Together with

Good Morning,

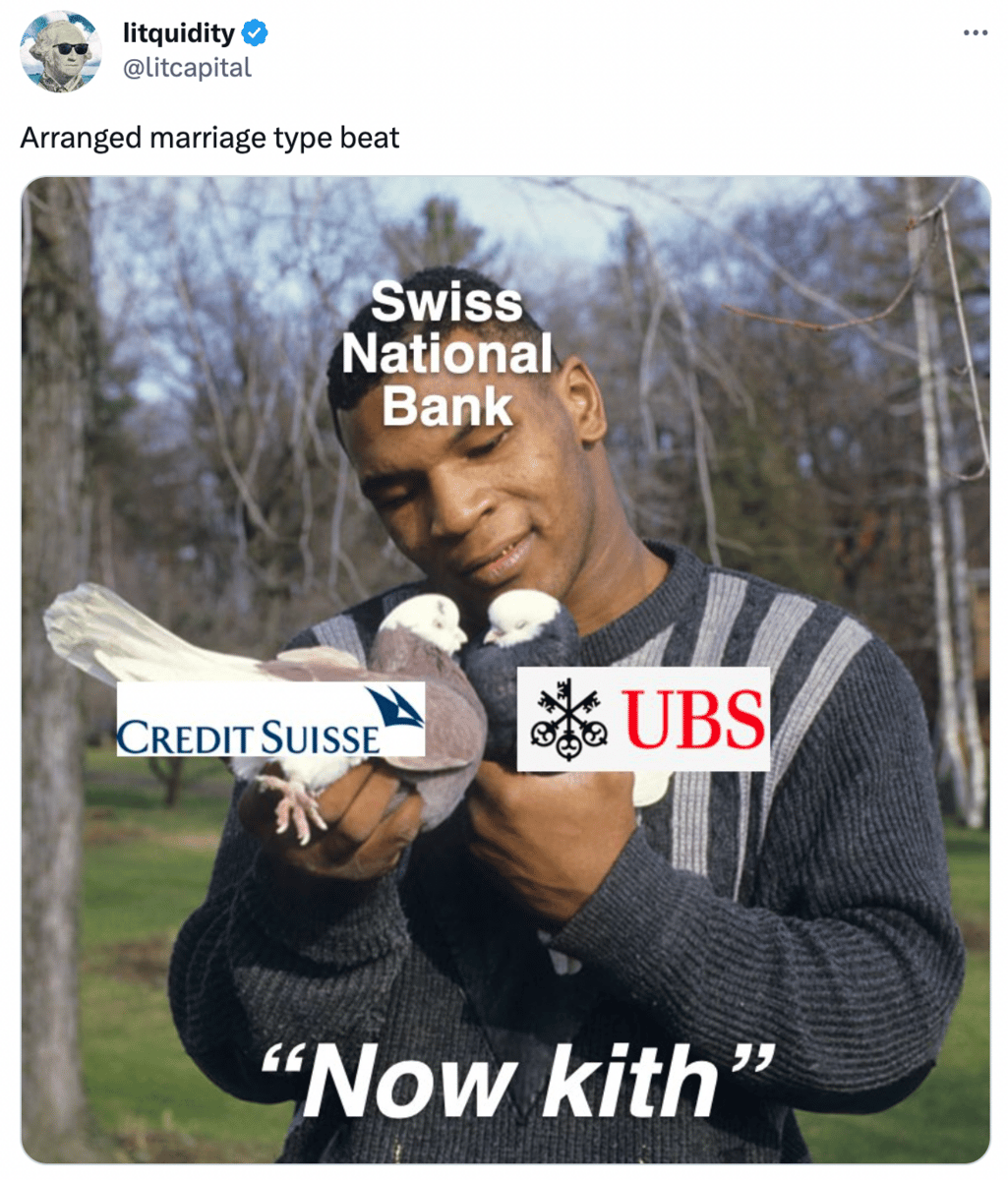

UBS is acquiring Credit Suisse for $3.25B, BoE is weighing ending its rate hike run, Americans are piling into T-bills, Goldman lost $200M in the market turmoil after SVB's collapse, Biden wants to ban execs of failed banks from the industry, and Berkshire has spent $1.8B on buybacks in 2023.

Looking to upgrade your dress shoe game this spring? Impress your coworkers with a new pair of Amberjacks.

Also, a quick note: Exec Sum is one of the first beehiiv newsletters to launch a comments feature. Feel free to drop a comment about your favorite story from today 🤝

Let's dive in.

