Together with

Good Morning,

Coinbase may relocate outside the US without changes to regulation, China’s GDP grew 4.5% YoY in Q1, US consumers are falling behind on payments, EU agreed to a $47B chip plan in response to US/Asia competition, McKinsey and Bain are delaying start dates for MBA hires, and US craft beer production remained flat in 2022.

Today’s sponsor, Plaid, was named a Leader (the top distinction) in the Forrester Wave: Open Banking Intermediaries Q1 2023 report, which is kind of a big deal. Check out the report here.

Let’s dive in.

Before The Bell

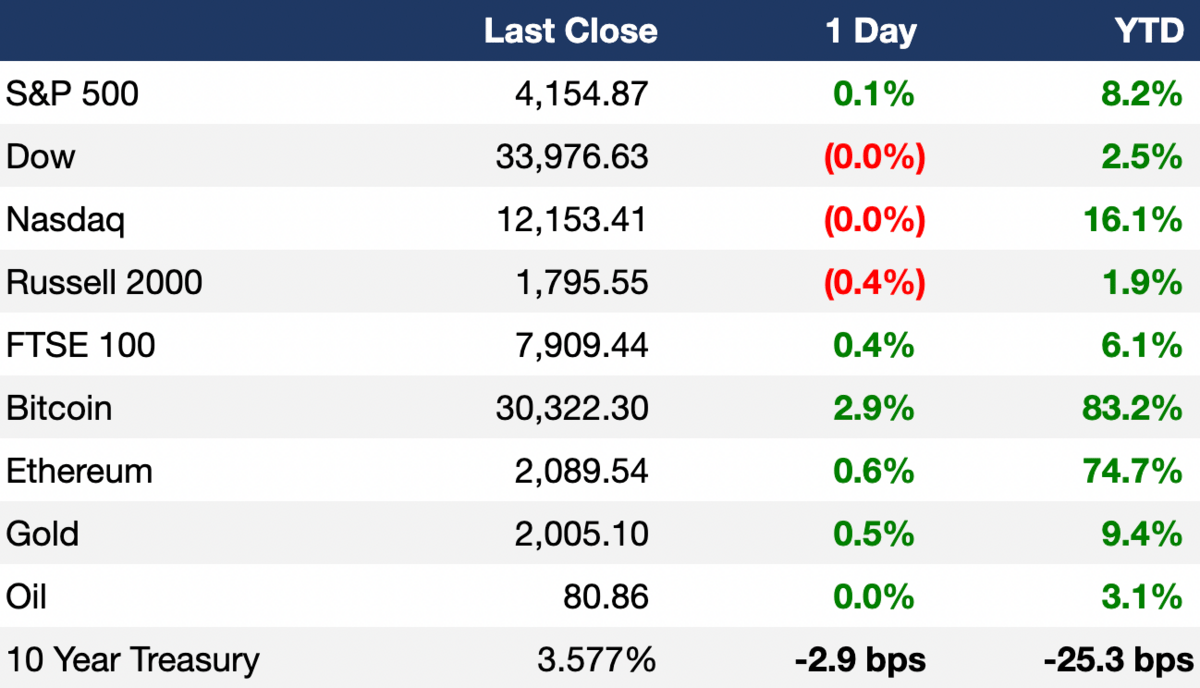

As of 4/18/2023 market close.

Markets

All three US indexes closed flat yesterday as investors continued to digest major earnings

The VIX fell to its lowest level since January 2022

The pan-European Stoxx 600 rose 0.4% to a fourteen-month high

MSCI World index rose 0.2% to its highest level since early-February

Earnings

Bank of America beat Q1 EPS and revenue estimates on hefty interest payments from customers and decade-high bond trading results on the back of high rates; CEO Moynihan sees a relatively mild recession (CNBC)

Goldman Sachs beat Q1 EPS estimates but missed on revenue on underwhelming fixed income trading and losses on the sale of some assets in its Marcus consumer business; Goldman earnings was the sole disappointment among major peers yet (CNBC)

Western Alliance Bancorp beat Q1 EPS and revenue estimates on a 36% YoY gain in interest income, while affirming its FY deposit growth forecast of ~15% despite the recent turmoil; their stock surged 13% AH (RT)

Netflix beat Q1 EPS estimates but missed on revenue on disappointing subscriber growth driven by its password-sharing crackdown; the firm also revealed worse-than-expected Q2 projections (YH)

Johnson & Johnson beat Q1 EPS and revenue estimates on growth in all three business segments and raised its FY sales guidance but lowered pharmaceuticals projections amid FX headwinds (CNBC)

What we're watching this week:

Today: Morgan Stanley, Tesla

Thursday: Blackstone, Truist, TSMC

Friday: Procter & Gamble

Full calendar here

Headline Roundup

Debt limit deadline might be sooner than expected (RT)

China GDP grew 4.5% YoY in Q1 amid end to Covid curbs (RT)

Investor allocation to stocks relative to bonds fell to lowest level since 2009 (BBG)

US consumers are increasingly falling behind on payments (RT)

EU agreed a $47B chip plan in response to US/Asia competition (RT)

Credit Suisse will report Q1 earnings before UBS next week (RT)

UK business insolvency surged to a post-Covid high in March (RT)

Jamie Dimon will face questioning in Jeffrey Epstein cases (RT)

McKinsey and Bain delay start dates for MBA hires (WSJ)

UBS will modify its $6B share buyback program amid Credit Suisse takeover (RT)

Kim Kardashian’s SKKY Partners hired six Wall St professionals including a new COO from Apollo (BBG)

Anti-Ark ETF founder plans to launch two new Ark-tied ETFs (BBG)

DE Shaw, Millennium and AQR are expanding India presence (RT)

ChatGPT can decode Fed speak and predict stock moves from headlines (BBG)

China banned Raytheon and Lockheed Martin execs from entering (RT)

Burger King is banking on TikTok virality to boost sales (RT)

Ex-Latham M&A chair Mark Gerstein joined PJT Partners as senior advisor (RT)

US craft beer production remained flat in 2022 in historic first (AX)

Fox settled for $787M with Dominion over election claims lawsuit (CNBC)

A Message From Plaid

The Plaid Train Keeps A-Rollin’

No, not the pattern (although we’re surprisingly big fans of that).

We’re talking about Plaid, the financial services company, which was just named a Leader by Forrester New Wave for the 2nd year in a row.

For the unfamiliar, this is a big deal. By being named a Leader (the top distinction) in the Forrester Wave: Open Banking Intermediaries, Q1 2023, Plaid has claimed their place among the heavy hitters of the industry – pretty impressive, considering the company has only been around since 2013.

Plaid excelled thanks to their polished product, scoring points for both “strong current offering” and “stronger strategy”. Take a peek at the report to see the metrics for yourself.

Deal Flow

M&A / Investments

French billionaire Rodolphe Saade offered to buy holding company Bollore’s logistics arm for $5.5B (BBG)

UK drugmaker GSK agreed to buy Canadian biotech Bellus Health for ~$2B (BBG)

Freight service operator Nippon Express is in talks to buy Austrian logistics provider Cargo-Partner, which could be valued at $1B+ (BBG)

State-owned telecom firm China Mobile is considering buying Hong Kong-based telecom firm HKBN, which has a market value of $1B (RT)

French utility Veolia Environnement is preparing a sale of Sade, its French water-pipe installation business, at a potential $329M valuation (BBG)

French lender Credit Mutuel is in talks to buy peer BNP Paribas’ consumer finance unit in Hungary (BBG)

Bank Goldman Sachs is exploring the sale of its Greensky fintech business as it moves to scale down its retail ambitions (RT)

UK-based Liontrust Asset Management is in talks to buy Swiss investment management firm GAM (RT)

Activist investor Litt’s Land & Buildings Investment Management urged REIT Apartment Investment and Management to evaluate all potential alternatives, including a sale (RT)

VC

Miovision, a Canadian startup providing intelligent transportation solutions, raised $260M in funding co-led by Telus Ventures, Maverix Private Equity, and Export Development Canada (FN)

Intelligence platform Maltego received $100M in growth funding from Charlesbank Technology Opportunities Funds (FN)

Bitcoin financial services company Unchained raised a $60M Series B led by Valor Equity Partners (FN)

Code security platform Semgrep raised a $53M Series C led by Lightspeed Venture Partners (TC)

Cyber risk management platform Safe Security raised a $50M Series B led by Sorenson Capital (PRN)

Clerkie, an AI-powered debt automation platform, raised a $33M Series A led by Left Lane Capital (PRN)

Intelligent care enablement platform Memora Health raised a $30M round led by General Catalyst (FN)

Ariceum Therapeutics, a biotech company developing radiopharmaceutical products, raised a $27.4M Series A extension co-led by Andera Partners and Earlybird Venture Capital (FN)

Nativo, a content technology platform where advertisers and publishers distribute brand stories at scale, raised $25M in structured capital from Capital IP (PRN)

SpecterOps, a provider of adversary-focused cybersecurity solutions, raised a $25M Series A led by Decibel (BW)

Sunvigo, a provider of residential solar systems, raised $21.4M in funding; $13.1M in growth capital from Future Energy Ventures and Triodos Energy Transition Europe Fund and $8.3M in financing from DKB AG (FN)

nZero, a near-real-time carbon management and accounting platform, raised a $16M Series A led by Fifth Wall and a national US energy company (PRN)

3D printing startup Quantica raised a $15.4M Series A led by an undisclosed family office (FN)

Composable checkout platform Rally raised a $12M Series A led by March Capital (BW)

Xenocor, a startup building a fog-free, articulating, single-use laparoscope, raised a $10M Series A led by GenHenn Venture Fund I (PRN)

BlueMark, a provider of independent impact verification and intelligence in the impact and sustainable investing market, raised a $10M Series A led by S&P Global (FN)

AI-powered retina scanning startup Mediwhale raised a $9M Series A led by SBI Investment (TC)

Evergrow, the all-in-one platform for clean energy tax credits, raised a $7M second round of financing led by First Round Capital, XYZ Venture Capital, Congruent Ventures, and Garuda Ventures (PRN)

Confidential computing startup Oblivious raised a $5.9M seed round led by Cavalry Ventures (FN)

Functional hydration brand Cure Hydration raised a $5.6M Series A led by Lerer Hippeau (FN)

VR game studio Vinci Games raised a $5.1M seed round led by Makers Fund (BW)

FinTech startup Charm Solutions raised a $3.5M seed round led by BootstrapLabs (FN)

Myxt, a provider of a collaborative music workplace, raised a $2M seed round from backers including Accel and Quiet Capital (FN)

Minagro, a Belgian startup developing green products for crop care, raised $1.3M in funding led by the management team (FN)

THE LNK, a cross-border online marketplace, raised a $1M seed round led by Reetu Gupta and Suraj Gupta (PRN)

Inboxbooster, a tech startup helping emails reach inboxes without spam, raised a $1M seed round from backers including Y Combinator and angels Francois Lagunas, Razvan Roman, and Ralph Gootee (FN)

IPO / Direct Listings / Issuances / Block Trades

SPAC

Hearing-aid maker Envoy Medical agreed to merge with Anzu Special Acquisition Corp. I in a $150M deal (LAW)

Debt

Japan's Sumitomo Mitsui Financial Group will issue AT1 bonds worth $1B in first bank AT1 issue since March (NKK)

Hong Kong conglomerate CK Hutchison is seeking to raise $1B in a US dollar bond sale (NDQ)

Abu Dhabi National Energy Company (or Taqa) raised $1.5B via dual tranche bond issuances, including its first green bond (GT)

UK-based LXi REIT raised $702M to refinance short-term debt maturities (MS)

UAE property developer DAMAC sold a three-year $400M Islamic bond (RT)

Canada will issue USD-denominated bonds in first since 2020 (MW)

Bankruptcy / Restructuring

Cineworld abandoned plan to sell its Eastern European and Israeli businesses (RT)

Fundraising

Crypto Corner

FTX’s restart plan attracted interest from Tribe Capital, a VC that previously invested in FTX (BBG)

Intel ended production of its bitcoin mining chip series (RT)

Coinbase may relocate outside the US unless the country changes its approach to regulation (BBG)

Coinbase's CEO sees crypto firms developing 'offshore' without clear US rules (RT)

BNY Mellon is going 'incredibly slow' on crypto (CD)

Bitcoin 30-day average mining revenues rose to highest level in ten months (RT)

Exec’s Picks

Technology news continues to cross over into the mainstream, with banking collapses, AI breakthroughs, and nonstop volatility in the venture capital industry. The Information has been a great resource to stay up to speed on insider news that does not get covered by TechCrunch, The Verge, or Bloomberg. Highly recommend a subscription to anyone serious about tech or venture capital. You can check them out here.

Axios covered everything you need to know about what’s next for Juul after settling thousands of lawsuits.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Litney’s managing partner, Bennett Jordan, recently met with Miami Mayor, Francis Suarez, to give tips to prospective finance candidates. Check out the IG Reel here.

Meme Cleanser

Want to chat social media growth, newsletter strategy, angel investing, Wall Street careers, or something else? Book a call with Litquidity here.

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.