Together with

Good Morning,

Citadel’s flagship fund is up 5.7% YTD, UK PE had a lucrative 2022, Blackstone’s REIT came under pressure, Goldman’s wealth clients aren’t interested in crypto, Trump sued Truth Social’s co-founders, and VC 'megafunds' may be history.

Looking to invest in private markets alongside veteran Wall Street investors? Check out today’s sponsor, 10 East.

Let’s dive in.

Before The Bell

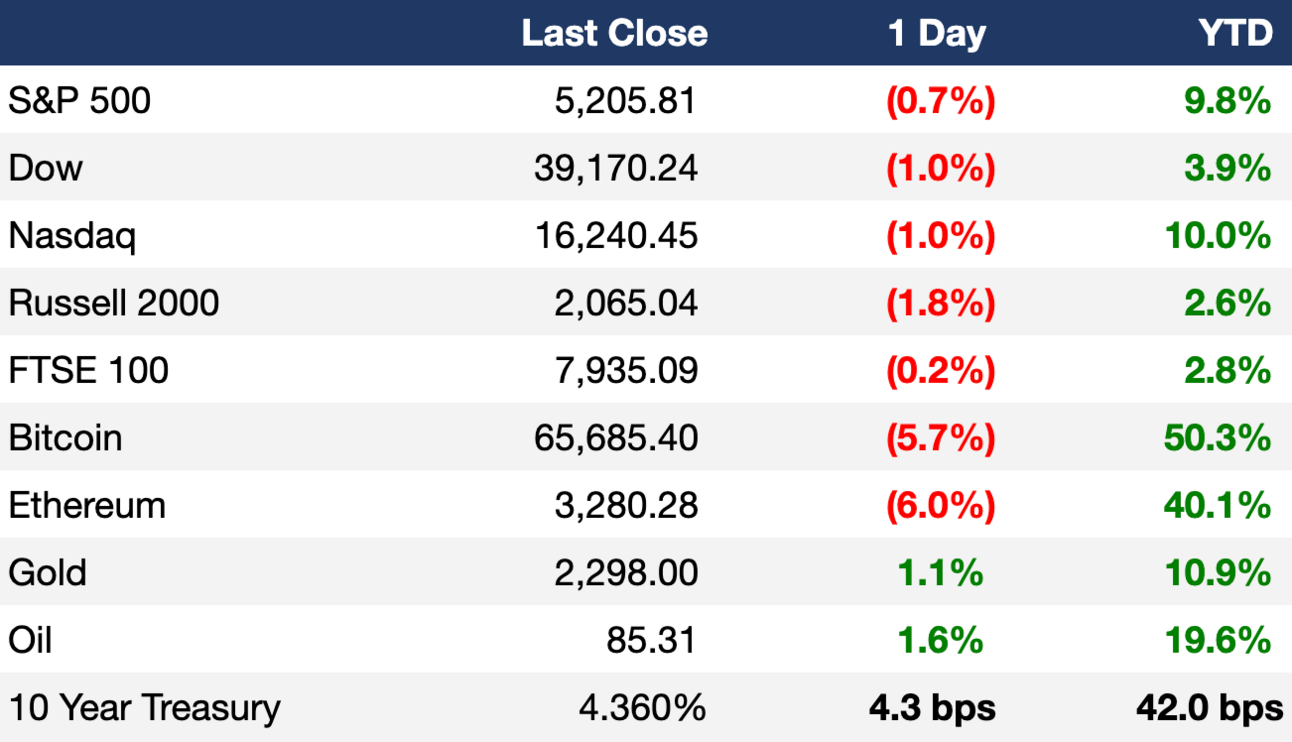

As of 04/02/2024 market close.

Markets

US stocks tumbled as investors lowered expectations of a Fed rate cut in June

US 10Y yield hit its highest level since November

Oil rose to its highest level since October

Brazil sold $1B in swaps in its first FX intervention in two years to prevent a volatility spike led by expiring NTN-A bonds

Earnings

Headline Roundup

Gentlemen’s club famous for 'nieces’ night' considers admitting Crispin Odey (FT)

UK PE dealmakers earned $6.3B in carried interest in 2022 (FT)

All Citadel strategies are up YTD (RT)

VC reckons with end of ‘megafund’ era (FT)

Fed officials see three rate cuts 'reasonable' this year (RT)

US job openings held steady in February (BBG)

Dividends outstripped cash flows at Blackstone REIT (FT)

Trump sued Truth Social co-founders out of stock ownership (CNBC)

CalPERS named ex-New Zealand Super Fund exec as CIO (FT)

UBS named three co-heads of Americas ECM (RT)

Ex-Gucci CEO Bizzarri set up an investment company (RT)

S&P 500 made up 27% of 2023 equity ETF flows (FT)

Tesla quarterly deliveries fell for first time since 2020 (RT)

FDIC is probing BlackRock and Vanguard over huge US bank stakes (WSJ)

Hong Kong suspended trading of several China developers’ shares (WSJ)

Iowa-LSU game was FanDuel's biggest-ever women's sports betting event (CNBC)

Intel disclosed a $7B operating loss in foundry business (CNBC)

EU exits winter with record-level gas storage (FT)

Taiwan hit by strongest earthquake since 1999 (FT)

A Message From 10 East

Where Sophisticated Investors Access Private Markets

10 East is a co-investment platform where sophisticated investors access private market investments alongside a veteran team with a 12+ year track record of strong performance across over 350 transactions. The firm is led by Michael Leffell, former Deputy Executive Managing Member of Davidson Kempner.

Members have the flexibility to participate on a deal-by-deal basis across private equity, credit, real estate, and venture capital.

Benefits of 10 East membership include:

Flexibility – members have full discretion over whether to invest on an offering-by-offering basis.

Alignment – principals commit material personal capital to every offering.

Institutional resources – a dedicated investment team that sources and diligences each offering.

There are no upfront costs or commitments associated with joining 10 East.

Exec Sum readers can join 10 East with complimentary access here.

Deal Flow

M&A / Investments

Silver Lake agreed to take private sports and entertainment company Endeavor at a $13B valuation (WSJ)

SLB agreed to acquire rival oilfield service provider ChampionX for $7.8B in an all-stock deal (BBG)

Transportation firm Savage is exploring options including a minority stake sale at a $5B+ valuation (BBG)

CD&R agreed to buy IT business Presidio from UK rival BC Partners at a ~$4B valuation (FT)

EQT will acquire compliance software provider Avetta from Welsh Carson Anderson & Stowe in a ~$3B deal, including debt (BBG)

Honeywell International is weighing a sale of its PPE unit amid fading post-Covid demand, which could fetch over $2B (BBG)

Blue Owl Capital will buy Kuvare Asset Management in a $1B deal (WSJ)

Authentic Brands Group agreed to acquire athletic apparel label Champion from Hanesbrands for ~$1B (YF)

Hong Kong-based alternative asset manager PAG purchased a logistics center in central Japan from real estate developer Hines for over $400M (BBG)

Digital-asset investment firm Republic purchased asset management firm GoldenTree’s $150M AUM crypto subsidiary GoldenChain (BBG)

Goldman Sachs’s Petershill unit, which specializes in buying stakes in alternative asset managers, agreed to acquire a 30%-40% stake in opportunistic credit firm Kennedy Lewis Investment Management (BBG)

Pakistan is seeking bids for a majority stake in unprofitable national carrier Pakistan International Airlines (BBG)

Yahoo acquired Instagram co-founders' AI news platform Artifact (RT)

HSBC is exploring the sale of its various Germany businesses including its wealth-management, custody and fund administration units (BBG)