Before The Bell

Markets

US stocks fell on Friday as investors pulled back from positions in bank shares amid lingering concerns over state of US banking sector

The S&P and Nasdaq notched winning weeks despite the banking chaos, with Nasdaq gaining 4.4%

S&P Banking index lost 4.6% in its largest two-week drop since March 2020

The pan-European Stoxx 600 lost 1.3% on Friday to post its steepest weekly loss in five months

Gold is on track for its largest one-week rally since March 2020

Bitcoin hit a nine-month high

We'll receive the Fed's latest rate policy decision and UK's inflation reading on Wednesday, and BoE's interest rate decision on Thursday

Investors widely expect a 25 bps Fed rate hike

Earnings

What we're watching this week:

Tuesday: Nike

Wednesday: Petco

Thursday: Accenture, General Mills

Full calendar here

Headline Roundup

Fed raised concerns about SVB’s risk management in 2019 (WSJ)

The Fed set a joint liquidity operation with ECB, BoE, SNB, BOJ and BoC (CNBC)

BoE weighs ending its rate hike run (RT)

Investors snapped up cash at the highest rate since April 2020 last week (RT)

Americans pile into T-bills amid US debt default risk (AX)

Two major European banks are seeking Fed/ECB reassurance (RT)

Midsize banks are pleading for unlimited FDIC backstop for two years (AX)

Pacific Western Bank experienced 'elevated' withdrawals following collapses of SVB/Signature Bank, but stabilized over the week (RT)

Goldman Sachs lost ~$200M in market upheaval following SVB collapse (FT)

Goldman Sachs readies claims trading for wiped out Credit Suisse debt (BBG)

China suspended and fined Deloitte’s Beijing office over Huarong audit ‘deficiencies’ (FT)

Indian IT giants TCS and Infosys have highest exposure to US regional banks (RT)

SVB employees blame remote work for bank failure (AX)

Biden wants to ban execs of failed banks from the industry (AX)

Berkshire Hathaway spent $1.8B on stock buybacks this year (RT)

SpaceX, Netflix and Boeing will join 'biggest-ever' US business mission to Vietnam (RT)

Trump is rumored to be arrested tomorrow (AX)

A Message From Amberjack

Rated #1 Best Overall Dress Shoes

Amberjack is a modern footwear brand started by former executives from Adidas, Cole Haan, & McKinsey. They've created the world's most advanced dress shoes, made with proprietary athletic materials that deliver incredible comfort and A-grade leather vertically sourced from one of the world’s leading tanneries.

They’ve been featured in Forbes, Business Insider, and Yahoo, and were just ranked the #1 best overall dress shoes in 2021 by Rolling Stone. Only downside is they constantly sell out – get yours today before they’re gone (or pre-order to ensure availability).

Deal Flow

M&A / Investments

Swiss bank UBS agreed to buy rival Credit Suisse in a government-brokered $3.25B all-stock deal (FT)

Pathology business Australian Clinical Labs offered to buy rival Healius for $1.1B (BBG)

French skincare group L’Oreal and PE firm Permira are among suitors competing for a stake in high-end cosmetics brand Aesop (BBG)

Lender New York Community Bancorp is planning to buy “substantially all deposits and certain loan portfolios” from US regional bank Signature Bank (BBG)

The FDIC plans to relaunch the sale process for failed lender Silicon Valley Bank (RT)

VC

Rippling, a workforce management software provider, raised an emergency $500M at a $11.25B valuation led by Greenoaks Capital, following the collapse of Silicon Valley Bank (BBG)

Nimble, an autonomous logistics and AI robotics company, raised a $65M Series B led by Cedar Pine (FN)

No-code data enablement startup Pitchly raised a $7M Series A led by Homegrown Capital (FN)

Fenix24, a cyber disaster recovery startup, raised a $5M round led by Eos Venture Partners (FN)

Wellness startup Sensate raised a $3.2M seed round led by Incisive Ventures (FN)

IPO / Direct Listings / Issuances / Block Trades

Debt

Credit Suisse wrote down $17.2B of Additional Tier 1 debt to zero on regulatory orders amid its rescue merger with UBS (BBG)

WeWork agreed with bond-holders, an investor, and SoftBank to cut debt by ~$1.5B through equitization, extend $1.6B in debt maturities to 2027, and receive $540M in new funding (BW)

The private investment arm of Inter-American Development Bank and Colombia's Banco de Bogota issued a $230M sustainability bond funding social and climate projects (RT)

Bankruptcy / Restructuring

SVB Financial Group, the ex-parent company of SVB, filed for Chapter 11 bankruptcy protection; SVB Securities and SVB Capital continue to operate and were not part of the bankruptcy filing (RT)

Fundraising

Crypto Corner

Signature Bank’s $4B in crypto-related deposits will be returned to customers directly, rather than being taken over by a unit of New York Community Bancorp (BBG)

SBF and US prosecutors are nearing a new bail agreement (RT)

Microsoft is testing a crypto wallet in its web browser Edge (TBC)

Venezuela overhauled national crypto department (CT)

Exec's Picks

Everyone knows that real estate is the best path to building wealth over time, but there’s just one problem: you always needed plenty of upfront capital to enter this market… Until now. CrowdStreet, the nation’s largest online private real estate investing platform, lets you invest in large real estate projects alongside dozens, and even hundreds, of other investors. Get started today by joining CrowdStreet here.

The Wall Street Journal published an article explaining the current turmoil in the banking sector through charts.

Given the historic UBS / Credit Suisse merger, it's a good time to plug our favorite coffee mug to celebrate the occasion:

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.