Together with

Good Morning,

The US reached its debt ceiling again, big hedge funds are outperforming small hedge funds, Jamie Dimon expects interest rates to climb above 5%, Jamie Dimon also got paid $34.5M in 2022, Texas banned Citi from underwriting municipal bonds, and Reed Hastings stepped down as Netflix's CEO.

Let's dive in.

Before The Bell

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

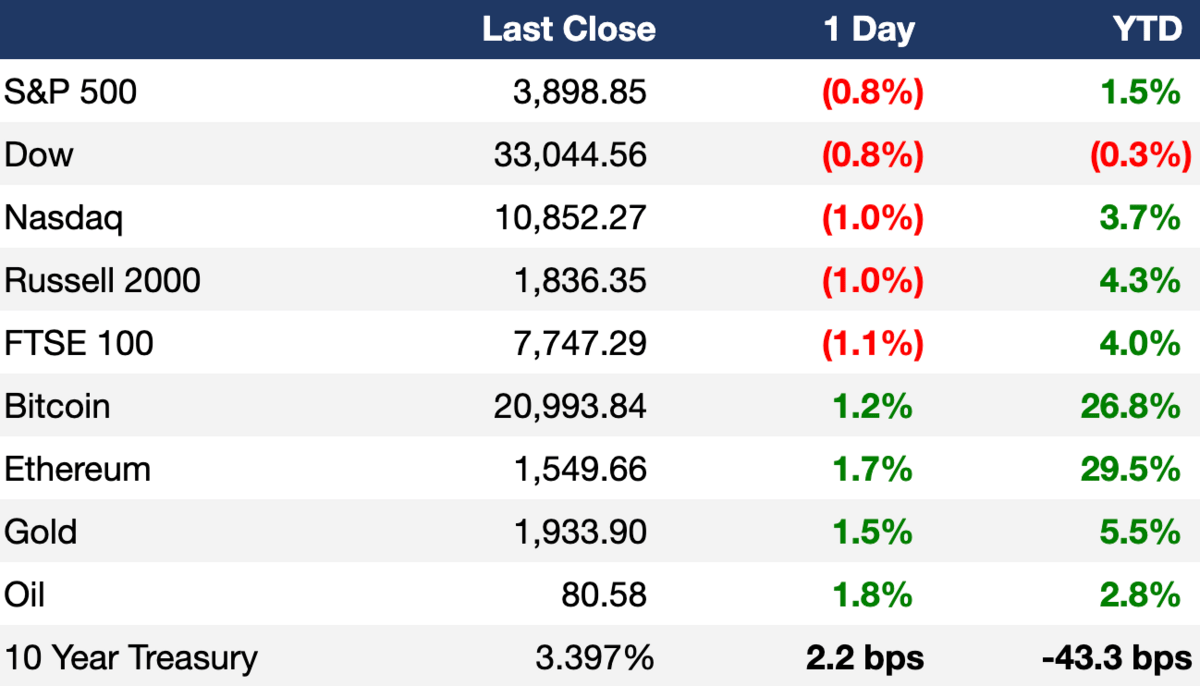

US stocks continued Wednesday's slide yesterday after strong labor market data renewed concerns of a hawkish Fed

The Dow and S&P 500 fell for a third-straight day

The pan-European Stoxx 600 fell 1.6% to break a six-day win streak after the ECB pushed back against bets on smaller rate hikes

Earnings

Netflix missed on Q4 EPS estimates but smashed new subscriber expectations sending shares up 7.2% AH (CNBC)

Procter & Gamble met Q2 EPS and revenue estimates, albeit on falling profit and revenue as higher prices struggled to offset dropping sales volumes; they nonetheless raised their FY sales forecast (CNBC)

Full calendar here

Headline Roundup

US reached its $31.4T debt ceiling, will start 'extraordinary measures' to avoid defaulting (AX)

US Treasury's 'extraordinary' cash management measures will last through June 5 (RT)

Japan’s inflation rate hit 4% for the first time since 1981 (BBG)

Moody's and Fitch expect a debt limit agreement, albeit with time (RT)

