Together with

Good Morning,

Rio Tinto hired banks to work on a historic $260B Glencore merger, Greenland ruled out joining the US, JPMorgan's earnings disappointed, the Clintons refused to testify in Congress' Epstein investigation, and Anthropic's new coding agent is taking social media by storm.

Level up your PE skillset for the new year with the Wharton Online-Wall Street Prep Private Equity Certificate Program. Save $300 with code LITQUIDITY. Learn more below.

Let's dive in.

Before The Bell

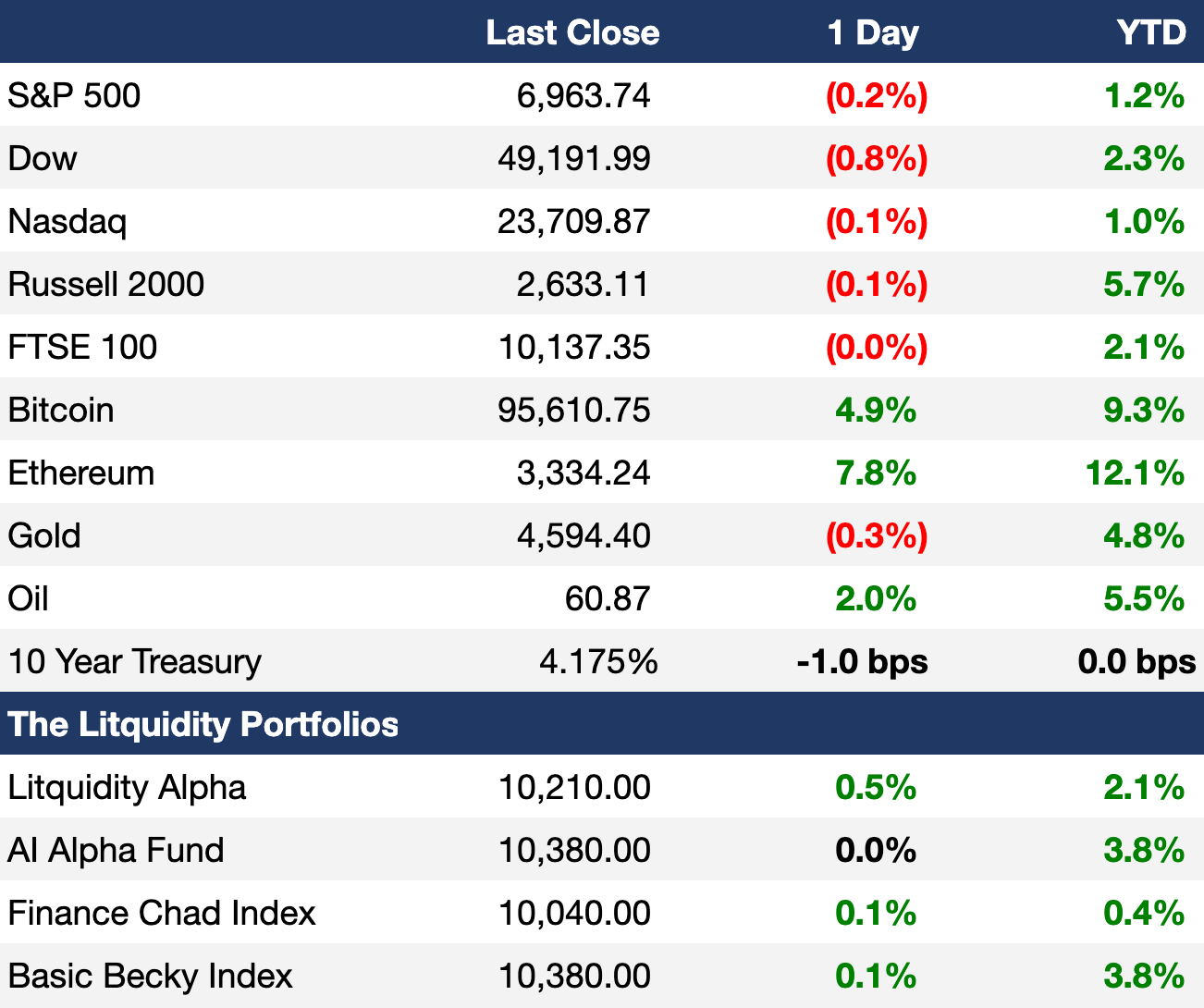

As of 1/13/2026 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks fell as investors parsed inflation data and JPMorgan's bellwether earnings for clues on the economy

Options traders are raising bets of zero Fed rate cuts this year

Munis are up 0.75% YTD in a typical 'January effect'

Korean won is down 2% YTD after weakening for a ninth day for its longest losing streak since 2008 as local degens continue investing abroad

Danish krone is getting close to its 'historical defense zone' of 7.48/€ amid Trump's Greenland threats

Earnings

JPMorgan beat Q4 earnings and revenue estimates on strong trading, though IB fees fell 5% and profit fell 7% due to a one-time Apple Card charge (CNBC)

Delta Airlines missed Q4 revenue estimates but beat on earnings as premium demand continues to surge (CNBC)

What we're watching this week:

Today: Wells Fargo, Citigroup, Bank of America, Infosys

Thursday: TSMC, BlackRock, Goldman Sachs, Morgan Stanley

Friday: State Street, PNC

Full calendar here

Prediction Markets

Trump signaled support for the toppling of Iran's regime as protests get violent

Trade your prediction on regime changes on Polymarket

Headline Roundup

Clintons refused to testify in Congress Epstein investigation (FT)

Central banks and Wall Street CEOs back J Pow amid investigation (RT)

Jamie Dimon warned against attacking Fed independence (WSJ)

Greenland ruled out joining the US (BBG)

Exxon is still interested in Venezuela despite Trump rebuke (RT)

US CPI growth slowed to 2.6% (CNBC)

US deficit shrank to $1.7T last year on record tariff revenue (BBG)

China trade surplus hit a record $1.2T (CNBC)

Wall Street expects strong Q4 earnings on robust US economy (RT)

Basis trade has ballooned to $1.5T (BBG)

US biotech share sales hit $2.5B YTD in its best since 2021 (BBG)

UBS CEO Ermotti will step down next year after Credit Suisse integration (FT)

HRT trading revenue hit a record $12.3B in 2025 (BBG)

Kirkland & Ellis was accused of conflict in PE spat (BBG)

China is probing foreigner's ETF trading after Jane Street India case (BBG)

CME will shift precious metals margin settings as prices swing (BBG)

VC Balderton Capital is up over 200,000% on its Revolut bet (FT)

BlackRock will cut ~1% of jobs (RT)

US gave green light to Nvidia H200 chip exports to China (RT)

Anthropic's new Cowork tool offers Claude Code without the code (TC)

Microsoft rolled out initiative to curb data center energy and water usage (RT)

Fanatics will launch a sports media and entertainment studio (CNBC)

Trump said 'help is on its way' for Iranian protesters (FT)

A Message from Wall Street Prep

There's a difference between running the model and running the deal.

Wharton Online's Private Equity Certificate Program teaches how PE professionals move from models to investment decisions using the same training taught inside top firms, including BlackRock, KKR, and more.

In just 8 weeks, you'll get:

Hands-on LBO modeling and deal analysis used by leading PE firms

A globally recognized certificate from a top business school

Lifetime access to networking events, meetups, and industry sessions

Enroll and save $300 with code LITQUIDITY. Starts Feb 9.

Deal Flow

M&A / Investments

Mining giant Rio Tinto hired Evercore, JPMorgan, and Macquarie for its historic $260B merger with rival Glencore

Netflix revised terms for its $83B Warner Bros. Discovery acquisition and proposed making an all-cash offer for their studios and streaming businesses

Canadian asset manager CI Global will acquire Invesco's $19B Canadian asset management business

Eli Lilly is preparing a $17.5B bid for French biotech Abivax

Australian pension Aware Super acquired a 31.3% stake in European Outlet Mall Venture from PIMCO-managed Allianz accounts; the platform owns four outlet centers valued at $3B

Regional lender U.S. Bancorp will acquire brokerage BTIG in a $1B cash and stock deal

Warburg Pincus is considering a $1B sale of UK specialist insurance broker McGill and Partners

French media group Banijay is in talks to merge its TV production business with rival All3Media; All3Media was valued at $1.5B in a sale last year

Crypto data platform CoinGecko is exploring a $500M sale

Blockchain firm Polygon agreed to buy crypto payments company Coinme and crypto infrastructure provider Sequence for over $250M

Africa-focused investment firm Silverbacks is in talks with the NBA to buy a Basketball Africa League franchise

UK brewer Diageo is considering divesting its China assets, including its 63% stake in China-listed Sichuan Swellfun

German consumer chemicals firm Symrise is in advanced talks to sell its terpenes business

VC

AI command-software startup Onebrief raised a $220M Series D at a $2.15B valuation led by Battery Ventures and Sapphire Ventures

JetZero, an all-wing aircraft startup, raised a $175M Series B led by B Capital

Defense Unicorns, an airgap software platform for military systems, raised a $136M Series B at a $1B valuation led by Bain Capital

Voice-AI platform Deepgram raised a $130M Series C at a $1.3B valuation led by AVP

Proxima, an AI-driven proximity therapeutics startup, raised an $80M seed round led by DCVC

Wasabi Technologies, a hot cloud storage provider, raised a $70M round led by L2 Point Management

WitnessAI, an enterprise AI security platform, raised a $58M round led by Sound Ventures

WithCoverage, an AI-enabled risk-management platform, raised a $42M Series B led by Sequoia Capital and Khosla Ventures

AI-drug-discovery startup Converge Bio raised a $25M Series A led by Bessemer Venture Partners

WeatherPromise, an AI weather-guarantee platform for travel and events, raised a $12.8M Series A led by Maveron

Protein-engineering startup Nuclera raised a $12M Series C extension led by Elevage Medical Technologies and Jonathan Milner

Quantum-software startup Haiqu raised an $11M seed round led by Primary Venture Partners

The 33rd Team, a football analytics and AI technology startup, raised an eight-figure Series B from Liberty Media, FORTA Advisors, Gary Vaynerchuk, and others

NetBird, a European open-source Zero Trust networking startup, raised a $10M Series A led by Pace Capital

Battery-printing startup MATERIAL raised a $7.1 MM round co-led by Outlander VC and Harpoon Ventures

Get real-time updates on any startup, VC, or sector. Try Fundable.

IPO / Direct Listings / Issuances / Block Trades

European defense giant Czechoslovak Group is preparing to launch an Amsterdam IPO at a $35B valuation

Construction tech firm EquipmentShare.com is seeking to raise $777M at a $6.4B valuation in its IPO

Austrian crypto trading platform Bitpanda is eyeing a Germany IPO at a $4.7B-$5.8B valuation

Blackstone-backed mobile ad company Liftoff filed for an IPO; the firm was valued at $4.3B in a stake sale last year

US is seeking to invest in defense giant L3Harris Technologies' missile unit via a $1B convertible preferred security

Copper-based components manufacturer Asta Energy Solutions is considering a Germany IPO at a $582M valuation

Indian asset managers SBI Funds and ICICI Prudential bid for half of Indian drugmaker Biocon's $460M institutional share placement

General Atlantic-backed Indian digital insurer Acko invited banks to pitch on a potential $350M IPO

SPAC

Crypto-friendly lender Old Glory Bank will merge with Digital Asset Acquisition Corp. at a $250M valuation

Debt

Apollo is willing to buy more of xAI's $3.5B debt at par as it looks to open trading on Valor Equity Partners' private credit deal

Major Ukraine corporates including state rail company Ukrzaliznytsia and state energy company NJSC Naftogaz are looking to delay payments or restructure a combined $3B in debt amid Russian strikes on infrastructure

Banks including JPMorgan and Citigroup are in talks to lend Argentinian natural gas producer Pan American Energy $1B

Nigeria plans to raise $352M in green bonds

Canadian utility Enova Power is preparing to raise $180M in a debut debt sale

Colombia sold $5B of dollar-denominated bonds for the first time since April

Benin hired Citi, Emirates NBD, HSBC, JPMorgan, and Arqaam Capital to market a potential dollar Sukuk and other debt securities

Bankruptcy / Restructuring / Distressed

Venezuela is appealing a Delaware court ruling that awarded Citgo parent PDV to Elliott-affiliate Amber Energy for $5.9B, part of a sale to pay up to $19B in creditor claims

Luxury retailer Saks' new CEO Richard Baker is exiting after just two weeks as the firms lines up a $1.75B DIP package for an imminent Chapter 11 bankruptcy

Brazil's finance ministry supported Brazil's central bank decision to liquidate Banco Master after warning it may be Brazil's largest banking fraud ever

Subprime auto lender Tricolor's founder Daniel Chu and ex-COO David Goodgame pleaded not guilty to fraud charges

Activist Saba Capital is pushing for London-focused flexible office-space provider Workspace to pursue a managed wind-down

Vanderbilt University took over the campus of troubled SF-based California College of the Arts that Nvidia CEO Jensen Huang once tried to save

Fundraising / Secondaries

Ares raised $7.1B for its debut private credit secondaries strategy, including a $1B JV with Mubadala

Nordic energy and infrastructure investor AIP Management raised $2.3B for a targeted $3.5B fifth fund

Crypto Sum Snapshot

Open interest in altcoin futures collapsed 55% since October

Ex-NYC mayor Eric Adams rug-pulled investors in 'NYCCoin' debut

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Bloomberg published a informative CEO's guide to navigating Trump's second term.

Bloomberg sat down with legendary sovereign RX lawyer Lee Buchheit to hear his thoughts on the path ahead for Venezuela's messy $170B of debt.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.