Together with

Good Morning,

A crazy 24 hours on the global stage, with flaring Middle East tensions and a devastating Boeing plane crash in India🙏

Elsewhere, private credit is increasingly aiding struggling PE, BlackRock is embarking on a mega $400B fundraising campaign, and Trump is getting creative with his attacks on J Pow.

It's time to upgrade your 13-week cashflow forecasts with a tool built specifically for PE and that's where Pegasus Insights comes in. Check 'em out!

Let's dive in.

Before The Bell

As of 6/12/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rose yesterday as optimistic inflation data sent yields lower

UK's FTSE 100 hit an ATH

China's CSI 300 is lagging Hong Kong's Hang Seng China Enterprises Index by the most YTD since 2003

China stocks premium over Hong Kong peers narrowed to 27%, a five-year low

HSCEI entered a bull market this week

Oil surged after Iran and Israel launched strikes on each other

Dollar hit its lowest since 2022

Taiwan dollar hit a three-year high

Earnings

Prediction Markets

The oil traders are monitoring the situation👍

Headline Roundup

Trump called J Pow a 'numbskull' in fresh attack on Fed rate policy (CNBC)

US PPI index rose 2.6% YoY (WSJ)

Quarter of top firms in London's 2021 IPO class quit the stock exchange (FT)

Trend hedge funds struggle as macro funds embrace volatile markets (RT)

Corporate insiders sold shares at fastest pace since November (BBG)

Two-thirds of family offices are planning to increase PE exposure (BBG)

PE stuck in limbo gets help from private credit (BBG)

US investors pivot to European private credit for stability (PB)

Moody's sounds alarm on private funds for individuals (WSJ)

Investor rush for India exposure revs up block deals and IPOs (BBG)

Japan credit sales hit a June high as risk appetite returns (BBG)

Citigroup and Carlyle partnered to lend and invest in fintechs (BBG)

CoreWeave short sellers are down $1.6B in losses (BBG)

Norway’s $1.9T SWF put TD Bank Group under observation (BBG)

BlackRock built an AI analyst to scan filings (BBG)

BlackRock CEO Larry Fink is not leaving anytime soon (BBG)

Toyota chairman wins re-election amid $33B buyout bid (RT)

Argentina monthly inflation fell below 2% for first time since Covid (FT)

Fake McDonald's is lobbying Putin to block return of western companies (FT)

US regulators say data centers pose threat to electric grids (BBG)

US household net worth fell for first time since 2023 (BBG)

Boeing crash in India was first fatal incident involving a 787 (WSJ)

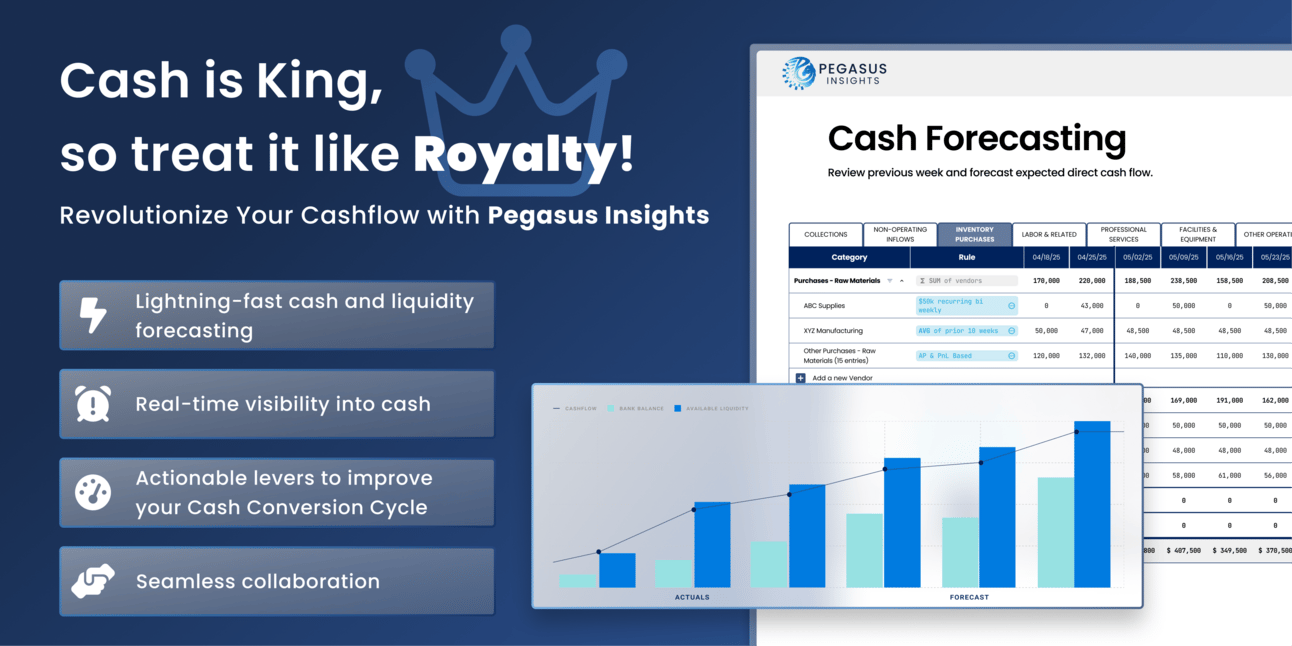

A Message from Pegasus

Liquidity Management for the PE Backed CFO

In an LBO, Cash is king! Pegasus Insights treats it like royalty.

Pegasus Insights is an AI-powered, next-gen, liquidity management platform purpose-built by Finance Experts for Finance Experts. Pegasus Insights helps PE-backed CFOs, Deal Teams, and Operating Partners optimize cashflow.

Pegasus Insights delivers:

Lightning-fast cash and liquidity forecasting

Real-time visibility into cash

Seamless collaboration

Actionable levers to improve your Cash Conversion Cycle

Model faster, with confidence, and stay ahead of the competition.

Book a demo to see it in action.

Deal Flow

M&A / Investments

Chinese Big Tech giant Tencent is exploring a deal to acquire $15B-listed South Korean game developer Nexon

French banking group BPCE agreed to acquire a 75% stake in Portugal's Novo Banco from Lone Star Funds at an ~$8.1B valuation

Biotech giant Thermo Fisher Scientific plans to sell its diagnostics unit for ~$4B to PE

Defense vehicle manufacturer Allison Transmission agreed to acquire drivetrain manufacturer Dana's off-highway unit for $2.7B

BioNTech agreed to acquire biopharma firm CureVac in an all-stock deal valued at ~$1.3B, representing a 34% premium

Japan's Sumitomo Realty & Development is seeking to sell a portfolio of Tokyo office assets for over $700M after activist Elliott disclosed a stake

J&J's consumer health spinoff Kenvue is exploring a sale of some of its skin health and beauty brands

VC

Multiverse Computing, a Spanish a quantum computing technology that shrinks LLMs' size by 95%, raised a $215M Series B led by Bullhound Capital

Nominal, a unified real-time test stack for physical systems, raised a $75M Series B led by Sequoia Capital

Tastewise, a GenAI platform for the food and beverage industry, raised a $50M Series B led by TELUS Global Ventures

Payment operating system Payrails raised a $32M Series A led by HV Capital

AI sales startup Landbase raised a $30M Series A led by Sound Ventures and Picus Capital

Brand tracking software startup Tracksuit raised a $25M Series B led by VMG Partners

German cleantech startup Voltfang raised a $17M Series B led by FORWARD.One

Warehouse automation startup Warp raised a $10M Series A led by Up.Partners and Blue Bear Capital

Bolo AI, an enterprise AI startup focused on the heavy industry, raised an $8.1M seed round led by True Ventures

AI-based software platform for industrial companies RIIICO raised a $5M seed round led by Pi Labs

Olyzon, an agentic CTV advertising platform, raised a $5M seed extension led by Cassius Capital

Weavy, an Israeli AI-powered platform for image and video editing, raised a $4M seed round led by Entree Capital

IPO / Direct Listings / Issuances / Block Trades

Chinese electronics components manufacturer Sanhua is seeking to raise $1B in a Hong Kong listing

Indian conglomerate Reliance Industries sold a 3.7% stake worth ~$900M in Asian Paints via block trade as part of portfolio rebalancing efforts

No-fee banking fintech Chime surged 66% in its trading debut after raising $864M in an IPO priced above a marketed range, giving the firm a $16.4B market cap

Luxury resort living developer GemLife raised $486M in Australia's biggest IPO YTD

JSW Cement began a roadshow for a Mumbai IPO that could raise up to $468M

Debt

India's Bangalore International Airport is in advanced talks to raise ~$1.1B through local currency bonds to refinance existing debt and fund expansion projects

Apollo is preparing an $870M loan to back Neinor Homes' $2.6B bid for Aedas Homes, a deal that could create Spain's largest residential developer

Trump's alma mater University of Pennsylvania secured $500M in credit lines amid federal funding freezes

Seazen Group sold a $300M note, the first dollar-bond issuance by a major private-sector Chinese developer since 2023

South Africa will provide additional guarantees to Transnet, enabling the state-owned ports and freight rail operator to meet upcoming debt obligations

Bankruptcy / Restructuring / Distressed

Bankrupt KKR-owned Japanese auto-parts supplier Marelli won court approval to borrow $519M to support its reorganization process

CWCapital took over the $359M mortgage on 85 Broad Street, Goldman Sachs former NYC HQ, after Ivanhoe Cambridge defaulted; the loan is now in special servicing as workout plans are explored

Solar company Sunnova won court approval to access a $90M bankruptcy loan to stay operational during Chapter 11 and support a sale

UK distressed assets investor Gordon Brothers acquired UK discount retailer Poundland from Poland's Pepco Group for $1

A PIMCO-led creditor group holding loans tied to Saks-parent Hudson's Bay acquisition of luxury retailer Neiman Marcus tapped advisers ahead of looming maturities

Fundraising / Secondaries

BlackRock plans to raise $400B across private market funds by 2030

Ares closed its debut data center fund Japan DC Partners I with $2.4B with a major commitment from Canada's CPPIB

Investment firm Patria Investments raised $314M for its debut LatAm private credit fund

Sustainability-focused VC Ecosystem Integrity Fund raised $225M for its fifth fund

Canadian biotech VC Genesys Capital is nearing the final close of its fourth fund, its largest fund yet

Crypto Sum Snapshot

SEC axed Biden-era proposed crypto rules in flurry of repeals

Crypto influencer Anthony Pompliano will launch a Bitcoin-buying vehicle

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

The Infrastructure Play for the Growing Crypto Industry

Bitcoin Depot (Nasdaq: BTM), the world's largest Bitcoin ATM operator, posted strong Q1 2025 profits. Revenue is driven by ATM usage, not just Bitcoin's price, fueling continued global expansion.

Ben Carlson shared his thoughtful perspective on the likelihood that stocks DON'T go up in the long-run.

*The above is for general informational purposes only and is not investment advice nor does it constitute an offer, recommendation, or solicitation to buy or sell a particular financial instrument. Bitcoin Depot is not a registered investment adviser under the U.S. Investment Advisers Act of 1940. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer by Bitcoin Depot to buy or sell any securities or other financial instruments

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

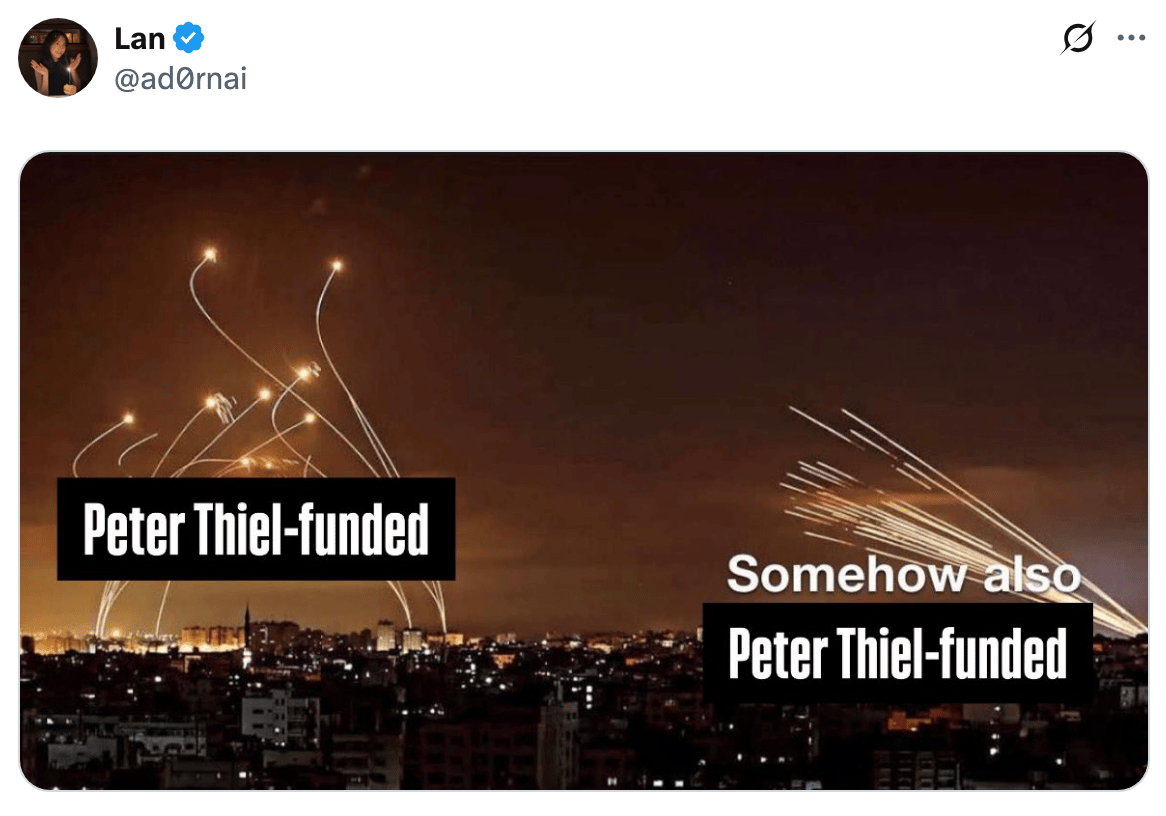

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.