Big HFs outperformed smaller ones for first time since 2018 (WSJ)

Jamie Dimon expects interest rates to cross 5% (CNBC)

JPMorgan leaves CEO Jamie Dimon's pay at $34.5M for 2022 (BBG)

Chinese firms are set for highest earnings growth in five years (RT)

JPMorgan and Standard Chartered won approval to expand in China (RT)

JPMorgan set aside $10B for private lending drive (RT)

Twitter's revenue dropped 35% in Q4 (TI)

Global property market faces $175B debt spiral (BBG)

Texas banned Citi from underwriting municipal bonds on gun law row (RT)

KKR blocked investor withdrawals from its $1.6B REIT (RT)

Netflix founder Reed Hastings will step down as CEO, remain as chairman (CNBC)

TikTok must comply with EU rules or face ban (RT)

Koch got $2.5B in dividends from a unit that offloaded its asbestos liability by spinning off and declaring bankruptcy (RT)

Capital One cut over 1.1k tech jobs (BBG)

WeWork will cut ~300 global jobs (RT)

US union membership rate hit an all-time low in 2022 (AX)

New Zealand PM Jacinda Ardern resigned (AX)

A Message From Nobody Studios

Nobody Studios - Invest once. Own 100 companies.

We achieved a 15x valuation, and we expect the same increase over the next 24 months.

Meet Nobody Studios.

Company creation and ownership needs an overhaul. As technology rapidly innovates, so must the way in which companies are built, funded, and operated.

Too many people miss out, get marginalized or struggle to have the opportunity to contribute to the companies that will shape our future.

Capital is either hard to come by, or startups are overfunded without any proven product in the market.

Nobody Studios is building 100 companies in 5 years alongside top execs from Amazon, Facebook, Google, Stripe, Coca-Cola and more.

Join our crowdfund for a minimum of $100, and become part of a community of business leaders turning ideas into companies!

Deal Flow

M&A / Investments

Mining company Hindustan Zinc agreed to buy miner Vedanta’s international zinc operations for $2.98B (BBG)

RSA Security, the former cyber security division of Dell Technologies, is exploring a sale of Archer, its risk and compliance software unit, for $2B+ (RT)

Digital media company Vice Media is restarting its sale process, likely at an up to $1B valuation (CNBC)

Mobile game developer Playtika offered to buy Rovio Entertainment, the maker of the Angry Birds mobile games, at an $810M valuation (BBG)

Asian PE firms Capital Square Partners and Basil Technology Partners agreed to merge in a $700M deal (BBG)

India’s Sun Pharmaceutical Industries agreed to buy US-based drugmaker Concert Pharmaceuticals for $576M (RT)

Legal software maker Exterro agreed to buy e-discovery software provider Zapproved (RT)

VC

Indian fintech startup PhonePe raised a $350M round at a $12B valuation led by General Atlantic (TC)

Autonomous electric yard truck startup Outrider raised a $73M Series C led by FM Capital (TC)

Link, a payments startup allowing merchants to accept direct bank payments, raised $30M: a $20M Series A led by Valar Ventures and a $10M seed round led by Tiger Global (TC)

aiOla, a startup using AI to automate manufacturing inspection processes, raised $25M in funding led by New Era (PRN)

Dreamscape Learn, an immersive learning company, raised a $20M Series A led by Bold Capital Partners, GSV Ventures, Verizon Ventures, and others (PRN)

Open source B2B e-commerce platform Oro raised a $13M round led by Zubr Capital (TC)

Notch, a startup helping restaurants digitize operations, raised a $10M round led by Portage (PRN)

Endevica Bio, a startup developing peptide drugs to treat cachexia, raised a $10M Series B from existing investors (BW)

Inclusive beauty e-commerce destination thirteen lune raised an $8M seed+ round led by The BrainTrust Fund (BW)

Dry cleaning robotics startup Presso raised an $8M seed round from Uncork Capital, 1517 Fund, AME Cloud Ventures, and more (TC)

Rx Redefined, a tech-enabled provider of medical supply services for group practices, raised an $8M Series A led by Crosscut Ventures (PRN)

Terminal49, an ocean freight visibility platform, raised a $6.5M Series A led by Stage 2 Capital (PRN)

Scenario, an AI platform that generates game art assets, raised a $6M seed round led by Play Ventures (TC)

Customer experience automation platform Akia raised a $6M Series A led by Altos Ventures (BW)

Metaverse and NFT startup Digital Village raised a $4M round led by BOLD (TCH)

Scrintal, a visual note taking and collaboration tool, raised a $1.08M round led by Spintop Ventures (TC)

IPO

Bank DKI, one of Indonesia's biggest regional development banks, is considering a $200M IPO this year (BBG)

SPAC

PE firm Helios Investment Partners plans to merge some of its assets with Onyx Acquisition Co. in an almost $1B deal (RT)

Bankruptcy / Restructuring

Brazilian retailer Americanas filed for bankruptcy protection amid discovery of ~$4B in accounting inconsistencies and a legal feud with creditors; the firm will restructure debt of ~$8.2B (RT)

Crypto lender Genesis filed for Chapter 11 bankruptcy protection; they plan to pursue a 'sale, capital raise, and/or an equitization transaction' in hopes to emerge under new ownership (CT)

Fundraising

PE firm Clayton Dubilier & Rice raised $16B for its $20B flagship buyout vehicle Fund XII (MM)

GSP, a New York-based principal investment firm, closed its Fund 4.0 with $850M in committed capital (BW)

Spanish asset manager Arcano raised $487M for its fourth dedicated PE secondaries fund (SI)

Sony Ventures Corporation, a subsidiary of Sony Group, raised $210M for its third fund (PRN)

Sports-focused early-stage VC firm Courtside Ventures raised a $100M Fund III (PRN)

Crypto Corner

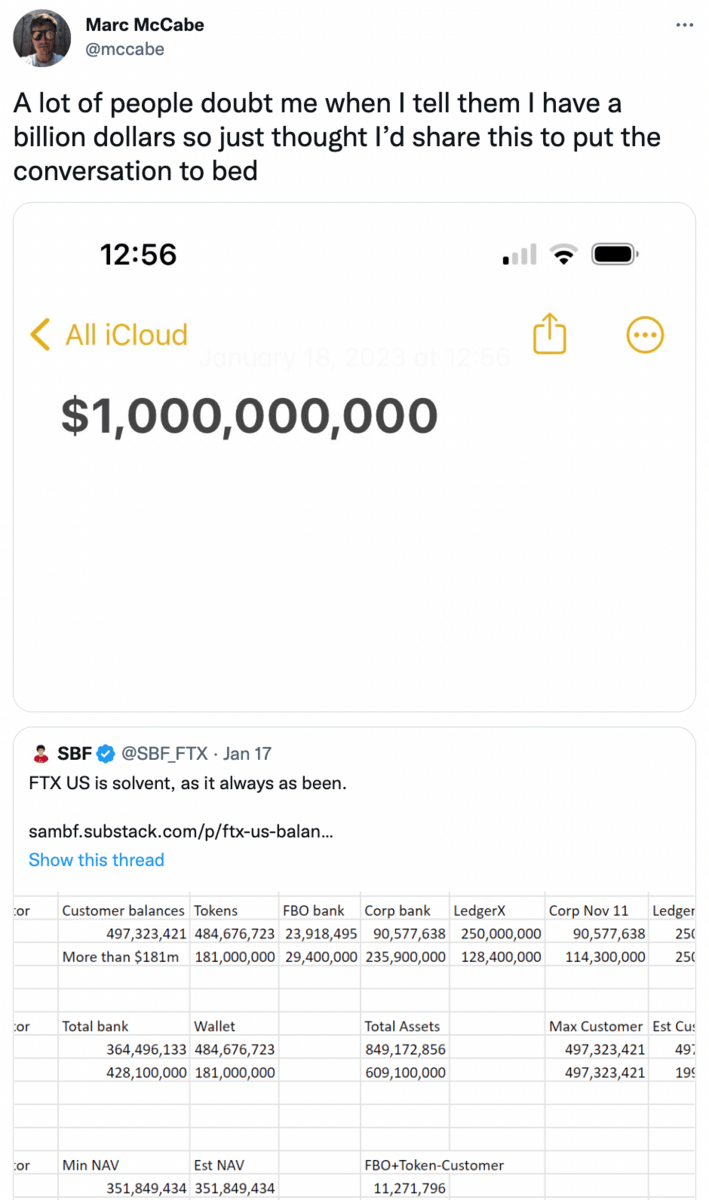

FTX's new CEO said the crypto exchange could restart (WSJ)

Alameda Research's multi-billion dollar relationship with Genesis began in 2018, with SBF asleep in a beanbag chair (WSJ)

DeFi protocol MakerDAO, which holds 85% of Gemini Dollars, will maintain its holding (AX)

Genesis creditors backed Winklevoss promissory note claim (TB)

Exec's Picks

💤 The ideal sleeping position is on the side, and the Marlow Pillow adapts to give side sleepers the support they need. It's made with a proprietary fill of memory foam and polyester fiber, and it was designed for easy adjustability, allowing users to find the exact loft profile that fits them. Upgrade your sleep game with a Marlow Pillow!

We recently circulated an opportunity to invest in a seed stage startup to our angel investing syndicate. If you're an accredited investor or qualified purchaser and want access to startup investment opportunities going forward, please fill out this survey.

Seeing as the US has reached it's debt ceiling again, it's time for us to send one of these hats to every member of congress:

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

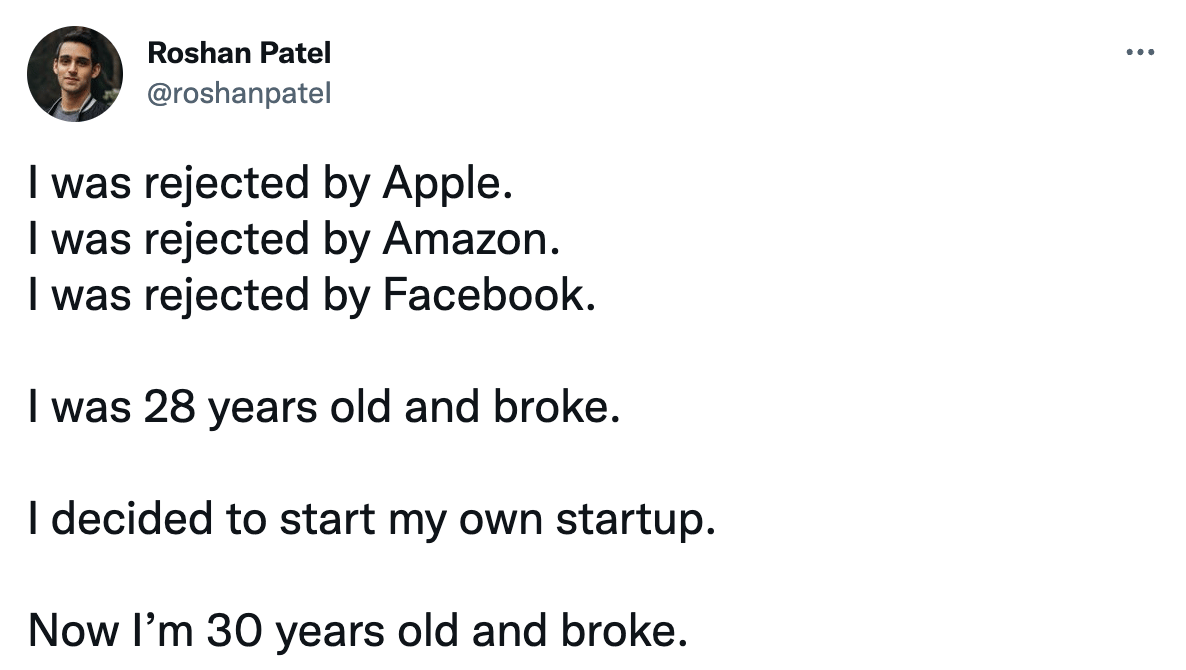

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.