Together with

Good Morning,

Cocoa is the new Bitcoin, Citigroup will complete its sweeping overhaul this week, Brazilian fintechs are being hit by loan defaults, Asian PE deal flow is at its lowest in nine years, and Reddit options traders are highly bullish while Trump’s SPAC options are betting on a crash.

Looking to break into private equity? Wharton Online and Wall Street Prep just opened enrollment for their Spring Cohort for their Private Equity Certificate Program, and you can sign up here.

Let’s dive in.

Before The Bell

As of 03/25/2024 market cap.

Markets

US stocks slipped ahead of Friday’s PCE release to begin this holiday-shortened week

The VIX dropped to its lowest level since 2018

Traders are betting a 20% chance of a BoE rate cut in May, double than the Fed or ECB

Cocoa futures jumped an additional ~8%, topping $9k for the first time ever

Earnings

What we're watching this week:

Today: Gamestop

Wednesday: Cintas, Jefferies, MillerKnoll

Thursday: Walgreens Boots Alliance

Full calendar here

Headline Roundup

Hedge funds have been swapping US stocks for European stocks (RT)

Asia PE deals set for worst Q1 since 2015 (RT)

Japan bankers see 10% decline in bonuses despite booming markets (BBG)

Citigroup will complete its sweeping overhaul this week after 5k layoffs (RT)

US median home prices hit a 2.5 year low, down 7.6% YoY (RT)

Reddit options bets overwhelmingly bullish as shares soar further (RT)

Trump Media SPAC options are pricing the stock to fall 95% MoM (BBG)

Bitcoin’s surge stirs crypto VC from its slumber (WSJ)

Foreign direct investment in China continues to fall (WSJ)

Boeing CEO Dave Calhoun and other leaders will step down (FT)

China is trying to stem outflow from domestically-focused ETFs (FT)

EU launched an investigation into Meta, Apple and Alphabet (CNBC)

Australia plans first stress test of financial system in 2025 (BBG)

Florida bans social media for kids under 14 (BBG)

Bullish bets on Mexican peso hits their highest level in over a year (BBG)

High delinquencies spell trouble for Brazil’s fintechs (BBG)

Italy poverty hits new high despite economic recovery (RT)

A Message From Wall Street Prep

Learn the Essentials of Private Equity with Industry Experts

Wharton Online and Wall Street Prep are excited to announce that enrollment is now open for the upcoming Spring Cohort for the Private Equity Certificate Program.

During this 8-week online program, students will learn the essentials of private equity through a theory-meets-practice methodology, taught by the top instructors at both Wharton Online and Wall Street Prep. Students will also be able to hear and gain insight from industry experts such as David Rubenstein and Martin Brand through our guest lecturer series.

In addition, students will have access to our exclusive graduate benefits, which include peer-to-peer networking events, invitation-only LinkedIn and Slack groups, and exclusive recruiting events with top private equity recruiting firms.

Use code LITQUIDITY to save $300 when you register for the program. And if you apply by April 15th, you can save an additional $200!

Deal Flow

M&A / Investments

Goldman Sachs Asset Management is exploring a sale of B&B Hotels in a potential deal that could value the European budget hotel chain at ~$3.8B (BBG)

Investment firm MNC Capital raised its all cash bid to acquire sporting and outdoor products maker Vista Outdoor to $3B from $2.9B (RT)

Air compressor maker Ingersoll Rand will acquire safety suit maker ILC Dover from investment firm New Mountain Capital for ~$2.3B (RT)

OE firm Advent International is looking to sell the European identity authentication business of Idemia, which may be valued at up to $1.1B (BBG)

Pharma giant Novo Nordisk will acquire RNA-based heart disease treatment developer Cardior Pharmaceuticals in a deal worth up to $1.1B (FT)

FTX will sell two-thirds of its 8% stake in AI startup Anthropic in a series of sales worth $884M; Mubadala unit ATIC Third International Investment will buy ~$500M worth of shares alongside Jane Street, Fidelity Management and Research, VC HOF Capital and 20 other buyers (BBG)

Spain acquired a 3% stake in Spanish telecom Telefonica for $757M as it seeks to counter Saudi Telecom’s plan to increase its shareholding in the company (BBG)

AmexGBT agreed to acquire rival CWT in a $570M deal (FT)

Blackstone-backed Encore Group USA is looking to raise at least $500M of preferred equity as the AV and event services company explores options on how to deal with $2.5B worth of debt maturing over the next 2 years (BBG)

AbbVie will acquire drug developer Landos Biopharma for up to $212M (RT)

Middle East logistics firm Tristar Transport revived attempts to sell itself after its prior IPO stalled over valuation discussions (BBG)

Australian retailer Premier plans to demerge its stationery store Smiggle and explore a demerger of sleepwear business Peter Alexander in 2025 (WSJ)

VC

Mirador Therapeutics, a startup developing therapeutic programs, raised a $400M round led by ARCH Venture Partners (FN)

FundGuard, a cloud-native, AI-powered, multi-asset class investment accounting platform, raised a $100M Series C led by Key1 Capital (BW)

Succinct, a developer of zero-knowledge proof tools, raised a $55M seed / Series A led by Paradigm (FN)

Regulatory compliance platform Global Screening Services raised a $47M round from CBA, Cynosure Group, and AlixPartner (TC)

Software risk management startup Finite State raised $20M in growth funding led by Energy Impact Partners (FN)

Sustainable sourcing platform Circular.co raised $10.5M in funding: a $5.3M round backed by Maniv, Oxygea, and Eclipse and a previous $5.2M seed round led by Eclipse (BW)

Goalsetter, a financial education platform for families, raised a $9.6M Series A extension round led by MM Catalyst Fund and Edward Jones (PRN)

Foundational, a startup using AI to identify and prevent data issues in platforms, raised an $8M seed round led by Viola Ventures and Gradient Ventures (BW)

Dema, a Swedish predictive analytics platform for ecommerce, raised a $7.8M seed round led by J12 Ventures, Daphni, and a group of angels (FN)

Airvine, a startup developing a multi-gigabit wireless backhaul system for indoor connectivity, raised a $6.2M Series A led by Crosslink Capital (PRN)

Buddywise, an AI-powered workplace safety platform, raised a $3.8M seed round led by Kvanted and J12 Ventures (FN)

Belong, a wealth-building platform, raised a $3.6M pre-seed round from Octopus Ventures, Viola Fintech, and others (EU)

3D tooling startup graswald.ai raised a $3.3M seed round led by Lakestar and Supernode Global (FN)

AI-coustics, a German startup using generative AI to enhance the clarity of voices in videos, raised a $2.2M funding round led by Connect Ventures, Inovia Capital and more (TC)

IPO / Direct Listings / Issuances / Block Trades

Unilever may choose Amsterdam over London for an $18.4B listing of its ice cream unit (BBG)

EV maker Lucid Group will receive a $1B investment in the form of a private placement for convertible preferred stock from Ayar Third Investment, an affiliate of Saudi Arabia’s PIF (BBG)

Southwest Gas Holdings unit Centuri Holdings, which builds and maintains energy networks, filed for a US IPO (RT)

Debt

Fortress Investment-backed Florida high-speed rail system Brightline is seeking up to $3.2B new capital from lenders to refinance its outstanding debt: ~$2.2B through investment-grade municipal bonds and $1B through junk bonds (BBG)

Bankruptcy / Restructuring / Distressed

Consumer lending conglomerate Curo filed for Chapter 11 bankruptcy with a plan to reduce ~$1B in debt (BBG)

WeWork co-founder Adam Neumann offered to purchase the bankrupt company for ~$600M (FT)

Struggling EV startup Fisker ended talks with a major automaker about an investment, raising the risk of bankruptcy (BBG)

Fundraising

Grosvenor, the Duke of Westminster’s property company, is launching a ~$1.1B real estate lending arm (FT)

PE firm Hildred Capital Management raised $750M for its first continuation fund to extend its ownership of two consumer-healthcare businesses (WSJ)

Industrial decarbonization-focused PE firm Ara Partners is raising $500M for its first infrastructure fund (AX)

Crypto Corner

Exec’s Picks

With 4-way stretch, wrinkle-resistant, and quick-dry fabric, Mizzen+Main shirts will have you feeling dry, fresh, and comfortable while always looking business ready. Upgrade your closet today and order your Mizzen+Main here!

Financial Times published their big read on how infrastructure went from investment backwater to a $1T asset class.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

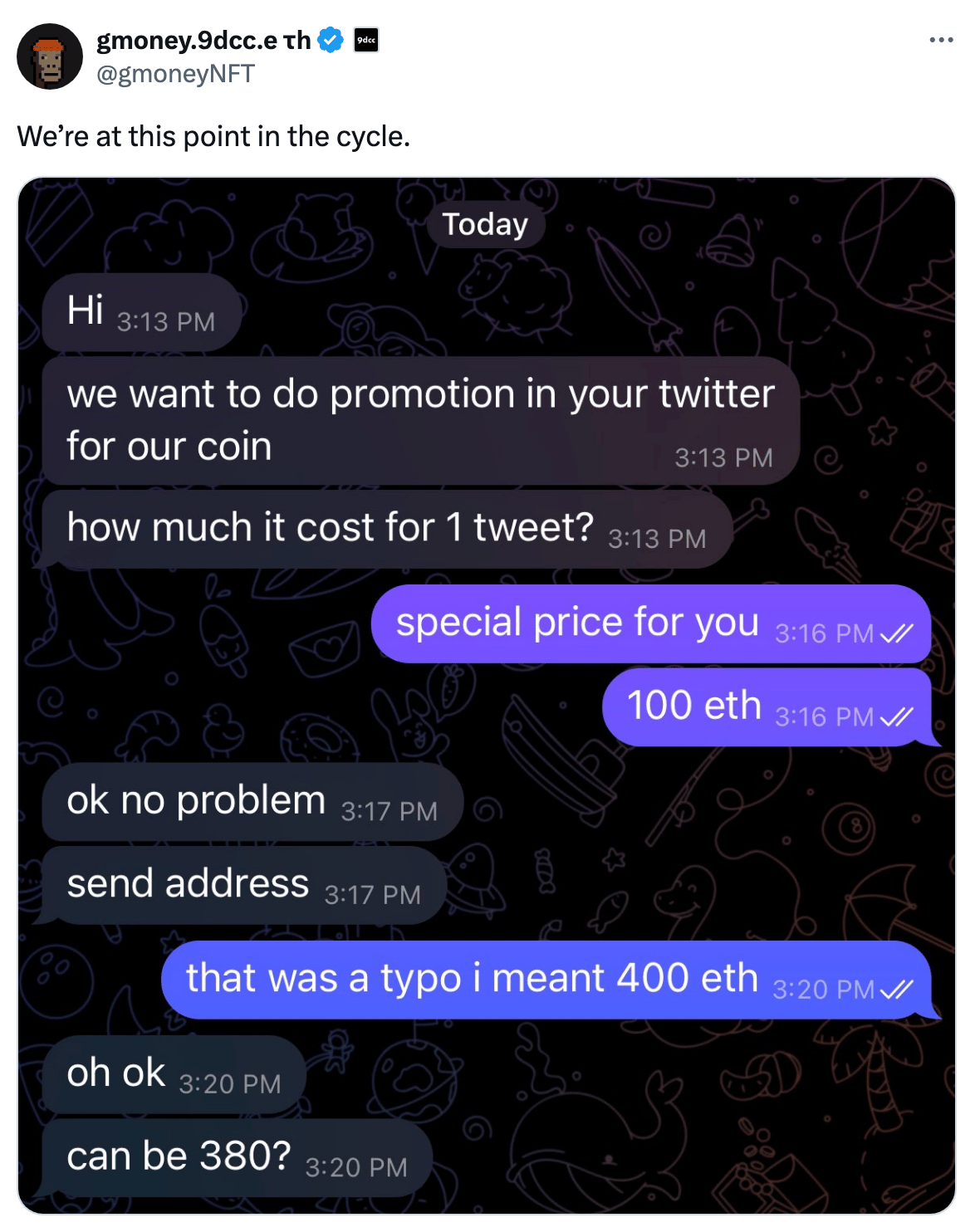

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter