Together with

Good Morning,

Biden and McCarthy appear to have reached a debt deal, dividends from the US’s biggest companies keep growing, corporate VCs are riding the AI wave, India once again has the 5th biggest stock market in the world, China rejected the US’s request to have defense chiefs meet, and Lazard named Peter Orszag as its new CEO.

If you’re looking to hire, manage, and pay a remote / global team, check out today’s partner: Deel.

Let’s dive in.

Before The Bell

As of 5/26/2023 market close.

Markets

US and UK stock and bond markets were closed in observance of public holidays yesterday

Stocks rallied Friday on rising optimism that DC lawmakers would reach a deal to raise the US debt ceiling while also digesting upwardly revised Q1 GDP, inflation and jobs data

Nasdaq notched a fifth straight green week to close at its highest level since August 2022

Odds of a 25 bps June Fed hike increased to 50.2% from 17.4% one week ago

The pan-European Stoxx 600 rose 1.2% Friday after falling to its lowest level since early-April

Japan's Nikkei index rose to its highest level since July 1990

2Y US Treasury yields rose for an 11th straight session

US 6-month CDS dropped 13 bps to 212 bps

Dollar hit a 6-month high versus yen

Turkish lira hit a new low after Erdoğan’s election victory

On June 2, we'll receive a crucial May jobs report

Earnings

Big Lots missed Q1 estimates after seeing a larger-than-expected loss due to furniture product shortages and bad weather, and management is suspending dividends; the stock fell 13% (MW)

What we're watching this week:

Today: HP

Wednesday: Salesforce, Chewy, CrowdStrike

Thursday: Broadcom, Macy’s, Dollar General, Lululemon, Dell

Full calendar here

Headline Roundup

Biden and McCarthy reached a debt-ceiling deal, which now awaits Congress approval (AP)

Dividends from 1.2k largest companies hit record $326B in Q1 (FT)

US MMFs swelled to a record high $5.4T last week (FT)

ETF share of US market turnover jumped to a record 31% (FT)

PE investment trusts are seeing extreme gaps in valuations vs offer prices (FT)

US investment adviser business is seeing a mass exodus (FT)

Corporate VCs are riding the AI startup wave (AX)

India reclaimed spot as world’s fifth-largest stock market (BBG)

AI boom is creating a chip shortage (WSJ)

China rejected US request for a meeting between defense chiefs (WSJ)

Norway’s wealth fund sides with climate activists against ExxonMobil and Chevron (FT)

Temasek cut pay of employees behind failed $275M FTX bet (FT)

Lazard named Peter Orszag as CEO (RT)

Georgian billionaire wins $926M from Credit Suisse after fraud (RT)

PwC Australia put nine partners on leave amid tax leak scandal (RT)

JPMorgan will cut ~500 jobs (RT)

Volkswagen is embracing an Americana personality to win US market (WSJ)

Nvidia's CEO thinks AI will allow everyone to be able to code (RT)

UK regulator is probing UK's sustainable loans market (FT)

Elon Musk is expected to visit China to meet officials this week (YF)

European taxis are flocking to Uber (RT)

High-school grads are forgoing college in hot labor market (WSJ)

A Message From Deel

Compliantly hire anyone, anywhere, in 5 minutes with Deel

Deel is your one-stop shop for hiring, paying, and managing your remote team.

With their tech-enabled self serve process, you can now hire independent contractors or full-time employees in over 150 countries, compliantly and in minutes.

They stay on top of local labor laws across the world to ensure compliance and mitigate risk so that you don't have to.

Today, Deel serves over 8,000 customers from SMBs to publicly traded companies.

Deal Flow

M&A / Investments

US crop merchant Bunge is in talks with commodities mining and trading company Glencore over a potential tie-up with its Viterra grains business, which would create a combined entity worth $25B (BBG)

Part owner and Australian billionaire Mike Cannon-Brookes acquired all assets of, and intends to restart, the collapsed $20B Australian solar project Sun Cable (BBG)

Jim Ratcliffe remains the lead bidder for Manchester United despite rival Qatari businessman Sheikh Jassim raising his bid to $6.31B (BBG)

ConocoPhillips bought the remaining 50% stake in its Surmont oil facility for ~$3B (RT)

HDI International agreed to purchase Liberty Mutual Insurance’s Latin American business for ~$1.5B (BBG)

Baring Private Equity Asia EQT will buy India’s Housing Development Finance Corp’s educational loan business Credila Financial Services for $1.3-1.5B (RT)

A savings bank-led consortium acquired a 24.95% stake in German utility EnBW’s high-voltage transmission grid TransnetBW for $1.1B (RT)

PE firm Kelso & Co is exploring a sale of Augusta Sportswear Brands, a US catalog seller of team sports uniforms, for $700M-$800M (RT)

Carlyle Group agreed to acquire Czech optics maker Meopta for ~$771M (RT)

German airline Lufthansa intends to take over ITA Airways completely after it previously announced its acquisition of a 41% stake in the Italian airline for $358M (RT)

Investors in UAE hospital chain Aster DM Healthcare are in talks to sell a 30% stake in their India business for ~$300M (RT)

Lecram Holdings offered to purchase UK online real estate agent Purplebricks Group for $193M (RT)

GF Securities plans to purchase a 20% stake in Value Partners Group from its founders for $140M (BBG)

French billionaire Saade’s shipping company CMA CGM acquired media outlet Groupe Hima, a publisher of La Tribune, as it seeks to diversify (BBG)

Africa’s largest asset manager, Public Investment Corporation, is backing a potential bid by the ex-CEO of Telkom SA SOC for a 35% stake in the mobile phone company (BBG)

VC

Worldcoin, a crypto-project focused on creating a global ID, a global currency, and an app that enables payments and transfers using its token, raised a $115M Series C round led by Blockchain Capital (TC)

Indian electric cargo vehicle maker Altigreen Propulsion Labs is looking to raise $85M at a $350M valuation (BBG)

NYMBUS, a provider of fintech solutions, raised a $70M Series D led by Insight Partners (BW)

Zageno, an online marketplace for life science research products, raised $33M in funding led by General Catalyst, Grazia Equity, and OakRidge Management Group (FN)

ESpace Networks, a Florida-based software company focused on enterprise connectivity, raised a $10M Series A from Columbia Capital (BW)

Bossjob, a chat-first career platform for professional hiring in Southeast Asia, raised $5M in funding from undisclosed backers (FN)

Vensum Power, a startup building a 25kW software-defined power converter, raised a $4.1M seed round led by Lifeline Ventures (FN)

Nia Health, a Berlin-based digital solutions company focused on providing treatment and support for chronic skin conditions, raised a $3.8M seed round led by High-Tech Gründerfonds (FN)

Fintech startup Plenty raised a $2.75M pre-seed round from Phenomenal Ventures, 35V, Adam Nash, and Inovia Capital (FN)

Metalex, an emerging US mining and metals company operating across the African continent, raised a $2M seed round led by Endura Capital Management (PRN)

Num Finance, an issuer of local stablecoins in Latin America, raised a $1.5M pre-seed round led by Reserve (FN)

i-TES, a thermal storage startup, raised a $1.5M round led by EUREKA! Venture SGR (FN)

IPO / Direct Listings / Issuances / Block Trades

Mexico could acquire up to half of Citigroup’s Mexican unit Banamex for up to $3B (RT)

Atmus Filtration Technologies, the filtration business of US diesel engine maker Cummins, IPO’ed at a $1.8B valuation, raising ~$275M (RT)

Surf Air Mobility Corp. is working to go public through a direct listing and plans to file publicly as soon as next week (BBG)

SPAC

Nasdaq threatened to delist Digital World Acquisition Corp, the SPAC planning to merge with Trump’s Truth Social (FRB)

Bankruptcy / Restructuring

Crypto Corner

Digital Currency Group closed its institutional trading platform TradeBlock (BBG)

A Dubai watchdog gave a warning about the risk of global regulatory gaps in crypto (BBG)

EU financial firms serving crypto clients are competing for top compliance staff due to increased demand after the collapse of Silvergate Capital and Signature Bank (BBG)

Indian crypto exchanges like CoinDCX, CoinSwitch, WazirX are currently in survival mode to try and survive the current bear market (CD)

Exec’s Picks

With a (temporary) debt ceiling deal on the horizon, we’re sharing a list of solutions that Jack Raines created in 2022 that would solve our debt problem once and for all.

Recent Wall Street deals show that Japanese banks are serious about being more competitive in US and global markets, according to Bloomberg.

Scott Chipolina covered the dark ties between crypto and the US opioid crisis in Financial Times.

Litney Partners - Financial Recruiting 💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

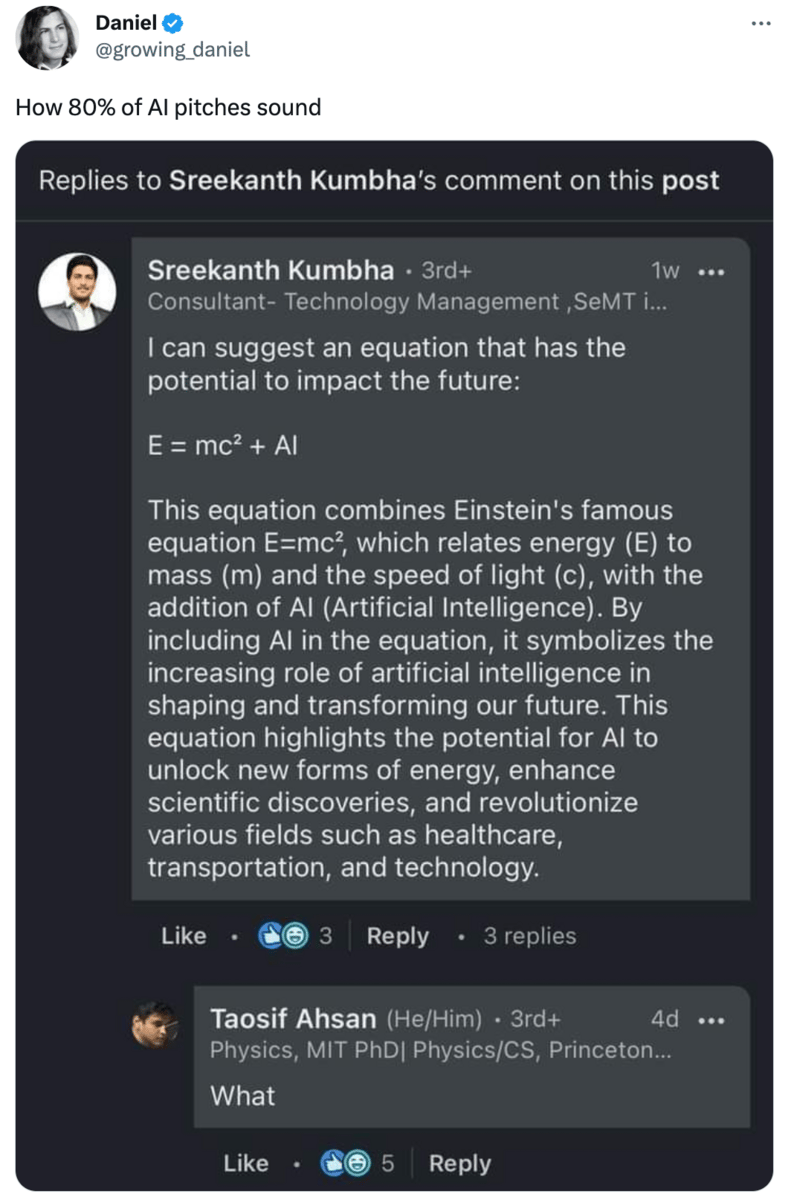

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter