Together with

Good Morning,

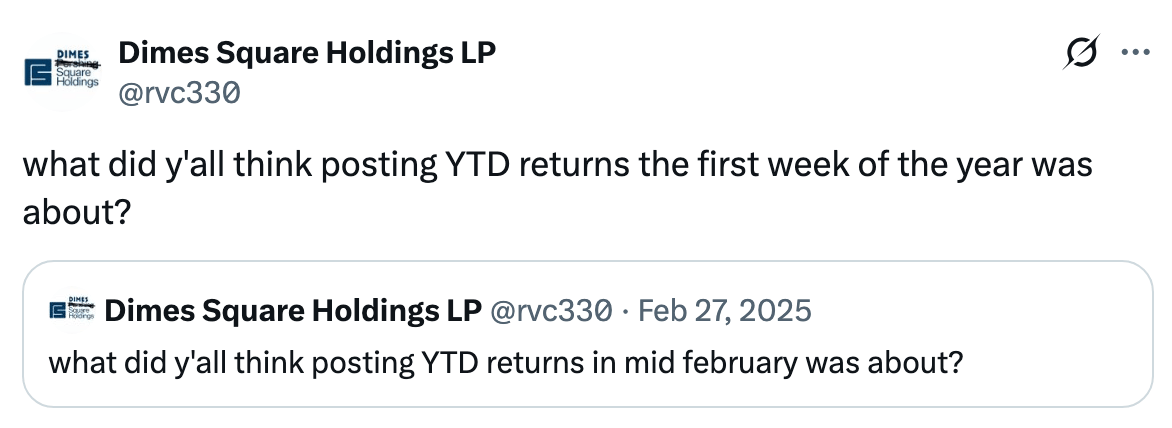

Wall Street's favorite trades, from tech to metals to Bitcoin, collapsed. All it took was a Claude update.

Since Claude broke the market, Claude can also fix it. So my intern worked through the night to vibe-code a solution 🤦

import Claude

def Plz_fix_market(broken market):

bull market = Claude.fix(broken market)

return (bull market)

Print("Ok Claude, {Plz_fix_market}")The flagship Wharton Online-Wall Street Prep Private Equity Certificate Program begins next week. If you've been debating it for some time, this is your sign to jump right in. Our discount is still active!

Let's dive in.

Before The Bell

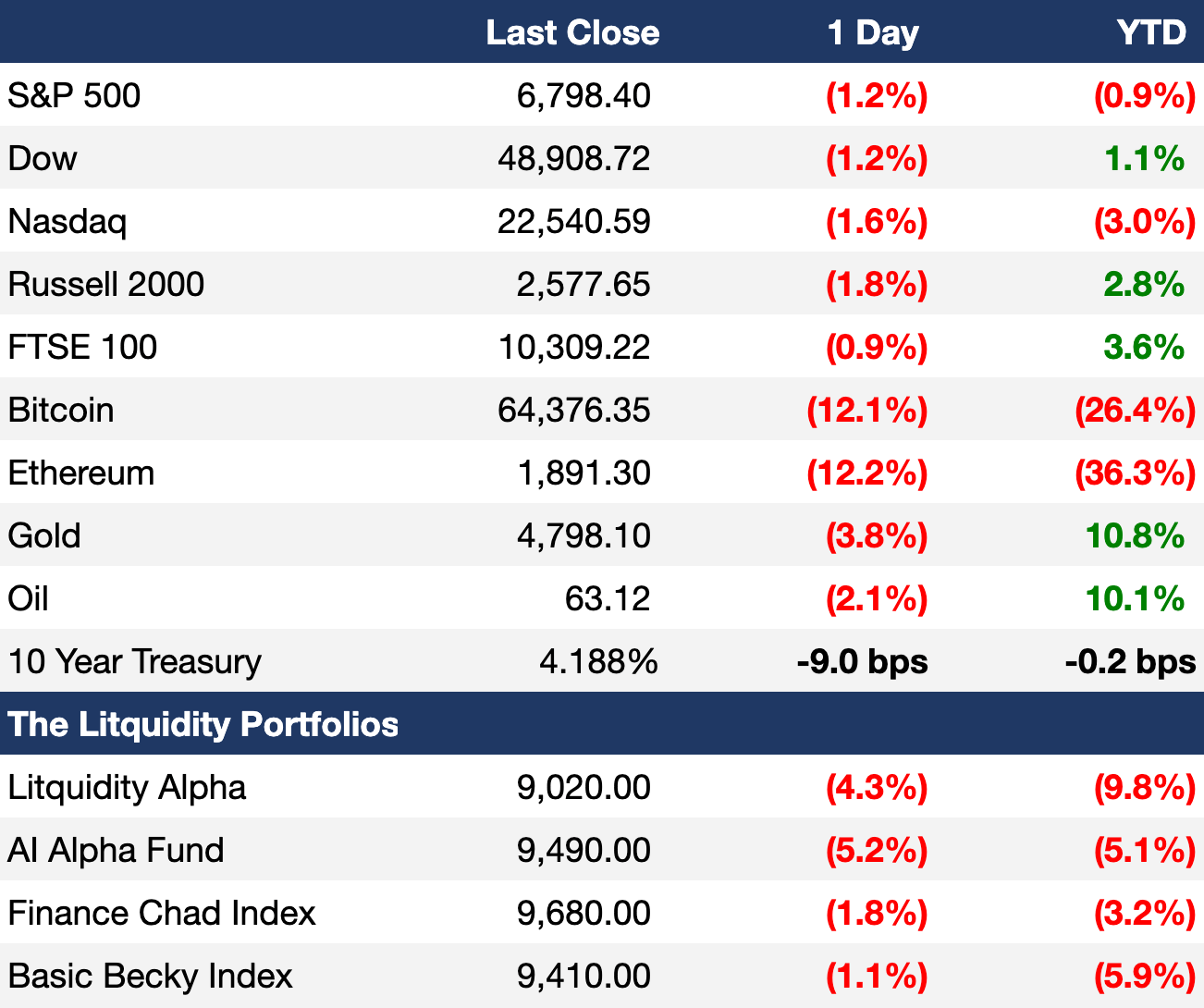

As of 2/5/2026 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks continued their decline as sour jobs data amplified the software-led selloff

S&P 500 turned negative YTD

S&P 500 Software & Services index is down 18% YTD after shedding $1T in market value in one week

Dollar rose to a two-week high

Pound fell 0.7% on threats to PM Starmer's leadership

Silver erased its 62% YTD gain with volatility at 46-year highs

Bitcoin tumbled to its lowest since October 2024

Earnings

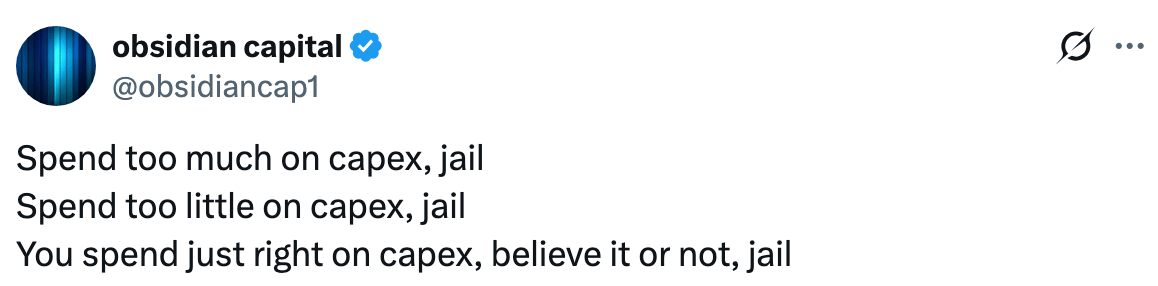

Amazon missed Q4 earnings estimates but beat on revenue on 24% growth in AWS; the firm projected a massive $200B in FY CapEx (CNBC)

KKR missed Q4 earnings despite AUM rising to $744B as the firm comes under pressure from AI and a 7% software exposure despite reassurances on risk management; the firm will acquire sports investor Arctos Partners (BBG)

Ares missed Q4 earnings and revenue estimates but AUM hit a record $622.5B with the firm seeing opportunities in the software disruption (WSJ)

Shell missed Q4 results on its weakest profit in five years due to lower oil prices and a challenging market environment in Europe energy (CNBC)

Reddit beat Q4 earnings and revenue estimates and issued strong Q1 guidance on 19% global DAUq growth to 121.4M (CNBC)

Roblox beat Q4 revenue estimates with narrower-than-expected losses as bookings and DAUs rose (WSJ)

Strategy beat Q4 revenue estimates but posted a $12B unrealized loss on its Bitcoin holdings (WSJ)

What we're watching this week:

Today: Toyota

Full calendar here

Prediction Markets

Those predicting the return of Jesus Christ this year have outperformed Bitcoin investors over the past five years

Trade event contracts on Polymarket, the world's largest prediction market

Headline Roundup

Clintons want Epstein testimony to take place in public (CNBC)

Bessent won't promise that Trump won't sue Kevin Warsh over policy (RT)

US job market is the worst since the Great Recession (BBG)

ECB held rates steady at 2% (CNBC)

BoE held rates steady at 3.75% (CNBC)

Wall Street's favorite trades are collapsing (BBG)

Anthropic's AI tool sparks selloff from software to broader market (BBG)

$1T software wipeout ensnares all stocks in AI's path (BBG)

Dip-buyers go missing as software selloff slams stocks (RT)

Stock-picking hedge funds had their worst day in a year (RT)

Short sellers raised software shorts after $24B profits (CNBC)

Options traders pile into tech hedges after software rout (BBG)

PE megafunds rush to defend software companies as AI rout deepens (BBG)

PE stocks sunk on AI and software worries (FT)

Hedge funds close to new cash as LPs rush to invest (BBG)

Crowded swap spread widener trade faces risk of rapid unwind (BBG)

Oracle's blockbuster bond sale may spur AI borrowing rush (BBG)

UBS IB units to see bonus pools jump by 20% (BBG)

Vanguard poached ten directors from BlackRock and Goldman (BBG)

Dubai's financial hub posts record growth on hedge fund boom (BBG)

A Message from Wall Street Prep

The insider's guide to investment committee nobody tells you.

The 8-week Private Equity Certificate Program from Wharton Online + Wall Street Prep delivers the same training used at Blackstone, KKR, and other top firms.

Join LIVE office hours with Wharton Business School faculty to pressure-test ideas and ask questions.

Earn your certificate from Wharton Online + join an optional closing ceremony in NYC!

Get lifetime access to program materials, invites to meet-ups, and networking sessions

Enroll today to join the next cohort starting February 9.

Code LITQUIDITY saves $300 off tuition.

Deal Flow

M&A / Strategic

Mining giants Rio Tinto and Glencore canceled their $260B merger plans

Canada's CPPIB and OMERS are seeking to sell their 33% stakes in UK's biggest ports operator Associated British Ports at an over $13.6B valuation

Thailand's largest auto-parts manufacturer Thai Summit Group is weighing a $1.5B-$2B sale

KKR agreed to acquire sports PE firm Arctos Partners in a $1.4B cash-and-stock deal

Zimbabwe's state-owned miner Mutapa Platinum is seeking partners to help fund and develop a $500M mine

Mining giant Anglo American warned of a third De Beers write-down in three years as it seeks to sell or spinoff its diamond unit amid a merger with Teck Resources

VC

AI startup Anthropic is in talks to sell secondary shares at a $350B valuation alongside plans to raise $20B at a $350B valuation

Structured-data AI startup Fundamental emerged forms stealth with a $255M seed and Series A at a $1.2 billion led by Oak HC/FT, Valor Equity Partners, Battery Ventures, and Salesforce Ventures

Interpretability-focused AI lab Goodfire raised a $150M Series B at a $1.25B valuation led by B Capital

Connect Music, a music rights and technology platform for independent artists, raised an $80M round led by Rockmont Partners

AI-native accounting automation startup Accrual raised a $75M round led by General Catalyst

Geospatial-AI startup Urban SDK raised a $65M growth round from Riverwood Capital

UK legaltech startup Lawhive raised a $60M Series B led by Mitch Rales

Turnstile, a quote-to-cash platform, raised a $29M round led by First Round

UK automated FX hedging startup Bound raised a $24.5M Series A led by AlbionVC

enshift AG, a European provider of integrated energy-transition solutions for real estate, raised a $21M Series A led by Swiss Solar Group

R3 Robotics, a European EV disassembly automation startup, raised a $16M Series A co-led by HG Ventures and Suma Capital

European electric-propulsion specialist Morpheus Space raised a $15M strategic round led by Alpine Space Ventures

AI product-security startup Nullify raised a $12.5M seed round led by SYN Ventures

Mathematical verification startup Midas raised a $10M round led by Valor Equity Partners and Nova Global

Get real-time updates on any startup, VC, or sector on Fundable.

IPO / Direct Listings / Issuances / Block Trades

Barrick Mining plans to spin off its top North American gold assets at a potential $60B valuation

China's Sinochem-owned agro-chemicals giant Syngenta is hiring banks for a potential $10B Hong Kong IPO

Hg-backed Norwegian software group Visma may delay its $22B London IPO amid the growing software selloff

Activist Elliott raised its stake in Toyota Industries to 7.1% in an effort to block Toyota's buyout

Neos Partners-backed electrical equipment maker Forgent Power Solutions raised $1.5B at an $8.8B valuation in its IPO

Blackstone-backed mobile advertising company Liftoff postponed its $762M IPO amid a market selloff

Cancer biotech Eikon Therapeutics raised $381M at a $972M valuation in its IPO

Bain Capital-backed furniture retailer Bob's Discount Furniture raised $330M at a $2.4B valuation in its IPO

Generate Biomedicines filed for an IPO

Rare earths miner Ionic is weighing an IPO

Debt

Goldman Sachs is readying a revised $3.75B financing to support TJC-backed chemical maker Arclin's $1.8B acquisition of DuPont's Aramids business

South Korea sold $3B of dollar bonds to boost FX reserves

Brazilian conglomerate CSN plans to raise $1.5B in a secured loan

Goldman Sachs, Blackstone, and Apollo are providing a $975M private credit loan for Australian PE firm BGH Capital's $1.6B LBO of pharma company Aspen's APAC business

Brazil's only rare earths miner Serra Verde gave US an option to acquire a stake in the company as part of a $565M financing deal

State-owned Life Insurance Corporation of India is in talks to buy zero-coupon STRIPS bonds

Funds / Secondaries

PE firm Clearlake Capital will double its GP commitment to its eighth flagship PE fund from $300M to $600M and lower its fund size target from $15B to $14.2B to buy a second fundraising extension

French PE firm Ardian raised over $5.2B for its ninth infrastructure secondaries fund

Oncology-focused VC Yosemite raised $200M for a targeted $350M sophomore fund

Commodities giant Trafigura is in talks with Chinese state-owned supply chain giant ITG to form a credit fund JV to finance commodity deals

Crypto Sum Snapshot

Welcome back, diamond hands. While you were on the moon, we've been publishing a daily newsletter that compiles the most important news and stories on everything crypto. Read it here.

Exec’s Picks

The situation at Two Sigma is absolutely insane. Their co-founders stepped down from their co-CEO roles in 2024 after disagreements turned so toxic so as to pose a 'material risk' to the firm. Now, one co-founder may end up losing half of his $7B net worth and control of the firm in a messy lawsuit-ridden divorce. Probably explains the fallout between the co-founders...What an absolute governance, management, succession, and personal nightmare for one of the most prominent quant hedge funds ever.

Investment Banking Opportunity – MD Level 💼

We are working with an EB investment bank to hire MDs across numerous coverage and product groups to expand their Chicago presence.

The firm is an influential advisor on M&A, restructurings, financings, and capital markets to corporations, partnerships, institutions, and governments globally with a footprint spanning four continents. They are looking for candidates who possess:

12+ years of IB or related advisory experience

Experience in leading transactions, including M&A and restructuring deals

Existing client relationships and a strong track-record of execution

Strong leadership, communication skills, and a team-oriented attitude

If this sounds like you, we'd love to connect. Apply here 🤝

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.