Together with

Good Morning,

Ken Griffin moved Citadel to Miami, J Pow is all-in on bringing down inflation, Netflix laid off 300 more employees, TikTok is on track for $12B in revenue, investment bankers are struggling to offload corporate debt, and vapers are hoarding Juuls in light of the FDA's ban.

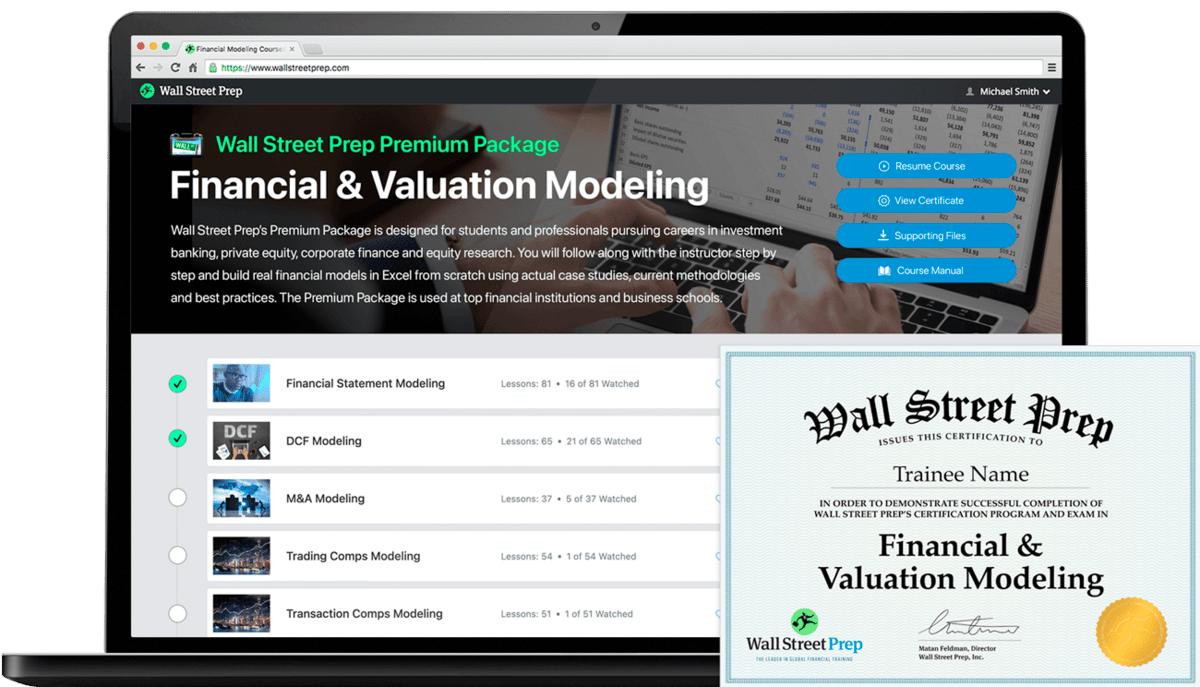

Interviewing for a new job or internship in IB or PE? Check out today's sponsor, Wall Street Prep, to access the financial modeling courses that major investment banks use to train their incoming analyst / associate classes!

Lastly, check out our Fourth of July merch collection in case y'all need a last minute patriotic gear.

Let's dive in.

Before The Bell

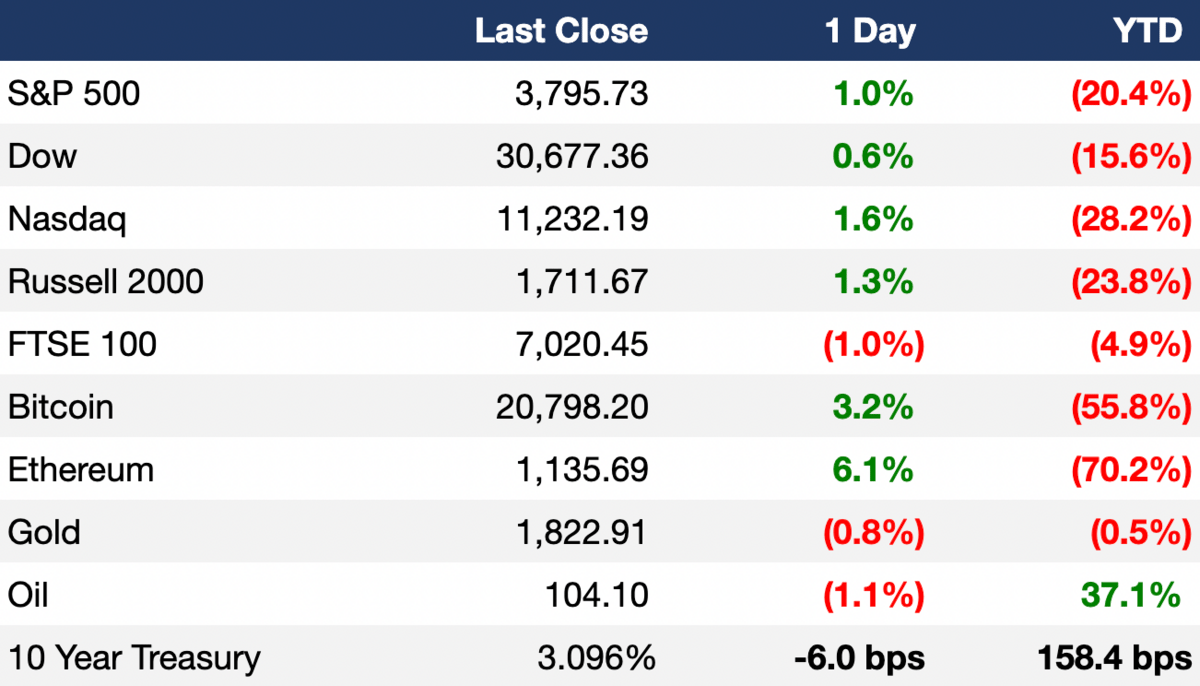

As of 6/23/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

Stocks rose as Jerome Powell reinforced the Fed’s commitment to bringing down inflation at all costs during his testimony before Congress

Commodities such as oil and copper slipped as recession fears mounted

Mortgage rates reached their highest level in more than a decade for the second straight week; the average rate on a 30-year fixed-rate mortgage is now 5.81%

The pan-continental Stoxx Europe 600 fell 0.8% following reports which showed Europe’s economy slowed in June

Earnings

Accenture fell about 0.5% after the company met Q3 expectations but lowered its revenue estimates for Q4 (BA)

Rite Aid soared 19% on the day as they exceeded estimated EPS by 14% and increased revenue projections for the year (MW)

FedEx reported profits in line with estimates for their most recent quarter and increased their full-year profit forecasts, causing shares to rise after-hours (BBG)

What we’re watching today: CarMax

Full calendar here

Headline Roundup

US and European investment bankers are bracing for billions of dollars in total losses on pricey LBOs as they struggle to offload corporate debt that’s losing value amid sweeping market selloffs (BBG)

Billionaire Ken Griffin is relocating the hedge-fund firm Citadel from Chicago to Miami following complaints of crime (WSJ)

Netflix layed off another three hundred employees as the company seeks lower costs (BBG)

The US Department of Education reached a legal settlement to forgive $6B in student loan debt for borrowers who attended for-profit colleges (BBG)

Vapers are hoarding Juul e-cigarettes as the FDA announced a ban on the sale of the company's products (BBG)

The Supreme Court struck down an NY gun law that restricted individuals from carrying a gun outside of their homes (CNBC)

Germany triggered the "alarm stage" of its emergency gas plan on Thursday in response to falling Russian supplies (RT)

European leaders formally accepted Ukraine as a candidate to join the EU (CNBC)

TikTok is on track to triple revenue this year to $12B, threatening Facebook’s hold on social media (BBG)

McDonald’s is simplifying its franchising policies to attract more diverse candidates (CNBC)

A Message From Wall Street Prep

Don't Blow Your Dream IB Interview

Finance nightmare, a short story:

Target undergraduate school. 4.0 GPA. Great extracurriculars. The MD plays golf with your dad.

You're set, this job is a lock. And you are breezing through the interview. The end is in sight, as long as you crush the case study. You are well on your way... until you can't remember how to run a DCF model.

And just like that, everything falls apart.

Game over. Have fun with the back office gig.

If you don't want to be a back-office guy, make sure you stick the interview by using Wall Street Prep.

Wall Street Prep offers a complete Financial and Valuation modeling training program, so you can learn financial statement modeling, DCF, Trading and Transaction Comps, M&A and LBO. This is the same program used to train professionals at top investment banks and financial institutions.

Crush your interview and land that dream job by checking out Wall Street Prep's course today!

Deal Flow

M&A / Investments

Software company Zendesk, which has a market value of ~$7B, is close to a deal with a group of buyout firms that includes Hellman and Friedman (WSJ)

BC Partners acquired French natural healthcare group Havea for ~$1.16B (RT)

PE firm TPG agreed to acquire all outstanding shares of Convey Health Solutions to take it private at a ~$1.1B valuation (RT)

US online sports merchandise retailer Fanatics is in talks to buy sports betting company Tipico (CNBC)

An investment group led by former Houston Astros GM Jeff Luhnow acquired Spanish soccer club Leganés (BBG)

Starburst, a data warehouse analytics service and data query engine, acquired Varada, a Tel Aviv-based startup that focuses on data lake analytics, for an undisclosed amount (TC)

Merck & Co. is pushing forward with a potential deal for biotech Seagen Inc., according to people familiar with the matter, in what would be one of the largest takeovers of the year (WSJ)

Bitcoin miner Crusoe Energy Systems acquired electrical manufacturer Easter-Owens Electric Co in a bid to vertically integrate the company (TB)

VC

Mojia Biotech, a Shanghai-based bio-manufacturing company dedicated to sustainable development and carbon neutrality, raised an $80M Series B led by Temasek (PRN)

Playter, a buy-now-pay-later platform used to fund startups and scaleups across the globe, closed a $55M equity and debt funding round led by Adit Ventures and Fasanara Capital (TC)

Evinced, a company providing accessibility support to coders, raised a $38M Series B led by Insight Partners (TC)

ESG Book, a provider of sustainability data and technology, closed a $35M Series B led by Energy Impact Partners (PRN)

Tibit Communications, a California-based startup developing network devices for fiber broadband access, raised a $30M Series C participated in by Liberty Global, Swisscom Ventures, Intel Capital, and others (PRN)

Florence Healthcare, which creates a workflow platform for clinical researchers, raised a $27M Series C-1 led by Insight Partners (TC)

Vibrant Planet, a forest management software platform used to combat wildfires, raised a $17M seed round led by Ecosystem Integrity Fund and The Jeremy and Hannelore Grantham Environmental Trust (TC)

Imaging diagnostics company Magnetic Insight raised a $17M Series B led by Celesta Capital (PRN)

ConductorOne, an identity control and access startup, raised a $15M Series A led by Accel (TC)

Epsilon3, a company that's building an operating system for the space industry, raised a $15M Series A led by Lux Capital (TC)

Designstripe, a creator of content and tools for designers, raised $10M in funding from Insight Partners and Silicon Valley Bank (PRN)

SleekFlow, a social commerce platform that helps businesses improve customer experience, closed an $8M Series A led by Tiger Global Management (TC)

Unify Jobs, an equitable hiring technology company, raised a $4.5M seed round led by North Coast Ventures (PRN)

ProPlanner (formerly Ipsum), a web-based collaborative construction technology platform, raised $2.7M in funding led by Insight Partners (PRN)

IPO / Direct Listings / Issuances / Block Trades

Italian energy company Eni will delay the IPO of its renewable energy unit Plenitude amid market volatility (BBG)

Chinese household consumer goods retailer Miniso Group won the Hong Kong stock exchange’s approval for its planned dual primary listing in the city (BBG)

Middle East’s Domino’s Pizza operator Alamar Foods will price its IPO in Saudi Arabia at the top of the range (BBG)

UAE-owned investment company Tecom will price its IPO at the top of the range and is expected to raise $445M (RT)

SPAC

Adara Acquisition Corporation will take Alliance Entertainment, a video game distributor, public through a merger valued at $480M (BJ)

Fundraising

Paris-based VC firm Breega raised a ~$263M fund which will enable them to back Series A stage companies and beyond (TC)

Crypto Corner

Crypto brokerage firm Voyager Digital will limit customers to $10,000 withdrawals and 20 daily transactions (BBG)

Coinbase adds support for on-chain Polygon and Solana transactions (CD)

Public blockchain platform Solana is launching a Web3-focused smartphone to improve crypto-mobile relationships (TV)

Fashion brand Gucci is joining its first DAO through a partnership with SuperRare, an NFT marketplace (TB)

Cristiano Ronaldo signed an NFT sponsorship deal with crypto exchange Binance (FT)

Exec's Picks

Yesterday, The Atlantic's Derek Thompson wrote a thought-provoking piece about how a recession could weaken the work-from-home revolution. Check out his piece here.

Between wars, pandemics, and inflation, it feels like the world is coming to an end. Jack Raines turned back the clock to show just how much better the world is now than at any other point in history. Check out his recent article here.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 40+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

Meme Cleanser

Catch the latest episode of our Big Swinging Decks podcast, presented by CoinFLEX.US, on Spotify, Apple, and YouTube 🤝