Together with

Good Morning,

Musk is pumping Doge again, bitcoin and tech outperformed in Q1, US M&A activity slowed in 2023, China new home sales were up big in March, Germany fined and banned EY from some audits after Wirecard scandal, the DOJ sued Activision, McDonald's temporarily shut its US offices to prepare for layoffs, and the UFC's parent company bought WWE.

Looking to upgrade your expense management software? Demo today's sponsor, Divvy, and they'll send you a $100 Amazon gift card!

Let's dive in.

Before The Bell

Markets

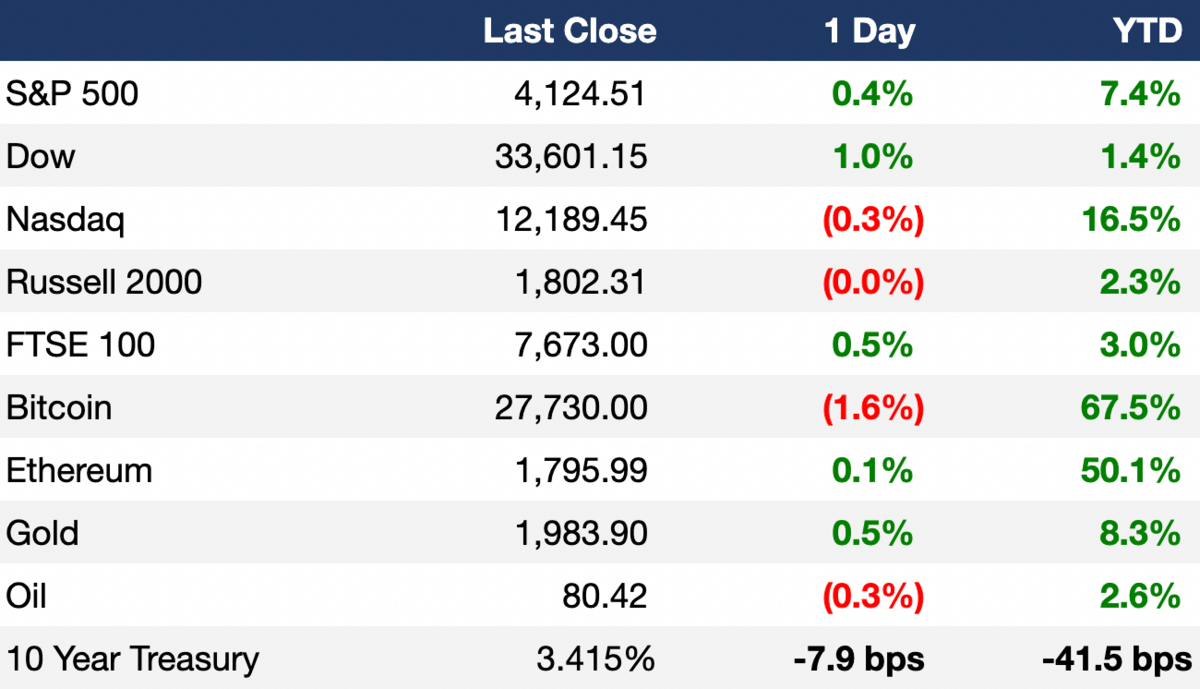

US stocks closed higher yesterday in part thanks to surging energy stocks following a surprise OPEC+ output cut announcement

Oil prices leaped 6%+ in biggest one-day jump in a year

Dollar index slid 0.9% for a 1.4% YTD decline

Earnings

What we're watching this week:

Thursday: Constellation Brands, Levi Strauss

Full calendar here

Headline Roundup

Bitcoin and Nasdaq were among best-performing assets in Q1 (AX)

US M&A activity fell 20% QoQ in Q1 (AX)

US manufacturing activity fell for fourth straight month to lowest since May 2020 (AX)

China new home sales rose 55.7% MoM in March (RT)

ECB called for clampdown on commercial property funds (FT)

Saudi Arabia's PIF disclosed ties to ~40 US VC firms including a16z and Coatue (TI)

Germany fined and banned EY from some audits over Wirecard scandal (RT)

Blackstone again blocked withdrawals from its $70B REIT in March (RT)

Dolce & Gabbana is planning entry into real estate sector (RT)

Cambridge Associates will increase investments in minority-owned money-management firms to ~$82B (BBG)

DOJ sued Activision for antitrust violations over its esports leagues (WSJ)

McDonald’s temporarily shut US offices as its prepares corporate layoffs (WSJ)

US Army awarded Lockheed Martin a $4.5B missiles contract (RT)

A Message From Divvy

Hop on a Divvy Demo, get $100*

If you’re a founder or the person controlling the finances at your company, the hunt for receipts is unilaterally the worst part of the job. But we have good news, with Divvy's effortless expense reporting solution you can now track and control spending, automate expense reports, and close your books faster.

Better news: If you hop on a demo of Divvy, BILL’s spend and expense management solution, and we’ll send you a $100 Amazon gift card.

Divvy offers:

Fully automated expense reports

Flexible and enforceable budgets

Scalable business credit that fits your needs

Ready to upgrade your expense management process (and add $100 as an extra treat)?

Deal Flow

M&A / Investments

Commodity company Glencore is still pursuing its $23B proposal to buy mining company Teck Resources, undeterred by firm rejections from Teck’s board and controlling shareholder (BBG)

REIT Extra Space Storage agreed to buy US self-storage operator Life Storage for $12.7B (RT)

Entertainment company Endeavor announced plans to combine the WWE with the mixed martial arts league UFC into a $21B powerhouse after purchasing the WWE for $9.3B (BBG)

The FTC ordered Illumina to divest its recent $8B cancer screening acquisition, Grail (FT)

Shale producer Ovintiv agreed to buy oil-focused assets in the Permian Basin for ~$4.3B (RT)

Food company Mars agreed to buy animal diagnostics business Heska for $1.3B (RT)

Electrical components manufacturer nVent Electric agreed to buy ECM Investors, the parent of construction and maintenance supplier ECM Industries, for $1.1B (RT)

Blackstone agreed to buy UK landlord Industrials REIT at an $860M valuation (BBG)

Waste management company Covanta agreed to buy sustainable waste management solutions provider Circon (BBG)

Blockchain tech platform Bakkt completed its $200M acquisition of trading platform Apex Crypto (CT)

State-owned Chinese conglomerate CITIC Limited agreed to buy a 55% stake in specialty steel producer Nanjing Iron & Steel Group (RT)

US-based savings and investing startup Acorns agreed to buy London-based GoHenry, which focuses on providing money management and financial education services to children and teens (TC)

VC

AI verification startup Fourthline raised $54M in an all-equity funding round led by Finch Capital (TC)

Swiss crypto startup SwissBorg raised a $23M Series A (VL)

Singapore-based quantum computing startup Horizon Quantum Computing raised an $18.1M Series A led by Tencent (TC)

Crypto startup Li.Fi raised a $17.5M Series A co-led by crypto-native investment firms Coinfund and Superscrypt (CD)

London-based Cybersecurity startup Push Security raised a $15M Series A led by Google Ventures (TC)

Contained vertical farming system startup Babylon Micro-Farms raised an $8M Series A led by Venture South (TC)

IPO / Direct Listings / Issuances / Block Trades

Chinese hotpot and BBQ ingredient supermarket chain Guoquan Supply Chain is considering a Hong Kong IPO that could raise $300M-$500M (BBG)

Saudi Arabian auto rental firm Lumi hired Saudi Fransi Capital and EFG Hermes to sell 30% of its shares in a planned IPO (RT)

Boston-based marketing automation startup Klaviyo is planning an IPO in H2 2023 (TC)

Debt

Banks led by Goldman Sachs will sell $3.8B in debt to refinance most of a $3.95B bridge loan that helped in Vista Equity and Evergreen Coast Capital's $16.5B acquisition of software maker Citrix Systems; they are set to surpass $1.3B in losses on the debt sale (RT)

UniCredit kicked off the first tranche of its $2.53B share buyback program (RT)

Telecom Italia raised $436M via sale of a new tranche of an existing bond in first debt deal by a junk-rated European company since recent banking turmoil (MS)

Mitsubishi UFJ is delaying the sale of an AT1 bond until at least mid-May following the recent Credit Suisse-triggered sell-off (BBG)

Bankruptcy / Restructuring

A US judge approved cosmetics maker Revlon to cut $2.7B from its debt and exit bankruptcy later this month (RT)

Cineworld scrapped plans to sell its US, UK and Ireland businesses after failing to find a buyer and proposed a new $4.53B debt restructuring plan and $2.26B capital raise to emerge from bankruptcy in Q2 (RT)

Online retailer Boxed filed for Chapter 11 bankruptcy protection just one year after going public via SPAC and plans to sell its Spresso SaaS business as a separate entity (BBG)

Fundraising

Crypto Corner

Exec's Picks

Logan Bartlett shared some slides from Redpoint's recent annual meeting covering the state of the venture capital market

NBA insider Ethan Strauss joined the Business Breakdowns podcast to cover the history, economics, and current business model of the NBA

Financial Times published a comparison of GPT-4 vs. Google's Bard

1440 is a daily newsletter helping 2M+ Americans stay informed on news spanning culture, science, politics, business, and everything in between. It's also 100% free to sign up. You can check them out here.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.