Together with

Good Morning,

Credit Suisse got fined $388M over Archegos collapse, MS’s Wilson turned more bullish, Twitter X is facing potential trademark issues, FDIC accused banks of manipulating deposit data, LVMH will sponsor Paris Olympic Games, and the US junk loan market hit its most downgrades since Covid.

Work shouldn’t be the only hard thing in your life. If something else hasn’t been, today’s sponsor, Hims, might be able to help.

Let’s dive in.

Before The Bell

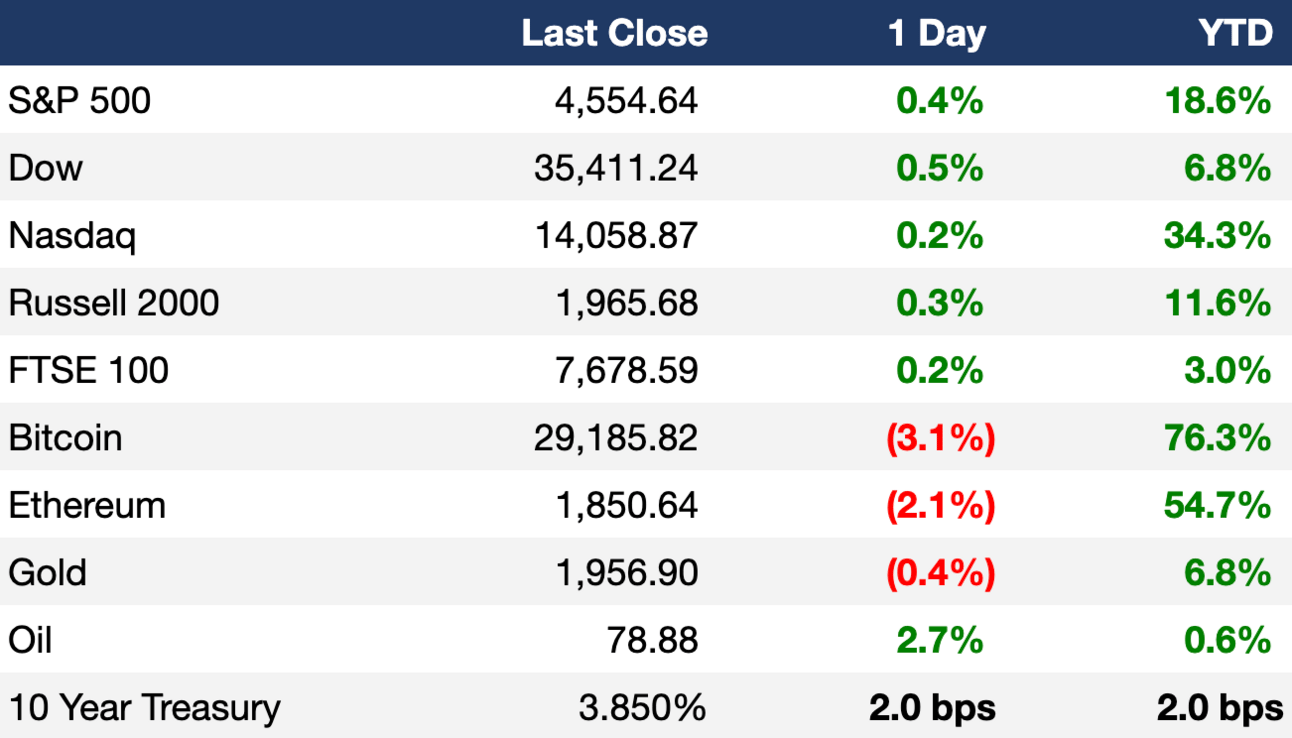

As of 7/24/2023 market close.

Markets

Stocks rose slightly to kick off the week as investors wait for several mega cap earnings reports as well as a key policy decision from the Fed

The Dow rose for an 11th-straight day for its longest winning streak since February 2017

A 25 bps rate hike would mark the Fed’s eleventh rate hike in nearly 18 months and take the fed funds rate to a 5.25%-5.50% range, a 22-year high

UK’s FTSE All-Share index rose 3.1% last week in best since early January

The Roundhill Meme ETF is up ~60% YTD

Indian rupee hit a 3-week high against the dollar

Earnings

Domino’s Pizza beat Q2 estimates thanks to a combination of easing supply chain pressures, lower ingredient costs, and sustained demand despite higher menu prices (RT)

What we're watching this week:

Today: Microsoft, Visa, Texas Instruments, Verizon, General Electric, Alphabet, General Motors

Wednesday: Meta, Coca-Cola, Boeing, AT&T, Chipotle

Thursday: Mastercard, McDonald’s, Comcast, Ford Motor, Intel

Friday: ExxonMobil, P&G, Chevron

Full calendar here

Headline Roundup

US business activity slowed to a five-month low in July (RT)

Credit Suisse fined $388M over Archegos collapse (FT)

‘We were wrong’: Morgan Stanley’s Wilson offers stocks mea culpa (BBG)

Wall Street is bracing for fresh deluge of T-Bills (BBG)

South, Mountain West see manufacturing boom under Biden (AX)

Stock market shrugs off recession signals as rally builds (WSJ)

FOMO drives investors as IPO market awakens from long slumber (WSJ)

FDIC accused banks of misreporting deposit data (FT)

South Korea's GDP grew 0.6% in Q2 (RT)

C-suite execs are taking salary cuts as pandemic practice persists (WSJ)

IRS ends policy of unannounced visits to taxpayers (RT)

US junk loan market hit with most downgrades since Covid in Q2 (FT)

Microsoft and Meta own IP rights to letter ‘X’ in new complication for Elon Musk (RT)

LVMH will sponsor the Paris Olympic Games (RT)

China asked law firms to diminish descriptions of risk in Chinese-firm global IPOs (RT)

Canada releases framework to phase out inefficient fossil fuel subsidies (RT)

Adidas swamped with $565M in orders for unsold Yeezy shoes (FT)

US regulator reports rising number of flawed audits (FT)

Tesla to discuss factory plan for new $24k car with India commerce minister (RT)

Mexico urges US court to revive $10B lawsuit against gun makers (RT)

Apple faces $1B UK lawsuit by apps developers over app store fees (RT)

US weighs potential deal with China on fentanyl (WSJ)

A Message From Hims

Life is Hard, You Should Be Too

We get it. You’re dealing with strict deadlines, an unreasonable boss, and long hours. Work has been hard lately… but something else hasn’t been.

It’s time to fix that (your love life, not your career) with Hims.

Hims offers 100% online, FDA-approved treatment options with free, discreet shipping (if prescribed) so you can get back on your A-game as soon as possible, and they offer treatments that are up to 95% cheaper than brand names.

It’s time to stop being soft in the one area that matters. Get started with Hims today.

*Prescription products require an online consultation with a healthcare provider who will determine if a prescription is appropriate. Restrictions apply. See website for full details and important safety information. Actual price to customer will depend on product and subscription plan purchased.

Deal Flow

M&A / Investments

Adobe’s $20B acquisition of cloud-based design platform Figma will face a full-scale EU antitrust investigation (RT)

Global Infrastructure Partners bought a 40% stake in Columbia Gas Transmission and Columbia Gulf Transmission pipelines from TC Energy for $4B (RT)

SoftwareOne AG launched a strategic review of its business after rejecting Bain Capital’s $3.7B takeover bid (BBG)

Self-storage company Public Storage is buying Blackstone REIT’s Simply Self Storage business for $2.2B, as BREIT faces investor withdrawals (BBG)

Taiwanese electronics manufacturer Foxconn will take a 50% stake in ZF Group's axle system assembly unit to grow automotive supply chain opportunities in a deal that values the business at $1.1B (RT)

Investment manager Rithm Capital is buying asset manager Sculptor Capital Management in a $639M deal (BBG)

Indian auto parts maker Samvardhana Motherson International bought German vehicle interior components manufacturer Dr. Schneider Group for $132M (RT)

Softbank Group and warehouse automation company Symbotic are investing $100M into joint venture GreenBox Systems to build AI-powered warehouses (RT)

Apollo Global Management is buying a minority stake in PetSmart from BC Partners (BBG)

Lyft is considering a partial or full sale of its bike and scooter business after receiving strong interest in the unit (BBG)

Pupuk Kalimantan Timur, Southeast Asia's biggest urea fertilizer maker, is in talks to acquire the fertilizer business of Australian multinational manufacturer Incitec Pivot (RT)

Leading coffee company JDE Peet’s acquired the coffee and tea operations of JAV Group, which is the fourth largest coffee business in Brazil (RT)

Qatari telecoms company Ooredoo, Kuwait’s Zain Group, and Dubai’s TASC Towers Holding are in exclusive talks to create the largest tower company in North Africa and the Middle East (RT)

Alternative money manager HighVista Strategies is buying the private markets subsidiary of Scottish asset manager abrdn, doubling HighVista’s AUM to $9B (BBG)

VC

OneTrust, a provider of a trust intelligence cloud platform, raised a $150M round at a $4.5B valuation led by Generation Investment Management (FN)

Space logistics startup Impulse Space raised a $45M Series A led by RTX Ventures (TC)

Crescendo Biologics, a clinical-stage immuno-oncology company, raised $32M in financing from Sofinnova Partners, Andera Partners, IP Group BioNTech, Takeda, and Kreos Capital (BW)

Motion G, a Singapore-based provider of integrated solutions for industry applications, raised $16M in funding led by Episteme (FN)

Ati Motors, an Indian startup building autonomous industrial robots, raised a $10.9M Series A led by True Ventures (FN)

Quench.ai, an AI learning coach, raised a $5M pre-seed round from firstminute capital, Tuesday VC, BY Venture Partners, and more (FN)

Voltpost, an electric vehicle charging company, raised a $3.6M seed round led by RWE Energy Transition Investments (FN)

Grounded Technologies, a deposit, loan, and CRA marketplace, raised $3.5M in funding led by BMO (BW)

Israel-based zero-emission ammonia producer Nitrofix raised a $3.1M seed round led by Clean Energy Ventures (FN)

Snowstorm, a startup allowing users to access the free and open internet from anywhere in the world, raised a $3M seed round led by Seed Club Ventures (FN)

Singapore-based game studio Eyeball Games raised a $1.5M pre-seed round led by White Star Capital (FN)

IPO / Direct Listings / Issuances / Block Trades

Specialty insurance provider Accelerant, which was last valued at $2.4B in December, is considering raising funds through either a private share sale or IPO (RT)

Chinese snack shop chain Busy For You is considering an IPO that could raise up to $200M (BBG)

Indian conglomerate ITC plans to spin off its hotel business from its cigarettes and foods units to form ITC Hotels, which owns 120 hotels across over 70 locations (RT)

Six Chinese bubble tea makers, which includes Mixue Bingcheng, China’s largest bubble tea chain, are planning IPOs in Hong Kong or the US (BBG)

SPAC

Medical device company Spinal Stabilization Technologies is merging with BlueRiver Acquisition Corp. in a $240M deal (BW)

Debt

Bankruptcy / Restructuring

Fundraising

Japan's trading house Itochu Corp is working with Sumitomo Mitsui Trust Bank to create a special fund for Itochu and institutional investors to invest $2B in renewable power generation assets in US and Canada (RT)

Milan-based United Ventures raised $72M for a targetted $162M fourth fund (SFT)

Women-led VC Supply Change Capital raised $40M for its first fund to invest in the global food industry (TC)

Crypto Corner

Exec’s Picks

Sweater Ventures (a Litquidity portfolio company) is helping both accredited and non-accredited investors support the next wave of groundbreaking startups. They are opening investments into the Sweater Inc fintech platform to the Exec Sum community, but this opportunity closes on July 31st. Interested in investing? Learn more here.

Mario Gabriele covered a collection of startups that are implementing AI in interesting ways.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter