Together with

Good Morning,

The SEC continued its crypto crackdown by suing Coinbase, the PGA Tour and LIV Golf are merging, the BoE ended its corporate bond sale program, European VC funding keeps dropping, Sequoia is splitting into three, Jamie Dimon is *not* running for public office, and Sam Altman wants OpenAI to remain private.

Did you know there’s a way to invest in real estate while also helping local communities? If that sounds like an interesting opportunity to you, check out today’s sponsor, Roots.

Let’s dive in.

Before The Bell

As of 6/6/2023 market close.

Markets

US stocks edged higher yesterday, led by strong performances from the financial and consumer discretionary sectors

The S&P and Nasdaq each clinched fresh YTD highs

The VIX traded below 14, reaching its lowest intraday level since February 2020

Merger-arbitrage investors had one of their worst months since early 2020

Wheat prices soared after a Russia attack in Ukraine raised concerns for the Black Sea grain trade

Treasury yields fell after the US started issuing a wave of T-Bills to rebuild its cash pile

Earnings

Ferguson’s Q1 results were in line with estimates as net sales were down 2% YoY, largely due to one fewer sales day in the quarter; management provided upbeat forward guidance (DAQ)

J.M. Smucker beat Q4 estimates thanks to investments in its growth platforms like Uncrustable sandwiches and Milk-Bone dog treats (YF)

What we're watching this week:

Today: GameStop, Campbell Soup

Thursday: DocuSign, Vail Resorts

Friday: NIO

Full calendar here

Headline Roundup

Bank of England ended its £20B corporate bond sale program as QE fades (RT)

Eurozone consumer inflation expectations fell significantly (BBG)

Eurozone retail sales were flat in April (RT)

European VC funding is forecast to drop a further 39% this year (CNBC)

Insider buying in US regional banks hit a three-year high in Q2 (RT)

Global growth will remain weak into 2024, World Bank says (CNBC)

Sequoia will split into three, separating its China and India/SE Asia businesses (CNBC)

Eight big stocks now account for nearly one-third of S&P 500's market cap (WSJ)

BofA private clients sold US equities for a tenth straight week (BBG)

Goldman Sachs is setting up a trading desk to handle Japanese power derivatives (BBG)

Jamie Dimon is not seeking public office (RT)

Amundi’s China head sets sights on $25T pension prize (BBG)

Calamos Investments filed to launch a convertible bond ETF (FT)

Linda Yaccarino began as Twitter's new CEO (RT)

Subway struggles to get big new franchisees to buy its US sandwich shops (RT)

Merck sued US over Medicare drug price negotiations (CNBC)

ChatGPT maker OpenAI is staying private so it can make ‘strange’ decisions (BBG)

A Message From Roots

A Real (Estate) Win-Win

Real estate investing has always felt like a zero-sum game: Either investors benefit and tenants don’t, or vice-versa… which, if you ask us, feels pretty outdated.

Roots agrees, which is why they’re changing all that with their community-focused real estate investing platform. Just check the blueprint:

Roots buys properties, fixes them up, and finds renters

Renters get invested in the fund for paying their rent on time, being good neighbors and taking care of the property.

Here’s the craziest part… this approach actually works.

The Roots Fund grew 16% last year (in a down market, no less), while tenant investors stockpiled a cool $175,000

Want to invest wisely AND do good for the community all in one fell swoop? Then check out Roots right here.

Deal Flow

M&A / Investments

Teck received several buyout proposals for its coal operations that were last valued at $8.2B, which would end Glencore’s twice rebuffed $22B acquisition attempt of the Canadian miner (RT)

Italian energy giant Eni has entered exclusive talks to acquire PE-backed gas and oil producer Neptune Energy after increasing its offer to a sum between $5B-$6B (RT)

Saudi Arabia’s City of the Future Neom finalized a deal to raise $5.6B from a group of local investors (BBG)

Barclays is selling $5.3B of Italian mortgage loans as it looks to exit the Italian retail banking industry (BBG)

$2.5B North Sea oil and gas producer Harbour Energy and $1.8B Gulf of Mexico peer Talos Energy are in talks to merge (RT)

Vitabiotics, a UK vitamin company led by ex-Dragons’ Den investor Tej Lalvani, is exploring options including a potential sale for as much as $1.2B (RT)

AIG is looking to sell a $1.1B stake in retirement services provider Corebridge Financial (RT)

New Zealand investment company Infratil has purchased the remaining 50% stake in One New Zealand for $1.1B from Brookfield Asset Management (BBG)

Mexican REIT Fibra Prologis is looking to invest $700M in warehouses located in the northern Mexican cities of Tijuana and Ciudad Juarez (BBG)

Associated British Foods, the owner of Primark and other major food businesses, is acquiring dairy technology company National Milk Records for $60M (RT)

Apple acquired Mira, a Los Angeles-based AR startup building headsets for the US military and other companies (RT)

The PGA Tour agreed to merge with Saudi PIF-backed LIV Golf; Saudi Arabia is prepared to invest billions into the new entity (CNBC)

Luxury fashion brands Prada and Ermenegildo Zegna are each acquiring a 15% stake in luxury knitwear company Luigi Fedeli e Figlio (RT)

Shell is selling its household energy supply arm (BBG)

VC

Carbon removal technology startup Charm Industrial raised a $100M Series B led by General Catalyst (FN)

GSoft, a software company improving the employee experience, received a $93.24M investment from CDPQ (FN)

AAVantgarde Bio, a clinical-stage biotechnology company developing two proprietary Adeno-Associated Viral vector platforms, raised a $65.2M Series A co-led by Atlas Venture and Forbion (FN)

Instabase, a startup providing an apps platform to understand and analyze 'unstructured' data, raised a $45M Series C at a $2B valuation led by Tribe Capital (TC)

Construction-focused last-mile logistics platform Curri raised a $42M Series B led by Bessemer Venture Partners (TC)

Mycelium technology company Ecovative raised a $30M Series E led by Viking Global Investors (BW)

WaveBL, a provider of electronic bills, raised a $26M Series B led by NewRoad Capital Partners (PRN)

Sourcemap, a provider of supply chain mapping and monitoring software, raised a $20M Series B led by Energize Ventures (PRN)

Bitcoin-denominated life insurance provider Meanwhile Insurance Bitcoin raised $19M across two seed rounds: one co-led by Sam Altman and Lachy Groom and one led by Gradient Ventures (CD)

RxLightning, a startup streamlining specialty medication access and affordability, raised a $17.5M Series A led by LRVHealth (BW)

Mend, a life sciences and digital health startup operating at the intersection of nutrapharma and food medicine, raised a $15M Series A led by S2G Ventures (PRN)

MyForest Foods, a plant-based meat startup, raised a $15M Series A-2 led by Ecovative Design (BW)

mend, a New York-based life sciences and digital health startup, raised a $15M Series A led by S2G Ventures (FN)

Spanish life insurance startup Life5 raised a $10.7M Series A from Singular, Mundi Ventures, and Sony Financial Ventures (TC)

Personalized nutrition startup AHARA raised a $10.3M seed round led by Greycroft (PRN)

LlamaIndex, a data framework for large language models, raised an $8.5M seed round led by Greylock (BW)

Carbon removal marketplace Nori raised $6.3M in funding led by M13, Toyota Ventures, Placeholder, and Cargill (BW)

IPO / Direct Listings / Issuances / Block Trades

Romanian energy producer Hidroelectrica is looking to raise ~$1.1B at a $10.6B valuation in what could be Europe's biggest IPO YTD (RT)

Zura Bio, a multi-asset clinical-stage biotech, raised $80M via private placement in a round led by Deep Track Capital, Great Point Partners, Suvretta Capital and a life sciences-focused investment fund (FN)

Restaurant franchising company Fat Brands is planning to IPO its Twin Peaks sports bar business to boost growth (BBG)

SPAC

Debt

Fundraising

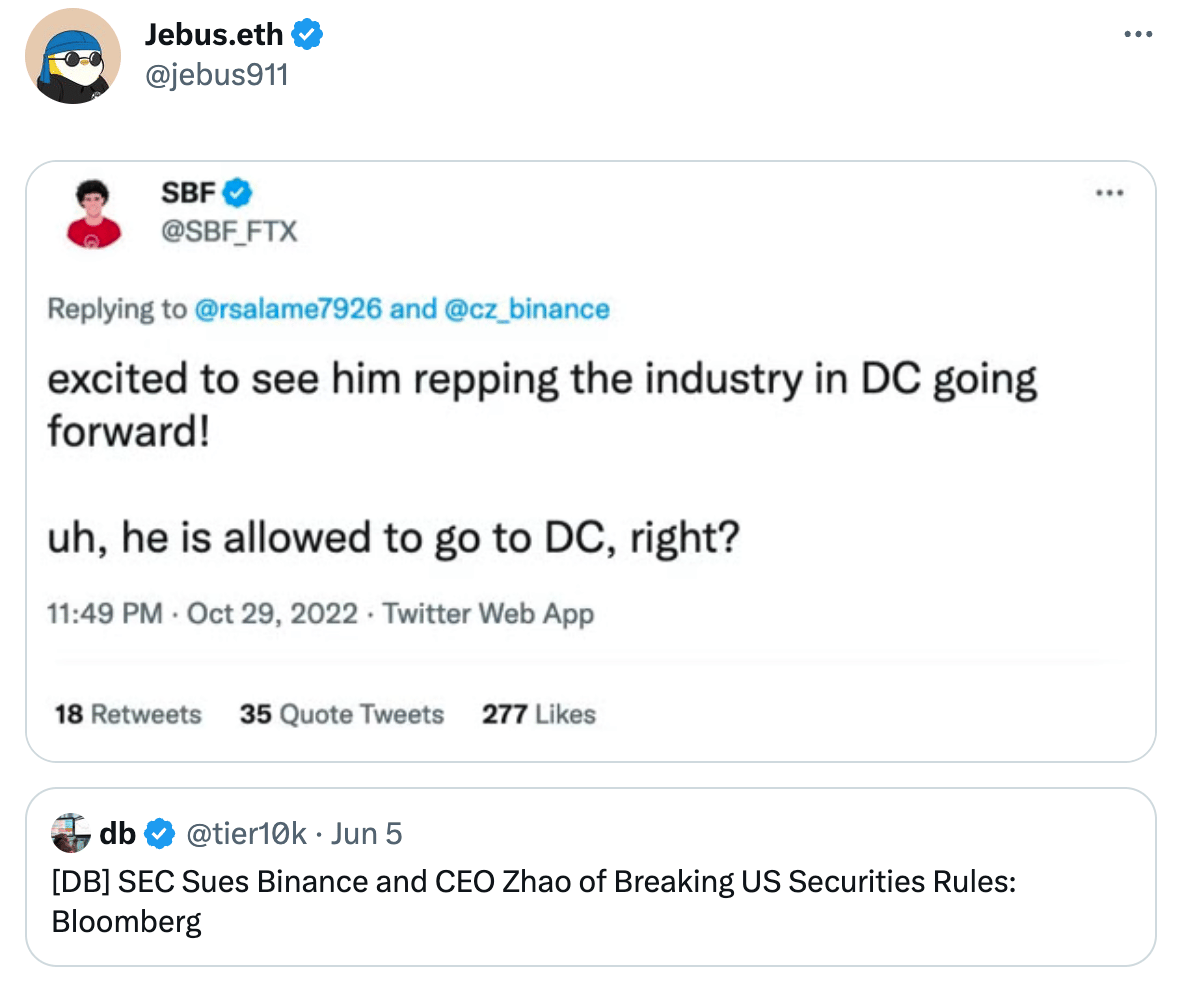

Crypto Corner

Exec’s Picks

Meghna Rao wrote a good piece on Ben Horowitz’s Dot Com Bubble pivot.

Tech layoffs have been hitting western states hard, as their unemployment rates outpace the US average.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter