Together with

Good Morning,

Regulators closed Signature Bank in the second bank failure in recent days, SVB and Signature Bank depositors will have full access to their funds today, US 1Y CDS hit a record high 83 bps, Japan equity funds saw their largest weekly outflow since 2018, Saudi Aramco had a record 2022 profit, and Meta is planning new job cuts.

Want to invest in Uber's robotic delivery partner? Click here to learn more about the latest fundraising round for today's sponsor, Serve.

Let's dive in.

Before The Bell

Markets

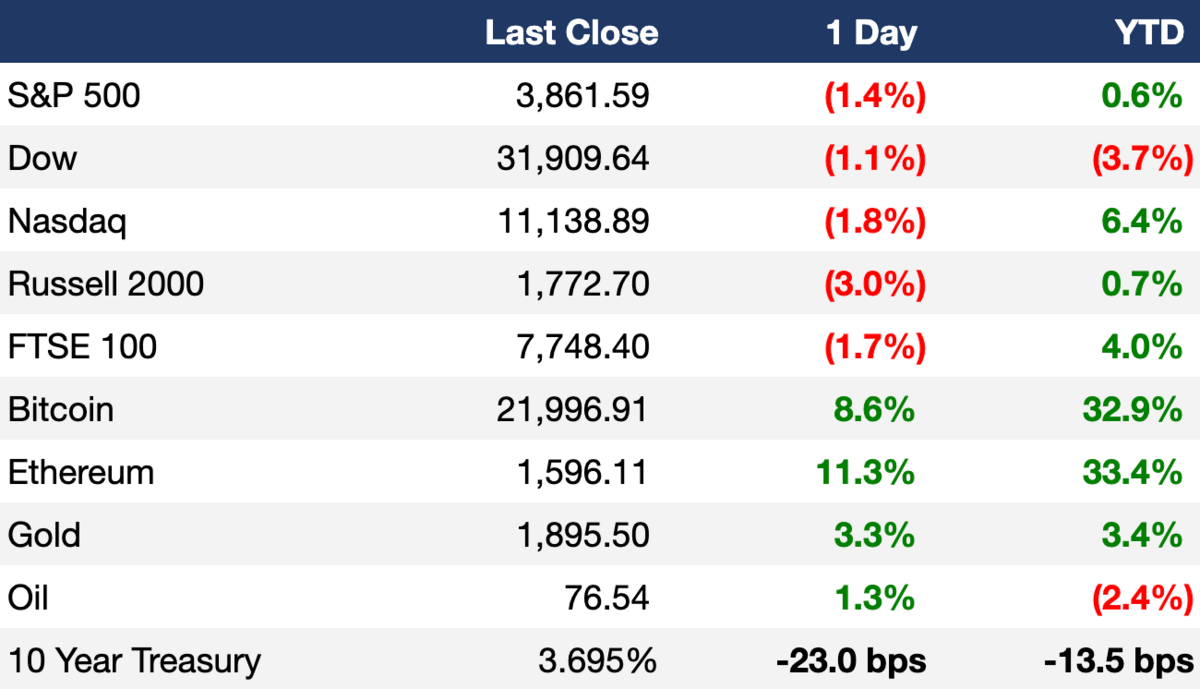

US stocks tumbled on Friday as Silicon Valley Bank's collapse sent shockwaves across financial markets

The S&P, Nasdaq and Dow saw their biggest weekly percentage losses since September, November and June respectively

S&P 500 regional banks index dropped 4.3% on Friday for an 18% weekly loss in its worst week since 2009

The VIX stock market volatility index shot up to its highest since October

The pan-European Stoxx 600 index slid 1.35% to a seven week low, while posting its steepest weekly loss YTD

MSCI World Index shed 1.4%

China's CSI 300 index and Hong Kong's Hang Seng tumbled 4% and 6% respectively last week in response to China's moderate GDP growth target

US 10Y yield fell 22 bps to under 3.7% in the biggest one-day drop in four months

US 6M yield hit 5.34% for its highest level since 2006

Dollar index fell 0.65%

It’s a crucial week for information, with February's CPI released on Tuesday, February's PPI out on Wednesday and ECB's rate policy decision on Thursday

ECB signaled possibility for a sixth-straight 50 bps rate hike

Earnings

What we're watching this week:

Tuesday: Lennar

Wednesday: Adobe

Thursday: FedEx, Dollar General

Full calendar here

Headline Roundup

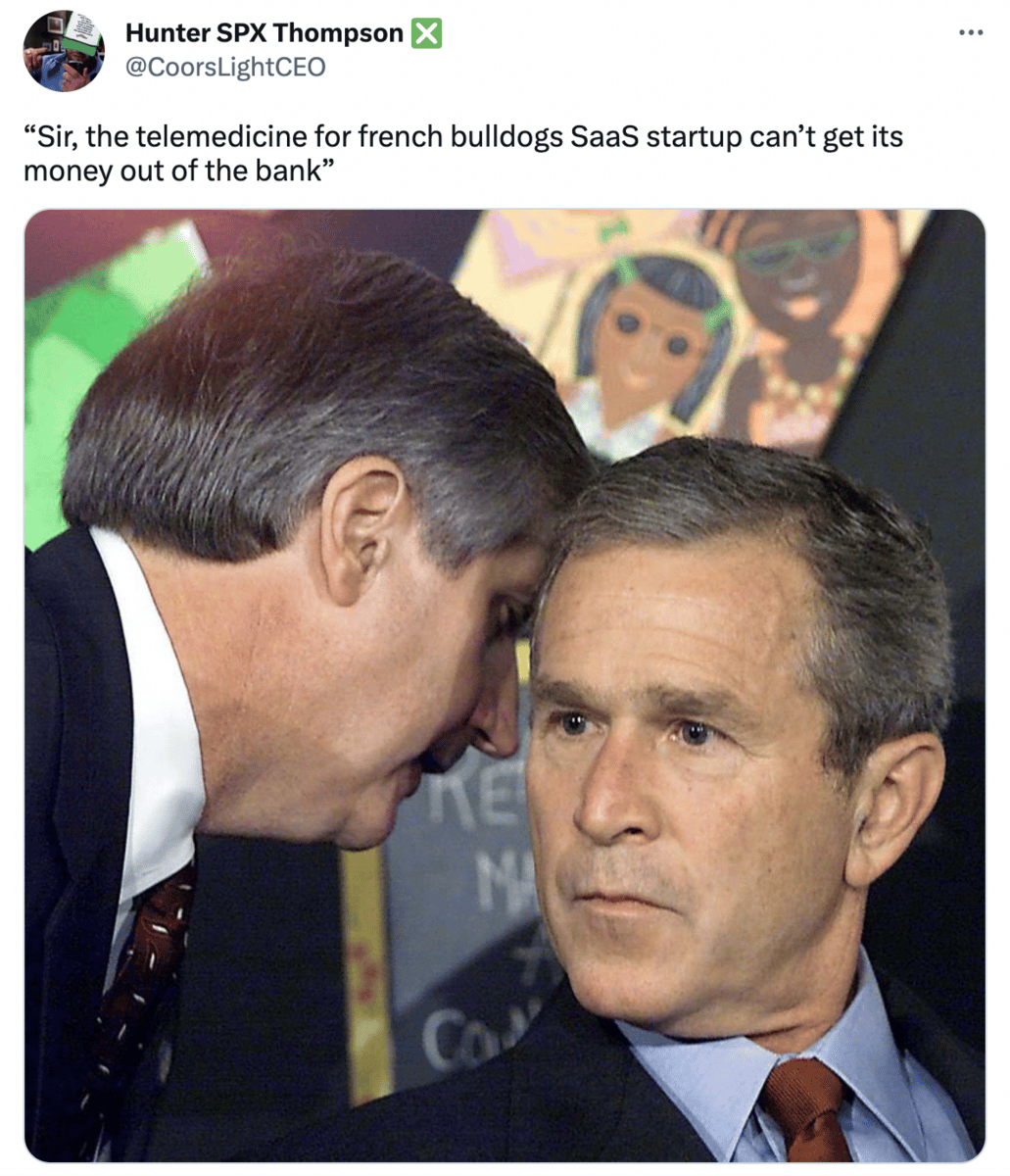

Silicon Valley Bank collapsed after experiencing the largest bank run in US history (CNBC)

Regulators closed Signature Bank in second bank failure in days (RT)

US added 311k jobs in February with unemployment rising to 3.6% (CNBC)

SVB depositors will have full access to money today (CNBC)

Fed announced an emergency lending facility to shore up US banks (FT)

US 1Y CDS hit a record high 83 bps (AX)

US and European banks have lost over $100B and $50B in market value from Thursday to Friday (RT)

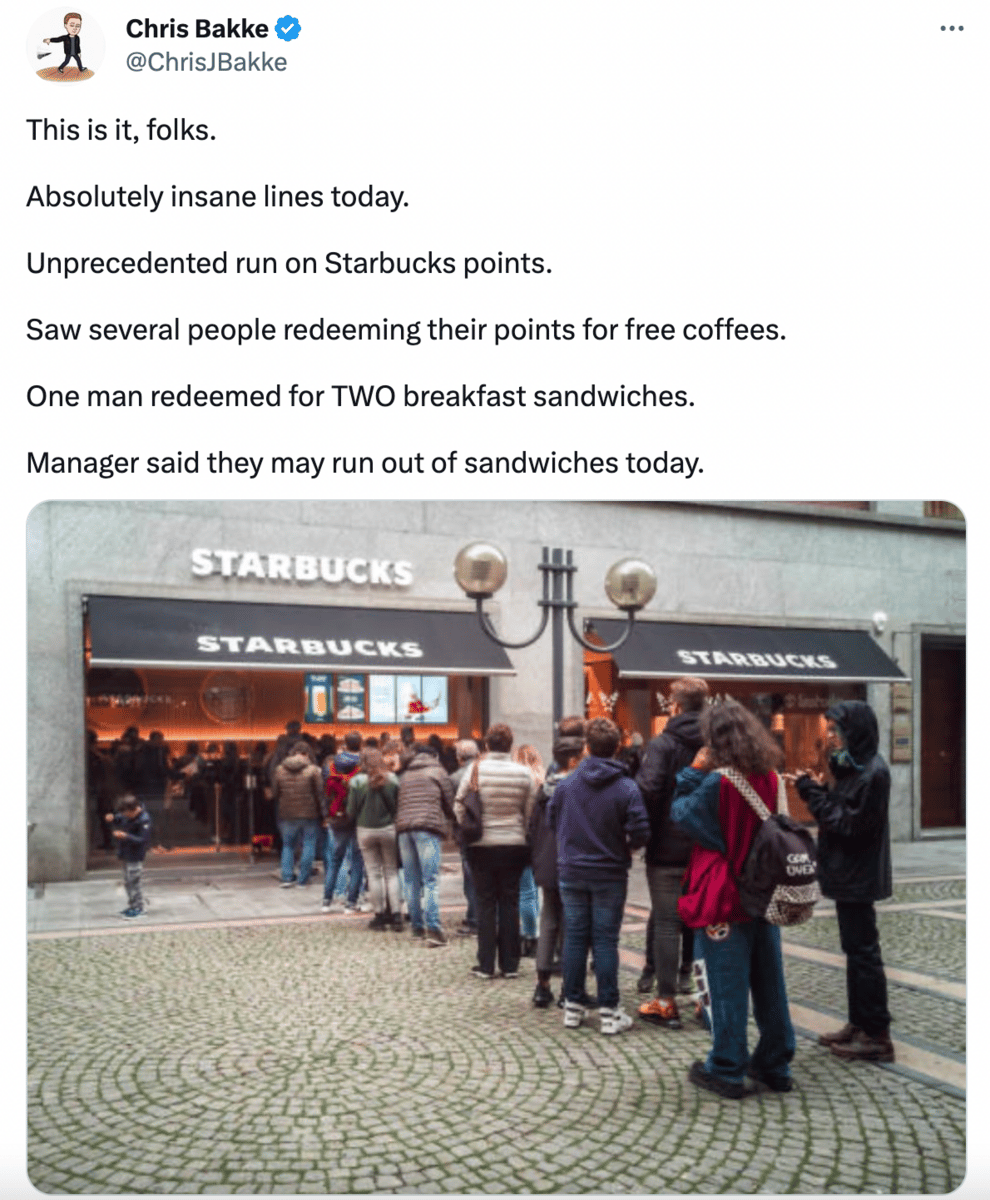

Investments in US money market funds hit an all-time high of $4.9T (RT)

Japan equity funds saw their largest weekly outflow since 2018 (RT)

Saudi Aramco posted a record $161B profit in 2022, triple of Exxon's (RT)

SVB CEO sold $3.6M in stock days before bank’s failure (BBG)

SVB paid out bonuses hours before seizure (AX)

Meta plans new job cuts that could match last year’s move (WSJ)

Gap will cut costs by another $300M after poor Q4 sales (WSJ)

Moderna will hire ~2k employees this year (RT)

Gopuff cut over 100 employees in second lay off round (BBG)

Saudi Arabia launched new national airline Riyadh Air (RT)

A Message From Serve

Final Month To Invest In Uber’s Robotic Delivery Partner

Serve Robotics is poised to have robots delivering food in major metropolitan areas across the U.S. in no time.

So far, they’ve partnered with Uber and 7-Eleven in cities like Los Angeles and San Francisco, with 20,000 deliveries under their belts at 95% fulfillment.

But this is only the beginning of Serve’s $310B delivery market transformation.

In addition to making delivery faster and cleaner everywhere, these fully electric sidewalk robots have the potential to cut 2% of global CO2 emissions.

The company already has $70M in potential revenue from contracts with their delivery partners, and they have taken investment from big brands like NVIDIA.

*Disclosure: This is a paid advertisement for Serve Robotics’ Regulation CF Offering. Please read the offering circular at invest.serverobotics.com

Deal Flow

M&A / Investments

Regulators are auctioning Silicon Valley Bank in hopes to find a buyer by today (WSJ)

NZ-based infrastructure investor HRL Morrison & Co. is in talks to acquire UK-based Ark Data Centres in a deal that could value the business at $3B (BBG)

Japanese bank SMFG is nearing a deal to buy a 15% stake in Vietnamese bank Vietnam Prosperity for ~$1.4B (BBG)

Gautam Adani is seeking to sell a 4-5% stake in Ambuja Cement for ~$450M to reduce debt (RT)

An unnamed party will buy Norwegian oil services company BW Offshore's floating production, storage and offloading vessel BW Opportunity for $125M (RT)

HSBC is set to buy the SVB UK for £1 (BBG)

Managers of SVB's IB arm are exploring a management buyout of the business (BBG)

Investment firms including PAG are interested in acquiring semiconductor and electronics equipment maker ASMPT (BBG)

Facebook owner Meta Platforms is exploring strategic alternatives for customer service company Kustomer (RT)

VC

Prelaunch, a startup helping founders validate product concepts, raised a $1.5M pre-seed round led Big Story VC (TC)

IPO / Direct Listings / Issuances / Block Trades

Debt

Adani Group prepaid $2.15B of a margin-linked share-backed financing and another $500M facility for its $10.5B acquisition of Ambuja Cements (RT)

Virgin Australia is in talks with banks for an up to ~$300M loan to pay its PE owner Bain Capital before the airline's planned re-listing for this year (RT)

SVB will receive an up to one year loan from a new Fed facility aimed at failing banks (CNBC)

Firms like Oaktree and Jefferies offered to buy startup deposits stranded at SVB for between 60-80¢ on the dollar (RT)

Bankruptcy / Restructuring / Distressed

Consumer loyalty solutions provider Loyalty Ventures filed for Chapter 11 bankruptcy protection (RT)

Crypto Corner

Circle’s USDC stablecoin will honor peg despite $3.3B exposure to SVB (RT)

Signature Bank closure deals another blow to the crypto industry, as the lender had relationships with the likes of Circle and Coinbase (BBG)

Mastercard and Visa are signing new debit card deals with web3 startups around the world (BW)

Exec's Picks

Have a big idea but struggling to find the right engineers to make it a reality? Meet Lemon.io, your one-stop marketplace for accessing over 1,000 on-demand developers. Lemon.io only offers handpicked developers with 3 or more years of experience and strong proven portfolios, ensuring that you get only the highest-quality talent, and your engineer can start working on your project within a week! Visit Lemon.io to learn more and find your perfect developer.

Marc Rubinstein wrote a thorough piece breaking down exactly how the SVB collapse happened.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.