Together with

Good Morning,

The US is further cracking down on China’s access to chip technologies, oil prices continue climbing due to uncertainty in the Middle East, Taylor Swift’s Eras Concert is the highest-grossing domestic concert film ever, Biden might visit Israel, car buyers aren’t falling in love with EVs, and Xi’s crackdown on finance in China hit its two-year mark.

Tired of receiving 20 spam calls per day? Get your personal data off the internet with today’s sponsor, Incogni.

Let’s dive in.

Before The Bell

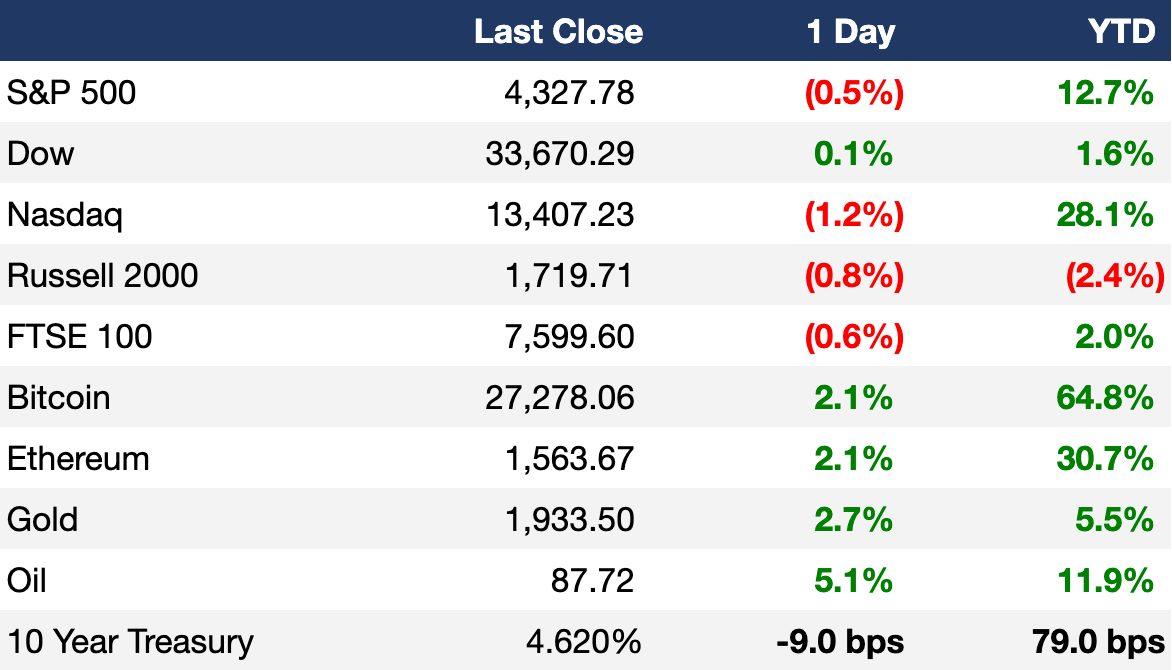

As of 10/13/2023 market close.

Markets

US stocks mostly declined in response to rising oil prices and heightened inflation expectations

The Nasdaq led indices down with a 1.23% decline, while the Dow rose 0.12%

Asian stocks fell due to a wave of negative Chinese economic data

Oil futures rose ~5% due to fears of escalating tensions in the Middle East

Earnings

JPMorgan Chase reported a 35% YoY increase in profit and beat Q3 analyst earnings and revenue estimates thanks to higher interest income and lower credit costs (CNBC)

Wells Fargo shares rose 3% after beating Q3 profit and revenue expectations thanks to higher interest rates, which offset lower lending activity (CNBC)

BlackRock beat Q3 earnings expectations but reported its first quarterly net long-term outflow since the early days of COVID-19 (FT)

Citigroup reported better-than-expected Q3 earnings and revenue thanks to growth in its institutional clients and personal banking divisions (CNBC)

What we're watching this week:

Monday: Charles Schwab

Tuesday: Bank of America, Goldman Sachs, United Airlines, Lockheed Martin, Johnson & Johnson, Prologis

Wednesday: Tesla, Netflix, Morgan Stanley, ASML, P&G, Discover, Nasdaq

Thursday: TSMC, Blackstone, AT&T, American Airlines

Friday: American Express

Full calendar here

Headline Roundup

US to tighten curbs on China’s access to advanced chip tech (BBG)

Stocks retreat amid Gaza risks as oil hovers above $90 (RT)

A recession is no longer the consensus (WSJ)

Taylor Swift Eras Tour is the highest-grossing domestic concert film ever (CNBC)

Investors are confident they can roll with global trade’s punches (BBG)

Time is running out for the ‘year of the bond’ as losses mount (BBG)

US and Israeli officials discuss possible Biden visit to Israel this week (AX)

Risk-advisory firms decide Hong Kong isn’t worth it (WSJ)

Automakers have big hopes for EVs, buyers aren’t cooperating (WSJ)

EU seeks to ease US tariff, green subsidy threats (RT)

Xi’s crackdown on finance hits two-year mark with no letup (BBG)

Bargain hunters dig in to ‘cheap’ European banks (RT)

Africa ambassador criticizes IMF, World Bank for not giving enough loans (CNBC)

‘Informal’ House Speaker talks underway with GOP, Jeffries says (BBG)

A Message From Incogni

Protect Your Identity with Incogni

Black Friday sales are a month away, which means a lot of sites will be offering discounts in exchange for your number and email address. The problem? Sharing your personal information makes you vulnerable to spam calls and emails.

If you’re sick of receiving these same unsolicited calls and emails, it's time you check out Incogni.

Incogni scrubs your personal data from the web, confronting the world’s data brokers on your behalf. And unlike other services, Incogni helps remove your sensitive information from all broker types, including those tricky People Search Sites.

Help protect yourself from identity theft, spam calls, and other malicious uses of your data by checking out Ingoni. Plus, just for Exec Sum readers: Get 55% off your Incogni annual subscription using code EXECSUM.

Deal Flow

M&A / Investments

Microsoft completed its $69B acquisition of Activision Blizzard (BBG)

KKR is preparing its binding bid to buy Telecom Italia’s landline grid; the grid was last valued at $25.3B (RT)

California is preparing a lawsuit to block Kroger’s $24.6B acquisition of Albertsons on the condition that it hurts consumers and workers (BBG)

Infrastructure investor Global Infrastructure Partners is considering an up to 51% stake sale in Asian renewable energy company Vena Energy at a ~$15B valuation (BBG)

The Qatari group led by Sheikh Jassim Bin Hamad J.J. Al Thani withdrew its bid for Premier League team Manchester United after its latest bid of over $6.1B was rejected (BBG)

Canadian pension funds including Canada Pension Plan Investment Board are weighing a potential $3B, 72% sale in Chile’s biggest power-transmission company Transelec (BBG)

US PE firm TPG will acquire a 9% stake in Tata Technologies from India's Tata Motors in a deal that values the unit at $2B (RT)

Miami-based infrastructure investor I Squared Capital is aiming to sign a $1.7B deal to acquire Deutsche Bahn's international transport business Arriva as soon as Monday (RT)

NatWest Group Pension Fund is weighing a $1.5B, 50% stake sale in Irish natural gas distributor Phoenix Energy (BBG)

PE firms Highview Capital and A&M Capital Partners are exploring a potential sale of meal distributor GS Foods Group at over $1.5B, including debt (RT)

Indian tycoon Peter Sondakh’s conglomerate PT Rajawali is considering a sale of its controlling interest in gold miner PT Archi Indonesia, which has a market value of $623M (BBG)

British clothing group Next will buy FatFace in a deal that values the fashion chain at $140M (RT)

Saudi Aramco is exploring a potential bid for Shell’s Pakistan assets, including Karachi-listed $123M Shell Pakistan (BBG)

Morgan Stanley and Cerberus Capital Management are among bidders for a quarter of UK pub operator Stonegate Pub’s pubs (BBG)

French investment firm Wendel is exploring a potential acquisition of PE firm IK Partners (BBG)

Chinese investment bank Guotai Junan Securities will buy a 49% stake in CPIC Fund Management from German insurer Allianz (RT)

PIF-backed Professional Fighters League is in talks to acquire its mixed martial arts competitor Bellator (FT)

VC

Main Street Health, a value-based healthcare organization, raised $315M in funding from various health plan and provider partners. (FN)

Fast energy storage startup Skeleton Technologies raised a $114M debt / equity round from Siemens Financial Services, Marubeni Corporation, and others (EU)

Alltrna, a startup unlocking transfer RNA biology, raised a $109M Series B from the company's founder, Flagship Pioneering, and others (VC)

Agomab Therapeutics, a biotech company focused on drug development for Crohn’s Disease, raised a $100M Series C led by Fidelity Management & Research Company (EU)

Swedish fintech startup Invoier received a $61M investment from the European Investment Fund (EU)

Bobnet, a European startup building retail automation solutions, raised a $50M Series B led by NCH Capital (PRN)

Stash, an NYC-based investing app, raised a $40M round led by T. Rowe Price (FN)

myenergi, a British smart home energy technology manufacturer, received a $36M investment from Energy Impact Partners (FN)

AI-driven drug delivery startup Mana.bio raised a $19.5M seed round led by a16z, Base4 Capital, NFX, and others (FN)

Bon Vivant, a startup using yeast microorganisms to produce dairy products, raised a $15.8M seed round led by Sofinnova Partners and Sparkfood (FN)

Canopy Servicing, a loan servicing startup, raised a $15.2M Series A1 at a $35M valuation led by Foundation Capital and Infinity Ventures (FN)

Intento, a machine translation and multilingual generative AI platform, raised an $8M Series A led by Somersault Ventures (VC)

Carbon Equity, a climate VC and PE fund investing platform, raised a $6M Series A led by BlackFin Capital Partners (FN)

Relay.app, a workflow automation startup, raised $3.1M in funding led by a16z (FN)

Hook, a music technology platform, raised a $3M seed round led by Point72 Ventures and Waverley Capital (VC)

Beldex, a Seychelles-based privacy ecosystem hub, raised $3M in funding led by Block Alpha (FN)

Volteras, a data startup for EVs, raised a $2.9M seed round from Exor, Long Journey Ventures, and more (TC)

PickNik Robotics, a startup building software for robotics, raised a $2M pre-seed round led by Stellar Ventures and Cypress Growth Capital (PRN)

Kodex AI, a Berlin-based startup developing AI-powered solutions for the financial industry, raised a $1.8M round led by Signals VC (FN)

IPO / Direct Listings / Issuances / Block Trades

China's biggest ride-hailing company, Didi Global, is aiming to IPO in Hong Kong in 2024; it delisted in 2022 after pushing ahead with a $4.4B NYSE listing without Chinese regulator approval (RT)

TAB Gida, the operator of Burger King in Turkey, received approval to list on the Borsa Istanbul and is seeking to raise as much as $246M (BBG)

Russian technology company Astra raised $36M in a Moscow IPO (RT)

Bankruptcy / Restructuring

Wireless spectrum venture Ligado Networks is preparing to file for Chapter 11 bankruptcy due to its inability to repay or refinance $4B debt due in November (WSJ)

Party goods retailer Party City exited Chapter 11 restructuring and eliminated $1B in debt (WSJ)

Peach farmer Prima, which is owned by PE firm Paine Schwartz Partners, filed for Chapter 11 bankruptcy and has $679M debt (RT)

Cybersecurity company IronNet, which was founded by former director of the US NSA, filed for bankruptcy (RT)

Fundraising

Macquarie Asset Management is in talks with investors to raise as much as $11.5B in total for a trio of funds dedicated to Asia Pacific infrastructure, global renewables and energy transition (BBG)

VC LaPhair Capital Partners launched Alpha Fund I, which is targeting $100M, to invest in high-growth companies focused on social responsibility in underserved communities (FN)

Crypto Corner

Exec’s Picks

This Bloomberg piece discusses how Birkenstock mistimed a shaky IPO market.

The Hustle explained how “space junk” is quickly becoming a problem as we launch more and more satellites into space.

New York’s Airbnb ban is turning into pure chaos, according to Wired.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter