street career with the FMVA® Certification from CFI, the #1 rated finance training provider.

Let's dive in.

Before The Bell

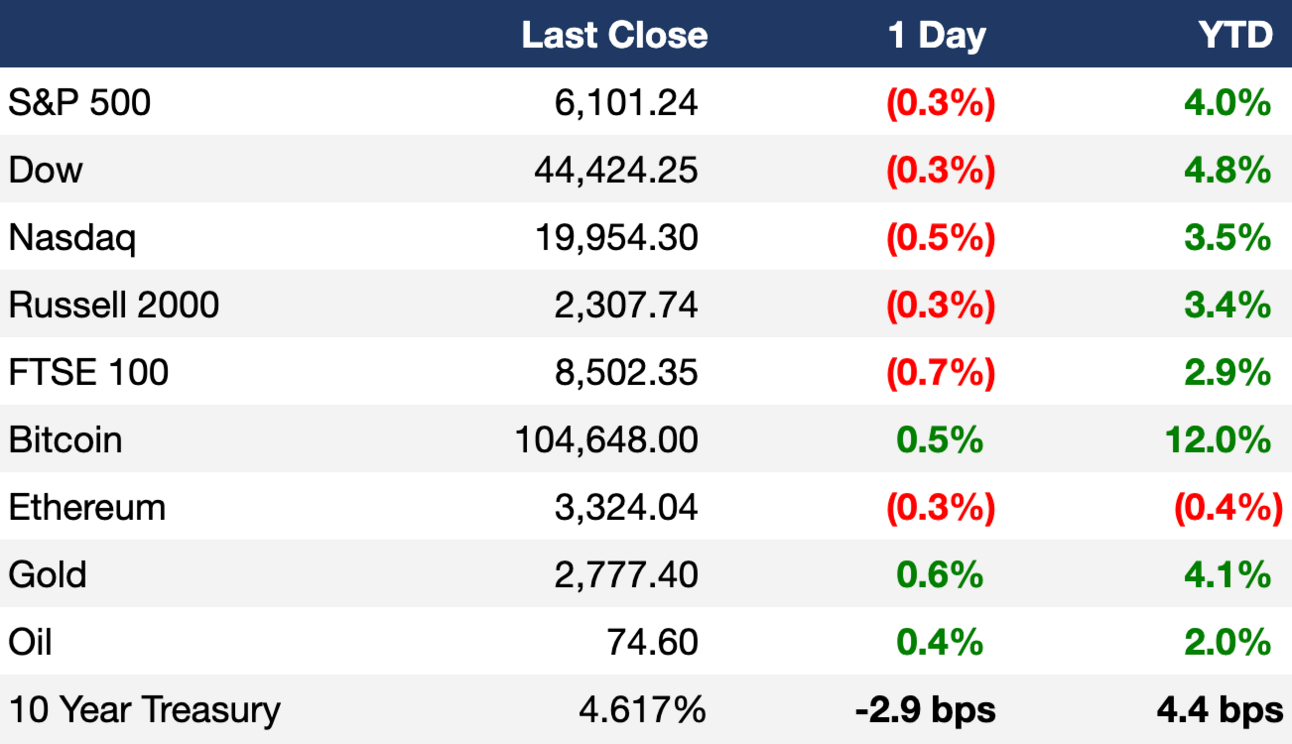

As of 1/24/2025 market close.

Markets

US stocks fell on Friday as investors digested new US policies and prepared for a slew of earnings ahead

All three major indexes snapped a four-day win streak

Dollar had its worst week in fourteen months after Trump hinted at softer China tariffs

Traders seem to be juggling data that supports rate cuts vs new policies that hinder the same. Or at least that's what Peter Tuchman sees. Check out his weekly market update straight from the floor. Energetic commentary as always…

Earnings

Verizon beat Q4 earnings estimates on its best quarter for wireless subscriber growth in five years (RT)

American Express met Q4 earnings and revenue estimates as spending picked up on the back of millennials and Gen Z (CNBC)

What we're watching this week:

Today: AT&T

Tuesday: Starbucks, Boeing, Lockheed Martin, RTX, Royal Caribbean

Wednesday: Tesla, Meta, Microsoft, ASML, IBM, T-Mobile

Thursday: Apple, Intel, Visa, UPS, Mastercard, Blackstone, Southwest

Friday: Brookfield, ExxonMobil, Chevron

Full calendar here

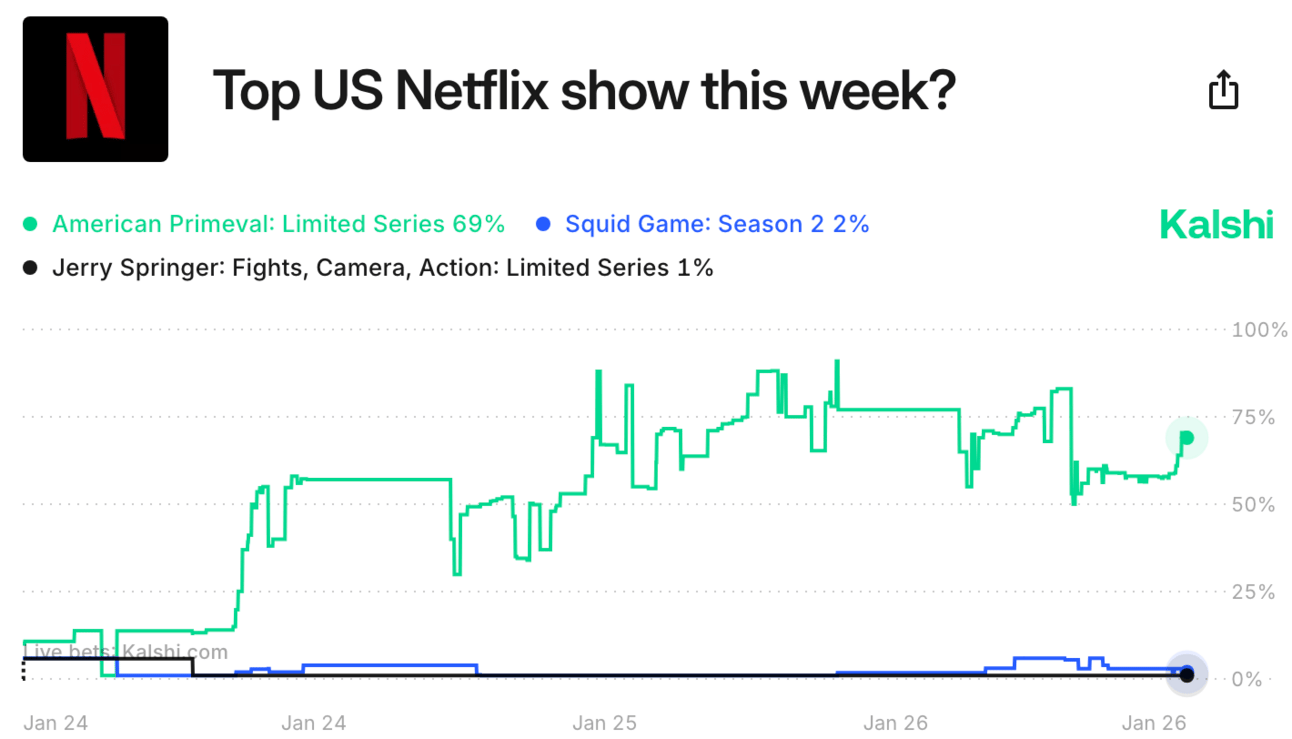

Prediction Markets

Netflix smashed earnings on record subscriber growth and if you're part of their revenue, perhaps you'll know what's trending.

Headline Roundup

US business activity hit a nine-month low but hiring accelerates (RT)

Eurozone private sector unexpectedly returned to growth (BBG)

BOJ raised rates to 0.5% to the highest since 2008 (CNBC)

Singapore eased monetary policy for first time since Covid (FT)

High-stakes earnings season begins as 'Mag 7' profit growth slows (BBG)

Stocks are jumping on earnings wins by the most since 2018 (BBG)

'Leveraged to the hilt': PE-backed firms hit by wave of bankruptcies (FT)

Off-exchange activity is now over half of total US stock market volume (BBG)

US stocks are most expensive relative to bonds since dotcom bubble (FT)

Junior London lawyers flock to PE roles as public markets struggle (FT)

Japanese investors dump Eurozone bonds at fastest pace in a decade (FT)

Europe banks will payout $130B to shareholders for second-straight year (FT)

Hedge fund industry AUM reached $4.5T in 2024 (RT)

Half of investors want to allocate more to hedge funds (RT)

Risk becomes a safe haven in volatile bond market (BBG)

FX volatility is set to wipe out EM carry trades (BBG)

China boosts index investments in latest bid to revive market (BBG)

Global funds rethink India promise as $2T rally stumbles (BBG)

Half of MBS investors expect Fannie and Freddie privatized by 2028 (BBG)

Frenetic executive orders leaves corporate America struggling to keep up (FT)

Lina Khan warns of catastrophe if US gives free hand to PE (FT)

UK seeks to unlock billions from pension schemes for investment (FT)

JPMorgan and BofA will lobby US after conservative criticism (RT)

JPMorgan's global chair of IB will retire after three decades (BBG)

Cheap Chinese AI model DeepSeek outperforms US giants (CNBC)

Starbucks new CEO earned $96M in just four months (BBG)

Target becomes latest to roll back DEI (CNBC)

Meta plans AI CapEx of up to $65B this year (RT)

Google pushes global agenda to educate workers and lawmakers on AI (RT)

US asks SCOTUS to pause cases as it reconsiders policy (RT)

Bangladesh hires Big Four audit firms to review ‘robbed’ banks (FT)

US homes sales fell to lowest level in 30 years last year (WSJ)

Used iPhones with installed TikTok app are selling for $3k (NYT)

A Message from CFI

Master your valuation and modeling technicals with CFI

You've aced your accounting exams and memorized all your corporate finance concepts, but can you confidently apply that in interviews and on the job?

That's where CFI comes in.

If you're interested in consistently delivering stronger models and valuations, it's time you check out CFI's Financial Modeling & Valuation Analyst (FMVA®) Certification. Their robust program equips you with the tools to develop advanced financial modeling techniques so you can truly grow your career.

See for yourself:

Over 75% of CFI learners report significant career advancement within months of completing their programs.

Real-World Application: CFI courses are designed and led by industry experts to give you practical knowledge that you can apply immediately in your role.

Comprehensive Training: From financial modeling to data analysis, our curriculum covers all the essential skills you need to succeed in your role.

Flexible Learning: Learn at your own pace, on your schedule, with our on-demand courses accessible 24/7 – anytime, anywhere.

Global Networking: Join an active community of over 2M finance professionals from over 170 countries who trust CFI to advance their careers in finance and banking.

Ready to get started? Earn your CFI FMVA® Certification today.

Deal Flow

M&A / Investments

US plans to tap Oracle and others US investors to take a controlling stake in TikTok US

AI startup Perplexity revised its TikTok merger proposal that could give US a 50% stake to followed by an IPO

Italian lender Monte dei Paschi di Siena launched a $13.9B all-share takeover offer for larger rival Mediobanca

Project Rise Partners made a last-minute $13.5B takeover bid for Paramount Global, which is in the process of being acquired by Skydance Media and RedBird Capital Partners

Beacon Roofing Supply is soliciting interest from strategic and PE suitors as it seeks to fend off a hostile $11B takeover bid from rival QXO

Global spirits maker Diageo is reportedly exploring a spinoff or sale of beer brand Guinness and is reviewing its stake in LVMH's drinks unit Moet Hennessy

PE firms Warburg Pincus, CVC, and TPG are bidders competing to acquire a stake in the Philippines' Metro Pacific Hospital from KKR and Singapore's GIC at a $3B valuation

Blackstone is nearing a deal to buy out partner TT Group's 50% stake in a $2.5B portfolio of more than 5k UK railway arches

Triton Partners is exploring a $2.1B sale of Kelvion, a German supplier of cooling equipment

Apax Partners is in talks to acquire a stake in audit and consulting firm CohnReznick at a $2B valuation

HongShan Capital Group agreed to buy a majority stake in audio equipment maker Marshall in a $1.1B deal

Businessman Digvijay Gaekwad's proposed to acquire a 26% stake in Indian financial services company Religare Enterprises at a ~$1.1B valuation

The Japfa founding family offered to take Singapore meat producer Japfa private at an $877M valuation

Boeing's sale of its Jeppesen navigation unit is attracting interest from RTX, Honeywell, GE Aerospace, TransDigm, and PE firms Advent, Blackstone, Carlyle, Thoma Bravo, Veritas, and Warburg Pincus

UK retailer WH Smith is exploring a sale of its UK high street business

Spain's Telefonica attracted takeover interest for its Argentina unit

Chinese construction machinery maker Sany Heavy Industry is considering a stake sale in its Sany Heavy Industry India unit

VC

ElevenLabs, a startup developing synthetic voice technology, raised a $250M Series C at a $3B-3.3B valuation led by ICONIQ Growth

Clutch, a startup helping credit unions improve the digital onboarding experience, raised a $65M Series B led by Alkeon Capital Management

Digital healthcare delivery startup Solera Health raised a $40M Series E led by Health Care Service Corporation

Recycle Track Systems, a waste and recycling management platform, raised $40M in funding led by Edison Partners

Women's hormone telehealth platform Allara raised a $26M Series B led by Index Ventures

SignalPlus, a software and infrastructure solutions for crypto derivatives, raised an $11M Series B led by AppWorks and OKX Ventures

AI-powered real estate negotiation platform Indigo raised an $8M seed round led by NFX, Era Ventures, and GTM Fund

Radius, a decentralized network turning MEV into a revenue source, raised a $7M seed round led by Pantera Capital

Foyer, a startup helping people save for home down payments, raised a $6.2M seed round led by Alpaca VC and Hometeam Ventures

Swarm Network, a decentralized platform for collaboration among multiple AI agents, raised a $3M seed round led by ZeroStage and Y2Z Ventures

Pipeshift, an AI infrastructure startup, raised a $2.5M seed round led by Y Combinator and SenseAI Ventures

IPO / Direct Listings / Issuances / Block Trades

Bain Capital-backed EcoCeres is considering a $500M-$1B European IPO that could value the producer of sustainable fuel at $5B

UAE's Etihad Airways is planning to IPO at a $1B valuation

Saudi Arabia's flynas is planning to IPO at a potential $2B valuation

Dorf-Ketal Chemicals India filed for a $580M local IPO

Bahrain-based Investcorp could consider an IPO in 3-5 years

Debt

Banks led by Morgan Stanley are preparing to sell up to $3B of senior debt tied to Elon Musk's LBO of Twitter / X

India's largest steelmaker JSW Steel is seeking a $900M loan

Bankruptcy / Restructuring / Distressed

The Container Store won court approval to exit Chapter 11 bankruptcy and restructure $88M of debt

Talks between Platinum Equity-backed PR firm Cision and a group of lenders fell apart days away from a credit facility repayment deadline

Fundraising

French insurer AXA's alternative assets business raised $4.2B for real estate debt strategies last year

VC Madrona raised $770M across its tenth early-stage fund and its fourth acceleration fund

Real estate investor Harrison Street raised $600M for a debut data center fund

Crypto Sum Snapshot

a16z will close London office in pullback from UK crypto investing

Coinbase CEO says surge in tokens make listing evaluations harder

SEC repeals crypto-accounting guidance reviled by industry

Trump signed an executive order to promote dollar-backed stablecoins worldwide

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

Alt Managers, stop wasting your time managing vendors, contracts, invoices, and expense allocations manually in Excel. StavPay automates and streamlines this process and now has over 95 clients with $2.2T AUM leveraging the system daily. Get more details at stavpay.com and schedule a demo today.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.