Together with

Good Morning,

NFL voted to allow PE investments, Hindenburg shorted Super Micro, Intel's struggles are causing cracks in their board, US companies are tweaking DEI policies, and China is planning a major bond market intervention.

See how you can transform your spend and expense management with BILL, and they'll send you a Blackstone Griddle.

Let’s dive in.

Before The Bell

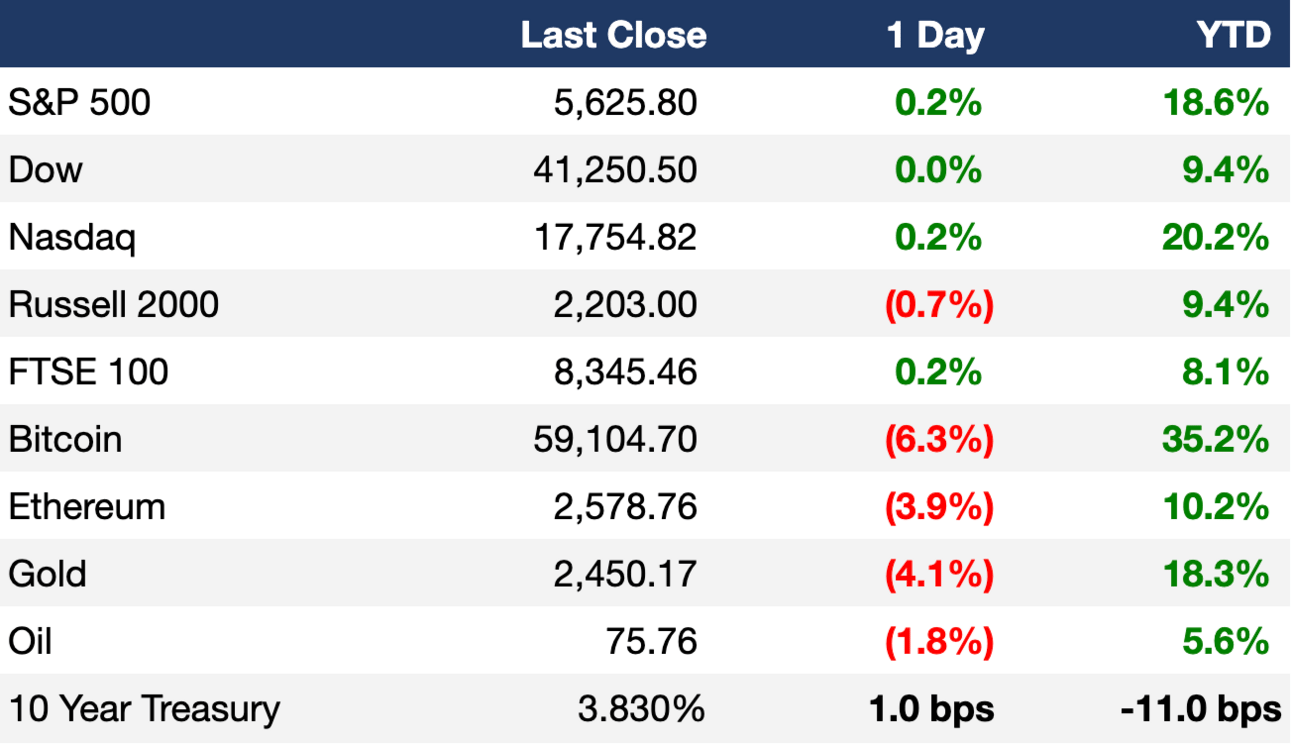

As of 08/27/2024 market close.

Markets

US stocks slightly rose ahead of Nvidia's earnings and Friday's PCE report

Options markets are pricing in a ±10% swing in Nvidia post-earnings

China's CSI 300 fell to seventh-month lows as buyback announcements failed to make up for disappointing earnings

US 2Y-10Y yield curve inversion hit its narrowest in three weeks

Dollar index is at a thirteen-month low

Pound hit a 2.5-year high on bets of a hawkish BoE

Earnings

What we're watching this week:

Today: Nvidia, CrowdStrike, Salesforce

Thursday: Dell, Best Buy, Dollar General, lululemon

Full calendar here

Headline Roundup

NFL owners vote to approve PE investments (WSJ)

China is planning a bond sale to potentially burst market 'bubble' (FT)

UBS Wealth Management raised US recession odds to 25% (RT)

US consumer confidence rose to a six-month high (RT)

Investors pour into US Treasury ETFs ahead of Fed rate cut (FT)

JPMorgan sees Indian firms doubling annual dollar bond sales (BBG)

Moody's warned of significant ratings impact for Israel from all-out conflict (RT)

Hindenburg reveals short position in AI darling Super Micro (BBG)

1740 Broadway bonds become first AAA to suffer loss since 2008 crisis (RT)

HSBC's new CEO weighs cutting layers of middle management (BBG)

High-profile Intel board member quits over differences (RT)

Klarna is weighing ousting its co-founder's key ally from board (FT)

Klarna aims to halve workforce with AI gains (FT)

TikTok's head of content strategy will depart leave (TI)

Hertz boosted its board size from nine to eleven (RT)

US companies tweak diversity policies as challenges mount (RT)

UK home listings hit a seven-year high (FT)

A Message From BILL

Take a demo, get a Blackstone Griddle

Financial operations heating up? BILL Spend & Expense can help you take control.

Automate expense reports, set budgets across teams, and get real-time insights into company spend.

Take a demo to learn how and we'll give you a 28" Blackstone Omnivore Griddle—so you can take control of your next barbecue, too.

Deal Flow

M&A / Investments

CVC is in talks to acquire significant minority stake in residential property manager Odevo at a ~$3B valuation (BBG)

ExxonMobil is seeking to sell some conventional Permian Basin oil assets for $1B (BBG)

Australian asset managers IFM Investors and ISPT are nearing a merger deal (BBG)

Australian pension Aware Super acquired a minority stake in UK bandwidth infrastructure firm euNetwork (RT)

VC

Data infrastructure startup Cribl raised a $319M Series E at a $3.5B valuation led by GV (TC)

Cloud optimization platform nOps raised a $30M Series A led by Headlight Partners (TC)

Supio, an AI platform for personal injury law, raised a $25M round led by Sapphire Ventures (TC)

Planera, a planning software for commercial construction projects, raised a $13.5M Series A led by Sierra Ventures (TC)

PostgreSQL database software startup pgEdge raised a $10M round led by Rally Ventures (PRN)

Polish electric bus startup MMI raised $8.3M in funding from Vinci S.A. (EU)

AI sales concierge startup RepAI raised $8.2M led by Osage Venture Partners (FN)

Jobilla, a digital recruitment technology, raised a $6.6M round from Juuri Partners, Trind VC, Business Finland, and more (EU)

AI-enabled career platform Impactpool raised a $3.9M Series A led by Mediahuis and Fort Knox (FN)

IPO / Direct Listings / Issuances / Block Trades

SPAC

Event management platform Events.com will merge with Concord Acquisition Corp. II in a ~$400M deal (BBG)

Debt

Blackstone is in talks with banks for a $3.7B loan to back its bid for Australian data center operator AirTrunk (BBG)

Global alcohol maker Diageo raised $2.1B in a euro debt sale (BBG)

Vista Equity Partners is in talks with banks and direct lenders for $1B of financing to support its acquisition of procurement software firm Jaggaer (BBG)

Chinese locality Shanghai Lingang is selling China's first floating rate bond since Covid in a $140M sale (BBG)

Bankruptcy / Restructuring / Distressed

Struggling Canadian budget airline Flair Airlines is in debt restructuring talks (BBG)

Fundraising

Crypto Corner

Exec’s Picks

The Dow is back above 40k and so are we with some fresh looks from The Summer Collection. Check out what's in store and scoop some Litquidity merch today.

Hindenburg is back with another scathing short-seller report, this time on AI darling Super Micro. Read the full report here.

Barry Ritholtz of Ritholtz Wealth Management wrote an insightful essay on why the Fed is often behind the curve.

Financial Services Recruiting 💼

If you're currently a junior banker looking to break into the buy side, lateral to another investment bank, or consider new paths amid changing market dynamics, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, debt funds, and investment banking.

To get started, simply head over to Litney Partners and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter