Together with

Good Morning,

Ken Griffin is tired of Chicago crime, Goldman and JPM strategists think recession fears are overblown, Spirit wants shareholders to reject JetBlue's bid, more subprime borrowers are missing payments, Twitter wants to limit misinformation, and the Fed is sticking to its interest rate plan.

Been a busy past few weeks and finally just dropped a few new things for our community. Check out Exec's Picks and the job board section below for more detail.

Happy Friday, and remember that we are co-hosting a three-day bender with Friday Beers this Memorial Day Weekend! If y'all are in NYC on Saturday, come kick it at Schimanski and meet the teams. Tix available here

Let's dive in.

Before The Bell

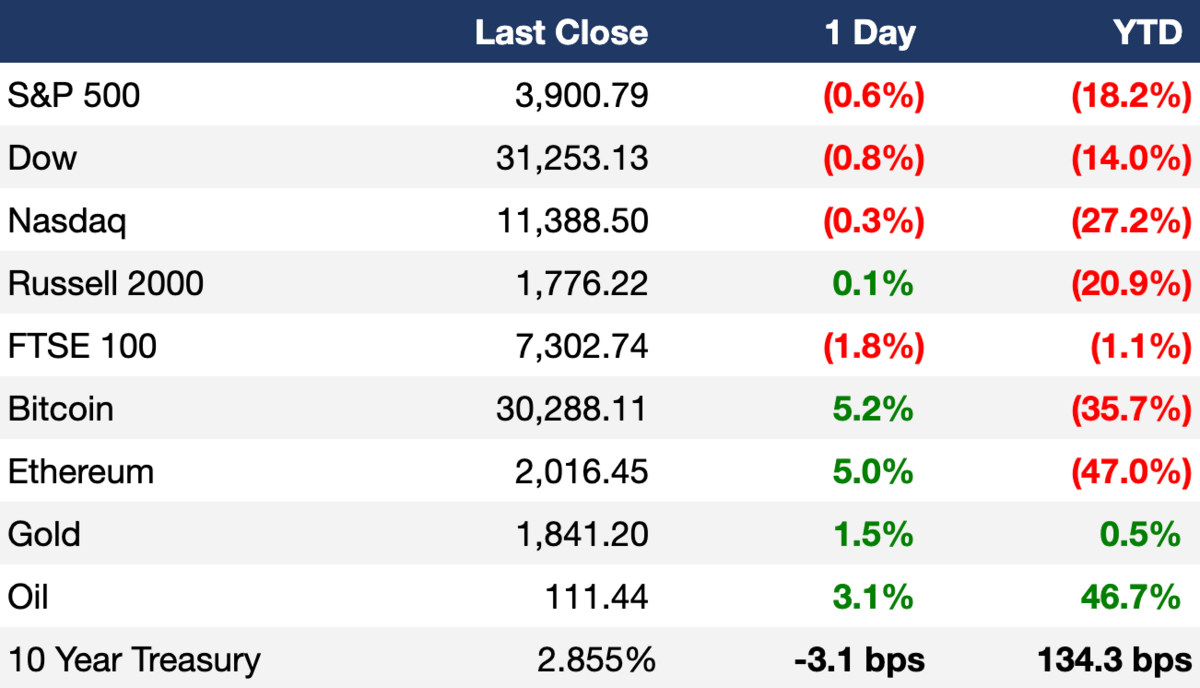

As of 5/19/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

All major indexes fell again yesterday, but their declines were less than 1% each

The S&P now sits 19% below its previous high, putting it right on the edge of bear market territory

A number of stocks in the S&P are now trading at 52-week lows including Target, Walmart, Bank of America, Intel, and Charles Schwab

Investors will continue to keep an eye on earnings reports that give insight into inflation, as Target dropped another 5%+ yesterday after tanking the day before due to a report showing rising costs

Earnings

Headline Roundup

Apple shows AR/VR headset to board in sign of progress on key project (BBG)

US Senate clears $40B in Ukraine aid, sending bill to Biden (BBG)

Goldman, JPMorgan strategists see recession fears as overblown (BBG)

Musk paid $250,000 to flight attendant who accused him of sexual misconduct (YHOO)

Fed to plow ahead on half-point hikes, undeterred by stock slump (BBG)

Spirit Airlines calls for shareholders to reject JetBlue bid (RT)

More subprime borrowers are missing loan payments (WSJ)

New bipartisan bill would force Google to break up its ad business (CNBC)

Twitter moves to limit spread of misinformation in crises (WSJ)

Ken Griffin’s Citadel nears tipping point on Chicago exit over crime (BBG)

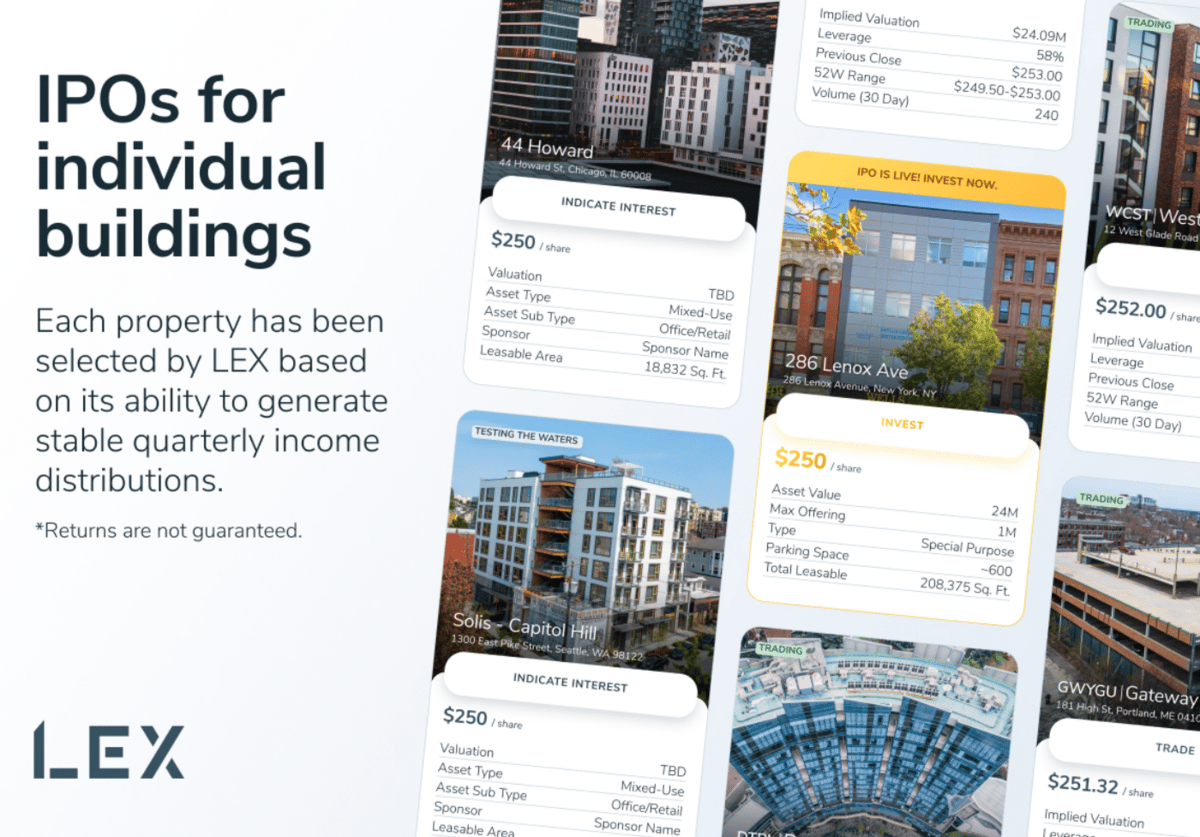

A Message From Lex

THE S&P 500 IS IN FREE FALL

War, inflation, interest rates, and a million other variables make stocks volatile. Luckily, a building is still a building. Commercial real estate is your answer to hedging inflation and diversifying your portfolio. That’s why we're excited about LEX.

Truth is, the best deals in real estate are hard to find, unless you shorted Russian stocks all the way to accreditation (legend) and now you have access. Even then, you’ve got scarce deals, crowdfunding, or REITs to pick from…until LEX.

LEX IPOs buildings so you can get in the game.

By taking buildings public, LEX has created a way for you to invest in marquee commercial real estate. Build a portfolio by picking the buildings you want to invest in. Each building gets a ticker and trades like your other stocks.

The best part? As a shareholder, you can get paid dividends flowing from the rent paid by the tenants. You can also earn tax advantaged passive income and trade without lockups.

Check out LEX’s live assets in New York City and upcoming IPO in Seattle.

Deal Flow

M&A / Investments

A consortium led by KKR reaffirmed its $14B takeover offer for Australian private hospitals operator Ramsay Health (BBG)

Brookfield Asset Management agreed to buy emergency household repairs provider HomeServe in a $5B deal (BBG)

Permian basin shale oil producer Centennial Resource Development agreed to buy rival Colgate Energy in a $2.5B deal (BBG)

Bridgepoint is considering the sale of treasury-management software provider Kyriba at a $2B+ valuation (BBG)

Alexander Govor, McDonald’s current licensee in Russia, agreed to buy the rest of McDonald’s Russia business and operate them under a new brand (CNBC)

Sixth Street Partners agreed to buy a 30% stake in Real Madrid Football Club for ~$381M (BBG)

Near, a data intelligence startup soon to go public via SPAC, raised $100M from CF Principal Investments (TC)

Saudi food delivery firm Jahez signed a non-binding pact to buy The Chefz (BBG)

VC

Swedish payments company Klarna is aiming to raise up to $1B at a low $30B range, a ~30% drop from its previous round, from new and existing investors (WSJ)

Southeast Asian payments infrastructure unicorn Xendit raised a $300M Series D led by Coatue and Insight Partners (TC)

Belong, a startup building a marketplace for renters, homeowners, and landlords, raised $80M: $50M in equity led by Fifth Wall and $30M in debt (TC)

Noyo, a startup building an API platform for delivering frictionless employee benefits, raised a $45M Series B led by Norwest Venture Partners (BW)

Talent acquisition platform Fetcher raised a $27M Series B led by Tola Capital (TC)

Professional network for B2B sales Bravado raised a $26M Series B led by Tiger Global (PRN)

Everstream Analytics, a supply chain and risk data-analytics company, raised a $24M Series A led by Morgan Stanley Investment Management (BW)

EV charger management platform ChargeLab raised a $15M Series A led by King River Capital (PRN)

Blockchain games company Azra Games raised a $15M seed round led by a16z (BW)

Cloud data security company Dig raised an $11M seed round led by Team8 (PRN)

Kenyan aquaculture tech startup Victory Farms raised a $5M round led by Bain Capital’s Ed Brakeman (TC)

ZincSearch, a startup building an unstructured data search engine, raised a $3.6M seed round led by Nexus Venture Partners (BW)

Eco-sneaker startup Psudo closed a $3M seed round led by SternAegis Ventures (BW)

Peek, a leasing enablement platform, raised a $2.5M seed round led by GFA Venture Partners (BW)

SPAC

Data intelligence firm Near agreed to merge with KludeIn I Acquisition Corp in a $1B deal (RT)

Fundraising

GoldenTree Asset Management is looking to raise up to $1.5B for its first fund dedicated to providing loans directly to companies (BBG)

Crypto Corner

Exec's Picks

We just launched our group chat on a new chat platform called Odyssey. If y'all want to chat with Lit, Mark, and other like-minded individuals about all things Wall Street (gossip, bonuses, job openings, etc.), you're welcome to join 350 of us by clicking this link.

In case you missed it, we dropped a new episode of Big Swinging Decks featuring an interview with Clay Gardner, the co-founder and co-CEO of Titan, a fintech startup providing with accessible active management strategies (i.e. like a hedge fund in a box). Check it out on YouTube. A few months ago, we also wrote a deep dive into their business model. If you're interested in reading about the current retail investing landscape and how Titan is looking to dominate, you can read it here.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 40+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

And for those who want a more of a "match-making" approach, we're now launching a Talent Collective. It's essentially a reverse-job board where top companies ask to be introduced to you based on candidate profiles. This is a free, application-only community targeted at finance professionals looking to transition to VC / tech / web3 (we'll have broader collectives as more companies join the platform).

Candidates: you are welcome to apply here and can choose to stay anonymous for privacy concerns.

Companies: if you're hiring, join our collective and start getting recurring drops of amazing talent who are searching for new gigs - actively or passively. Apply now, as spots are limited.

Meme Cleanser

Catch the latest episode of our Big Swinging Decks podcast, presented by CoinFLEX.US, on Spotify, Apple, and YouTube 🤝