VC

Flip, a social commerce platform, raised a $144M Series C at a $1.05B valuation led by Streamlined Ventures (BW)

AI chip startup Hailo raised a $120M Series C extension from Israeli businessman Alfred Akirov, automotive importer Delek Motors, and OurCrowd (TC)

Seso, a startup building software to fix farm workforces, raised a $26M Series B led by BOND’s Mary Meeker (TC)

Modal, a startup providing personalized technical skills training, raised a $25M round led by Left Lane Capital (TC)

Video security platform Lumana raised a $24M seed round led by Norwest and S Capital (VC)

BurnBot, a startup providing mechanized vegetation management and fuel treatment solutions, raised a $20M Series A led by ReGen Ventures (FN)

Aidium Mortgage CRM, a provider of innovative mortgage technology solutions, raised a $19M Series A led by PeakSpan Capital (PRN)

Renewable fuels startup Raven SR raised $15M in financing led by Ascent Funds (VC)

Agora, a DeFi digital dollar and asset platform, raised a $12M seed round led by Dragonfly (PRN)

AI-powered data intelligence startup Proxima raised a $12M Series A led by Mucker Capital (BW)

TechGrid, a business platform for technology service providers, raised a $9.2M Series A from Bellini Capital (BW)

Warwick Acoustics, a startup developing in-car electrostatic speakers, raised a $8.5M round led by Mercia Ventures (FN)

Quadratic, a spreadsheet that speaks Python and other programming languages natively, raised a $5.6M seed round led by GV (TC)

Virtual healthcare startup HealthArc raised a $5M growth round led by ScOp Venture Capital (PRN)

Ailytics, a Singapore-based B2B heavy industry software startup, raised a $2.7M pre-A round led by Tin Men Capital (FN)

Supersimple, an AI-native data analytics platform, raised a $2.2M pre-seed round led by Tera Ventures (PRN)

IPO / Direct Listings / Issuances / Block Trades

Safety testing company UL Solutions is seeking to raise up to $812M at a $5.8B valuation in its US IPO (RT)

Indian power producer JSW Energy plans to raise $600M via a share sale to institutional investors (RT)

India's largest REIT Embassy Office Parks plans to raise $400M via a QIP (RT)

Blackstone is exploring raising up to $300M in an Indian IPO of International Gemological Institute, which it acquired in 2023 for $570M (RT)

LatAm fintech giant Creditas is planning a US IPO by 2026 (BBG)

General Electric completed its split into three independent businesses, becoming GE Healthcare, GE Vernova and GE Aerospace; energy spinoff GE Vernova began trading yesterday (AX)

Chipmaking startup Cerebras Systems picked Citigroup as the lead underwriter for its targeted H2 2024 IPO (BBG)

SPAC

Tembo, the utility vehicle electrification subsidiary of VivoPower, will merge with Cactus Acquisition Corp. 1 in an $838M deal (GNW)

Debt

Bankruptcy / Restructuring / Distressed

WeWork plans to emerge from bankruptcy in May-end after restructuring out of $8B in leases (WSJ)

Shoes for Crews filed for Chapter 11 bankruptcy with plans to sell the business to lenders (BBG)

Retailer Express is in talks with lenders to finance a potential Chapter 11 bankruptcy (BBG)

Cloud computing and networking provider ConvergeOne reached a deal with a group of creditors to restructure its balance sheet and receive fresh equity as part of a potential Chapter 11 filing (BBG)

SPAC-merged Airspan Networks Holdings won bankruptcy court approval to cut debt under an expedited schedule (BBG)

Fundraising

Crypto Corner

Exec’s Picks

Learn private equity from industry experts and world-renowned faculty by enrolling in the Private Equity Certificate Program from Wharton Online and Wall Street Prep. Use code LITQUIDITY to save $300 when you register for the program and save an additional $200 if you enroll by April 15th.

In light of General Electric’s final split, WSJ narrated the story of their rich 130 year history.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter